|

市场调查报告书

商品编码

1435860

合约包装与履行服务 - 市场占有率分析、产业趋势与统计、成长预测(2024 年 - 2029 年)Contract Packaging and Fulfillment Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

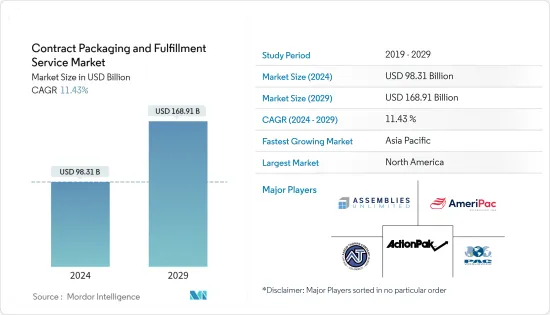

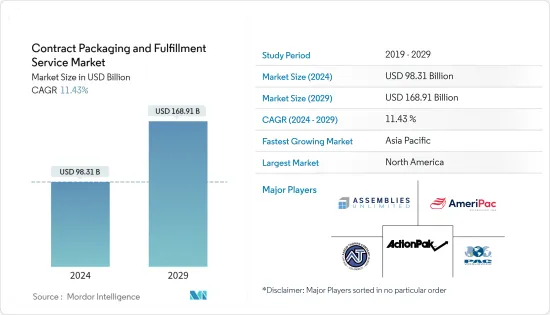

合约包装和履行服务市场规模预计到2024年为983.1亿美元,预计到2029年将达到1689.1亿美元,在预测期内(2024-2029年)CAGR为11.43%。

COVID-19 大流行进一步推动了食品饮料和製药行业需求的增加。此外,全球电子商务产业的成长是推动预测期内研究市场成长的一些主要因素之一。

主要亮点

- 近年来,由于製造公司对合约包装商的偏好发生变化,合约包装和履行服务市场出现了显着增长,因为他们越来越注重成本优化,以增强其核心竞争力。许多行业专家声称,由于机器维护成本和劳动力成本降低,这些服务可以降低营运成本 7-10%。

- 许多政府也对药品和食品的标籤和包装制定严格的法律法规,这进一步扩大了合约包装的范围。例如,在美国,由于类似的法律,由于资本和其他监管障碍,公司更愿意将製造和包装外包。

- 在欧洲和北美等已开发市场,提高品质的需求也迫使企业投资于所研究的市场。在这些地区,合约包装和履行服务提供者的角色从外部包装的临时设施转变为策略创新合作伙伴,这确保了更短的交货时间并可以生产更小的生产批次。

- 市场也见证了协会和组织的出现,以提高所研究市场的知名度。欧洲联合包装商协会和合约包装协会就是几个例子。欧洲约有 1,000 家活跃的合约包装供应商,其中 40-50% 是小公司。

- 随着 COVID-19 的爆发,合约包装和履行服务市场出现了巨大的增长,因为封锁和社交距离规范导致电子商务市场蓬勃发展,大多数消费者更喜欢线上购物和公司管道正在外包其包装端到端或独立服务,以满足不断增长的需求。

合约包装与履行服务市场趋势

合约包装预计将显着成长

- 合约包装服务在所研究的市场中占有最大的市场份额之一,因为它包括装瓶/灌装、包装、贴标、包装等各种操作,这些操作是合约包装服务的重要组成部分。此外,合约包装分为三个部分——初级包装、二级包装和三级包装。

- 初级包装涉及与产品的直接接触,或是封闭产品的第一层包装,使用户能够保护和保存产品免受外部污染、损坏和变质。

- 初级合约包装提供了製造商可能无法获得的「关键任务」功能,特别是当涉及到需要小批量生产或频繁转换的项目时,例如通常在初级製造经济体之外的新产品或利基产品或季节性需求。

- 初级包装通常包括泡罩包装、蛤壳式包装、纸板包装、单位剂量包装和收缩包装。 Wasdell Packaging Group 等公司提供初级合约包装服务,包括泡罩包装、容器填充、带状包装以及小袋填充和包装。

