|

市场调查报告书

商品编码

1435844

光连接模组:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Optical Interconnect - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

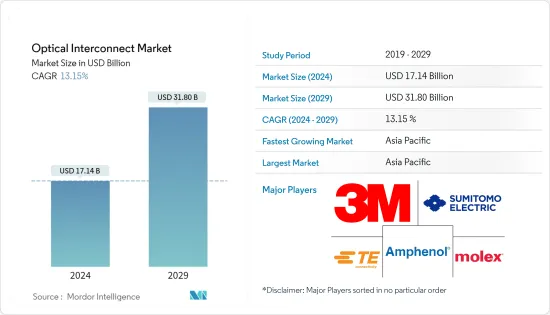

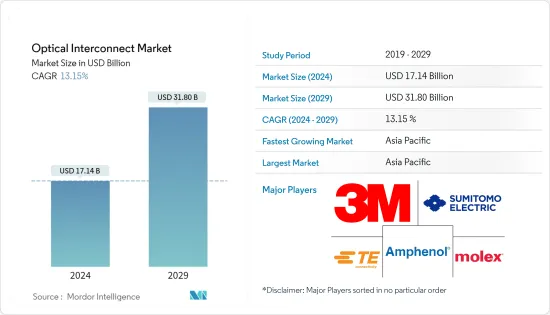

预计2024年光光连接模组市场规模为171.4亿美元,预计2029年将达到318亿美元,在预测期间(2024-2029年)复合年增长率为13.15%。

由于 COVID-19 对各行业的负面感染疾病,3M 等公司现在正在製造医疗产品,以协助世界各地的各个相关人员对抗新型冠状病毒 (COVID-19)。 3M 在世界各地(包括美国、亚洲和欧洲)的製造工厂将 N95 口罩的产量翻了一番,达到每年 11 亿隻。这减少了光互连电缆的产量。

然而,随着在家工作能力变得绝对必要,Nexcom(台湾)等市场参与者正计划帮助世界各地的通讯供应商和资料中心虚拟和扩展其容量。为了满足当前网路对更高速度的需求,NC 220FMS3 模组提供了一个 PCIe3.0 x16 介面和两个 QSFP28 端口,每个端口都支援 100Gb/s 乙太网路连接。此模组提供高速连接,无资料包遗失。 100 G 光收发器(提供 100 Gb/s 乙太网路)、其外形尺寸类型和标准将根据成本和功耗进行开发。这些被认为是互连市场发展的主要驱动力,并潜在地带动互连市场的光连接模组需求。

主要亮点

- 此外,直接调变VCSEL阵列、平行光纤带和检测器阵列广泛应用于解决光学背板容量问题。未来,光连接模组的新趋势预计将带来更强大的功能,包括光域中的交叉连接交换器和资料封包路由等功能。

- 对通讯频宽的需求不断增长预计将推动市场发展。随着不同类型的通讯及其付加实体中大量新服务的出现,对频宽的需求正以前所未有的速度成长。与电气互连相比,光连接模组能够提供更多频宽,并在运算效能方面提供显着优势。

- 在光学方面,相信未来10年,跨晶片通讯所需的能量将接近0.5 pJ b1以下,而晶片外通讯技术等通讯所需的能量将接近0.1 pJ b1。随着频宽的增加,以经济实惠的方式移动资料的能力有望降低未来多核心处理器系统的功耗和总体成本。

- 自2020年初以来,Ciena、Infinera、华为和诺基亚等供应商一直在突破现代光学技术的界限。华为CloudFabric EVN二层DCI解决方案提供扩充性、高效的二层互连,支援跨IP WAN扩充多达32个资料中心。与华为类似,Ciena 和 Infinera 等竞争厂商也正在开发支援 800G 的连贯解决方案,为下一代光学 DCI 平台提供支援。

- 到 2020 年第二季度,数百万人转为在家工作,视讯消费量(占全球资料流量的 60%)达到历史最高水准。关键服务受到影响,Wi-Fi网路基地台面临拥塞。 FWA 有其局限性,会对互连点造成压力。

