|

市场调查报告书

商品编码

1435869

自主资料平台:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Autonomous Data Platform - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

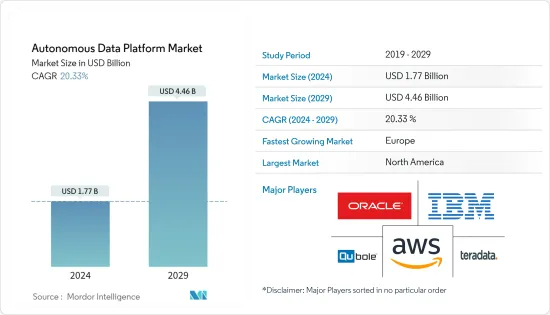

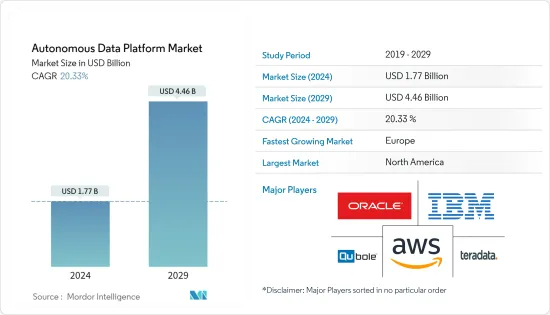

自主资料平台市场规模预计到 2024 年为 17.7 亿美元,预计到 2029 年将达到 44.6 亿美元,在预测期内(2024-2029 年)市场规模将增加 203.3 亿美元。复合年增长率为 % 。

认知运算技术和进阶分析的日益采用,以及复杂和非结构化资料的增加正在推动市场成长。在世界各地,人们正在交换未来几年将不断发展的资讯。 Domo Inc. 估计,到 2020年终,地球上每个人每秒将产生 1.7 MB 的资料。此外,中小企业对自主资料平台的需求不断增长以及云端技术的加速采用是该市场成长的决定因素。

主要亮点

- 事实证明,巨量资料是当今企业广泛使用的技术之一。自主资料平台控制和优化巨量资料基础设施。根据Salesforce最新的购物指数,2018年与前一年同期比较位商务年增13%,预计2020年零售电商销售额将超过4兆美元。美国人口普查局报告称,2019 年,87% 的美国客户在数位管道上发起搜寻,高于前一年的 71%。这就需要加强云端巨量资料服务的使用。

- 该技术提供的优势正在加速云端运算的采用。根据《富比士》预测,到 2020 年,云端运算市场规模预计将增至 1,600 亿美元,实现 19% 的成长率。预计云端基础的部署在预测期内将显着成长。云端平台提供的增强协作、可扩展性和成本效益预计将推动对云端基础的自主资料平台的需求。

- 互联网的普及将增加设备和自主资料工具的数量。这种资料成长的主要原因是网路。根据思科VNI报告,到2022年,将有约48亿网路用户,即世界人口的60%。资料消费量成长的另一个关键因素是全球平均 Wi-Fi 速度的上升,根据思科 VNI 全球 IP 流量预测,2022 年亚太地区的 Wi-Fi 速度将比 2017 年增加一倍以上。

- 然而,复杂的分析过程、缺乏熟练和训练有素的专业人员以及与维持品质和安全同步相关的问题是限制该市场成长的因素。此外,认知运算技术的日益普及以及对高阶分析的需求不断增长为市场成长提供了充足的机会。

- 推动 COVID-19 疾病对巨量资料分析产业乃至自主资料平台市场影响成长的主要因素是数位转型需求的增加、分析投资的增加、远端服务和位置资料的需求,以及对真实资料的需求。时间资讯追踪并监测 COVID-19 疾病的传播。

- 特别是在 COVID-19感染疾病期间,近乎即时地提取、可视化这些情报并根据这些情报采取行动的需求变得越来越关键,包括努力阻止传播并帮助企业生存。这正在成为一个目标,并且正在成为现实受到鼓励。

自主资料平台市场趋势

零售业预计将显着成长

- 随着网路使用的增加,零售业变得更加以客户为中心。科技的进步也正在加速该产业消费者行为的改变。因此,自主资料平台已成为零售业的重要组成部分,帮助零售商在竞争激烈的市场中提高客户忠诚度。该平台帮助零售商即时追踪客户的购物旅程,使零售商能够了解并满足客户的需求和要求。

- 巨量资料为人工智慧提供动力,因此人工智慧将继续进军零售和消费品产业。世界各地的许多巨量资料公司声称可以帮助负责人、零售商和电子商务公司管理他们的资料,以便他们能够个人化客户参与、预测库存并细分区域内的客户行为。

