|

市场调查报告书

商品编码

1435810

企业绩效管理:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Enterprise Performance Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

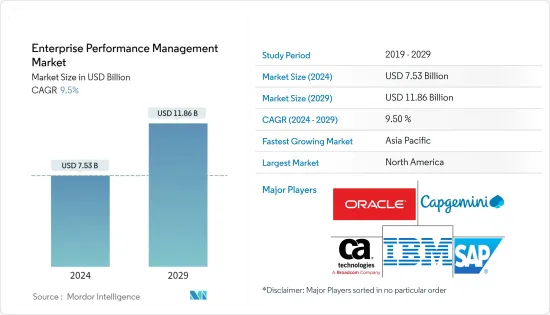

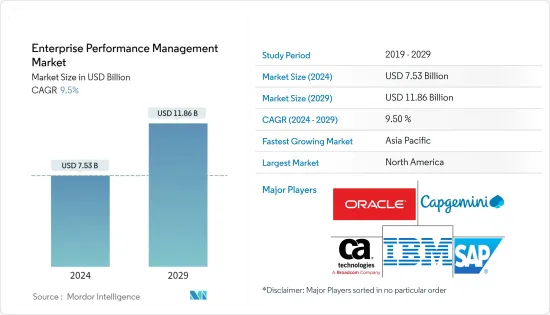

2024年企业绩效管理市场规模预计为75.3亿美元,预计到2029年将达到118.6亿美元,在预测期内(2024-2029年)增长9.5%,复合年增长率增长。

对透明商务策略的需求不断增加、对核心业务的关注度不断提高、整体绩效的提高以及组织内资料主导决策的增加正在推动 EPM 市场的成长。

主要亮点

- 云端基础的EPM 的采用在全球范围内不断增加,赢得了市场的关注。例如,JTEKTOracle Cloud EPM 软体及其相关功能。

- 将机器人流程自动化 (RPA) 工具整合到企业绩效管理中是影响 EPM 市场成长的主要趋势之一。将 RPA 纳入公司的绩效管理流程可以让员工更专注于核心业务。

- 此外,领先企业正在整合新的基础设施效能管理(IPM)解决方案。例如,2022年11月,人工智慧主导的混合云端管理和监控解决方案领先供应商Virtanen宣布,其旗舰基础设施效能管理(IPM)产品VirtualWisdom将整合到Virtana平台中。 Virtana 平台是一种软体即服务 (SaaS) 平台,使用户能够透过将多种产品组合到一个解决方案中来解决与工具蔓延相关的问题。

- 各行业产生的资料量和敏感度不断增加,提高了监管要求,并推动了 EPM 软体的采用。此外,两家公司都在适应各种併购策略,开发新产品,并将其产品组合扩展到 EPM 产品的各种资料分析功能。

- 然而,企业需要意识到 EPM 软体的巨大优势。公司仍无法利用即时与新技术结合来主动分析业务指标、提高透明度并决策流程。 EPM 软体供应商可以透过推出更实惠的服务包在客户中销售其产品。

- COVID-19 预计将对所研究的市场产生积极影响。由于一些公司的财务中断是前所未有的,因此公司预计将部署 EPM 软体进行影响分析。 TCS 等许多公司已经计划重新设计其业务流程,并且远端绩效管理模组可能会添加到现有的 EPM 工具中。

企业绩效管理 (EPM) 市场趋势

BFSI 产业预计将占据主要市场占有率

- 全球金融危机之后,银行变得高度意识到可以帮助它们利用经济繁荣和流动性来降低资产负债表风险并重建成本基础的槓桿。然而,许多银行仍然容易受到客户财务状况的影响,包括银行商业化导致贷款义务增加,从而导致激烈的竞争。