- 这些场景将导致工业和企业部门的投资大幅增加,以及云端运算活动的激增。所有这些因素,再加上用于扩展资料中心功能的技术,导致了资料中心市场的巨大繁荣。预计此类趋势将进一步刺激所研究市场的成长。

光连接模组市场趋势

资料通讯预计将推动光连接模组的需求

- 光互连的主要应用之一是在资料通讯网路中,例如资料中心网路、无线接取网路网路和有线接取网路。目前的资料中心网路是基于电子分封交换,云端运算的发展导致网路流量快速成长。光连接模组已成为实现高吞吐量、低延迟和低功耗的有前景的替代方案。

- 据 IEEE Communications 称,全光纤网路可为资料中心节省高达 75% 的能源。使用高能源效率、高频宽、低延迟的互连至关重要,特别是在企业使用的大型资料中心,人们对在这些资料中心部署光互连表现出浓厚的兴趣。

- 目前,光技术在资料中心中仅用于点对点链路,类似于旧通讯网路(不透明网路)中使用的点对点光链路。然而,光开关互连仍处于研究阶段。

北美市场成长迅速

- 互联网的快速普及预计将促进该地区的市场成长。此外,根据思科系统公司的数据,2021 年北美的云端流量预计约为每年 6844Exabyte,与其他地区相比是最高的。根据爱立信移动报告 2020 年 11 月版,预计到年终,北美约 4% 的行动用户将使用 5G。因此,这种趋势创造了市场空间,因为行动电话基地台和其他应用程式需要强大的互连来处理 5G 传输。

- 北美也有许多提供光连接模组产品和解决方案的厂商,其中一些厂商热衷于创新新的解决方案,以提高互连频宽密度,同时功耗降低约 10 倍。例如,2020年3月,Ayar Labs宣布获得洛克希德马丁创投公司的策略投资。这笔资金将用于加速 Ayar Labs取得专利的单片封装内光学 I/O (MIPO) 解决方案的商业化。需要高频宽、低延迟和高能效短距离互连的应用。

- 此外,资料中心内的资料移动正在成为一项关键功能,美国和加拿大出现了许多利用资料中心服务的新业务,机器对机器 (M2M) 流量的使用增加。为了解决这个问题,IBM重点是为资料中心提供光交换机,这是解决问题的关键。 IBM 正在致力于使用硅光子技术建构可重新配置的光开关。一旦实施,该光学解决方案将代表光连接模组市场的新趋势。

- 2020 年 6 月,全球互连与资料中心公司 Equinix 宣布同意以 7.5 亿美元的全现金交易从 BCE Inc 购买由 13 个加拿大各地资料中心组成的投资组合。这 13 个资料中心站点代表 25 个贝尔资料中心设施,有可能产生约 1.05 亿美元的年收益。

光连接模组行业概况

光连接模组市场本质上是分散的,其特点是存在多个主要供应商以及其他知名供应商。主要供应商越来越注重提高人们光连接模组开发课程及其优势以及新创新和收购的认识。此外,世界各地的供应商正在透过策略联盟和投资来寻求市场的稳定。主要企业有3M、工业。

- 2020 年 12 月 - 康宁公司投资 4.5 亿美元扩建其位于北卡罗来纳州康科德市卡巴勒斯县光缆工厂,创造 475 个新就业岗位,使其成为全球最大的工厂。

- 2020年11月-製造基于光纤网路连结主要架构的晶片解决方案的Ayar Labs在B轮资金筹措中筹集了3,500万美元。据该公司执行长表示,这笔资金将用于继续产品开发和进一步商业化工作。该公司技术的关键应用包括发生大规模资料移动的下一代运算,包括航太和政府应用、人工智慧和高性能运算、通讯和云端应用以及自动驾驶汽车的雷射雷达。和其他自治系统。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 由于云端运算、人工智慧和高效能运算的需求,通讯频宽的需求不断增加

- 增加对资料中心互连和光纤通讯的投资

- 市场限制因素

- 光互连相关技术的实用化延迟

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争公司之间的敌意强度

- 评估 COVID-19 对市场的影响

第五章市场区隔

- 类型

- 光收发器

- 主动光缆(AOC)

- 嵌入式光学模组(EOM)

- 目的

- 通讯

- 资料通讯

- 地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 其他亚太地区

- 拉丁美洲

- 中东和非洲

- 北美洲

第六章 竞争形势

- 公司简介

- 3M Company

- Sumitomo Electric Industries Ltd

- Molex LLC

- Amphenol Corporation

- TE Connectivity Ltd.

