|

市场调查报告书

商品编码

1435886

认同分析:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Identity Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

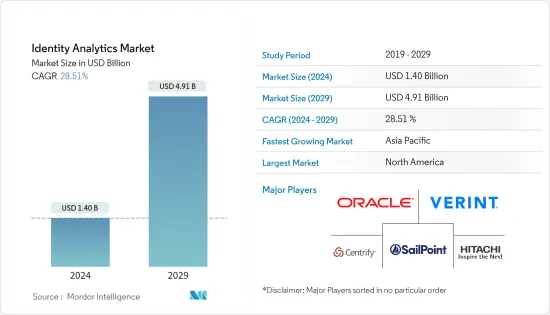

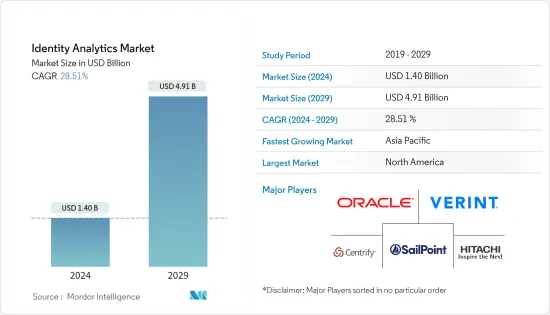

Identity Analytics 市场规模预计到 2024 年为 14 亿美元,预计到 2029 年将达到 49.1 亿美元,在预测期内(2024-2029 年)复合年增长率为 28.51%。

主要亮点

- 身分分析解决方案是就使用者存取和权限做出明智决策的关键。这些解决方案使用先进的分析和机器学习来降低身分存取风险。组织正在实施高级分析和机器学习解决方案等新技术,以确保持续的合规性。

- 世界各地的企业都在增加数位化支出,包括支付流程,我们看到所有类型的组织都在数位化方面做出了努力。 TechRepublic Premium 最近的一项调查显示,47% 的受访者计划在 2021 年在数位转型上投入比 2020 年更多的资金。此外,2020 年,58% 的受访者表示已将纸张数位化,45% 的受访者表示实施了线上培训模组。

- 身分分析市场主要受到严格法规、合规性要求以及企业中 BYOD 趋势采用等解决方案实施等因素的推动。例如,2021 年 3 月推出的《INFORM(线上零售市场诚信、通知与公平)消费者法案》。法律要求零售商验证其市场上畅销产品的合法性。由于严格的政府法规,身份检验解决方案正在各个最终用户产业中实施。

- 随着企业 IT 部门在部署云端系统的同时维护本地解决方案,控制谁可以存取哪些应用程式变得更加重要。这为企业及其团队带来了新的身分分析挑战。挑战包括身分管理、合规性可见性等等。

- 在 COVID-19感染疾病期间,身分分析解决方案将对市场产生积极影响,并为其在预测期内的成长做出重大贡献。活跃在市场上的供应商也因疫情而收益激增。 2021 年 2 月,Ekata 宣布收益激增,新增 300 名客户。这场大流行加速了电子商务的采用,并增加了对身份验证等服务的需求,以防止网路诈骗。

身份分析市场趋势

预计 BFSI 产业在预测期内将出现显着成长

- 各种用途的线上付款的成长趋势促使银行建立第三方申请的安全通道,增加了对身分分析服务的需求。此外,据观察,银行鼓励线上查询,因为提供金融服务的媒介具有成本效益和效率。

- CRN 于 2022 年 2 月进行的一项研究发现,金融机构正在利用机器学习和预测分析来预测非法贸易和身分盗窃事件、提高 KYC 自动化并识别发现模式。在这方面,身分分析可以帮助组织在犯罪和担忧发生之前减轻其影响。

- 多家公司为整个行业的机构提供创新的身份和存取管理解决方案。例如,Wipro 提供的身份和存取管理服务使澳洲四大银行之一实现了零重大事故。因此,业内多个市场相关人员的这些努力,加上银行业越来越多地采用云端技术,预计将进一步推动身分分析解决方案的采用。