- 其他最终用户产业(例如食品、饮料和个人护理)对初级包装的需求不断增长,促使参与者增加最终产品的产量,使他们必须透过以下方式缩短上市时间:外包包装活动。预计这将在预测期内推动初级合约包装市场的发展。

亚太地区将见证最高成长

- 疫情推动了电子商务的成长,包括中国卖家和欧洲买家之间的跨境线上销售。根据 CNBC 报道,2020 年中国跨境电商销售额增长至 31.1%,而仓库增长了 80%。阿里巴巴等中国市场的一些巨头一直在透过全球速卖通平台和菜鸟物流部门拓展其跨境电子商务业务。预计这将推动该地区的配送和仓储服务。

- 据阿里巴巴称,2020年最后三个月,跨国电商为菜鸟营收年增51%至17.4亿美元。该公司国际商业批发收入成长53%,占美元同期为 5.77 亿。这增加了市场供应商扩大亚洲市场仓储服务的机会。

- 此外,中国的联合包装服务也不断增加,越来越多的供应商涉足这一领域。例如,中国公司 Sofeast 为中国买家提供与当地供应商的联合包装服务,使客户能够外包标籤和包装服务,无需 IP、定价或配销通路信息,

- 此外,亚马逊、eBay、flipkart 和 snapdeal 等各种线上市场的当日送达和餐饮订单等趋势也帮助组织获得了专业知识。此外,亚马逊 Flipkart 正在透过开设其配送中心来扩大其在发展中经济体的立足点。例如,2020 年 7 月,亚马逊印度公司宣布扩大在印度的配送网络,新增 10 个配送中心 (FC) 并扩大 7 座现有建筑。由此,亚马逊将营运网路扩展到印度 15 个州的 60 个配送中心,将储存容量增加了 20%,总容量超过 3,200 万立方英尺。这有助于加快包装、物流和运输的交付和成长。

合约包装与履行服务业概述

由于市场上存在多个在国内和国际市场开展业务的参与者,合约包装和履行服务市场竞争非常激烈。市场似乎适度集中,主要参与者采取扩张等策略,以保持竞争力并扩大其影响力。市场上一些主要的参与者包括 Aaron Thomas Company、ActionPak Inc.、Assemblies Unlimited 等。

- 2021 年 3 月 - ActionPak Inc. 宣布其位于新泽西州卡姆登的 175,000 平方英尺新包装工厂完成了 196 千瓦屋顶太阳能安装,以按照严格的 SQF 和 FDA 进行食品和 OTC 产品的初级和二级包装指导方针。据说 491 块太阳能板可以抵消新建建筑 20% 的用电量。

- 2020 年 5 月 - 夏普 (UDG Healthcare PLC) 宣布从 Quality Packaging Specialists International LLC (QPSI) 收购一家药品包装工厂。该设施占地 160,000 平方英尺,并获得监管部门的全面批准。它包括 12 个初级生产套件,以及多条二级包装线的空间,用于提供初级和二级药品包装,包括装瓶、起泡、小瓶贴标和医疗器械配套以及序列化服务。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力 - 波特分析

- 供应商的议价能力

- 新进入者的威胁

- 买家/消费者的议价能力

- 替代产品的威胁

- 竞争激烈程度

- COVID-19 对市场影响的评估

第 5 章:市场动态

- 市场驱动因素

- 希望透过外包非核心业务获得竞争优势的公司

- 食品和饮料行业等关键行业的需求稳定

- 主要仓储供应商进入合约包装领域可望推动创新

- 市场限制

- 严格的政府法规

- 来自内部包装的竞争

- 行业法规和标准

- 合约包装的演变

第 6 章:市场细分

- 服务类型

- 包装设计与原型製作

- 合约包装(装瓶/灌装、包装、标籤、包装等)

- 封装测试

- 仓储和履行

- 其他服务类型

- 最终使用者类型

- 食物

- 饮料

- 製药

- 居家及个人护理

- 其他最终用户部分

- 地理

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第 7 章:竞争格局

- 公司简介

- Aaron Thomas Company, Inc.

- ActionPak Inc.

- Assemblies Unlimited, Inc.

- PAC Worldwide, Inc.

- AmeriPac Inc

- Kane Logistics

- FW Logistics

- Warren Industries, Inc.

