|

市场调查报告书

商品编码

1435815

内容情报:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Content Intelligence - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

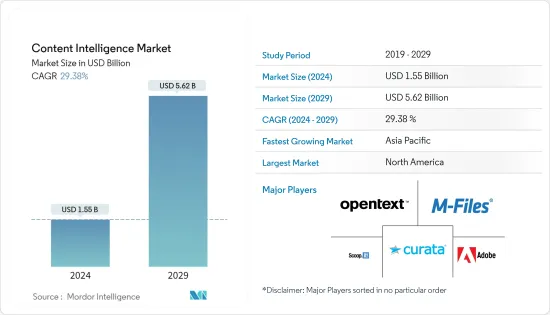

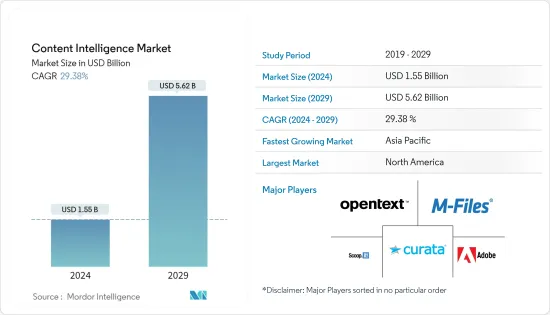

内容智慧市场规模预计到 2024 年为 15.5 亿美元,预计到 2029 年将达到 56.2 亿美元,在预测期内(2024-2029 年)市场规模将成长 29.38%,预计将以复合年增长率成长。

互联网的发展和各行业数位转型技术的采用正在产生大量资料。例如,WordPress 是一个流行的内容管理系统(CMS) 平台,为网路上35.2% 的网站提供支持,截至2020 年3 月,拥有超过4.09 亿用户访问200 亿个页面,每月访问7,000 个页面。报告查看了10,000,000 个新帖子。

主要亮点

- 此外,Adobe Inc 进行的一项研究发现,一般人每天花费约 7.8 小时与数位内容互动,其中青少年每天花费 11.1 小时。此外,用户越来越需要更个人化的内容。

- 现代负责人开始认识到分发有用内容以利用竞争激烈且不断增长的数位内容市场的重要性和价值,这正在推动集客式行销等内容行销策略成为主流。我就是。

- 此外,内容行销近年来经历了各种变革。向行销分析转变以增强自动化正在主导利用先进技术的内容行销策略的发展,从而引发了对内容智慧的需求。

- 内容智能为内容负责人提供了重要资料,以了解其受众、制定策略并证明高投资报酬率。这使得负责人能够从产生的大量资料中获得宝贵的见解,指导基于资料的决策,并创建更有效的内容,同时证明决策的合理性并使其更加有效。您将能够对其进行管理。

- 本质上,内容智慧利用机器学习、自然语言处理、人工智慧和巨量资料等技术,高效、有效地执行重复性任务,同时准确分析讯息,帮助负责人高度个人化内容。确保更多流量、参与度、潜在客户和保留率。

- 例如,CI 工具 Concured 使用 AI 来预测网路上最受欢迎的主题,并提案接下来要写什么内容。此外,它将 Twitter 和 Facebook 等平台的社交参与与原始内容中的主题相关联,并将其转换为主题分数,为最终用户提供新的内容创建机会。此外,它还依赖深度学习演算法来提供趋势。

内容智慧市场趋势

各产业内容智能的新兴趋势

- 随着网路流量的增加,负责人现在正在考虑个人化等内容策略。这使得组织能够超越基于用户位置和人口统计数据的传统内容行销策略,转向用户行为和社交媒体活动等高级资讯。利用内容智能等工具,从而推动市场成长。例如,Youtube、Amazon Prime 和 Netflix 等媒体串流平台正在积极利用内容个人化来提高用户参与度。

- 随着 Salesforce Desk 和 Zoho CRM 等 CRM 平台在各行业中不断发展,以协助高效、有效地管理客户关係,考虑在此类平台中实施人工智慧等技术,正在推动内容智慧市场的潜在成长。

- 例如,Content IQ 提取透过传入通讯产生的内容,将相关资讯整合到下游流程中,并将其提供给面向消费者的系统。透过快速将内容转化为可操作的资料,您的员工可以在与客户沟通时获得全面的见解。此外,如果能够存取聊天机器人和电子邮件等非结构化资料,组织将能够为其客户提供个人化服务。

- 此外,透过将内容智慧与商业智慧整合,组织可以利用内容智慧的潜力,透过分析合约、通讯、电子邮件等中的现有业务内容并识别趋势、机会和优化,进一步增强业务决策。

- 此外,内容智慧还可以帮助进行风险分析,因为它可以儘早追踪文件及其内容,并透过资料添加智慧见解,以便更好地概述指定完成情况,帮助组织遵守监管要求,从而帮助防止诈欺。

