|

市场调查报告书

商品编码

1643226

远端资产追踪 -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Remote Asset Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

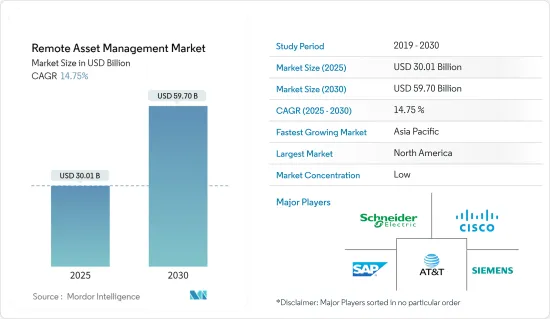

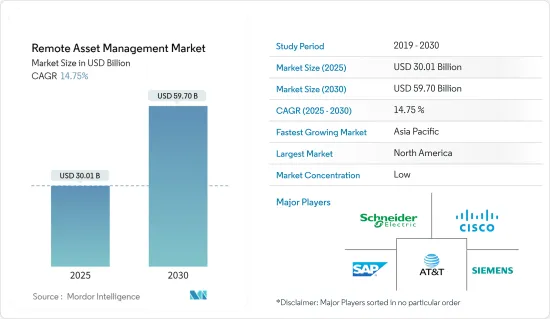

远端资产管理市场规模预计在 2025 年为 300.1 亿美元,预计到 2030 年将达到 597 亿美元,预测期内(2025-2030 年)的复合年增长率为 14.75%。

远端资产管理是对机器、设备等资产进行远端监控和管理。我们使用各种技术从这些资产中收集资料并进行分析,以优化效能并减少停机时间。远端系统管理已成为製造业、能源和运输领域面临的关键挑战,以便更有效地利用资源并延长关键设备的使用寿命。

关键亮点

- 推动远端资产管理需求的关键因素是预测性维护、支援物联网的远端资产管理解决方案以及基于物联网的感测器成本的下降。远端资产管理实现组织资产与中央监控应用程式之间的即时双向通讯,从而改善资产管理和控制。

- 资产绩效管理 (APM) 是一套全面的解决方案和服务,包括用于监控资产健康和可靠性等变数的软体。它也用于规划资产维护和剥离策略。例如,通用电气公司的 Predix 系统包含许多元件,包括 APM Health、APM Reliability、APM Strategy 和 APM Integrity。 APM 系统在行动点提供洞察,以延长资产寿命、消除计划外维修、减少停机时间、降低维护成本并降低设备故障的可能性。

- 此外,所使用的软体是远端资产管理,允许中央应用程式和资产之间的双向通讯,以改善管理控制。这个远端资产管理产业列出了各种将扩大商机的潜在应用。此管理系统使用沃达丰 SIMS 监控和管理资产超过 100 年。沃达丰的远端资产管理系统协助交易、业务开发以及维护机器、资产和系统。

- 此外,云端运算服务越来越便宜,网路存取越来越完善,元件也越来越便宜,已开发国家和开发中国家的政府都在加大对资讯通信技术的投资。由于这些原因,预计远端资产追踪的需求在短期和长期内都将大幅增长。智慧型手机的广泛普及、互联网的广泛使用以及物联网的进步正在推动远端资产管理市场的发展。

- 资产管理解决方案的高成本预计会阻碍远端资产管理市场的扩张。

- COVID-19 导致许多国家实施封锁,导致汽车、供应链和运输等许多行业对即时定位系统 (RLTS) 解决方案的需求下降。许多物流组织和供应链完全关闭,汽车和运输业也是如此,只留下医疗保健产业蓬勃发展。在医疗业务中,需要许多机械工具和监测设备来在即时监视器上显示资料并将其储存在资料库日誌中以进行进一步研究。

远端资产管理市场趋势

製造业预计将占据很大市场份额

- 製造业越来越多地转向远端资产管理解决方案来优化生产、降低成本和提高效率。远端资产管理使用感测器和其他远端监控技术从中心位置管理设备和机械的性能,实现即时分析和决策。这项技术在製造业中非常有用,因为停机和维护成本可能是主要问题。

- 製造业远端资产管理的好处包括提高营运可见度、减少停机时间和维护成本、提高安全性和合规性。一些公司正在使用数位双胞胎技术远端监控资产,以提高预测性维护和整体设施效率。