- Swan Packaging Fulfillment, Inc.

- Multi-Pac Solutions LLC

- Sharp (UDG Healthcare plc)

- Boughey Distribution Ltd

- Budelpack Poortvliet BV

- Wasdell Packaging Group

- Sonoco Products Company

第 8 章:投资分析

第 9 章:市场机会与未来趋势

The Contract Packaging and Fulfillment Service Market size is estimated at USD 98.31 billion in 2024, and is expected to reach USD 168.91 billion by 2029, growing at a CAGR of 11.43% during the forecast period (2024-2029).

The increased demand from food and beverage and pharmaceutical industries was further fuelled by the COVID-19 pandemic. Furthermore, growth of the e-commerce industry globally are among some of the major factors driving growth of the market studied over the forecast period.

Key Highlights

- In recent years, the contract packaging and fulfilment services market has witnessed significant growth, owing to the changing preference of manufacturing firms toward contract packagers, as they are increasingly focusing on cost optimization, to enhance their core competency. Many industry experts claim that these services can reduce operational costs by 7-10%, due to the reduced maintenance costs of machines and labor costs.

- Many governments are also mandating stringent laws and regulations on the labeling and packaging of drugs and food products, which is further expanding the scope of contract packaging. For instance, in the United States, due to similar laws, the companies have preferred to outsource their manufacturing and packaging due to capital and other regulatory barriers.

- In developed markets, such as Europe and North America, the need to enhance quality is also forcing companies to invest in the studied market. In these regions, the role of contract packaging and fulfilment service providers shifted from temporary facility for external packaging to a strategic innovation partner, which ensures even shorter delivery times and can produce even smaller production batches.

- The market is also witnessing the emergence of associations and organizations to create more awareness in the studied market. European Co-Packers Association and Contract Packaging Association are a few examples. There are around 1,000 contract packaging vendors active in Europe, out of which 40-50% are small companies.

- With the outbreak of COVID-19, the contract packaging and fulfillment services market has witnessed tremendous growth as the e-commerce market has taken a boom owing to lockdown and social distancing norms where the majority of the consumer are preferring online channel for shopping and companies are outsourcing their packaging end to end or standalone services to meet the growing demand.

Contract Packaging and Fulfillment Service Market Trends

Contract Packing is Expected to Witness Significant Growth

- Contract packing service holds one of the largest market shares in the studied market as it comprises of various operation ranging from Bottling/Filling, Packaging, Labeling, Wrapping, among other that are an essential part of contract packaging services. Also, the contract packing are divided into three parts- primary packaging, secondary packaging, and tertiary packaging.

- Primary packaging involves direct contact with the product or is the first packaging layer in which the product is enclosed, which enables the user to protect and preserve the product from external contamination, damage, and spoiling.

- Primary contract packaging provides 'mission-critical' capabilities that may be inaccessible to manufacturers, especially when it comes to projects that require short runs or frequent changeovers, such as new or niche products, or seasonal demand, that are usually outside of primary manufacturing economies.

- The primary packaging typically includes blister packs, clamshell packaging, paperboard packaging, unit dose packs, and shrink-wrapping. Players, such as the Wasdell Packaging Group, provide primary contract packaging services that include blister packing, container filling, strip packs, and sachet filling and packing.

- The rising demand from other end-user industries, such as food and beverages and personal care, for the primary packaging, has left the players to increase the production of their end products, thereby making it essential for them to reduce the time to markets by outsourcing the packaging activities. This is expected to boost the primary contract packaging market over the forecast period.

Asia-Pacific to Witness Highest Growth

- The pandemic has fueled E-commerce growth, including the cross-border online sales between Chinese sellers and European buyers. According to CNBC, China's cross-border e-commerce sales rose to 31.1% in 2020, while warehouses grew by 80%. Some of the Chinese market's big giants, such as Alibaba, have been expanding their cross-border e-commerce business through the AliExpress platform and Cainiao logistics arm. This is expected to drive the Fulfillment and warehousing services in the region.

- According to Alibaba, cross-border e-commerce has contributed a 51% year-on-year surge in Cainiao's revenue to USD 1.74 billion in the last three months of 2020. Revenue from the company's international commerce wholesale rose 53%, accounting for USD 577 million during that time. This increases opportunities for the vendors in the market to expand the warehousing services in the Asian market.

