|

市场调查报告书

商品编码

1435804

基底金属:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Base Metals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

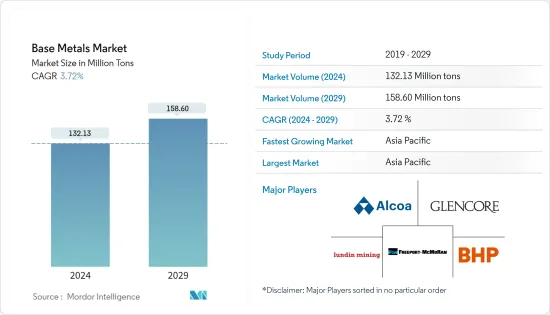

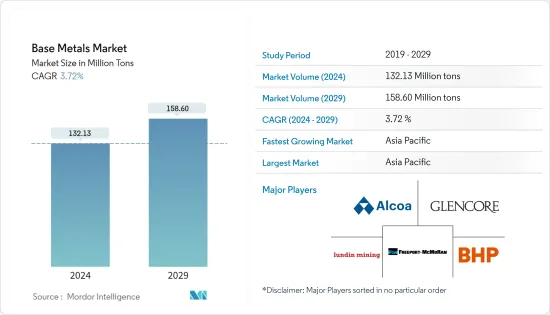

基底金属市场规模预计2024年为1.3213亿吨,预计到2029年将达到1.586亿吨,在预测期内(2024-2029年)复合年增长率为3.72%增长。

冠状病毒感染疾病(COVID-19)大流行对市场产生了负面影响。这是因为製造设施和工厂因封锁和限制措施而关闭。供应链和运输中断造成了进一步的市场瓶颈。然而,随着所研究市场的需求復苏,该产业在 2021 年出现復苏。

主要亮点

- 从中期来看,推动所研究市场成长的主要因素是建设产业需求的增加。

- 相反,基底金属加工和使用基底金属製造产品期间温室气体排放的增加预计将阻碍研究市场的成长。

- 然而,电动车(EV)生产行业不断增长的需求预计将在预测期内提供许多机会。

- 预计亚太地区将主导市场,其中最大的消费来自中国、印度和日本。

基底金属市场趋势

建设产业需求不断扩大

- 建设产业使用的基底金属因其耐用性和强度而被选择,并具有广泛的功能。其中最常见的是铝和铜。

- 铝因其耐腐蚀性、导电性和延展性而常用于建设产业。由于其能抵抗恶劣天气,这种金属被用于窗户、门、电线以及户外标誌和路灯。金属被加工成板材、管材和铸件。暖通空调管道、屋顶、墙壁和把手均由铝製成。此外,它在建设产业中也很常见。

- 铜基管材常用于建筑物内的管道构造。铜是一种具有延展性和延展性的金属,可以抵抗水和土壤的腐蚀。它还可以回收。铜管易于焊接并形成持久的结合。所有这些特性使这种金属成为管道和管材的理想选择。硬铜管是建筑物中热水和冷水管道的理想选择,而软质铜管通常用于製造暖通空调系统和热泵的冷媒管线。

- 根据土木工程师协会(ICE)的研究,到2030年全球建筑业预计将达到8兆美元,主要由中国、印度和美国推动。因此,不断增长的建设产业预计将增加基底金属市场的需求。

- 根据美国人口普查局的数据,2022年美国私人建筑价值为1.43兆美元,较2021年的1.28兆美元增加10.47%。 2022年住宅支出为8,991亿美元,较2021年成长13.3%,非住宅支出为5,301亿美元,较2021年下降9.1%。美国的私人建筑预计将带动该国建设产业对基底金属市场的需求上升。

- 此外,2022年5月,美国政府宣布将拨款超过1,100亿美元,实施4,300个机场港口现代化、道路桥樑重组等具体计划。这些计划预计将使 50 个州的约 3,200 个社区受益。