- Go!Foton Inc.

- II-VI Incorporated

- Corning Incorporated

- Cisco Systems Inc.

- Huawei Technologies Co. Ltd

第七章 投资分析

第八章市场机会及未来趋势

The Optical Interconnect Market size is estimated at USD 17.14 billion in 2024, and is expected to reach USD 31.80 billion by 2029, growing at a CAGR of 13.15% during the forecast period (2024-2029).

Due to the adverse effects of COVID 19 across industries, players such as 3M are currently manufacturing medical products to assist various stakeholders globally, to combat Covid-19. 3M has doubled production of N95 respirators to 1.1 billion per year at its global manufacturing facilities, including in the U.S., Asia, and Europe. This has led to reduced manufacturing for optical interconnect cables.

However, as the ability to work from home has become an absolute necessity, market players such as Nexcom (Taiwan) plans to help telecom providers and data centers across the world to virtualize and expand capacity. For meeting current network demands for faster speeds, the NC 220FMS3 module provides a PCIe3.0 x16 interface and two QSFP28 ports, each supporting 100Gb/s Ethernet connectivity. The module provides high-speed connectivity without any packet loss. The 100 G optical transceivers (providing 100Gb/s ethernet), their form factor type, and standard are developed according to the cost and power consumption, which are regarded as the main drive in the development for interconnect market, which potentially drives the demand of optical interconnect.

Key Highlights

- Moreover, directly modulated VCSEL arrays, parallel fiber ribbons, along with detector arrays, are highly being applied to optical backplane capacity issues. In the future, additional higher functionality is highly expected as an emerging trend for optical interconnects, which includes features such as cross-connect switches and data packet routing in the optical domain.

- The increasing demand for communication bandwidth is expected to drive the market. Due to the emergence of a large number of new services in different types of communications and their value-added entities, the demand for bandwidth has gone up more than ever before. Optical interconnect drive it possible in providing more bandwidth and bring great advantage to computing performance, compared to electrical interconnects.

- With optics, over the next decade, it is believed that the energy-requiring for cross-chip communication would approach less than 0.5 pJ b1 and to 0.1 pJ b1 for communication, such as off-chip communication technology. By utilizing the ability to move data affordably, both the power consumption and the total cost for such future multicore processor systems are expected to be reduced with improving bandwidth.

- Since the beginning of 2020, vendors, like Ciena, Infinera, Huawei, and Nokia, have been pushing the limits of modern optics. Huawei CloudFabric EVN Layer 2 DCI solution provides highly permits scalable, efficient layer 2 interconnection that allows expansion of up to 32 data centers across IP WANs. Like Huawei, competing vendors, like Ciena or Infinera, are also working on their 800G-capable coherent solutions, which may power next-generation optical DCI platforms.

- By the second quarter of 2020, millions of people switched to work from home, and video consumption (which amounts to 60% of the global data traffic) was at an all-time high. Critical services were being impacted, and Wi-Fi access points were facing congestion; FWA witnessed limitations, and interconnect points were burdened.

- These scenarios also surge the cloud computing activities, along with significantly increasing investments from the industrial and enterprises segment. All these factors made a massive boom in the data center market along with technologies incorporated to expand the capabilities of data centers. Such trends are expected to further stimulate the growth of the market studied.

Optical Interconnect Market Trends

Data Communication is Expected to Spur the Demand for Optical Interconnects

- One of the major applications of optical interconnectivity is within data communication networks which include datacenter networks, wireless access networks, and wired access networks. Current data center networks, which are based on electronic packet switches, experiences an exponential increase in network traffic due to cloud computing development. Optical interconnects emerged as a promising alternative that offers high throughput, low latency, and reduced power consumption.

- According to IEEE Communications, all-optical networks could provide up to 75% energy savings in the data centers. Especially in large data centers used in enterprises, the use of power efficient, high bandwidth, and low latency interconnects is of paramount importance, and there is signi?cant interest in the deployment of optical interconnects in these data centers.