- 因此,BFSI 领域的公司越来越多地实施 EPM 应用程序,以简化其财务规划和预算流程。瑞典和泰国的银行开始在其核心业务中实施进度管理解决方案。

- 它还推出了云端基础的客製化解决方案,使 EPM 解决方案在整个行业中得到更广泛的采用。例如,根据资料库资料库私人资料库云端格式,处理资料的速度提高了近 10 倍。这有助于储存、循环和利用资料,以便在 SAP 和其他 Oracle 工具中进行进一步分析,从而优化系统效能。

- 同样, Oracle提供 SAP S/4HANA Finance,这是一种 ERP 财务管理和会计软体解决方案,涵盖从产业计画和分析到财务管理和协作财务业务的所有内容。云端整合可让您远端存取与效能相关的资讯。

- 此外,由于全球冠状病毒感染疾病(COVID-19) 大流行扰乱了 BFSI 行业的业务运营,预计公司现在将能够部署 EPM 软体进行业务影响分析。此外,由于各个公司都在远端工作,EPM 软体提供了急需的支援来维持业务需求。例如,Oracle Hyperion EPM 评估使用者环境并确定是否需要进行调整以最佳化远端使用者的体验。

亚太地区预计将成为成长最快的市场

- 预计市场成长将由最终用户细分市场的发展推动。预计零售和电子商务行业在预测期内将拥有该地区最大的市场规模。

- 该地区印度等新兴经济体的监管控制力度加大,各行业业务发展迅速且竞争激烈,对商务策略指南的需求不断增加,为金融专业人士创造了先例趋势,持续不断的压力正在推动对EPM解决方案的需求。

- 根据《经济时报》报道,2022 年 4 月,印度绩效管理软体新兴企业Mesh, Inc. 筹集了由 RTL Group主导的1,100 万美元资金,用于其在亚太和美国的扩张计划。同样,2021 年 6 月,该公司在种子轮融资中筹集了 510 万美元。该公司还报告称,自成立以来,收益增加了16倍。

- 不断发展的 5G 网路预计还将利用由此产生的软体和相关工具的云端迭代来支援此类软体在银行等最终用户领域的远端部署。根据gadgets360.com报道,该网站2022年8月报道称,电信部电讯无线电频道竞标发出频谱分配函,确认印度13个城市将在下个月获得高速互联网服务。

- 此外,中国政府推出了「中国製造2025」倡议,以提高製造业的竞争力。提高国家製造能力的目标进一步增加了 EPM 等软体的采用,以增强知情成长和决策,并具有其他好处以有效管理业务。预计这将带来进展。

企业绩效管理 (EPM) 产业概述

企业绩效管理市场适度分散,服务供应商之间竞争激烈。供应商不断向其现有解决方案添加新模组,以改善客户的绩效管理。策略性收购和合作伙伴关係持续塑造生态系统,公司选择适合其组织规模和要求的服务。此外,我们还看到云端运算等最新技术的引入,并正在努力提高系统的复杂性。

- 2022 年 8 月 - Nissan 选择 Anaplan, Inc. 收集和分析来自世界各地的全球资料。 Nissan 使用 Anaplan 收集和分析其营运中的全球资料,以简化复杂的业务,做出更快、更明智的业务决策,并提供即时绩效管理,目的是为未来提供更快的业务决策。

- 2022 年 7 月 - Oracle 公司发布企业绩效管理 (EPM) 11.2.10,现在可以在 Oracle 软体交付云端下载。新版本包括 Java 8 Update 331、EPM 安全指南中更新的钱包建立部分以及 Oracle 21c资料库支援等功能。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- 评估 COVID-19 对产业的影响

第五章市场动态

- 市场驱动因素

- 需要最大限度地降低营运成本

- 主导资料驱动普及

- 市场限制因素

- 缺乏企业意识/知识

第六章市场区隔

- 部署

- 本地

- 云

- 公司规模

- 小到中尺寸

- 大公司

- 最终用户产业

- BFSI

- 通讯

- 卫生保健

- 製造业

- 其他最终用户产业

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第七章 竞争形势

- 公司简介

- IBM Corporation

- SAP SE

- CA Technologies(Broadcom Inc.)