- 此外,中国正处于建设热潮之中。该国拥有全球最大的建筑市场,占全球建筑投资的20%。到 2030 年,预计光是该国就将在建筑上花费近 13 兆美元。

- 此外,由于政府的支持和倡议,印度的住宅产业正在崛起,需求进一步增加。据印度品牌股权基金会(IBEF)称,住房与城市发展部(MoHUA)已在2022-2023年预算中拨出98亿日元用于建造住宅,并设立基金以完成停滞的计划,并拨款5000万美元。因此,住宅领域投资的增加预计将为基底金属市场创造上行需求。

- 据加拿大建筑协会称,建筑业是加拿大最大的雇主之一,为国家的经济成功做出了重大贡献。该产业占该国内生产总值(GDP)的7%。例如,根据加拿大统计局的数据,2022年第二季建筑施工总投资成长3.3%,达到623亿美元,连续第三个季度成长。住宅投资达 464 亿美元,主要是由于多用户住宅住宅建设支出增加。非住宅领域成长 2.6%,达到 158 亿美元。

- 此外,加拿大新建筑计划 (NBCP) 和经济适用住宅倡议(AHI) 等各种政府计划正在支持该行业的成长。在加拿大,住宅和商业领域近年来经历了稳定成长。该国已经出现了多个大型建设计划,例如 Panda Condominiums、Harwood Condominiums、Power and Adelaide Condominiums 以及 Amazon Distribution Center/Ottawa。

- 由于摩洛哥商业设施和酒店开发计划的增加,预计基底金属市场的需求将会上升。以摩洛哥为例,希尔顿目前经营五家酒店,全国各地还有六家酒店正在开发中,其中包括即将在未来几个月开业的Conrad Rabat Arzanasset 以及DoubleTree by Hilton Marina。・阿加迪尔酒店及公寓(Agadir Hotel & Residences) 计划于 2023 年第三季开幕。

- 由于上述所有因素,预计在预测期内对基底金属的需求将会上升。

亚太地区主导市场

- 预计亚太地区将在预测期内成为基底金属的最大市场。建筑业投资的增加、电气和电子产量的增加以及跨国公司对工业部门投资导致的重型设备需求激增是推动该地区基底金属需求的一些关键因素。

- 中国在亚太地区基底金属市场中占有最大的市场占有率。由于国内投资和建设活动的增加,预计在整个预测期内对基底金属市场的需求将增加。近年来,中国一直是世界基础建设的主要投资者之一,并做出了重要贡献。例如,根据国家统计局(NBS)的数据,2022年中国建筑业产值达到27.63兆元(4.11兆美元),比2021年成长6.6%。

- 由于中国的人口趋势,预计住宅的成长将继续加速。家庭收入水准的提高以及农村人口向都市区的迁移预计将继续推动国内住宅建筑业的需求。

- 而且,中国还是全世界最大的汽车製造国。由于物流和供应链的改善、企业活动的增加以及丰富的国内消费促进政策等因素促进了国内小客车市场产品的发展,中国已成为最大的小客车生产国之一。因此,这增加了小客车产业对基底金属消费的需求。例如,根据OICA的数据,2022年中国小客车产量为238万辆,较2021年成长11%。

- 由于车辆排放气体法规收紧、车辆安全性提高、车辆驾驶辅助系统的引入以及零售和电子商务领域物流的快速增长,印度对新型和先进轻型商用车的需求大幅增加。 (轻型商用车)。例如,根据OICA的数据,2022年印度轻型商用车产量达61.74万辆,较2021年成长27%,较2020年恢復60%。

- 此外,由于印度汽车工业的投资增加和进步,基底金属的消费量预计将增加。例如,塔塔汽车在2022年4月宣布,计画未来5年向小客车业务投资30.8亿美元。因此,由于汽车产量增加和汽车行业投资增加,预计国内汽车和交通行业对基底金属市场的需求将增加。

