|

市场调查报告书

商品编码

1435821

汽车衬套:市场占有率分析、产业趋势、成长预测(2024-2029)Automotive Bushing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

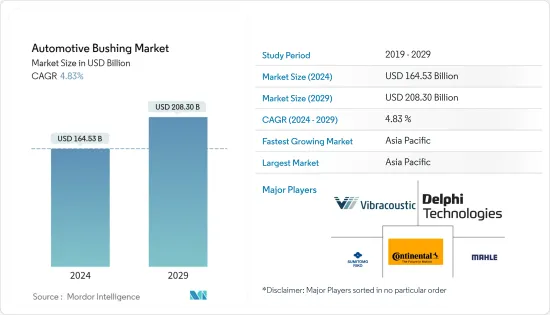

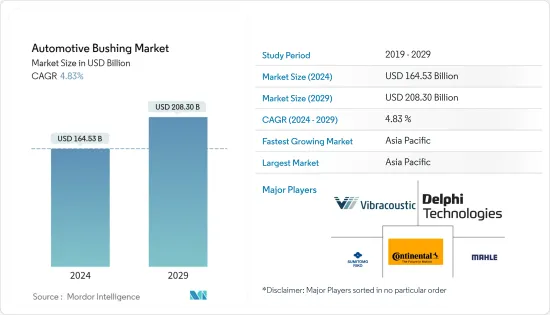

汽车衬套市场规模预计2024年为1645.3亿美元,预计到2029年将达到2083亿美元,在预测期内(2024-2029年)复合年增长率为4.83%增长。

主要亮点

- 冠状病毒感染疾病(COVID-19)大流行对汽车衬套市场产生了重大影响。疫情给汽车产业带来了很大的衝击。受疫情影响,不少汽车製造商被迫停产。这导致汽车衬套的需求下降。

- 疫情也扰乱了汽车供应链。这使得汽车製造商很难获得製造衬套所需的材料。疫情造成的经济放缓也导致新车需求下降。这对汽车衬套的需求产生了连锁反应。然而,随着情况恢復正常,汽车产量大幅增加,带动了隔年的市场。

- 随着车辆标准的提高,车辆必须具有最低程度的噪音、声振粗糙度和振动。最终用户对噪音和空气污染的日益关注以及要求汽车製造商尽量减少车辆噪音污染的严格政府标准是汽车衬套市场的主要成长动力。我是。

- 随着人们收入水准的提高,他们会花额外的钱购买新车和豪华车。预计全球汽车销售量在预测期内将增加。随着汽车销量的增加,作为汽车各部件必不可少的材料的衬套市场预计将扩大。

汽车衬套市场趋势

更高的舒适度和更安静的汽车推动市场

- 不断提高的舒适度和更安静的汽车正在推动汽车衬套市场的发展。衬套用于悬吊系统中以吸收衝击和振动。这提供了更平稳的行驶并降低了噪音。例如,2023年3月,大陆集团宣布推出新的Busch电动车产品线。新的 Busch 产品线旨在降低电动车的 NVH,电动车比汽油车更容易产生噪音和振动。

- 衬套用于引擎支架,将引擎与车辆的其他部分隔离。这可以减少噪音和振动并提高引擎性能。

- 衬套用于变速箱安装座,以将变速箱与车辆的其他部分隔离。这可以减少噪音和振动并提高传输性能。

- 随着对更舒适、更安静的汽车的需求增加,对衬套的需求预计也会增加。这是因为衬套在降低噪音和振动方面发挥着重要作用。

- 轻型车辆越来越受欢迎,这增加了对衬套的需求。由铝或复合材料等轻质材料製成的衬套越来越受欢迎,因为它们可以在不牺牲性能的情况下减轻重量。

- 电动车和自动驾驶汽车等新技术正在增加对新型套管的需求。电动车需要能够承受马达高扭矩的衬套,自动驾驶汽车需要能够提供精确控制的衬套。

- 随着越来越多的驾驶者选择更换磨损或损坏的衬套,汽车衬套售后市场正在不断增长。这增加了售后供应商对衬套的需求。

- 总体而言,汽车衬套市场预计在未来几年将继续成长。市场预计将受益于对舒适和安静汽车的需求不断增长、新技术的发展和售后市场的成长。

亚太地区获得主要市场占有率

- 亚太地区在汽车衬套市场中占有主要市场占有率。亚太地区的汽车工业正在快速成长,这增加了对汽车衬套的需求。

- 例如,预计2022年包括中东在内的亚太地区销量约为3,750万辆小客车,其中中国销量超过2,360万辆。相较之下,预计2021年亚太地区小客车销量约3,457万辆。