北美占据主要市场占有率

- 由于 Adobe Inc.、Scoop、OpenText Corporation、Atomic Reach Inc. 和 Vennli Inc. 等主要供应商的存在,北美占据了很大的份额。

- 此外,互动广告局和普华永道发布的一份报告指出,美国的数位广告支出已超过 1,000 亿美元,这表明 Content Intelligence 等市场情报平台的潜在成长潜力。

- 此外,该地区在活跃的社群媒体用户、内容创作者和智慧型手机普及方面被认为正在经历健康成长。例如,Facebook 报告称,美国和加拿大每月约有 2.48 亿有效用户。这标誌着该地区产生的资料量增加,可以利用内容智慧等平台来推动对趋势的洞察,从而促进市场成长。

- 此外,最近的 COVID-19 大流行、封锁的宣布以及在家工作的专业人士增加了对互联网的需求。全球媒体公司报告成长了 50-70%,其中美国加州报告成长了 46.5%。在本案例中,我们利用内容智慧的发展来帮助组织进一步製定内容策略并推动疫情期间的市场成长。

内容智慧产业概况

内容情报市场适度分散,由 Adobe Inc 和 Scoop 等几家主要企业组成。还有 OpenText 公司。供应商正在利用策略联合倡议和收购来扩大其影响力,作为竞争优势来获得市场占有率。

2023 年 2 月,Adobe Experience Cloud 将包含额外的 AI 功能,以实现个人化数位体验。 Adobe Teacher GenAI 是一个新的副驾驶,可让负责人和其他客户经验团队利用许多 Adobe Experience Cloud 应用程式来实现多个用例,包括整个客户旅程中的资产创建和个人化。

2023 年 3 月,IBM 和 Adobe 联手协助行销和创新公司优化其内容供应链。内容供应链将人员、流程、工具、见解和工作方法连接到整合的工作流程中,并为相关人员提供端到端的可见性,以创建、管理、审查、部署和分析内容。我会做到的。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 市场限制因素

- 价值链分析

- 波特五力分析

- 买家/消费者的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 评估 COVID-19 对产业的影响

第五章市场区隔

- 成分

- 解决方案

- 服务

- 部署

- 云

- 本地

- 混合

- 组织规模

- 中小企业

- 大公司

- 最终用户产业

- 媒体娱乐

- 政府/公共部门

- BFSI

- 资讯科技/通讯

- 製造业

- 医疗保健/生命科学

- 零售业

- 其他的

- 地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 其他亚太地区

- 拉丁美洲

- 中东/非洲

- 北美洲

第六章 竞争形势

- 公司简介

- M-Files Corporation

- Adobe Inc.

- Scoop.it

- ABBYY

- OpenText Corporation

- Curata Inc.

- Socialbakers

- Concured

- Atomic Reach Inc.

- OneSpot Inc.

- Vennli Inc.

- Content360 Ltd

- Smartlogic

第七章 投资分析

第八章 市场机会及未来趋势

The Content Intelligence Market size is estimated at USD 1.55 billion in 2024, and is expected to reach USD 5.62 billion by 2029, growing at a CAGR of 29.38% during the forecast period (2024-2029).

The growth of the internet and the adoption of digital transformation technologies across the industry are leading to the generation of an enormous volume of data. For instance, WordPress, a popular content management system (CMS) platform that powers 35.2% of all sites on the web, reports as of March 2020, each month, it generates over 409 million people viewing 20 billion pages with 70 million new posts.

Key Highlights

- Also, research conducted by Adobe Inc states that the average person spends around 7.8 hours daily interacting with digital content, with teenagers reporting 11.1 hours daily. Furthermore, there also has been a trend with users demanding more personalized content.

- Modern marketers are starting to appreciate the importance and value of delivering useful content to capitalize on the growing digital content market amidst the competition, thereby content marketing strategies such as inbound marketing have become a dominant force.

- Furthermore, content marketing has been experiencing various transformations over the last few years. The shift towards marketing analytics to increase automation is leading the evolution of content marketing strategies leveraging advanced technologies, thereby initiating the demand for content intelligence.

- Content Intelligence offers content marketers the data essential to understand the audience and help them strategize and prove higher ROI. It enables marketers to gain valuable insights from the volume of data generated that allows them to derive data-driven decisions to create more effective content while justifying the decisions and managing upwards effectively.

- Essentially, Content intelligence is powered by technologies such as machine learning, natural language processing, AI, and big data that enable it to conduct repetitive tasks efficiently and effectively while ensuring the information is analyzed accurately, thereby helping marketers to hyper-personalize the content while ensuring greater traffic, engagement, leads, and retention.

- For instance, Concured, a CI tool, utilizes AI to predict subjects that grab the most internet attention and suggest what the content should be written about next. Additionally, it correlates social engagements from platforms like Twitter and Facebook from the original content against the topic to translate into a topic score, thereby providing the end-users opportunity for new content creation. Furthermore, it relies on deep-learning algorithms to provide trends.