- MapR Technologies 是一家自主技术公司,帮助零售商储存、整合和分析来自电子商务、销售点 (资料) 系统、点选流资料、电子邮件、社交媒体和电话的各种线上和线下客户资料.我们提供资料平台。中心记录 - 一切都在一个中央储存库中。沃尔玛正在经历数位转型。目前,全球最大的私有云端系统正在开发中,据称每小时能够管理Petabyte的资料。

- 据 IBM 称,62% 的零售商表示,使用巨量资料可以提供竞争优势。预计在预测期内,该行业对巨量资料技术的采用将显着增加,从而对自主资料平台市场的成长产生积极影响。

- 零售业需要强大的自主资料平台来即时收集各种来源的各种类型的资料,包括结构化和非结构化资料。该行业面临的重大挑战包括对全通路体验和消费者即时追踪的需求。由于自主资料平台和服务有助于有效应对这些挑战,预计未来几年零售商对它们的采用将会增加。

北美占最大市场占有率

- 网路和行动装置在北美的广泛普及为公司接触该地区的通路合作伙伴、客户和其他相关人员创造了可能性。用于与业务合作伙伴和客户建立联繫并提供适合客户业务需求的内容的行动装置和社群媒体平台的普及导致企业采用自主资料平台和服务。

- 美国跨国公司英特尔看到了巨量资料的巨大价值。该公司利用巨量资料更快开发晶片、识别製造缺陷并通报安全威胁。透过采用巨量资料,该公司能够促进预测分析,并在提高品质的同时节省约 3000 万美元的品质保证支出。白宫也投资约2亿美元用于巨量资料计划。此外,该国在所研究的市场中拥有大量专业人士,并且在预测期内具有巨大的成长潜力。

- 美国零售商的成长预计将推动对供应链管理的投资,他们热衷于改善客户体验。巨量资料应用和自主资料平台可以帮助实现这两个目标。美国商务部发布的季度电商统计数据显示,2019年消费者在美国卖家网上花费了6017.5亿美元,比上年的5236.4亿美元增长了14.9%,这比2018年的增长率更高。被报导。商务部较与前一年同期比较增长13.6%。因此,我们预计美国零售商对巨量资料的使用以及自主资料平台的使用将显着增加。

- 公司使用基于机器学习技术的软体和服务来提供最可靠的最终用户体验,并专注于提供最好的服务。他们利用自主资料平台来分析客户相关资料并发现客户购买行为、季节性需求和产品需求等参数。随着独立资料平台的出现,负责人可以将各种来源的客户资料集中到一个平台中,从而节省整合工作的时间。

自主资料平台产业概况

自主资料平台市场主要由 IBM、微软和 Teradata Corporation 等主要传统厂商主导。企业关心员工和客户资料的隐私和控制,因此他们信任现有供应商而不是新进入者。资料的激增正在推动 Oracle、MapR 和 AWS 等资料管理平台供应商开发和设计自主资料平台,帮助 IT 团队简化和管理流程。自主资料平台的提供者正在相互竞争,以扩大其市场范围并增加在新市场的影响力。

- 2020 年 6 月 - 领先的 Python资料科学平台供应商 Anaconda, Inc. 与 IBM Watson 宣布建立新的合作伙伴关係,以简化企业对 AI开放原始码技术的采用。透过合作,两家公司计划促进创新并解决许多公司面临的人工智慧和资料科学技能差距。 Anaconda Team Edition 储存库与 IBM Cloud Pak for Data 上的 IBM Watson Studio 集成,使组织能够更好地管理和加速跨任何云端的 AI开放原始码技术的采用。

- 2020 年 2 月 - Oracle宣布推出 Oracle 云端资料科学平台。其核心是Oracle云端基础设施资料科学,帮助企业协作建置、训练、管理和部署机器学习模型,加速资料科学计划的成功,提供共用计划、模型目录和团队安全策略、可重复性和审核。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 越来越多地采用认知运算技术和进阶分析

- 由于互连设备和社群媒体的显着成长,非结构化资料量不断增加

- 市场限制因素

- 复杂的分析过程需要熟练专业人员的服务

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争公司之间的敌意强度

- 产业价值链分析

- COVID-19疾病对自主资料平台市场的影响分析

第五章市场区隔

- 按组织规模

- 大公司

- 中小企业

- 依部署类型

- 公共云端

- 私有云端

- 混合云端

- 按行业 按最终用户

- BFSI

- 医疗保健和生命科学

- 零售和消费品

- 媒体和通讯

- 其他最终用户产业(政府、製造业)

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第六章 竞争形势

- 公司简介

- Oracle Corporation

- International Business Machines Corporation

- Amazon Web Services

- Teradata Corporation

- Qubole Inc

- MapR Technologies, Inc.

- Alteryx Inc.

- Ataccama Corporation

- Cloudera, Inc.

