|

市场调查报告书

商品编码

1435797

感应马达(感应马达):市场占有率分析、产业趋势与统计、成长预测(2024-2029)Induction Motor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

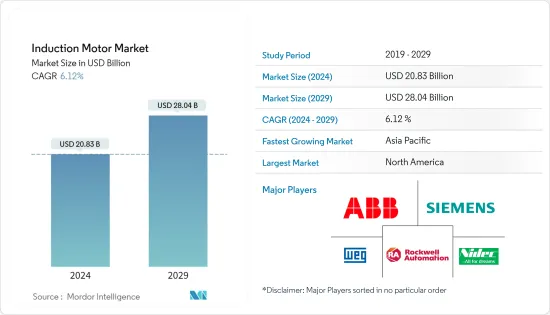

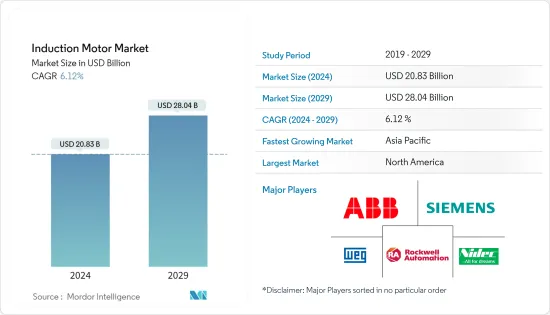

感应马达市场规模预计到2024年为208.3亿美元,预计到2029年将达到280.4亿美元,在预测期内(2024-2029年)复合年增长率为6.12%,预计将会成长。

由于没有滑环、换向器和电刷,感应马达几乎免维护或需要很少的维护,这是这些马达需求不断增长的主要因素之一。

主要亮点

- 感应马达是一种交流马达,其中扭矩是透过定子中产生的变化磁场与转子线圈中感应的电流之间的反应产生的。它们被用于大多数机器,因为它们比传统马达更强大且更环保。它们独特的坚固性需要很少的维护,使它们适合汽车和製造应用。在不同气候条件下发挥作用的能力也是推动其需求的主要因素。

- 对减少温室气体排放的日益关注以及对低能耗产品的消费量是电动车成长的主要驱动力。国际能源总署(IEA)预计,2022年全球电动车销量将大幅成长,第一季销量达200万辆,较2021年同期成长75%。电动汽车产业预计将成长。这些马达因其坚固、可靠和低维护的特性而被电动车 (EV) 製造商广泛使用,从而推动了对感应马达的需求。

- 维持世界发展对电能的需求不断增加,需要对发电进行持续大量投资,这推动了感应马达在电力领域的应用。

- 此外,在建筑物和工业设施中节省能源和降低营运成本的一些最重要的机会来自于优化马达系统。根据美国能源局,美国消耗的电力大约有一半流经马达,其中 90% 是交流 (AC)感应马达。研究表明,将感应马达的整体效率提高 5% 可以节省足够的能源,与数百兆瓦的新发电厂产生的能源相匹配。

- 然而,寻找感应马达的替代技术开发已成为成长的主要瓶颈。例如,特斯拉在 Model 3 中开发并改用同步磁阻马达,显着增加了续航里程。该公司还致力于用这种新马达取代 Model S 和 X 中的感应马达。

- 新型冠状病毒感染疾病(COVID-19)的爆发对市场成长产生了负面影响,主要是由于离散製造业的营运暂停。例如,根据加拿大政府2021年製造业月调查,2021年4月製造业销售额下降2.1%至571亿美元,21个产业中有11个产业销售额下降。此外,冠状病毒感染疾病(COVID-19) 的爆发影响了全球汽车产业的生产设施,并极大地影响了所研究市场的成长。