- 亚太地区对豪华车的需求不断增加,这些汽车通常比经济型汽车需要更多的衬套。

- 电动车和自动驾驶汽车等新技术的发展正在增加对新型套管的需求。这些车辆比汽油车辆更容易产生噪音和振动,因此必须使用专用这些车辆设计的衬套。

- 亚太汽车产业面临越来越大的提高安全性的压力,衬套在安全系统中发挥着重要作用。衬套用于各种安全关键应用,例如悬吊和转向系统。随着安全问题的增加,安全系统中对套管的需求也预计会增加。

- 中国、日本和印度这些国家是世界上一些最大的汽车製造商的所在地,对豪华车和新技术的需求也在快速增长。因此,预计这些国家在未来几年仍将是汽车衬套的主要市场。

- 总体而言,亚太地区汽车衬套市场预计在未来几年将继续成长。市场预计将受益于豪华车需求的增加、新技术的发展以及安全问题的增加。

汽车衬套产业概况

汽车衬套市场高度分散,因为市场上有许多地区和国际参与者。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 汽车产量增加

- 重视车辆舒适性和降低 NVH

- 市场限制因素

- 经济波动和不确定性

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 车型

- 小客车

- 商用车

- 应用程式类型

- 悬吊系统衬套

- 引擎悬置衬套

- 底盘衬套

- 传动轴套

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 韩国

- 其他亚太地区

- 世界其他地区

- 巴西

- 阿拉伯聯合大公国

- 其他的

- 北美洲

第六章 竞争形势

- 供应商市场占有率

- 公司简介

- Delphi Technologies

- Continental AG

- Sumitomo Riko

- Vibracoustic

- Boge rubber and plastics

- Hyundai Polytech India Pvt. Ltd.

- Cooper Standard Holdings Ltd.

- Dupont

- Mahle

- Tenneco

第七章 市场机会及未来趋势

简介目录

Product Code: 69757

The Automotive Bushing Market size is estimated at USD 164.53 billion in 2024, and is expected to reach USD 208.30 billion by 2029, growing at a CAGR of 4.83% during the forecast period (2024-2029).

Key Highlights

- The COVID-19 pandemic had a significant impact on the automotive bushing market. The pandemic caused a number of disruptions to the automotive industry. Many automotive manufacturers were forced to shut down production due to the pandemic. This led to a decrease in demand for automotive bushings.

- The pandemic also caused disruptions to the automotive supply chain. This made it difficult for automotive manufacturers to obtain the materials they needed to produce bushings. Economic slowdown: The economic slowdown caused by the pandemic also led to a decrease in demand for new vehicles. This had a knock-on effect on the demand for automotive bushings. But as the situation got back to normal and the production of vehicles increased significantly, it drove the market in the coming year.

- With the growing standards of vehicles, it is essential for a vehicle to have minimum levels of noise, harshness, and vibrations. The increased concern about noise and air pollution amongst the end users and strict government norms for automobile manufacturers to ensure that their vehicle produces minimum levels of noise pollution have been the major growth drivers in the automotive bushing market.

- With the increase in income levels of the people, they are spending their excess money on buying new and luxurious vehicles. It is expected during the forecast period that the sales of automobiles all around the world will grow. With an increase in sales of automobiles, the market for bushing will also increase as it is an essential material in various parts of an automobile.

Automotive Bushing Market Trends

Rise in Comfort Levels and Silent Cars Driving the Market

- The rise in comfort levels and silent cars is driving the automotive bushing market. Bushings are used in the suspension system to absorb shocks and vibrations. This helps to provide a smoother ride and reduce noise. For instance, in March 2023, Continental AG announced that it had launched a new line of bushings for electric vehicles. The new line of bushings is designed to reduce NVH in electric vehicles, which are more prone to noise and vibration than gasoline-powered vehicles.

- Bushings are used in engine mounts to isolate the engine from the rest of the vehicle. This helps to reduce noise and vibration, and it also helps to improve the performance of the engine.

- Bushings are used in transmission mounts to isolate the transmission from the rest of the vehicle. This helps to reduce noise and vibration, and it also helps to improve the performance of the transmission.

