|

市场调查报告书

商品编码

1435827

基于 MEMS 的 IMU:市场占有率分析、行业趋势/统计、成长预测 (2024-2029)MEMS-Based IMU - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

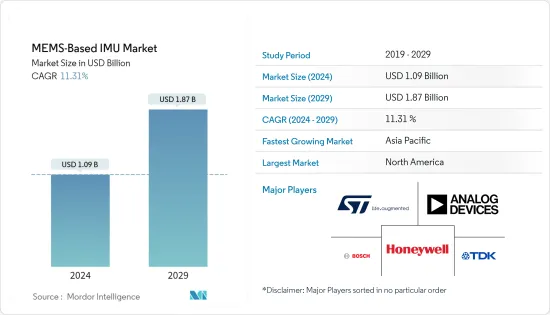

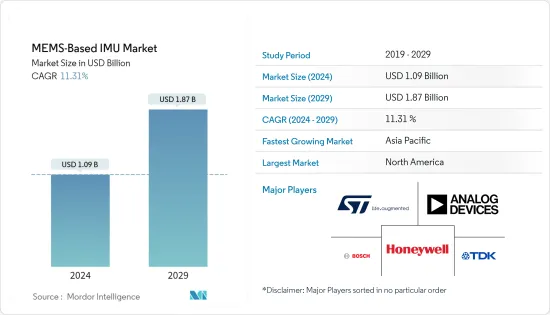

基于 MEMS 的 IMU 市场规模预计 2024 年为 10.9 亿美元,预计到 2029 年将达到 18.7 亿美元,预测期内(2024-2029 年)复合年增长率为 11.31%。

市场成长主要由世界新兴国家的应用数量增加、技术进步和需求增加所推动。 MEMS 技术透过在不影响性能标准的情况下缩小设备尺寸和功耗,在扩大惯性测量系统的应用基础方面发挥了关键作用,从而推动了市场成长。

主要亮点

- 该装置中使用的MEMS惯性感测器具有稳健性、可靠性、高速和温度稳定性等高特性,导致市场不断成长。即使是最小的位置或加速度变化也可以被侦测到。此外,物联网设备发展的成长正在推动市场成长。

- 必须保护 MEMS IMU 的内部组件免受恶劣环境的影响,例如热、湿气和腐蚀性化学物质。然而,对製造和环境变化的高度敏感性使得陀螺仪等微机械 IMU 感测器的封装成为一项具有挑战性的任务,并增加了封装成本,从而阻碍了市场成长。由于 COVID-19 的全球传播,市场面临巨大的阻力。由于 COVID-19 在全球蔓延而实施的封锁影响了设备製造,拖累了最终用户行业的消费者需求,并影响了价格。然而,随着復苏,市场需求可能会上升至趋势线。

- 随着世界国防机构对精确武器的依赖日益增加,讯号链的性能、品质和设计变得更加关键。 MEMS 陀螺仪透过讯号链设计的三个关键方面增强产业发展。

- 例如,2021 年 12 月,Honeywell宣布在美国国防高级研究计划局 (DARPA) 的资助下,开发下一代基于 MEMS 的惯性感测器技术,用于商业和国防导航应用。Honeywell实验室最近的研究表明,这种新型感测器比Honeywell的 HG1930 惯性测量单元 (IMU) 精确一个数量级以上,后者是一种战术级设备,已运作超过 150,000 个单元。

- 此外,随着 COVID-19 大流行的爆发,由于多个製造业停工,基于 MEMS 的 IMU 市场受到严重打击。然而,由于 COVID-19 大流行,世界各地的汽车製造商面临越来越大的关闭工厂的压力。自从联邦、州和地方政府开始鼓励人们尽可能待在家里以来。这导致了各个行业的供应链中断。例如,在冠状病毒爆发期间,福特和通用汽车已停止各自在北美製造工厂的生产。由于全球冠状病毒大流行导致汽车需求预计下降,本田北美公司和宝马公司也关闭了美国和美国的工厂。

基于MEMS的IMU市场趋势

汽车产业预计将占据重要市场占有率

- 最新一代的高级驾驶辅助系统(ADAS)和自动驾驶汽车需要精确的惯性测量单元来准确预测车辆运动并即时确定精确位置,从而使基于MEMS的IMU得以促进成长。市场。此外,随着自动驾驶的发展,市场对基于安全的应用的需求预计将增加数倍,从而创造市场机会。

