|

市场调查报告书

商品编码

1435902

氯乙烯单体:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Vinyl Chloride Monomer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

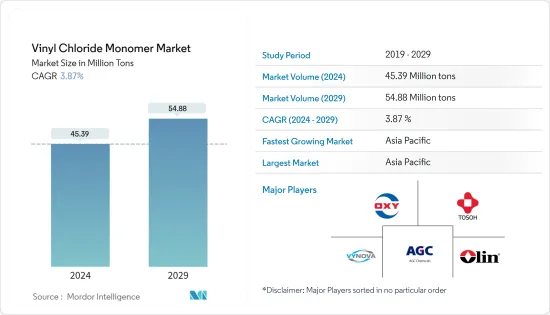

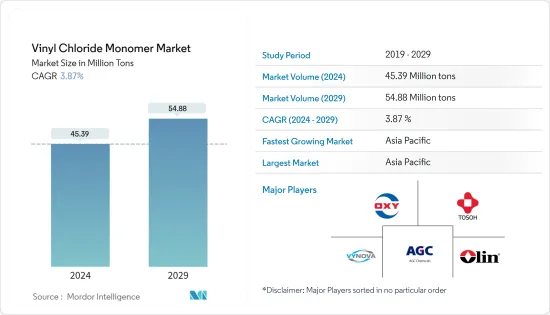

预计2024年氯乙烯单体市场规模为4,539万吨,预估至2029年将达5,488万吨,预测期间(2024-2029年)复合年增长率为3.87%。

冠状病毒感染疾病(COVID-19)大流行对市场产生了负面影响。这是因为製造设施和工厂因封锁和限制措施而关闭。供应链和运输中断造成了进一步的市场瓶颈。然而,随着所研究市场的需求復苏,该产业在 2021 年出现復苏。

主要亮点

- 短期内,建筑业需求的增加以及医疗保健行业需求的增加是推动所研究市场成长的一些因素。

- 另一方面,日益严重的环境问题、各种应用的替代品的可用性、原材料价格的波动以及严格的政府监管是阻碍市场成长的因素。

- 此外,生物基氯乙烯单体(VCM)的出现以及透过研发进行的产品进步预计将在预测期内提供大量机会。

- 预计亚太地区将主导全球氯乙烯单体市场,由于中国和印度等国家建筑业的需求不断增加,预计亚太地区也将成为预测期内成长最快的市场。

氯乙烯单体市场趋势

建筑业扩大市场

- 氯乙烯单体被认为是各种行业中使用的着名化学品之一。室温下为无色可燃性气体。氯乙烯单体主要用于製造聚氯乙烯,用于建设产业。

- 在建设产业,氯乙烯单体用于墙板、屋顶、电线和窗户型材。

- 根据美国人口普查局统计,2022年美国商业建筑价值达1,147.9亿美元,与前一年同期比较增加17.63%。

- 根据土木工程师协会(ICE)的研究,到2030年全球建筑业预计将达到8兆美元,主要由中国、印度和美国推动。

- 此外,亚太、中东、非洲等地区在工业领域、医院、购物中心、综合体、酒店以及IT领域吸引了大量的国内外投资,这将带来更多的投资。可能会完成。我们满足PVC产品的需求。

- 此外,中东和非洲基础建设投资的增加预计将增加氯乙烯单体市场的需求。例如,在沙乌地阿拉伯,房地产开发的增加、住宅房地产需求的增加以及政府发展社会经济基础设施的努力预计将推动产业成长。

- 沙乌地住宅部长马吉德·霍盖尔 (Majid Al Khogeir) 表示,沙乌地阿拉伯计划在未来五年内再建造 30 万套住宅。沙乌地阿拉伯根据 2030 年愿景制定的关键倡议之一是住宅。这可能会创造对氯乙烯单体市场的需求。未来几年它将受到该国建筑业的关注。