- 该领域的解决方案范例包括 GE Digital 的资产绩效管理软体、IBM 的 Maximo 应用程式套件以及 Birlasoft 等公司提供的远端资产监控解决方案。此外,工业设备製造商正在投资零接触远端资产管理解决方案,以实现对设备和机械的安全、非接触式监控和维护。

- 最近,inMotionNow 宣布收购 (DAM) 平台供应商 Lytho。 Lytho 的数位资产管理功能、内容范本自动化和可自订的品牌入口网站与 inMotionNow 的创新工作流程平台 inMotion ignite 相得益彰。两家公司正在推出一个集中的、易于管理的平台,用于规划、创建、共用、储存和发布内容。 Lito 为金融、製造业和汽车业的客户提供服务。

- 根据Trading Economics的数据,2023 年第三季度,印度製造业对 GDP 的贡献价值超过 850 亿美元。这一数字与上一季相比有所增长,但仍远高于 2020 年第三季因冠状病毒 (COVID-19) 疫情而出现的下降。印度的建设业和製造业是当时受打击最严重的产业之一。然而,製造业迅速復苏,一个季度后又恢復到危机前的水平。

预计北美将占很大份额

- 据估计,北美占据远端资产管理市场的最大份额。先进技术的高度采用、用于资讯共用的先进通讯网路的存在以及熟练劳动力的可用性正在推动北美远端资产管理市场的成长。

- 此外,连网型设备的增加预计将进一步推动远端资产管理市场的发展。例如,根据思科的数据,预计到 2023 年美国的人均设备和连线数量将位居世界第一。

- 根据 Verizon 车队技术趋势报告,车队经理、高阶主管和其他行动业务专业人士从投资车队管理技术中获得了价值。

- 最近发布的 2021-2024 年数位营运策略计画 (DOSP) 概述了加拿大政府在服务、资讯、资料、IT 和网路安全方面的数位化目标的战略方向。 DOSP 由六个策略主题组成。资讯科技、数位身分验证和机构改革。政府的这项倡议彰显了数位转型的重要性。

- 同样,Adobe 宣布了一款新的资产管理工具:Adobe Experience Manager Assets Essentials。 Adobe 也发布了第一个整合这项新体验的工具:Adobe Journey Optimizer。此次发布是为了满足对数位内容和改善客户旅程的需求。此外,人工智慧远端资产管理解决方案人工智慧(AI)越来越多地被用于远端资产管理解决方案,以提高营运效率、减少停机时间并最大限度地降低营运成本。

远端资产管理行业概览

由于存在多个供应商提供不同的解决方案,远端资产管理市场呈现细分化。解决方案提供者投资多项研究和开发活动,以改善其现有解决方案,并将最新的技术发展融入其解决方案并推出新产品。此外,公司将全球扩张视为占领最大市场份额的途径。

- 2023 年 3 月,Drishya AI Labs 与 VEERUM 合作,透过数位双胞胎增强资产管理。 Drishya 基于人工智慧 (AI) 的数位双胞胎技术与 VEERUM 的突破性视觉化解决方案相结合,将帮助棕地根据工程图和历史工厂资料创建数位双胞胎。 Drishya 和 VEERUM 对人工智慧的使用将有助于以经济高效的方式数位过时资产管理、实现远端现场管理并自动化工程交付成果,同时保持库存和标籤清单为最新。

- 2023 年 2 月,思科将在其物联网营运仪表板中引入新的云端服务,以提高工业资产的可见性,从任何地方安全地管理资产,并为工业物联网 (IoT) 客户的操作技术(OT) 团队提供一条通往云端自动化的无缝途径。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场动态

- 市场驱动因素

- 透过加值託管服务增加第三方物流业者的需求

- 整个供应链越来越多地采用物联网

- 市场限制

- 初期投资和培训成本高

- COVID-19 工业影响评估

第六章 市场细分

- 按组件

- 解决方案

- 即时位置资讯系统

- 分析和彙报

- 资产绩效管理

- 监控和安全

- 其他解决方案(网路频宽管理、行动工作人员管理)

- 服务

- 解决方案

- 按类型

- 固定资产

- 转移资产

- 依实施类型

- 本地

- 云

- 按最终用户

- 製造业

- 医疗

- 零售

- 能源公共产业

- 运输和物流

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Siemens Corporation

- AT&T Inc.

- Cisco Systems, Inc.

- Hitachi, Ltd.

- Schneider Electric SE

- PTC Inc.

- Bosch Software Innovations GmbH

- Verizon Communications, Inc.