- 由于经济快速增长,对小客车和商用车的高需求以及生产工厂数量的增加可能会推动市场成长。

- 例如,2022 年 7 月,宝马集团推出了一个新计划,该项目将允许汽车在生产现场移动,而无需辅助人员。该工厂自动驾驶计划是与两家Start-Ups合作实现的:韩国的 Soul Robotics 和瑞士的 Embotech。我们使工厂和配送中心的新车物流更有效率。

- 此外,在第一波疫情结束期间,ADI 公司宣布其高精度惯性测量单元 (IMU) 将为其下一代即时运动 (RTK)探勘接收器提供支援。已选择用于 CHC 导航。透过卫星定位与惯性定位结合,可以实现任意地点高精度、高效的定位测量。

- 此外,2022年5月,义法半导体宣布推出ASM330LHHX,这是一款基于MEM的惯性测量单元(IMU),可实现智慧驾驶,并透过机器学习(ML)核心支援汽车产业追求更高水准的自动化。

北美占最大市场占有率

- 由于稳定性控制、安全措施和碰撞侦测系统等应用的进步,汽车产业成为高阶 IMU 的新兴市场。随着豪华汽车製造商可能在未来几年内向 L5 自动驾驶迈进,该市场可能为配备 IMU 的加速度、雷射雷达和运动侦测系统相关的 MEMS 感测器提供巨大的机会。

- 在第二波疫情期间,固态 LiDAR 感测器开发商 Innoviz Technologies Ltd 已筹集约 1.7 亿美元,以支持宝马于 2022 年初推出的配备 LiDAR 的车辆。

- 根据国际能源总署 (IEA) 的数据,2021 年美国电动车市场强劲復苏,销量成长一倍多,超过 50 万辆。美国整体汽车市场也有所改善,但电动车的市场占有率增加至 4.5%。特斯拉继续主导美国电动车市场。总体而言,该国的汽车产业正在成长,并对所研究的市场做出了贡献,尤其是该地区的汽车产业。

- 2021 年 4 月,Avita Health System 成为美国第一家植入基于 CardioMEMS 的 IMU 系统用于治疗心臟衰竭患者的重症医院。该设备允许医生远端监测心臟压力并提供即时治疗。该公司的第一台设备被植入俄亥俄州加利恩医院。

- 此外,Inertial Labs 于 2021 年 4 月推出了 IMU-NAV-100,这是 Inertial Labs 产品组合中的新型战术级 MEMS IMU。新型感测器是完全整合的惯性解决方案,利用最先进的 3 轴 MEMS加速计和陀螺仪来高精度测量线性加速度、角速度和俯仰/滚动。

基于MEMS的IMU产业概况

基于 MEMS 的 IMU 市场较为分散。整体而言,现有竞争对手之间的竞争非常激烈。展望未来,与大公司的收购和合作将专注于创新。该市场的主要企业包括霍尼韦尔国际公司、模拟设备公司、博世感测器技术有限公司和意法半导体国际公司。

- 2022 年 1 月 - TDK 公司宣布推出 InvenSense ICM-45xxx SmartMotion 超高性能 (UHP) 系列 6 轴 MEMS动作感测器。它引入了片上自校准、业界最低的功耗以及世界上第一个平衡陀螺仪(BG)技术。

- 2021 年 4 月Honeywell推出全新系列基于 MEMS 的紧凑型惯性测量装置,这些装置经过加固,可提供一流的精度和耐用性,以承受高衝击环境。新型 HG1125 和 HG1126 惯性测量单元 (IMU) 的大小与水瓶盖大致相同,成本低廉,可用于商业和军事应用。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 评估 COVID-19 对产业的影响

第五章市场动态

- 市场驱动因素

- 新兴应用的增加(物联网设备、无人驾驶汽车等)

- 越来越多地采用基于 MEMS 的低成本 IMU

- 市场限制因素

- 响应不断变化的消费者需求

第六章市场区隔

- 最终用户产业

- 消费者

- 车

- 医疗保健

- 航太/国防

- 工业的

- 其他的

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第七章 竞争形势

- 公司简介

- Honeywell International Inc.