感应马达市场趋势

感应马达的工业应用显着成长

- 马达目前用于许多对公司生产力至关重要的工业应用。如今,每个製造公司都将优化生产效率作为首要目标。感应马达经济高效、坚固耐用、免维护,并且能够在所有环境条件下运行,使其越来越多地应用于采矿、水泥、汽车、石油和天然气、医疗保健和製造领域。这些是一些泵浦、升降机、起吊装置、电动剃刀、起重机、破碎机、石油开采设备等。由于低排放率,整个产业的环保意识不断增强,也促进了感应马达的成长。

- 近年来,随着人口从农村地区转移到都市区寻找工作,都市化不断加快。根据世界银行统计,世界城市人口占总人口的比例为57%。这增加了对建设零售、商业和住宅住宅的资源需求,以满足快速增长的需求,对工业部门的成长和感应马达的需求产生积极影响。

- 製造是感应马达的关键驱动力,因为它们用于熔炉、输送机、捲绕机、泵浦、风洞和其他工业设备。製造业正在崛起,特别是在疫情造成的最初下滑之后,感应马达的需求也有望进一步成长。例如,根据工业(UNIDO)的数据,2022年第一季全球製造业产量与前一年同期比较增4.2%。

- 考虑到不断增长的需求,一些感应马达供应商正在专注于开发具有创新功能的新型感应马达,以满足新工业用例的不同要求。预计这种趋势将在未来几年支持感应马达市场的成长。

预计亚太地区在预测期内将出现显着成长

- 由于许多行业对自动化各种加工步骤的投资不断增加,预计亚太地区将在预测期内对感应马达市场的成长做出最大贡献。此外,效率的提高和重量的减轻导致电动车越来越多地采用感应马达,取代DC马达。

- 该地区的石油和天然气、汽车、采矿和金属以及建筑等行业正在稳步增长,预计将为全球感应马达公司提供巨大的成长机会。

- 东南亚拥有丰富的天然气、石油等碳氢化合物资源。中国是该地区最大的石油生产国,2021年原油产量约400万桶/日(资料来源:英国石油公司)。 2022年5月,中国国家能源局製定了2022年将国内原油产量增加至约15亿桶的目标,表达了政府对石油探勘和生产的重要性。

- 此外,亚太地区的汽车产业也正在经历变化的趋势,一些国家正在推广电动车的采用。政府的支持性监管也在电动汽车产业的发展中发挥重要作用。例如,中国政府设定了到 2030 年汽车销售的 40% 为电动车的目标。

感应马达产业概况

感应马达市场竞争激烈,由罗克韦尔自动化公司、ABB 有限公司、西门子公司、WEG 电气公司和日本电产电机公司等少数大公司主导。凭藉着显着的市场份额,这些领先公司正专注于扩大海外客户群。这些公司正在利用策略合作倡议来提高市场占有率和盈利。然而,随着技术进步和产品创新,中小企业正在透过赢得新合约和开拓新市场来增加其市场份额。

- 2022年6月 - 日本电产株式会社在美国推出结合了鼠笼感应马达和SR马达基本原理的高效铝保持架SR马达「SynRA(铝笼转子感应马达磁阻马达)」市场。启动时,Nidec 的 SynRA 作为感应马达旋转,与鼠笼式感应马达相比,损耗更低,效率更高。

- 2022 年 3 月 - Havells India 推出了节能 ECOACTIV 风扇系列,推出了 19 款新型号,涵盖落地扇、吊扇、壁扇和通气扇类别。新风扇包括 ECOACTIV 超高效 BLDC 和感应马达。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链/供应链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 评估 COVID-19 对产业的影响

第五章 市场促进因素

- 市场驱动因素

- 扩大电动车的应用

- 住宅和工业领域对节能的需求不断增加

- 市场限制因素

- 替代技术的研究和开发

第六章市场区隔

- 按类型

- 单相感应马达

- 三相感应马达

- 按用途

- 住宅

- 商业的

- 工业的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 法国

- 英国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 拉丁美洲

- 中东/非洲

- 北美洲

第七章 竞争形势

- 公司简介

- Rockwell Automation Inc.

- Nidec Motor Corporation

- ABB Ltd

- Siemens AG

- WEG Electric Corp.