- 因此,建设产业的上述趋势预计将在预测期内推动氯乙烯单体市场的成长。

亚太地区主导氯乙烯单体市场

- 亚太地区主导了全球市场占有率,印度、中国、菲律宾、越南和印尼的住宅和商业建筑投资增加。

- 2018年至2022年中国建筑业产值显示产业逐步成长。例如,根据中国国家统计局的数据,2022年中国建筑业产值达到高峰约27.63兆元(约4.1兆美元)。

- 由于家庭收入的提高以及人口从农村地区向都市区的迁移,预计中国的住宅建设需求将继续增长。公共和私营部门对经济适用住宅的更多关注将促进住宅建设行业的发展。

- 此外,2021年建设产业新契约金额1,345亿元(195.2亿美元),与前一年同期比较%,成长速度年减7.1%。年。 2022年1月,中国宣布在「十四五」规划(2021-2025年)期间发展建筑业,使国家经济支柱走上更绿色、更聪明、更安全的道路。因此,预计氯乙烯单体市场因施工而增加的合约量将会上升。

- 此外,亚太地区的医疗保健产业近年来出现了显着成长,并可能推动所研究的市场。例如,印度的医疗保健支出从2020年的27.3亿卢比(369.2亿美元)增加到2021年的47.2亿卢比(638.3亿美元),成长了近73%。此外,根据《2023年经济调查》,2021-2022年印度医疗保健公共支出占GDP的2.1%。

- 在印尼,由于2020-2024年国家中期发展计画(RPJMN)和2021-2030年电力采购计画(RUPTL)相关的政府投资快速增加,建筑市场规模不断扩大。例如,根据印尼统计数据,2021 年印尼约有 203,400 个活跃的建筑企业。

- 因此,亚太国家的所有此类投资和计划计划都正在推动该地区的建设活动,预计将在预测期内推动该地区氯乙烯单体市场的需求。

氯乙烯单体产业概况

氯乙烯单体市场本质上是细分的。市场的主要企业包括(排名不分先后)西方石油公司、AGC化学公司、Vynova集团、奥林公司、东曹公司等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 医疗保健领域的需求不断增加

- 建设产业的高消费量

- 抑制因素

- 日益增加的环境问题和各种应用替代品的可用性

- 其他限制

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第五章市场区隔(市场规模(数量))

- 目的

- PVC

- 其他用途

- 最终用户产业

- 建筑与建造

- 卫生保健

- 电

- 其他最终用户产业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、合作与协议

- 市场占有率(%)分析**/市场排名分析

- 主要企业采取的策略

- 公司简介

- AGC Chemicals

- Dow

- Ercros SA

- Mexichem

- NOVA Chemicals

- Occidental Petroleum Corporation

- Olin Corporation

- Reliance Industries Limited

- Shin-Etsu PVC BV

- The Axiall Corporation

- The Chemson Group

- Tosoh Corporation

- Vinnolit GmbH &Co. KG

- Vynova Group

- Westlake Chemical Corporation

第七章市场机会与未来趋势

- 生物基氯乙烯单体的出现

- 透过研究和开发进行产品演变

- 增加氯乙烯单体 (VCM) 作为添加剂的使用

The Vinyl Chloride Monomer Market size is estimated at 45.39 Million tons in 2024, and is expected to reach 54.88 Million tons by 2029, growing at a CAGR of 3.87% during the forecast period (2024-2029).

The COVID-19 pandemic negatively impacted the market. This was because of the shutdown of the manufacturing facilities and plants due to the lockdown and restrictions. Supply chain and transportation disruptions further created hindrances for the market. However, the industry witnessed a recovery in 2021, thus rebounding the demand for the market studied.

Key Highlights

- Over the short term, rising demand from the building and construction sectors, as well as rising demand from the healthcare sector, are some of the factors driving the growth of the market studied.

- On the flip side, rising environmental concerns, the availability of substitutes in various applications, fluctuating raw material prices, and stringent government regulations are some of the factors hindering the growth of the market.

- Furthermore, the emergence of bio-based vinyl chloride monomer (VCM) and advancements in the product through research and development are expected to provide numerous opportunities over the forecast period.

- Asia-Pacific is expected to dominate the global vinyl chloride monomer market, and it is also estimated to be the fastest-growing market over the forecast period due to the increasing demand from building and construction sectors in countries such as China and India.

Vinyl Chloride Monomer Market Trends

Building and Construction Sector to Boost Market

- Vinyl chloride monomer is considered one of the notable chemicals used in various businesses. It is a colorless, combustible gas at room temperature. Vinyl chloride monomer is mostly used in the production of polyvinyl chloride, which is utilized predominantly in the building and construction industry.