- Oracle Corporation

- Capgemini SE

- Anaplan Inc.(Thoma Bravo)

- Workiva Inc.

- HCL Technologies Limited

- Adaptive Insights Inc.(Workday Inc.)

- Vena Solutions

- Talentia Software

第八章投资分析

第九章 市场未来展望

The Enterprise Performance Management Market size is estimated at USD 7.53 billion in 2024, and is expected to reach USD 11.86 billion by 2029, growing at a CAGR of 9.5% during the forecast period (2024-2029).

The increasing need to have a transparent business strategy, growing focus on core business, overall improvement in performance, and rising data-driven decision-making in the organization are driving the growth of the EPM market.

Key Highlights

- The increase in the adoption of cloud-based EPM worldwide is gaining market traction. For instance, in July 2022, JTEKT reported a 25% reduction in budgeting time, reduced project delivery time, and improved forecast and assertiveness, as the company utilized Oracle Cloud EPM software and its related features in areas like business, finance, information technology, and human resources.

- Integrating Robotic Process Automation (RPA) Tools in enterprise performance management is one of the critical EPM market trends influencing growth. Including RPA in the enterprise's performance management processes will enable employees to focus more on core operations.

- Moreover, the leading companies are integrating new infrastructure performance management (IPM) solutions. For instance, in November 2022, a Leading supplier of AI-driven hybrid cloud management and monitoring solutions, Virtanen, announced that its flagship Infrastructure Performance Management (IPM) product, VirtualWisdom, would be integrated into the Virtana Platform. The Virtana Platform is a Software-as-a-Service (SaaS) platform that enables users to address the problems associated with tool sprawl by combining many products into a single solution.

- The increasing regulatory requirements owing to the rising volume and sensitive nature of data being generated across industries are prompting the deployment of EPM software. Moreover, the companies adapt to various merger and acquisition strategies to develop new products and expand their portfolio to different data analytics features in EPM products.

- However, enterprises still need to be made aware of the tremendous benefits of EPM software. The companies are yet to leverage the real-time benefits, coupled with the new technologies, to analyze their business metrics in advance and streamline their decision-making processes with added transparency. The EPM software providers can market the products among clients by introducing more affordable service packages.

- COVID-19 is expected to have a positive impact on the market studied. Since the financial disruption for some of the businesses is unprecedented, companies are expected to deploy EPM software for impact analysis. With many companies, like TCS, already planning to restructure business processes, remote performance management modules will likely be added to the existing EPM Tools.

Enterprise Performance Management (EPM) Market Trends

BFSI Sector is Expected to Account for Major Market Share

- Later the global financial crisis, the banks have become very conscious about the measure that helps them reduce risk on their balance sheet and restructure their cost bases by leveraging economic prosperity and liquidity. However, many banks remain vulnerable to customers' financial circumstances, such as loan debts added with the commercialization of banks, giving rise to cut-throat competition.

- Thereby, companies in the BFSI sector are increasingly deploying EPM applications to streamline financial planning and budgeting processes. Swedish and Thai banking have started implementing progress management solutions into their core operations.

- Also, the introduction of cloud-based bespoke solutions has enabled the broader deployment of EPM solutions across the industry. For instance, according to the update issued by Oracle Corporation for SAP customers in July 2022, Oracle Exodata Database Machine consolidated SAP and non-SAP Databases into private Database Cloud form, handling the data almost ten times faster or more. This helps in the circulation and utilization of storing the data for further analytics in SAP and other Oracle tools for optimizing system performance.

- Similarly, Oracle offers SAP S/4HANA Finance, an ERP financial management and accounting software solution that covers everything from business planning and analysis to treasury management and joint finance operations. The integration of the cloud helps access performance-related information remotely.