- 印度拥有第四大铁路网,全长123,240公里,开行客运列车13,450列,货运列车9,141列,7,350个车站每天运送旅客2400万人次,每天运送旅客20388万人次,运输货物吨位。印度铁路的最新发展和政府措施可能会扩大待开发的市场。根据 2022-23 年联邦预算,铁道部已拨款 1.4 兆卢比(184 亿美元)。这将扩大汽车和运输业的基底金属市场。

- 铜、锡、镍、铝等是电子工业中常用的金属。亚洲地区是全球最大的电气和电子设备生产国,中国、日本、韩国、新加坡和马来西亚等国家在全球占据主导地位。

- 根据 JEITA(日本电子资讯科技协会)的数据,2022 年 12 月日本国内消费性电器产品出货收益达到 1,252 亿日圆(9.6,404 亿美元)。 3月份是2022年消费性电器产品出货最强劲的月份,约1255亿日圆(9.6635亿美元),而5月份则是最慢的月份,为864亿日圆(9.6635亿美元)(6528万美元)。因此,中国消费电器产品出货的增加预计将为基底金属市场提供上涨空间。

- 因此,该地区所有这些有利的趋势和投资预计将在预测期内推动基底金属的需求。

基底金属产业概况

基底金属市场本质上是分散的。市场的主要企业(排名不分先后)包括嘉能可、自由港麦克莫兰、美国铝业公司、伦丁矿业公司、必和必拓等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 建设产业的需求不断增加

- 对轻量化车辆的高需求

- 其他司机

- 抑制因素

- 温室气体排放增加

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模:基于数量)

- 类型

- 铜

- 锌

- 带领

- 镍

- 铝

- 锡

- 最终用户产业

- 建造

- 汽车/交通

- 电力/电子

- 消费性产品

- 医疗设备

- 其他的

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、联盟、协议

- 市场占有率分析/排名分析

- 主要企业策略

- 公司简介

- Alcoa Corporation

- Anglo American plc

- BHP

- Freeport-McMoRan

- Glencore

- Jiangxi Copper Corporation

- Lundin Mining Corporation

- Rio Tinto

- Vale

- Vedanta Resources Limited

第七章 市场机会及未来趋势

The Base Metals Market size is estimated at 132.13 Million tons in 2024, and is expected to reach 158.60 Million tons by 2029, growing at a CAGR of 3.72% during the forecast period (2024-2029).

The COVID-19 pandemic negatively impacted the market. This was because of the shutdown of the manufacturing facilities and plants due to the lockdown and restrictions. Supply chain and transportation disruptions further created hindrances for the market. However, the industry witnessed a recovery in 2021, thus rebounding the demand for the market studied.

Key Highlights

- Over the medium term, the major factor driving the growth of the market studied is the increasing demand from the construction industry.

- On the flip side, the increasing emission of greenhouse gases during the processing of base metals and the manufacturing of products using base metals is expected to hinder the growth of the market studied.

- However, increasing demand from the electric vehicle (EV) production sector is anticipated to provide numerous opportunities over the forecast period.

- The Asia-Pacific region is expected to dominate the market, with the largest consumption from China, India and Japan.

Base Metals Market Trends

Growing Demand from the Construction Industry

- Chosen for their durability and strength, base metals used in the construction industry serve a wide range of functions. The most common of them are aluminum and copper.

- Aluminum is commonly used in the construction industry because it is resistant to corrosion, highly conductive, and ductile. Due to its resistance to harsh weather, the metal is used in windows, doors, and wire, as well as outdoor signage and street lights. The metal is processed into sheets, tubes, and castings. HVAC ducts, roofs, walling, and handles are made of aluminum. Furthermore, they are frequently found in the construction industry.

- Copper-based tubing is often used to construct pipes in buildings. Copper is a ductile and malleable metal, and it is resistant to corrosion from water and soil. It is also recyclable. Copper tubing is easily soldered, forming lasting bonds. All of these properties make this metal ideal for piping and tubing. Rigid copper tubing is ideal for hot and cold tap water pipes in buildings, while soft copper tubing is frequently used to make refrigerant lines in HVAC systems and heat pumps.