- 此外,2022 年 1 月,印度 RBL 银行宣布与 Google 合作,加强客户经验策略并扩大其价值提案,透过 Abacus 2.0 数位平台为其快速成长的客户群提供服务。透过此次合作,RBL 将更能管理客户资料和分析,实现有效的交叉销售,并大幅降低客户获取成本。

- 由于安全在金融领域极为重要,因此我们的银行合作伙伴将大量时间花在安全上。例如,根据英国政府的数据,付款和金融服务约占英国网路攻击的 75%。这些发展正在对市场产生正面影响。世界银行集团的身份证促进发展 (ID4D) 等一些倡议正在帮助新兴国家引入新系统,利用新技术来增加持有官方身份证件的公民数量。很有帮助。

北美预计将占据很大份额

- 北美区域市场成长的主要驱动力是技术提供者的大量存在以及主要行业中身份相关违规事件的增加。该地区的这些公司致力于开发创新解决方案,以保持在地区和全球竞争形势中的地位。

- 加拿大市场各行业也越来越多地采用资料主导的决策。云端业务管理解决方案供应商 Sage 于 2021 年 3 月在美国和加拿大市场推出了针对 Sage 300 和 Sage 100 的首个云端 Sage 资料和分析服务整合。该公司的商业智慧套件使其能够为用户提供即时销售仪表板和详细资讯。由人工智慧和机器学习演算法支援的损益报告。

- 此外,2021 年 6 月,Stripe 推出了 Stripe Identity,这是网路公司安全验证 30 多个国家/地区用户身份的简单方法。 Stripe Identity 让企业验证您的身分就像接受付款一样简单。 Stripe Identity 是同类首创的自助服务工具,允许线上企业在短短几分钟内开始验证用户身份,无需任何程式码。预计此类趋势将进一步推动北美地区所研究市场的成长。

- 此外,软体的使用正在成为加拿大银行的趋势,加拿大皇家银行于 2020 年 3 月成为第一家实施数位 ID 的银行。加拿大皇家银行为加拿大、美国和其他 34 个国家的 1,700 万客户提供服务。国家。该公司推出了用于开户的数位身分证,可以在银行分店以及透过手机和网站远端使用。

- 此外,严格的政府法规(例如《美国金融服务业现代化法》(GLB))在美国采用 ID 解决方案方面发挥关键作用。该法律要求证券公司和金融机构实施严格的法规,透过制定评估资料风险和防范威胁的计画来保护消费者资料隐私。

身份分析产业概述

身分分析市场竞争适中,由许多全球和区域参与者组成。这些公司占据了重要的市场占有率,并致力于扩大全球客户群。这些供应商更专注于研发投资、策略合作伙伴关係以及其他有机和无机成长策略,以在整个预测期内获得竞争优势。

- 2022 年 8 月 -多重云端架构云端 Gurucul 已发布。除了部署支援之外,这些新的跨云功能还为跨云环境的存取和活动提供关联、进阶连结和行为基准。

- 2022 年 2 月 - LogRhythm 推出新的品牌识别。此次品牌重塑代表了该公司致力于帮助安全营运中心消除人员短缺、增加对新攻击和技术的了解,并自信地应对不断变化的威胁形势。此次品牌重塑是 LogRhythm 2022 年众多变化中的第一个,包括新的视觉效果、未来的云端原生平台以及反映公司愿景和发展的新观点。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争公司之间的敌意强度

第五章市场动态

- 市场驱动因素

- 主要产业中与身分相关的诈骗事件呈上升趋势

- 市场挑战

- 实施身分分析解决方案的高成本

第六章 COVID-19 疾病对身分分析市场的影响

第七章市场区隔

- 配置类型

- 解决方案

- 服务

- 介绍

- 本地

- 云

- 企业规模

- 中小企业

- 大公司

- 使用者

- 资讯科技/通讯

- BFSI

- 政府

- 零售和消费者

- 卫生保健

- 其他最终用户(製造、能源、电力)

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第八章 竞争形势

- 公司简介

- Oracle Corporation

- Verint Systems Inc.

- Hitachi ID Systems, Inc.

- Brainwave GRC

- LogRhythm, Inc.