Content Intelligence Market Trends

Emerging Trends of Content Intelligence Across Industries

- Amidst the growth of internet traffic, marketers are now considering content strategies, such as personalization, as it allows organizations to look beyond traditional content marketing strategies based on users' location and demographics to advanced information, like their behavior and social media activity. It leverages tools like content intelligence, thereby driving the market's growth. For instance, media streaming platforms such as Youtube, Amazon Prime, and Netflix actively use content personalization to increase user engagement.

- As with the growth of CRM platforms such as Salesforce Desk and Zoho CRM across the industry to help manage customer relationships efficiently and effectively, added businesses considering implementing technologies such as AI into such platforms drive the potential growth of the content intelligence market.

- For instance, the Content IQ extracts the content generated through incoming communication, integrates relevant information to the downstream processes, and provides it to the consumer-facing system; this quick turnaround of content to actionable data provides the staff comprehensive insights while still communicating with the customer. Additionally, given access to unstructured data, such as chatbots and email, organizations would provide personalized services to their customers.

- Also, integrating content intelligence with business intelligence would allow organizations to enhance their business decisions further to identify trends, opportunities, and optimization by leveraging content intelligence potential to analyze existing business content from contracts, communications, and emails, among others.

- Furthermore, content intelligence would also help analyze risk as it makes early tracking of documentation and its content possible added with intelligent insights with the given data for a better overview of completion of the set help organizations to comply with regulations and thereby prevent fraud.

North America Holds Major Market Share

- North America holds a significant share owing to the presence of major vendors, such as Adobe Inc. and Scoop: it, OpenText Corporation, Atomic Reach Inc., and Vennli Inc.

- Moreover, a report published by Interactive Advertising Bureau and PricewaterhouseCoopers states that US digital ad spending has exceeded USD 100 billion, which suggests the potential growth of market intelligence platforms such as content intelligence.

- Furthermore, the region is considered to have healthy growth in terms of active social media users, content makers, and smartphone penetration. For instance, Facebook reported around 248 million monthly active users in the United States and Canada. It suggests growth in the volume of data generated in the region, which platforms like content intelligence can leverage to drive insights about trends, thereby elevating the market's growth.

- Additionally, the recent global COVID-19 outbreak, the announcement of lockdowns, and work from home for the working professional increased the demand for the internet. Media houses reported a growth of 50-70% worldwide, with the US-California reporting a change of 46.5%; this instance leveraged the development of content intelligence as it allowed organizations to strategize their content amid the pandemic further and drive the market's growth.

Content Intelligence Industry Overview

The content intelligence market is moderately fragmented and consists of several major players, including Adobe Inc and Scoop. It, and OpenText Corporation. The vendors are enhancing their reach, leveraging strategic collaborative initiatives and acquisitions as a competitive advantage to capture market share.

In February 2023, Adobe Experience Cloud includes additional AI features for personalizing digital encounters. Adobe Sensei GenAI is a new copilot for marketers and other customer experience teams to leverage across many Adobe Experience Cloud applications for several use cases, like asset creation and personalization across the customer journey.

In March 2023, IBM and Adobe collaborated to help marketing and creative firms optimize their content supply chains. The content supply chain creates, manages, reviews, deploys, and analyzes the content by linking people, processes, tools, insights, and working methods into a unified workflow and providing stakeholders with end-to-end visibility.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Buyers/Consumers

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assesment of COVID-19 Impact on the Industry

5 MARKET SEGMENTATION

- 5.1 Component

- 5.1.1 Solution

- 5.1.2 Service

- 5.2 Deployment

- 5.2.1 Cloud

- 5.2.2 On-premise

- 5.2.3 Hybrid

- 5.3 Organization Size

- 5.3.1 Small- and Medium-Sized Enterprises

- 5.3.2 Large Enterprises

- 5.4 End-user Vertical

- 5.4.1 Media and Entertainment

- 5.4.2 Government and Public Sector

- 5.4.3 BFSI

- 5.4.4 IT and Telecom

- 5.4.5 Manufacturing

- 5.4.6 Healthcare and Lifesciences

- 5.4.7 Retail

- 5.4.8 Other End-user Verticals

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 India

- 5.5.3.2 China

- 5.5.3.3 Japan

- 5.5.3.4 Rest of Asia-Pacific

- 5.5.4 Latin America

- 5.5.5 Middle-East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 M-Files Corporation

- 6.1.2 Adobe Inc.

- 6.1.3 Scoop.it

- 6.1.4 ABBYY

- 6.1.5 OpenText Corporation

- 6.1.6 Curata Inc.

- 6.1.7 Socialbakers

- 6.1.8 Concured

- 6.1.9 Atomic Reach Inc.

- 6.1.10 OneSpot Inc.

- 6.1.11 Vennli Inc.

- 6.1.12 Content360 Ltd

- 6.1.13 Smartlogic