- As the demand for more comfortable and silent cars increases, the demand for bushings is also expected to increase. This is because bushings play an important role in reducing noise and vibration.

- Lightweight vehicles are becoming increasingly popular, and this is driving the demand for bushings. Bushings made from lightweight materials, such as aluminum and composites, are becoming more popular as they offer weight savings without compromising performance.

- New technologies, such as electric vehicles and autonomous vehicles, are driving the demand for new bushings. Electric vehicles require bushings that can handle the high torque of electric motors, and autonomous vehicles require bushings that can provide precise control.

- The aftermarket for automotive bushings is growing as more and more motorists are choosing to replace worn or damaged bushings. This is driving the demand for bushings from aftermarket suppliers.

- Overall, the automotive bushing market is expected to continue to grow in the coming years. The market is expected to benefit from the increasing demand for comfortable and silent cars, the development of new technologies, and the growth of the aftermarket.

Asia Pacific Captures Major Market Share

- Asia-Pacific captures the major market share in the automotive bushing market. The growing automotive industry in Asia Pacific: The automotive industry in Asia Pacific is growing rapidly, and this is driving the demand for automotive bushings.

- For instance, in 2022, it was estimated that about 37.5 million passenger cars were sold within the Asia-Pacific region, including the Middle East, of which over 23.6 million were sold in China. Comparatively, it was also estimated that approximately 34.57 million passenger cars will be sold in the Asia-Pacific region in 2021.

- The increasing demand for premium vehicles: The demand for premium vehicles is increasing in Asia-Pacific, and these vehicles typically require a greater number of bushings than economy vehicles.

- The development of new technologies, such as electric vehicles and autonomous vehicles, is driving the demand for new bushings. These vehicles are more prone to noise and vibration than gasoline-powered vehicles, which requires the use of bushings that are specifically designed for these vehicles.

- The automotive industry in the Asia-Pacific is under increasing pressure to improve safety, and bushings play an important role in safety systems. Bushings are used in a variety of safety-critical applications, such as suspension and steering systems. As the focus on safety continues to increase, the demand for bushings in safety systems is also expected to increase.

- China, Japan, and India These countries are home to some of the largest automotive manufacturers in the world, and they are also seeing rapid growth in the demand for premium vehicles and new technologies. As a result, these countries are expected to continue to be major markets for automotive bushings in the coming years.

- The use of lightweight materials in vehicles is increasing, and this is driving the demand for automotive bushings. Lightweight materials can help to reduce noise, but they can also make vehicles more prone to noise. Automotive bushings can be used to mitigate the noise from lightweight materials. Active noise cancellation is a technology that can be used to reduce noise. This technology is becoming increasingly popular in vehicles, and it is expected to drive the demand for automotive bushings.

- Overall, the automotive bushing market in the Asia-Pacific is expected to continue to grow in the coming years. The market is expected to benefit from the increasing demand for premium vehicles, the development of new technologies, and the increasing focus on safety.

Automotive Bushing Industry Overview

The automotive bushing market is highly fragmented due to the presence of many regional and international players in the market. The major players in the market are Continental AG, Vibracoustic, Mahle, Delphi Technologies, Sumitomo Riko, Etc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Vehicle Production

- 4.1.2 Emphasis on Vehicle Comfort and NVH Reduction

- 4.2 Market Restraints

- 4.2.1 Economic Fluctuations And Uncertainties

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Vehicle Type

- 5.1.1 Passenger Car

- 5.1.2 Commercial Vehicle

- 5.2 Application Type

- 5.2.1 Suspension System Bushings

- 5.2.2 Engine Mount Bushings

- 5.2.3 Chassis Bushings

- 5.2.4 Transmission Bushings

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 Brazil

- 5.3.4.2 United Arab Emirates

- 5.3.4.3 Other Countries

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share**

- 6.2 Company Profiles*

- 6.2.1 Delphi Technologies

- 6.2.2 Continental AG

- 6.2.3 Sumitomo Riko

- 6.2.4 Vibracoustic

- 6.2.5 Boge rubber and plastics

- 6.2.6 Hyundai Polytech India Pvt. Ltd.

- 6.2.7 Cooper Standard Holdings Ltd.

- 6.2.8 Dupont

- 6.2.9 Mahle

- 6.2.10 Tenneco

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand for Electric and Hybrid Vehicles

- 7.2 Sustainability and Environmental Considerations

02-2729-4219

+886-2-2729-4219