- Additionally, the global COVID-19 pandemic causing the disruption in business operations in the BFSI sector is expected to enable companies to deploy EPM software for business impact analysis. Moreover, with various companies working remotely, the EPM software provides much-needed support to maintain business requirements. For instance, Oracle Hyperion EPM evaluates the user environment and determines the needs to be tuned to optimize the experience of remote users.

Asia Pacific is Expected to be the Fastest-Growing Market

- The market growth is expected to be driven by the development of the end-user segments. The retail and E-commerce vertical is expected to hold the largest market size in the region during the forecast period.

- As emerging countries such as India in the region with growing regulatory controls, rapid and highly competitive business across the industries has increased the need for the guidance of business strategies added to the unprecedented and unrelenting pressure on finance professionals is driving the demand for EPM solutions.

- According to The Economic Times, in April 2022, Mesh, Inc, an Indian start-up providing Performance Management software, raised USD 11 million in funding led by RTL Group for plans to expand across the Asia Pacific and the United States. Similarly, in June 2021, the company raised USD 5.1 million as a part of its seed round. The company also reported its revenue to have grown 16 times since its foundation.

- Also, the growing 5G networks are expected to aid the remote deployment of such software in end-user segments like banking, leveraging the cloud iterations of the software and related tools utilizing the outcomes. According to gadgets360.com, in August 2022, the website reported that the Department of Telecom confirmed 13 Indian cities to get high-speed internet services the following month as it issued spectrum assignment letters to the bidders for radio wave channels.

- Besides, China's government has launched the 'Made in China 2025' initiative to improve the country's manufacturing competitiveness. The goal of upgrading the nation's manufacturing capacity is expected to lead to higher deployment of software like EPM to bolster informed growth and decision-making, leveraging other benefits for managing businesses effectively.

Enterprise Performance Management (EPM) Industry Overview

The enterprise performance management market is moderately fragmented, with intense competition among the service providers. The vendors continually add new modules to their existing solutions to aid better performance management of customers. Strategic acquisitions and partnerships continue to shape the ecosystem, with companies opting for services customized as per the size and requirements of the organizations. Also, incorporation of the cloud and other latest technologies is seen for upgrading the

- August 2022 - Nissan Motor Co., Ltd selected Anaplan, Inc. to collect and analyze global data worldwide. Nissan aimed to streamline complex operations, making more informed and prompt business decisions by using Anaplan to collect and analyze global data across its businesses, enabling real-time performance management and faster business decisions for the future.

- July 2022 - Oracle Corporation released Enterprise Performance Management (EPM) 11.2.10, available for download on Oracle Software Delivery Cloud. The new version included features like Java 8 Update 331, an updated Wallet creation section in the EPM Security guide, Oracle 21c database support, and other features.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of Covid-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Need for Minimizing Operational Expenses

- 5.1.2 Proliferation of Data Driven Decision Making

- 5.2 Market Restraints

- 5.2.1 Lack of Awareness and Knowledge Among Enterprises

6 MARKET SEGMENTATION

- 6.1 Deployment

- 6.1.1 On-premise

- 6.1.2 Cloud

- 6.2 Size of Enterprise

- 6.2.1 Small and Medium

- 6.2.2 Large

- 6.3 End-user Industry

- 6.3.1 BFSI

- 6.3.2 Telecommunication

- 6.3.3 Healthcare

- 6.3.4 Manufacturing

- 6.3.5 Other End -user Industries

- 6.4 Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Rest of World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 SAP SE

- 7.1.3 CA Technologies (Broadcom Inc.)

- 7.1.4 Oracle Corporation

- 7.1.5 Capgemini SE

- 7.1.6 Anaplan Inc. (Thoma Bravo)

- 7.1.7 Workiva Inc.

- 7.1.8 HCL Technologies Limited

- 7.1.9 Adaptive Insights Inc. (Workday Inc.)

- 7.1.10 Vena Solutions

- 7.1.11 Talentia Software