- According to a study by the Institution of Civil Engineers (ICE), the global construction industry is expected to reach USD 8 trillion by 2030, primarily driven by China, India, and the United States. Therefore, the growing construction industry is expected to have an upside demand for base metals market.

- According to the US Census Bureau, the value of private construction in the United States in 2022 was USD 1.43 trillion, which shows an increase of 10.47% compared to 2021, which amounted to USD 1.28 trillion. Residential construction spending in 2022 amounted to USD 899.1 billion, which showed an increase of 13.3% compared to 2021, while non-residential construction spending amounted to USD 530.1 billion, which showed a decrease of 9.1% compared to 2021. Therefore, increasing in the private constructions in the United States is expected to create an upside demand for base metals market from the country's construction industry.

- Additionally, in May 2022, the the United States government announced to the allocation of over USD 110 billion for carrying out 4.3 thousand specific projects for modernizing airports and ports and rebuilding roads and bridges. These projects are expected to benefit around 3.2 thousand communities across the 50 states.

- Moreover, China is in the midst of a construction mega-boom. The country has the largest building market in the world, making up 20% of all construction investment globally. The country alone is expected to spend nearly USD 13 trillion on buildings by 2030.

- Furthermore, the residential sector in India is on an increasing trend, with government support and initiatives further boosting the demand. According to the India Brand Equity Foundation (IBEF), the Ministry of Housing and Urban Development (MoHUA) allocated USD 9.85 billion in the 2022-2023 budget to construct houses and create funds to complete the halted projects. Therefore, the increasing investments in the residential sector are expected to create an upside demand for the base metal market.

- According to the Canadian Construction Association, the construction sector is one of Canada's largest employers and a major contributor to the country's economic success. The industry contributes 7% of the country's Gross Domestic Product (GDP). For instance, according to Statistics Canada, total investment in building construction increased by 3.3% during Q2 2022, and reached USD 62.3 billion, thus increasing for the third consecutive quarter. The residential investment reached USD 46.4 billion, largely due to increased spending on building multifamily homes. The non-residential sector increased by 2.6% to USD 15.8 billion.

- In addition, various government projects, such as New Building Canada Plan (NBCP) and Affordable Housing Initiative (AHI), are supporting the sector's growth. In Canada, the residential and commercial sectors have been witnessing steady growth in the recent past. The country witnessed some of the largest construction projects, such as Panda Condominium, Harwood Condominium, Power and Adelaide Condominium, and Amazon Distribution Centre/Ottawa.

- Due to the growing number of commercial and hotel development projects in Morocco, the demand for base metals market is expected to have an upside demand. For instance, In Morocco, Hilton currently operates five hotels and has six hotels under development across the country, with Conrad Rabat Arzanaset to open in the coming months and the DoubleTree by Hilton Marina Agadir Hotel & Residences set to open in Q3 2023.

- Owing to all above mentioned factors, the demand for base metals is expected to have an upside demand during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is projected to be the largest market for base metals during the forecast period. The increasing investments in the construction industry, rising electrical and electronics production, and surging demand for heavy equipment, with multinational companies investing in the industrial sector, are some of the major factors driving the demand for base metals in the region.

- China holds the largest Asia-Pacific market share for the base metals market. The demand for the base metals market is expected to rise throughout the forecast period due to rising investments and construction activity in the country. China is a huge contributor, as it has been one of the leading investors in infrastructure worldwide over the past few years. For instance, according to the National Bureau of Statistics (NBS) of China, in 2022, the output value of construction works in China amounted to CNY 27.63 trillion (USD 4.11 trillion), an increase of 6.6% compared with 2021.

- Demographics in China are expected to continue to spur growth in residential construction. Rising household income levels combined with population migrating from rural to urban areas is expected to continue to drive demand for residential construction sector in the country.