- Rockwell Automation, Inc.

- Infosys Limited

- SAP SE

- Meridium, Inc.

- International Business Machine Corporation

第八章投资分析

第九章 市场机会与未来趋势

The Remote Asset Management Market size is estimated at USD 30.01 billion in 2025, and is expected to reach USD 59.70 billion by 2030, at a CAGR of 14.75% during the forecast period (2025-2030).

Remote asset management refers to remotely monitoring and managing assets, such as machines and equipment. It involves using various technologies to collect data from these assets and then analyzing them to optimize their performance and reduce downtime. In the manufacturing, energy and transport sectors, where resources can be more efficiently used as well as extending the life of important equipment, remotely managing assets has become a key issue.

Key Highlights

- The primary drivers driving the need for remote asset management are predictive maintenance, loT-enabled remote asset management solutions, and the lowering cost of IoT-based sensors, which in turn reduces operational expenses of remote assets by increasing the use of remote asset management. Remote asset management enables real-time two-way communication between the organization's assets and the central monitoring application to improve asset management and control.

- Asset Performance Management (APM) is a comprehensive collection of solutions and services that includes software for monitoring variables such as asset health and reliability. They are also used to plan asset maintenance and divestiture strategies. For example, General Electric's Predix system contains many components, such as APM Health, APM Reliability, APM Strategy, and APM Integrity. APM systems deliver numerous insights at the point of action to extend asset life, eliminate unscheduled repair work, decrease downtime, lessen maintenance costs, and reduce the chance of equipment failure.

- Further, the software used is remote asset management, allowing two-way communication between the central application and the asset for improved management control. This remote asset management industry offers a variety of potential applications for expanding business opportunities. The Management System monitors and tracks the assets over the centenary using Vodafone SIMS. The Vodafone remote asset management system aids in transacting, developing businesses, and maintaining machinery, assets, and systems.

- Moreover, cloud computing services are becoming more affordable; internet access is improving; components are becoming less expensive; and governments in both developed and developing regions are increasing their investments in ICT. These reasons are projected to fuel significant demand for remote asset management in the short and long term. Rising smartphone adoption, internet penetration, and loT advancements drive the remote asset management market.

- The high cost of asset management solutions is expected to hamper the remote asset management market expansion.

- COVID-19 caused lockdowns in many nations, resulting in a drop in demand for Real-time location system RLTS solutions from many industries like autos, supply chain, and transportation. Many logistic organizations and supply chains, as were the automobile and transportation sectors, were completely shut down, leaving only the healthcare industry to thrive. Many mechanical tools and monitoring devices were required in the healthcare business to show data on a live monitor or save it on a database log for subsequent study.

Remote Asset Management Market Trends

Manufacturing Industry is Expected to Hold Prominent Share of the Market

- The manufacturing industry increasingly turns to remote asset management solutions to optimize production, reduce costs, and improve efficiency. Remote asset management involves using sensors and other remote monitoring technologies to track the performance of equipment and machinery from a central location, enabling real-time analysis and decision-making. This technology can be instrumental in the manufacturing industry, where downtime and maintenance costs can be significant issues.

- Some benefits of remote asset management in the manufacturing industry include better visibility into operations, reduced downtime and maintenance costs, and improved safety and compliance. Some companies use digital twin technology to remotely monitor assets and enhance predictive maintenance and overall equipment effectiveness.

- Examples of solutions in this area include GE Digital's Asset Performance Management software, IBM's Maximo Application Suite, and remote asset monitoring solutions offered by companies like Birlasoft. In addition, industrial manufacturers are investing in zero-touch remote asset management solutions to enable safe, contactless monitoring and maintenance of their equipment and machinery.

- Moreover, recently, inMotionNow announced the acquisition of Lytho,an (DAM) platform provider. Lytho's digital asset management capabilities, content templating automation, and customizable brand portals complement inMotionNow's creative workflow platform, inMotion ignite. In order to plan, produce, share, store and publish content, both companies will provide a central and easily managed platform. Lytho has customers in the financial, manufacturing, and automotive industries.

- According Trading Economics, During the third quarter of 2023, the contribution of India's manufacturing industry to the country's GDP was valued at over 85 billion USD This was an increase compared to the previous quarter, but still a much higher value than the third quarter of 2020, when the value decreased due to the coronavirus (COVID-19) pandemic. India's construction and manufacturing industries were among the worst hit then. But the manufacturing industry recovered quickly and reached pre-crisis level again after one quarter.