- Securonix, Inc.

- Gurucul Solutions Pvt Ltd.

- Nexis GmbH

- Sailpoint Technologies Holdings Inc

- Centrify Corporation

- Okta Inc.

- MicroStrategy Incorporated

第九章投资分析

第10章市场的未来

The Identity Analytics Market size is estimated at USD 1.40 billion in 2024, and is expected to reach USD 4.91 billion by 2029, growing at a CAGR of 28.51% during the forecast period (2024-2029).

Key Highlights

- Identity analytics solutions are key in making informed decisions about user access and permissions. These solutions use advanced analytics and machine learning to mitigate the risk of identity access. Organizations are adopting new technologies, such as advanced analytics and machine learning solutions, to ensure continuous compliance.

- Enterprises worldwide are increasing spending on digitization, including the payment processes, and the push towards digitization can be witnessed in all types of organizations. According to a recent TechRepublic Premium survey, 47% of the respondents planned on spending more on digital transformation in 2021 than in 2020. In addition, in 2020, 58% of the respondents reported digitizing paper, and 45% reported adopting online training modules.

- The market for identity analytics is primarily driven by elements like the adoption of solutions through strict regulations, the requirement for compliance, and the adoption of BYOD trends in businesses. The INFORM (Integrity, Notification, and Fairness in Online Retail Marketplaces) Consumers act, for instance, was introduced in March 2021. Retailers are required by the law to confirm the legitimacy of the top market sellers. Identity verification solutions are deployed in various end-user industries as a result of the government's strict regulations.

- As enterprise IT adopts more cloud systems while maintaining on-premises solutions, controlling who can access which applications become more important. This poses a new challenge for enterprises and their teams regarding identity analytics. Some of the challenges include identity management, compliance visibility, and more.

- During the COVID-19 pandemic, identity analytics solutions will positively impact the market and contribute to its growth significantly during the forecast period. Vendors operating in the market have also witnessed a surge in revenue owing to the pandemic. In February 2021, Ekata announced that its revenue surged with the addition of 300 new customers. The pandemic accelerated the adoption of e-commerce, boosting demand for services, such as identity verification, to safeguard against cyber fraud.

Identity Analytics Market Trends

BFSI Industry is Expected to Grow at a Significant Rate Over the Forecast Period

- The growing trend of online payments for various purposes has driven banks to establish secure channels for third-party charges, thus, driving the demand for identity analytics services. Furthermore, it has been observed that banks encourage online access because the medium is cost-effective and efficient in delivering financial services.

- According to a survey conducted by CRN in February 2022, financial institutions have leveraged machine learning and predictive analytics to predict fraudulent transactions and personal information theft cases, enhance KYC automation, and discover unfamiliar patterns of individual users. In this aspect, identity analytics helps organizations mitigate crime and concerns before they occur.

- Several companies are providing innovative identity and access management solutions to various institutions in the industry. For instance, Wipro provides identity and access management services, which result in zero critical incidents for one of Australia's biggest four banks. Hence, these initiatives by several market players in the industry, coupled with the increasing adoption of cloud technology in the banking industry, are expected to further the adoption of identity analytics solutions.

- Further, in January 2022, RBL Bank, India announced that it has partnered with Google to strengthen its customer experience strategy and expand its value proposition to serve its rapidly growing customer base through the Abacus 2.0 digital platform. Through this collaboration, RBL will ably manage customer data and analytics, enable effective cross-selling, and significantly reduce customer acquisition costs.

- In the financial sector, as security is vital, allied banking firms have been spending a significant share on security. For instance, payment and financial services account for about 75% of cyber-attacks in the United Kingdom According to UK government. Such developments are positively influencing the market. Some initiatives, like the World Bank Group's Identification for Development (ID4D), help developing countries put into effect new systems that increase the number of citizens with official identification with the support of new technologies.

North America is Expected to Hold a Significant Share

- The prior driver for the growth of the North America geographic segment is the significant presence of technology providers and the increasing number of identity-related breaches across major industries. These players present in the region are focusing on the development of innovative solutions to stay in the regional and globally competitive landscape.