- Regal Beloit Corporation

- Baldor Electric Company

- Emerson Electric Co.

- Schneider Electric SE

- Marathon Electric

- Kirloskar Electric Company

- CG(Comton & Greaves)

- ThomasNet

第八章投资分析

第九章 市场机会及未来趋势

The Induction Motor Market size is estimated at USD 20.83 billion in 2024, and is expected to reach USD 28.04 billion by 2029, growing at a CAGR of 6.12% during the forecast period (2024-2029).

Due to the absence of slip rings, commuters, and brushes, the induction motors are nearly maintenance-free or require low maintenance, which is among the major driving factors behind the growth in demand for these motors.

Key Highlights

- An induction motor is an AC electric motor in which torque is produced by the reaction between a varying magnetic field generated in the stator and the current induced in the coils of the rotor. It is used in most machinery as it is more powerful and eco-friendly than conventional motors. Unique robustness makes it a suitable choice for automotive and manufacturing applications, as it requires less maintenance. Its ability to work under varying climatic conditions is another major factor driving its demand.

- The rising focus on reducing greenhouse gas emissions and the demand for products that consume less energy are the major factors for the growth of electric cars. According to the International Energy Agency (IEA), the global sales of electric vehicles have been rising strongly in 2022, with 2 million sold in the first quarter, up 75% from the same period in 2021. The growth of the EV industry is expected to drive the demand for induction motors, as these motors are widely used by electric vehicle (EV) manufacturers, owing to their robust, reliable, and low maintenance features.

- The increasing demand for electrical energy to sustain global development requires consistent heavy investments in power supply generation that have driven induction motors' application in the electricity sector.

- Furthermore, some of the most significant opportunities to save energy and reduce operating costs in buildings and industrial facilities come from optimizing electric motor systems. According to the US Department of Energy, about half of all electricity consumed in the United States flows through motors, 90% of which are alternating-current (AC) induction motors. The study indicated that a 5% improvement in the overall efficiency of the induction motor would save enough energy comparable to energy produced by the new power plant of a few hundred megawatts.

- However, research on developing alternative technology for induction motors is the major bottleneck for its growth. For instance, Tesla has developed and switched to a synchronous reluctance motor in Model 3, which has significantly boosted the range. The company is also working on replacing the induction motors in their Model S and X with this new motor.

- The outbreak of COVID-19 has negatively impacted the market growth, mainly due to the stoppage in discrete manufacturing industry operations. For instance, according to the Monthly Survey of Manufacturing, 2021 by the Government of Canada, Manufacturing sales fell 2.1% to USD 57.1 billion in April 2021 on lower sales in 11 of 21 industries. Also, the outbreak of COVID-19 has affected the production facilities of automotive sectors across the globe, which has significantly impacted the growth of the studied market.

Induction Motor Market Trends

Industrial Application of Induction Motor to Experience Significant Growth

- Motors are used in many industrial applications today, which are critical to the enterprise's productivity. Presently, every manufacturing company pursues optimized production efficiency as its primary goal. As induction motors are cost-effective, robust, maintenance-free, and can operate in any environmental condition, they are increasingly being used in mining, cement, automotive, oil and gas, healthcare, and manufacturing industries. They are part of pumps, lifts, hoists, electric shavers, cranes, crushers, oil extracting equipment, etc. Increasing awareness of environmental protection across industries also contributes to the growth of induction motors, as they have a low emission rate.

- In the past few years, populations shifted from rural to urban areas in search of jobs, which led to urbanization. According to the World Bank, the global urban population as a percentage of the total population stood at 57%. This has driven the demand for resources to construct retail, commercial, and residential housing facilities to accommodate the surging need, which positively impacts the growth of the industrial sector and the demand for induction motors.

- The manufacturing industry has been the significant driver for induction motors as these motors are found in furnaces, conveyors, winders, pumps, wind tunnels, and other industrial equipment. With the manufacturing industry witnessing an upward growth trend, especially after the initial setback created by the pandemic, the demand for induction motors is also expected to grow further. For instance, according to the United Nations Industrial Development Organization (UNIDO), global manufacturing production registered a year-over-year output growth of 4.2 percent in the first quarter of 2022.