- Analog Devices Inc.

- TDK Corporation

- Bosch Sensortec GmbH

- STMicroelectronics NV

- Xsens Technologies BV

- NXP Semiconductors NV

- Sensonor AS

- Northrop Grumman LITEF GmbH

- Silicon Sensing Systems Limited

- Murata Manufacturing Co. Ltd

- MEMSIC Inc.

第八章投资分析

第9章 市场的未来

The MEMS-Based IMU Market size is estimated at USD 1.09 billion in 2024, and is expected to reach USD 1.87 billion by 2029, growing at a CAGR of 11.31% during the forecast period (2024-2029).

The market's growth is primarily fueled by the increase in the number of applications, technological advancements, and the increasing demand in emerging countries globally. The MEMS technology played a significant role in expanding the application base for inertial measurement systems by scaling down these devices' size and power consumption without compromising on their performance metrics, thereby driving the market's growth.

Key Highlights

- The market studied is growing, as MEMS inertial sensors used in the unit offer highly robust, reliable, fast, and temperature-stable characteristics. They can detect even the most minor changes in position and acceleration. Furthermore, the growing development of IoT devices is driving the market's growth.

- The internal components of MEMS IMU need to be protected from harsh environments, such as heat, moisture, and corrosive chemicals. However, the high sensitivity to fabrication and environmental variations makes the packaging of IMU sensors, such as micromachined gyroscopes, a challenging task and increases the packaging cost, thereby hampering the market's growth. The market is facing heavy headwinds due to the outbreak of COVID-19 worldwide. Lockdowns enforced by the spread of COVID-19 worldwide affected the manufacturing of devices, dragged consumer demand across end-user industries, and influenced the prices. However, with the resurgence, the market demand will likely rise to the trend line.

- As global defense agencies become more dependent on precision weapons, the signal chain's performance, quality, and design are even more mission-critical. MEMS gyroscope strengthens the industry with three essential aspects of signal chain design.

- For instance, in December 2021, Honeywell announced the development of the next generation of MEMS-based inertial sensor technology with financing from the US Defense Advanced Research Projects Agency (DARPA), which will be used in both commercial and defense navigation applications. Honeywell lab studies recently revealed that the new sensors are more than an order of magnitude more precise than Honeywell's HG1930 inertial measurement unit (IMU), a tactical-grade device with more than 150,000 units in operation.

- Furthermore, the beginning of the COVID-19 pandemic has severely hit the market for MEMS-based IMU owing to the shutdown of several manufacturing industries. However, automakers globally have faced increased pressure to shut down their factories due to the COVID-19 pandemic. After the federal, state, and local governments started recommending people stay in their homes as much as possible. This has caused supply chain disruptions across various industries. For instance, Ford and General Motors suspended production at their respective manufacturing facilities in North America amid the coronavirus outbreak. Honda North America and BMW also closed their plants throughout the U.S. and Europe owing to an expected decline in car demand related to the global coronavirus outbreak.

MEMS Inertial Measurement Unit (IMU) Market Trends

Automotive Sector is to Hold Significant Market Share

- The latest generation of Advanced Driver Assistance Systems (ADAS) and autonomous vehicles require an exact inertial measurement unit to accurately predict the motion of a vehicle to determine its precise position in real-time, thereby driving the growth of the MEMS-based inertial measurement unit market. Also, with the evolution towards autonomous driving, the demand for the market is expected to increase multiple-fold for safety-based applications and create opportunities in the market.

- The increase in the number of production plants for passenger and commercial vehicles due to the high demand for these vehicles and the presence of rapidly expanding economies are likely to boost the market's growth.

- For instance, in July 2022, The BMW Group launched a new project that will see cars manoeuvre around production without requiring a driver. The Automated Driving In-Plant project is being realized in collaboration with two startups - Seoul Robotics from South Korea and Embotech from Switzerland. It will enhance the efficiency of new-vehicle logistics in plants and distribution centers.