- Gemini Data Inc.

- Datrium, Inc.

- Denodo Technologies

- Paxata, Inc.

- Zaloni Inc.

第七章 投资分析

第八章市场机会及未来趋势

The Autonomous Data Platform Market size is estimated at USD 1.77 billion in 2024, and is expected to reach USD 4.46 billion by 2029, growing at a CAGR of 20.33% during the forecast period (2024-2029).

The growing adoption of cognitive computing technology and advanced analytics as well as the rising volume of complex and unstructured data drive market growth. Across the world, people are swapping information that is going to develop in the coming years. Domo Inc. estimated that 1.7MB of data will be created every second for every person on earth by 2020 end. Additionally, rising demand for autonomous data platforms from SMEs and accelerating adoption of cloud technology are the determinants for the growth of this market.

Key Highlights

- Big Data has turned out to be one of the widespread technologies being utilized by companies today. An autonomous data platform controls and optimizes the big data infrastructure. According to the most contemporary Shopping Index of Salesforce, digital commerce grew at a rate of 13% year-over-year in Q4 2018, and projected retail e-commerce sales exceeding USD 4 trillion through 2020. The US Census Bureau reported that 87% of the US customers began their hunt in digital channels in 2019, up from 71% the previous year. This calls for enhanced use of big data services for the cloud.

- Owing to the advantages the technology grants, cloud computing is witnessing an accelerated development in its adoption. According to Forbes, the market for cloud computing will increase to USD 160 billion by 2020, achieving a growth rate of 19%. Cloud-based deployment anticipated to have meaningful growth during the forecast period. Enhanced collaboration, Scalability, and cost-effectiveness offered by the cloud platform are expected to encourage the demand for cloud-based autonomous data platforms.

- The propagation of the Internet will feed this increase in the number of devices and autonomous data tool. The Internet happens to the principal reason for this growth in data. According to the Cisco VNI report, there will be about 4.8 billion internet subscribers in 2022, 60% of the global population. According to Cisco VNI Global IP Traffic Forecast, the other significant factor for the increase in consumption of data will be the rise in global average Wi-Fi speeds that are exacted to more than double in Asia-Pacific in 2022 as compared to 2017.

- However, complicated analytical process, lack of skilled and trained professional, and problem associated with the maintaining sync between quality and safety acts as a restricting factor for this market growth. Moreover, growing popularity of cognitive computing technology and the increasing need for advanced analytics will provide adequate opportunities for the growth of the market.

- The principal factors driving the growth of COVID-19 impact on the Big Data Analytics industry and hence Autonomous Data Platform Market are increasing demand for digital transformation, increased investments in analytics, growing demand for remote services and location data, and increasing need for real-time information track and monitor the COVID-19 spread.

- Especially during the COVID-19 pandemic - including efforts to contain its spread and help businesses stay afloat - the need to extract, visualize, and execute this intelligence in near-real-time is increasingly becoming a mission-critical objective, thus giving a boost to the Autonomous Data Platform Market.

Autonomous Data Platform Market Trends

Retail Vertical is Expected to Register a Significant Growth

- With the growing use of the Internet, the retail vertical has become more customer-centric. Advancements in technologies have also made this vertical witness the accelerated changes in consumers' behavior. Consequently, the autonomous data platform has become an essential part of the retail vertical, assisting retailers to attain improved customer loyalty in the highly competitive market. The platform helps retailers track customers' shopping journeys in real-time, thus enabling retailers to understand and address their customers' needs and requirements.

- Big data powers AI, and so it follows that AI would continue to find its way into the retail & consumer goods industry. Many big data companies globally claim to assist marketers, retailers, and eCommerce companies in managing their data so that it would allow them to personalize customer engagement, forecast inventory, and segment customers in the region.

- MapR Technologies is offering an Autonomous Data Platform, which helps retailers store, integrate, and analyze the wide variety of online and offline customer data e-commerce transactions, point of sale (POS) systems, clickstream data, email, social media, and call center records - all in one central repository. Walmart is experiencing a digital transformation. It is in the process of developing the world's most extensive private cloud system, which is supposed to have the capacity to manage 2.5 petabytes of data every hour.

- According to IBM, 62% of retailers report that the use of Big Data is giving them a competitive advantage. It is expected that the industry will witness significant growth in the adoption of Big Data technology over the forecast period, thereby positively impacting the Autonomous Data Platform market's growth.

- The retail sector needs a strong autonomous data platform to collect different data types, including structured and unstructured, from various sources in real-time. The significant challenges faced by this vertical include the demand for omnichannel experience and the tracking of consumers in real-time. As autonomous data platforms and services help efficiently address these challenges, their adoption by retailers is expected to increase in the coming years.