- Moreover, China is also the largest manufacturer of automobiles in the world. China is one of the largest producers of passenger cars, due to the improving logistics and supply chains, increased business activity, and the country's raft of pro-consumption measures, among other factors contributing to the passenger car market products in the country. Therefore, this has increased demand for base metals consumptuon from the passenger car segment. For instance, according to OICA, in 2022, the passenger car production in China amounted to 2.38 million units, which shown an increase of 11% compared to 2021.

- In India, increasing regulations on vehicle emissions, advancement in vehicle safety, the introduction of driver-assist systems in vehicles, and rapidly growing logistics in the retail and e-commerce sectors, have been significantly driving the demand for new and advanced Light commercial vehicles (LCVs). For instance, accroding to OICA, in 2022, light commercial vehicle production in India amounted to 617.4 thousand units, which showen an increase of 27% compared to 2021 and a recovery of 60% compared to 2020.

- Moreover, increased investments and advancements in the automobile industry in India is expected to increase in the consumption of base metals. For instance, in April 2022, Tata Motors announced plans to invest USD 3.08 billion in its passenger vehicle business over the next five years. Therefore, increasing in the peroduction of automobiles and increasing investments in the automobile industry is expected to have an upside demand for base metals market from the country's automotive and transportaion industry..

- India has the fourth largest railway network with a route length of 123.24 thousand kilometres and 13.45 thousand passenger trains and 9.141 thousand freight trains transporting 24 million passengers and 203.88 million tonnes of freight per day from 7.35 thousand stations. Recent developments and government initiatives in railways in India may boost the market studied. As per Union Budget 2022-23, Ministry of Railways have been allocated INR 1.40 trillion (USD 18.40 billion). Thus boosting the base metals market from automobile and transportation industry.

- Copper, tin, nickel, and aluminum are some common metals used by the electronics industry. The Asian region is the largest producer of electrical and electronics across the globe with countries such as China, Japan, South Korea, Singapore, and Malaysia dominating at the global level.

- In Japan, according to JEITA (Japan Electronics and Information Technology Association), domestic shipments of consumer electronics in Japan reached a value of JPY 125.2 billion (USD 964.04 million) in December 2022. While March was the strongest month for consumer electronics shipments during2022, with around JPY 125.5 billion (USD 966.35 million), May was the weakest, with the value falling to JPY 86.4 billion (USD 665.28 million). Therefore, increasing in the shipments of consumer electronics from the country is expected to have an upside for base metals market.

- Hence, all such favorable trends and investments in the region are expected to drive the demand for base metals during the forecast period.

Base Metals Industry Overview

The Base Metals Market is fragmented in nature. The major players in this market (not in a particular order) include Glencore, Freeport-McMoRan, Alcoa Corporation, Lundin Mining Corporation, and BHP, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from the Construction Industry

- 4.1.2 High Demand for Lightweight Vehicles

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Increasing Emission of Greenhouse Gases

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Copper

- 5.1.2 Zinc

- 5.1.3 Lead

- 5.1.4 Nickel

- 5.1.5 Aluminum

- 5.1.6 Tin

- 5.2 End-user Industry

- 5.2.1 Construction

- 5.2.2 Automotive and Transportation

- 5.2.3 Electrical and Electronics

- 5.2.4 Consumer Products

- 5.2.5 Medical Devices

- 5.2.6 Others

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Alcoa Corporation

- 6.4.2 Anglo American plc

- 6.4.3 BHP

- 6.4.4 Freeport-McMoRan

- 6.4.5 Glencore

- 6.4.6 Jiangxi Copper Corporation

- 6.4.7 Lundin Mining Corporation

- 6.4.8 Rio Tinto

- 6.4.9 Vale

- 6.4.10 Vedanta Resources Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand from Electric Vehicle (EV) Production Sector

- 7.2 Other Opportunities