- Moreover, during the end of the first wave of the pandemic, Analog Devices, Inc. announced its high-precision inertial measurement unit (IMU) was selected by CHC Navigation to enable its next-generation, real-time kinematic (RTK) rover receiver, which can achieve high-precision and high-efficiency positioning and measurement at any position through the combination of satellite and inertial positioning.

- Further, in May 2022, STMicroelectronics announced MEMs-based inertial measurement unit (IMU) ASM330LHHX to enable smart driving and support the automotive industry's quest for higher levels of automation with its machine-learning (ML) core.

North America Accounts for the Largest Market Share

- The automotive sector is the emerging market for high-end IMUs, following advancements in applications, such as stability control, safety measures, and crash detection systems. As the premium automakers may approach L5 autonomous driving in the next few years, the market may provide a massive opportunity for IMU-powered MEMS sensors related to acceleration, LiDAR, and motion detection systems.

- During the second pandemic wave, Innoviz Technologies Ltd, a developer of solid-state LiDAR sensors, raised around USD 170 million to back BMW's LiDAR-equipped cars, which will be rolled out by the beginning of 2022.

- According to the International Energy Agency (IEA), in 2021, the United States made a strong comeback in the electric car market, with sales more than doubling to more than half a million units. The entire car market in the United States improved as well, but electric vehicles increased their market share to 4.5%. Tesla continues to dominate the electric car market in the United States. Overall, the automotive sector in the country has been growing, contributing to the market studied, especially in the automotive industry, in the region.

- In April 2021, Avita Health System became the first critical access hospital in the United States to implant the CardioMEMS- based IMU system for treating heart failure patients. The device enables doctors to monitor cardiac pressure remotely and provide real-time treatments. The first device offered by the company was implanted at Galion Hospital in Ohio.

- Further, in April 2021, Inertial Labs launched the IMU-NAV-100, a new tactical-grade MEMS IMU in Inertial Labs' portfolio. The new sensor is a fully integrated inertial solution that measures linear accelerations, angular rates, and pitch/roll with high accuracy, utilizing state-of-the-art three-axis MEMS accelerometers and gyroscopes.

MEMS Inertial Measurement Unit (IMU) Industry Overview

The MEMS-based Inertial Measurement Unit Market is fragmented. Overall, the competitive rivalry among existing competitors is high. Moving forward, acquisitions and partnerships of large companies are focused on innovation. Some of the key players in the market are Honeywell International Inc., Analog Devices Inc., Bosch Sensortec GmbH, and STMicroelectronics International N.V.

- January 2022 - TDK Corporation announced the availability of the InvenSense ICM-45xxx SmartMotion ultra-high-performance (UHP) family of 6-axis MEMS motion sensors. This introduces the on-chip self-calibration, the industry's lowest power consumption, and the world's first BalancedGyro (BG) technology.

- April 2021 - Honeywell launched a new series of MEMS-based miniature inertial measurement units that are ruggedized to offer best-in-class accuracy and durability to survive high-shock environments. Roughly the size of a water bottle cap, the new HG1125 and HG1126 inertial measurement units (IMUs) are low-cost and serve both commercial and military applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 An Assessment of the impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Number of Emerging Applications (IoT Devices, Robotic Cars, etc.)

- 5.1.2 Increasing Adoption of Low-cost MEMS-based IMUs

- 5.2 Market Restraints

- 5.2.1 Keeping Pace with the Changing Consumer Demand

6 MARKET SEGMENTATION

- 6.1 End-user Industry

- 6.1.1 Consumer

- 6.1.2 Automotive

- 6.1.3 Medical

- 6.1.4 Aerospace & Defense

- 6.1.5 Industrial

- 6.1.6 Others End-user Industries

- 6.2 Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia Pacific

- 6.2.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Honeywell International Inc.

- 7.1.2 Analog Devices Inc.

- 7.1.3 TDK Corporation

- 7.1.4 Bosch Sensortec GmbH

- 7.1.5 STMicroelectronics N.V.

- 7.1.6 Xsens Technologies B.V.

- 7.1.7 NXP Semiconductors N.V.

- 7.1.8 Sensonor AS

- 7.1.9 Northrop Grumman LITEF GmbH

- 7.1.10 Silicon Sensing Systems Limited

- 7.1.11 Murata Manufacturing Co. Ltd

- 7.1.12 MEMSIC Inc.