- The implementation of data-driven decision-making is also rising in Canadian markets across various sectors. Cloud business management solutions vendor Sage launched its cloud-first Sage Data and Analytics service integration for Sage 300 and Sage 100 in the United States and Canadian markets in March 2021. With its business intelligence toolkit, it can provide users with live sales dashboards and detailed P&L reports with the help of AI and machine learning algorithms.

- Further, in June 2021, Stripe introduced the Stripe Identity, a simple way for internet businesses to securely verify users' identities from over 30 countries. Stripe Identity makes identity verification as effortless for a business as payment acceptance. Stripe Identity is the first self-serve tool of its kind, allowing any online business to begin verifying the identities of their users in just a few minutes, with no code required. Such trends are further expected to boost the growth of the studied market in the North American region.

- Moreover, the software usage among banks in Canada is becoming a trend, with the Royal Bank of Canada being the first to implement digital identity in March 2020. The Royal Bank of Canada serves 17 million customers in Canada, the United States, and 34 other countries. It rolled out a digital identity for account opening, which is available at the bank branches and remotely via mobile and its website.

- Additionally, stringent government regulations, such as the Gramm-Leach-Bliley (GLB) Act, play a crucial role in adopting identity solutions in the United States. The act needs securities firms and financial institutions to implement strict regulations for protecting consumer data privacy by establishing a program that assesses risks to the data and guards against threats.

Identity Analytics Industry Overview

The Identity Analytics market is moderately competitive and consists of many global and regional players. These players account for a considerable market share and focus on expanding their client base globally. These vendors focus more on research and development investment, strategic partnerships, and other organic & inorganic growth strategies to earn a competitive edge throughout the forecast period.

- August 2022 - Gurucul, a provider of next-generation SIEM, XDR, UEBA, identity, and access analytics, announced expanded poly cloud architecture support, improved multi-cloud deployments, and cross-cloud across all major cloud stacks, including Amazon. In addition to deployment support, these new cross-cloud capabilities provide correlation, advanced linking, and behavior baselines on access and activity across cloud environments.

- February 2022 - LogRhythm introduces its new brand identity. This rebranding represents the company's efforts to help security operations centers close staff gaps, increase knowledge of new attacks and technologies, and confidently navigate the ever-changing threat landscape. The rebranding is the first of many changes to LogRhythm in 2022, including a new visual look, a future cloud-native platform, and new perspectives that reflect the company's vision and evolution.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Cases of Identity-Related Frauds Across Major Industries

- 5.2 Market Challenges

- 5.2.1 Significantly High Cost of Deploying Identity Analytics Solutions

6 IMPACT OF COVID-19 ON THE IDENTITY ANALYTICS MARKET

7 MARKET SEGMENTATION

- 7.1 Component Type

- 7.1.1 Solutions

- 7.1.2 Services

- 7.2 Deployment

- 7.2.1 On-Premise

- 7.2.2 Cloud

- 7.3 Enterprise Size

- 7.3.1 Small & Medium Enterprises

- 7.3.2 Large Enterprises

- 7.4 End-users

- 7.4.1 IT and Telecommunication

- 7.4.2 BFSI

- 7.4.3 Government

- 7.4.4 Retail and Consumer

- 7.4.5 Healthcare

- 7.4.6 Other End-users (Manufacturing, Energy and Power)

- 7.5 Geography

- 7.5.1 North America

- 7.5.2 Europe

- 7.5.3 Asia Pacific

- 7.5.4 Latin America

- 7.5.5 Middle East and Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles*

- 8.1.1 Oracle Corporation

- 8.1.2 Verint Systems Inc.

- 8.1.3 Hitachi ID Systems, Inc.

- 8.1.4 Brainwave GRC

- 8.1.5 LogRhythm, Inc.

- 8.1.6 Securonix, Inc.

- 8.1.7 Gurucul Solutions Pvt Ltd.

- 8.1.8 Nexis GmbH

- 8.1.9 Sailpoint Technologies Holdings Inc

- 8.1.10 Centrify Corporation

- 8.1.11 Okta Inc.

- 8.1.12 MicroStrategy Incorporated