North America to Hold the Largest Market Share

- The extensive penetration of the Internet and mobile devices in North America has created possibilities for enterprises to reach out to channel partners, clients, and other stakeholders in the region. The widespread use of mobile devices and social media platforms to connect with business partners and clients for giving customized content as per the business necessities of clients has prompted businesses to embrace autonomous data platforms and services.

- American multinational corporation, Intel is finding meaningful value in big data. The firm uses big data to develop chips quicker, recognize manufacturing glitches, and inform about security threats. By adopting Big Data, the firm has been able to facilitate predictive analysis and save around USD 30 million on its Quality Assurance spend while still increasing quality. The White House has also invested around USD 200 million in big data projects. The country also has a huge number of professionals in the studied market, which offers a vast potential to grow over the forecast period.

- The US retailer's growth is expected to foster their investment in the supply chain management and are rigorously trying to enhance the customer experience. Big data applications and Autonomous data platform can help them in achieving both. Customers spent USD 601.75 billion online with U.S. merchants in 2019, up 14.9% from USD 523.64 billion the prior year, according to the U.S. Department of Commerce quarterly ecommerce figures released, and that was a higher growth rate than 2018, when online sales reported by the Commerce Department rose 13.6% year over year. As a result, the use of big data and hence Autonomous data platform is also expected to rise significantly among the US retailers.

- Companies focus on offering the most reliable end-user experience and providing the best services by using machine-learning technology-based software and services. They leverage the autonomous data platform to analyze customer-related data and to find parameters such as customers' buying behavior, seasonal demand, and product demand. With the advent of independent data platforms, marketers can centralize customers' data from different sources at one platform, thereby saving hours of integration work.

Autonomous Data Platform Industry Overview

The Autonomous Data Platform Market is concentrated with major legacy players dominating the market like IBM, Microsoft, and Teradata Corporation. Since companies are concerned regarding the privacy and management of their employee/customer data, they trust established vendors more rather than new entrants. The proliferation of data has pushed data management platform vendors, such as Oracle, MapR, and AWS, to develop and design autonomous data platforms that help IT teams simplify and manage processes. The autonomous data platform providers are competing with each other to expand their market coverage and increase their presence in newer markets.

- June 2020 - Anaconda, Inc. provider of the leading Python data science platform and IBM Watson announced a new collaboration to help simplify enterprise adoption of AI open-source technologies. By working together, the two companies plan to help fuel innovation and address the AI and data science skills gap that many enterprises face. Anaconda Team Edition repository will be integrated with IBM Watson Studio on IBM Cloud Pak for Data, enabling organizations to better govern and speed the deployment of AI open-source technologies across any cloud.

- Feb 2020 - Oracle announced the availability of the Oracle Cloud Data Science Platform. At the core is Oracle Cloud Infrastructure Data Science, helping enterprises to collaboratively build, train, manage and deploy machine learning models to increase the success of data science projects, helping improve the effectiveness of data science teams with capabilities like shared projects, model catalogs, team security policies, reproducibility and auditability.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Adoption of Cognitive Computing Technology and Advanced Analytics

- 4.2.2 Expanding Volume of Unstructured Data Due to the Phenomenal Growth of Interconnected Devices and Social Media

- 4.3 Market Restraints

- 4.3.1 Complex Analytical Process Requiring Skilled Professionals Services

- 4.4 Industry Attractiveness - Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Industry Value Chain Analysis

- 4.6 Analysis on the impact of COVID-19 on the Autonomous Data Platform Market

5 MARKET SEGMENTATION

- 5.1 By Organization Size

- 5.1.1 Large Enterprises

- 5.1.2 Small and Medium-Sized Enterprise

- 5.2 By Deployment Type

- 5.2.1 Public Cloud

- 5.2.2 Private Cloud

- 5.2.3 Hybrid Cloud

- 5.3 By End-user Vertical

- 5.3.1 BFSI

- 5.3.2 Healthcare and Life Sciences

- 5.3.3 Retail and Consumer Goods

- 5.3.4 Media and Telecommunication

- 5.3.5 Other End-User Verticals (Government, Manufacturing)

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia Pacific

- 5.4.4 Latin America

- 5.4.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Oracle Corporation

- 6.1.2 International Business Machines Corporation

- 6.1.3 Amazon Web Services

- 6.1.4 Teradata Corporation

- 6.1.5 Qubole Inc

- 6.1.6 MapR Technologies, Inc.

- 6.1.7 Alteryx Inc.

- 6.1.8 Ataccama Corporation

- 6.1.9 Cloudera, Inc.

- 6.1.10 Gemini Data Inc.

- 6.1.11 Datrium, Inc.

- 6.1.12 Denodo Technologies

- 6.1.13 Paxata, Inc.

- 6.1.14 Zaloni Inc.