- Also, co-packing services are increasing in China, with more and more vendors venturing into the business. For instance, Sofeast, a chines-based company, offers Co-packaging for Chinese buyers with local suppliers and enable the customers to outsource the labeling and packaging services by eliminating the need for IP, pricing, or distribution channel information,

- Furthermore, trends like same-day deliveries and catering orders from various online marketplaces, like Amazon, eBay, flipkart, and snapdeal, have helped organizations gain expertise. Also, Amazon, Flipkart, is expanding its foothold in the developing economy by opening its fulfillment center. For instance, in July 2020, Amazon India announced to expand its fulfillment network in India, with ten new Fulfillment Centers (FC) and an expansion of 7 existing buildings. With this, Amazon expands its operations network to sixty fulfillment centers across 15 states in India to increase the storage capacity by 20% to total more than 32 million cubic feet. This helps in faster delivery and growth of packaging, logistics, and transportation.

Contract Packaging and Fulfillment Service Industry Overview

The Contract Packaging and Fulfillment Service Market is highly competitive owing to the presence of multiple players in the market operating their business in domestic and international markets. The market appears to be moderately concentrated with the major players adopting strategies like expansion among others in order to stay competitive and expand their reach. Some of the major players in the market are Aaron Thomas Company, ActionPak Inc., Assemblies Unlimited among others.

- March 2021 - ActionPak Inc. announced that it completed the 196-kW rooftop solar installation on its new 175,000 sq ft, packaging facility located in Camden, New Jersey, to do both primary and secondary packaging of food and OTC products under strict SQF and FDA guidelines. The 491 solar panels are said to offset 20% of the electric usage at the newly constructed building.

- May 2020 - Sharp (UDG Healthcare PLC) announced the acquisition of a pharmaceutical packaging facility from Quality Packaging Specialists International LLC (QPSI). The facility is 160,000 sq. ft and has full regulatory approval. It encompasses 12 primary production suites, space for multiple secondary packaging lines for offering both primary and secondary pharmaceutical packaging including bottling, blistering, vial labeling and medical device kitting as well as serialization services.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Threat of New Entrants

- 4.3.3 Bargaining Power of Buyers/Consumers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Companies Looking to Gain Competitive Advantage by Outsourcing Non-core Operations

- 5.1.2 Steady Demand from Key Verticals, such as the Food and Beverage Sector

- 5.1.3 Entry of Key Warehousing Vendors in the Field of Contract Packaging Expected to Drive Innovation

- 5.2 Market Restraints

- 5.2.1 Stringent Government Regulations

- 5.2.2 Competition from In-house Packaging

- 5.3 Industry Regulations and Standards

- 5.4 Evolution of Contract Packaging

6 MARKET SEGMENTATION

- 6.1 Service Type

- 6.1.1 Packaging Design & Prototyping

- 6.1.2 Contract Packing (Bottling/Filling, Packaging, Labeling, Wrapping, etc.)

- 6.1.3 Package Testing

- 6.1.4 Warehousing and Fulfilment

- 6.1.5 Other Service Types

- 6.2 End-user Type

- 6.2.1 Food

- 6.2.2 Beverage

- 6.2.3 Pharmaceutical

- 6.2.4 Household & Personal Care

- 6.2.5 Other End-user Segments

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Aaron Thomas Company, Inc.

- 7.1.2 ActionPak Inc.

- 7.1.3 Assemblies Unlimited, Inc.

- 7.1.4 PAC Worldwide, Inc.

- 7.1.5 AmeriPac Inc

- 7.1.6 Kane Logistics

- 7.1.7 FW Logistics

- 7.1.8 Warren Industries, Inc.

- 7.1.9 Swan Packaging Fulfillment, Inc.

- 7.1.10 Multi-Pac Solutions LLC

- 7.1.11 Sharp (UDG Healthcare plc)

- 7.1.12 Boughey Distribution Ltd

- 7.1.13 Budelpack Poortvliet B.V

- 7.1.14 Wasdell Packaging Group

- 7.1.15 Sonoco Products Company