- Considering the growing demand, several induction motor providers are focusing on developing new types of induction motors with innovative functionality to fulfil various requirements of new industrial use cases. Such trends are expected to support the growth of the induction motor market in the coming years.

Asia Pacific is Expected to Register Significant Growth During the Forecast Period

- Asia-Pacific is likely to be the highest contributor to the growth of the induction motor market during the forecast period due to an increase in investment to automate various processing steps in many industries. Moreover, the increasing adoption of induction motors in electric vehicles replaced the DC motors due to their improved efficiency and lightweight.

- Industries, such as oil and gas, automotive, mining and metal, and construction, are witnessing steady growth in the region, which is expected to offer tremendous growth opportunities for the global induction motor players.

- Southeast Asia is a rich source of hydrocarbon resources, like natural gas and petroleum. China is the biggest oil producer in the region, accounting for about 4 million barrels of oil per day in 2021 (Source: British Petroleum). In May 2022, China's National Energy Agency set a target to increase domestic crude oil production to approximately 1.5 billion barrels in 2022 after the government expressed the importance of exploration and production of crude oil.

- Furthermore, the automotive industry in the Asia Pacific region is also witnessing a trend shift, with several countries promoting the adoption of electric vehicles. The supportive government regulation also plays a crucial role in the growth of the electric vehicle industry. For instance, the Chinese government had set up goals of having EVs make up 40 percent of all car sales by 2030.

Induction Motor Industry Overview

The induction motor market is competitive and dominated by a few major players, like Rockwell Automation Inc., ABB Ltd, Siemens AG, WEG Electric Corporation, and Nidec Motor Corporation. These major players with a prominent share in the market are focusing on expanding their customer base across foreign countries. These companies leverage strategic collaborative initiatives to increase their market shares and profitability. However, with technological advancements and product innovations, mid-size to smaller companies are growing their market presence by securing new contracts and tapping new markets.

- June 2022 - Nidec Corporation launched SynRA (Synchronous Reluctance Motor with Aluminum Cage Rotor), an aluminum cage-equipped, high-efficiency synchronous reluctance (SR) motor that combines an SR motor with the cage-type induction motor's basic principles, for the US market. Nidec's SynRA rotates as an induction motor when activated, produces less loss, and achieves higher efficiency than the cage-type induction motor.

- March 2022 - Havells India unveiled its range of energy-efficient ECOACTIV fans by launching 19 new models under the pedestal, ceiling, wall, and ventilator fan category. The new content of fans comes equipped with ECOACTIV super efficient BLDC and induction motor.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Inductry Value Chian/Supply Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of COVID-19 Impact on the Industry

5 MARKET DRIVERS

- 5.1 Market Drivers

- 5.1.1 Increasing Application in Electric Vehicles

- 5.1.2 Elevated Requirement of Power Savings in Residential and Industrial Sectors

- 5.2 Market Restraints

- 5.2.1 R&D of Alternative Technology

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Single-phase Induction Motor

- 6.1.2 Three-phase Induction Motor

- 6.2 By Application

- 6.2.1 Residential

- 6.2.2 Commercial

- 6.2.3 Industrial

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 France

- 6.3.2.3 United Kingdom

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle-East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Rockwell Automation Inc.

- 7.1.2 Nidec Motor Corporation

- 7.1.3 ABB Ltd

- 7.1.4 Siemens AG

- 7.1.5 WEG Electric Corp.

- 7.1.6 Regal Beloit Corporation

- 7.1.7 Baldor Electric Company

- 7.1.8 Emerson Electric Co.

- 7.1.9 Schneider Electric SE

- 7.1.10 Marathon Electric

- 7.1.11 Kirloskar Electric Company

- 7.1.12 CG (Comton & Greaves)

- 7.1.13 ThomasNet