- Currently, optical technology is utilized in data centers is only for point-to-point links, which is in the same way as point-to-point optical links that were used in older telecommunication networks (opaque networks). However, optically switched interconnects are still in the research phase.

North America To Witness High Market Growth

- The rapid penetration of the internet is expected to raise the growth of the market in this region. Moreover, according to Cisco Systems, the cloud traffic in 2021 is estimated to be around 6844 exabytes per year in North America, which is highest in comparison to other regions. According to the November 2020 edition of the Ericsson Mobility Report, North America was expected to end 2020 with about 4% of its mobile subscriptions being 5G. Hence, such trends create scope for the market, as a powerful interconnect is required to enable cell towers and other applications to handle 5G transmissions.

- Also, North America has various players that provide optical interconnect products and solutions, along with players who are also keen to innovate new solutions for the improvement in interconnect bandwidth density at around 10x lower power. For instance, in March 2020, Ayar Labs announced that it had received a strategic investment from Lockheed Martin Ventures, where the funds will be used to accelerate the commercialization of Ayar Labs' patented monolithic in-package optical I/O (MIPO) solution for applications that require high bandwidth, low latency, and power-efficient short-reach interconnects.

- Moreover, data movement within the data center is becoming a critical feature, and the rise in the ample of new businesses leveraging data center services in the United States, and Canada will leverage more machine-to-machine (M2M) traffic. To overcome this problem, IBM focuses on providing optical switches in the data center as a key to resolve the problem. IBM is undertaking to build reconfigurable optical switches using silicon-photonic technology. If implemented, this optical solution becomes a new trend in the optical interconnect market.

- In June 2020, Equinix Inc., the global interconnection and data center company, announced its agreement to purchase a portfolio of 13 data centers across Canada from BCE Inc for USD 750 million in an all-cash transaction. The 13 data center sites representing 25 Bell data center facilities are likely to generate approximately USD 105 million annualized revenue.

Optical Interconnect Industry Overview

The Optical Interconnect Market is fragmented in nature and is characterized by the presence of several key vendors and other prominent vendors. The key vendors are increasingly focusing on creating awareness about the optical Interconnect development courses and their benefits, along with new innovation and acquisitions. Further, global vendors are trying to stabilize themselves in the market, through strategic collaborations and investements. Key players are 3M, Sumitomo Electric Industries, etc.

- December 2020 - Corning Inc. spent USD 450 million to expand its Cabarrus County fiber optic cable plant in Concord, N.C., generating 475 new jobs and making it the largest such facility in the world.

- November 2020 - Ayar Labs, which makes chip solutions based on optical networking principal's architecture raised USD 35 million in a Series B round of funding. According to the company's CEO, the funding will be used to continue developing its product and working on further commercialization. The main application area for the company's technology is next-generation computing, anywhere that there is a massive movement of data, including aerospace and government applications, artificial intelligence and high-performance computing, telecoms and cloud applications, and lidar for self-driving car and other autonomous systems.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand for Communication Bandwidth Owing to Demand for Cloud Computing, AI, and HPC

- 4.2.2 Increasing Investment in Data Centers Interconnect and Fiber Optic Communication

- 4.3 Market Restraints

- 4.3.1 Slow Commercialization of Optical Interconnection Related Technologies

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of Impact of Covid-19 on the Market

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Optical Transceivers

- 5.1.2 Active Optical Cables (AOCs)

- 5.1.3 Embedded Optical Modules (EOMs)

- 5.2 Application

- 5.2.1 Telecommunication

- 5.2.2 Data Communication

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 Rest of Asia Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles*

- 6.1.1 3M Company

- 6.1.2 Sumitomo Electric Industries Ltd

- 6.1.3 Molex LLC

- 6.1.4 Amphenol Corporation

- 6.1.5 TE Connectivity Ltd.

- 6.1.6 Go!Foton Inc.

- 6.1.7 II-VI Incorporated

- 6.1.8 Corning Incorporated

- 6.1.9 Cisco Systems Inc.

- 6.1.10 Huawei Technologies Co. Ltd