North America is Expected to Hold Major Share

- North America is estimated to hold the highest remote asset management market share. The high adoption of advanced technology, the presence of advanced telecommunication networks for information sharing, and the availability of a skilled workforce are some factors which are driving the growth of the remote asset management market in North America.

- In addition, the growth in connected devices is expected to further propel the market for remote asset management. For instance, according to Cisco, the United States is expected to have the highest average per capita of devices and connections by 2023.

- Fleet managers, executives, and other mobile business professionals are achieving value by investing in fleet tracking technology, according to the Verizon Fleet Technology Trend Report, which includes surveys conducted by more than 700 fleet managers, executives, and other mobile business professionals in the United States.

- The 2021-2024 Digital Operations Strategic Plan (DOSP), launched recently, sets the strategic direction for the Canadian government's digital ambitions across services, information, data, IT, and cybersecurity. The DOSP consolidates six strategic themes: IT, digital identity, and institution transformation. The initiative by the government shows the importance of digital transformation, which creates a need for the storage of digital assets produced during the implementation.

- Similarly, Adobe launched a new asset management tool, Adobe Experience Manager Assets Essentials. The first tool to integrate this new experience, Adobe Journey Optimizer, has been released as well. The launch responds to the demand for digital content and the improvement of the customer experience.The launch is in response to the push towards digital content and improving customer journeys. Further, artificial intelligence remote asset management solutions Artificial intelligence (AI) has been increasingly used in remote asset management solutions to improve operational efficiency, reduce downtime, and minimize operational costs.

Remote Asset Management Industry Overview

The remote asset tracking market is fragmented, considering the presence of multiple vendors providing different solutions. The solution providers are investing in multiple R&D activities to improve existing solutions and launch new products by integrating the latest technological developments in their solutions. Furthermore, companies are viewing global expansion as a path to attracting maximum market share.

- In March 2023, Drishya AI Labs and VEERUM team up to provide enhanced asset management via digital twins. Drishya's artificial intelligence (AI)-based digital twin technology collaborates with VEERUM's ground-breaking visualization solution to assist brownfield plants in creating digital twins from engineering drawings and historical plant data. The usage of AI by Drishya and VEERUM helps to cost-effectively digitalize obsolete asset management, enable remote site management, and automate engineering deliverables while keeping inventory and tag lists up to date.

- In February 2023, Cisco introduces new cloud services in IoT Operations Dashboard to increase industrial asset visibility, securely manage assets from anywhere and provide Industrial Internet of Things (IoT) customers with a seamless path to cloud automation for Operational Technology (OT) teams

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand from Third-party Logistics Players through Value-add Tracking Services

- 5.1.2 Increasing Adoption of Internet of Things Across the Supply Chain

- 5.2 Market Restraints

- 5.2.1 High Initial Investment and Training Costs

- 5.3 Assessment of Impact of COVID-19 on the Industry

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Solution**

- 6.1.1.1 Real Time Location System

- 6.1.1.2 Analytics and Reporting

- 6.1.1.3 Asset Performance Management

- 6.1.1.4 Surveillance and Security

- 6.1.1.5 Other Solutions (Network Bandwidth Management, Mobile Workforce Management)

- 6.1.2 Services

- 6.1.1 Solution**

- 6.2 By Type

- 6.2.1 Fixed Asset

- 6.2.2 Mobile Asset

- 6.3 By Deployment Mode

- 6.3.1 On-Premise

- 6.3.2 Cloud

- 6.4 By End-User

- 6.4.1 Manufacturing

- 6.4.2 Healthcare

- 6.4.3 Retail

- 6.4.4 Energy and Utilities

- 6.4.5 Transportation and Logistics

- 6.4.6 Other End-Users

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia-Pacific

- 6.5.4 Latin America

- 6.5.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Siemens Corporation

- 7.1.2 AT&T Inc.

- 7.1.3 Cisco Systems, Inc.

- 7.1.4 Hitachi, Ltd.

- 7.1.5 Schneider Electric SE

- 7.1.6 PTC Inc.

- 7.1.7 Bosch Software Innovations GmbH

- 7.1.8 Verizon Communications, Inc.

- 7.1.9 Rockwell Automation, Inc.

- 7.1.10 Infosys Limited

- 7.1.11 SAP SE

- 7.1.12 Meridium, Inc.

- 7.1.13 International Business Machine Corporation