- In the construction industry, the vinyl chloride monomer is utilized in siding, roofing, wire, and window outlines.

- According to US Census Bureau, the value of commercial construction in the United States amounted to USD 114.79 billion in 2022, which showed an increase of 17.63% compared with the previous year.

- According to a study by the Institution of Civil Engineers (ICE), the global construction industry is expected to reach USD 8 trillion by 2030, primarily driven by China, India, and the United States.

- Additionally, regions like Asia-Pacific and the Middle East and Africa, are attracting huge domestic, as well as foreign investments for setting up industrial units, hospitals, malls, multiplexes, and hotels, as well as in the IT sector, which may add to the demand for PVC products.

- Moreover, increasing investment in infrastructure construction in the Middle East and Africa is expected to boost the demand for the vinyl chloride monomer market. For instance, in Saudi Arabia, the growing number of real estate developments, increasing demand for residential property, and governmental initiatives to develop socio-economic infrastructure shall drive the industry growth.

- According to Majid Al-Hogail, the Saudi Housing Minister, the Kingdom of Saudi Arabia plans to construct 300,000 extra housing units over the next five years. One of Saudi Arabia's significant initiatives under Vision 2030 is housing. This will likely create demand for the vinyl chloride monomer market. from the country's construction sector in the upcoming years.

- Hence, the aforementioned trends in the construction industry are expected to drive the growth of the vinyl chloride monomer market, during the forecast period.

Asia-Pacific Region to Dominate Vinyl Chloride Monomer Market

- The Asia-Pacific region dominated the global market share with growing investments in residential and commercial construction in India, China, the Philippines, Vietnam, and Indonesia.

- The output value of construction in China from 2018 to 2022, indicates progressive growth in the industry. For instance, according to the National Bureau of Statistics of China, in 2022, the construction output value in China achieved its peak at around CNY 27.63 trillion (USD 4.10 trillion).

- Rising household income rates, along with population migration from rural to urban areas, are expected to continue to drive demand for residential construction in China. Increased emphasis on both public and private sector affordable housing would fuel development in the residential construction sector.

- Furthermore, in 2021, the value of newly signed contracts in the construction industry was CNY 134.5 billion (USD 19.52 billion), an increase of 2.5% year-on-year, and the growth rate narrowed by 7.1% compared with the same period last year. In January 2022, China unveiled plans to develop its construction industry during the 14th Five-Year Plan (2021-2025), paving a pillar of the country's economy on a greener, smarter and safer path. Therefore, increasing contracts from the construction is expected to have an upside for vinyl chloride monomer market.

- Additionally, the healthcare sector in the Asia-Pacific region witnessed major growth in recent years, which is likely to drive the market studied. For instance, India's health sector expenditure increased from INR 2.73 lakh crore (USD 36.92 billion) in 2020 to INR 4.72 lakh crore (USD 63.83 billion) in 2021, an increase of nearly 73%. Moreover, ni the economic survey of 2023, India's public expenditure on healthcare stood at 2.1% of GDP in 2021-22.

- In Indonesia, due to surging government investments as part of the 2020-2024 National Medium-Term Development Plan (RPJMN) and the Electricity Procurement Plan (RUPTL) 2021-2030, the size of construction market is growing consecutively. For instance according to Statistics Indonesia, in 2021, there were approximately 203.4 thousand construction establishments active in Indonesia.

- Hence, all such investments and planned projects in the Asia-Pacific countries are providing a boost to construction activities in the region, which are anticipated to drive the demand for vinyl chloride monomer market in the region during the forecast period.

Vinyl Chloride Monomer Industry Overview

The Vinyl Chloride Monomer Market is partially fragmented in nature. The major players in this market (not in a particular order) include Occidental Petroleum Corporation, AGC Chemicals, Vynova Group, Olin Corporation, and Tosoh Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Demand in Healthcare Sector

- 4.1.2 High Consumption from Building and Construction Industry

- 4.2 Restraints

- 4.2.1 Increasing Environmental Concerns and Availability of Substitutes in Various Applications

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Application

- 5.1.1 PVC

- 5.1.2 Other Applications

- 5.2 End-user Industry

- 5.2.1 Building and Construction

- 5.2.2 Healthcare

- 5.2.3 Electrical

- 5.2.4 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis **/ Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AGC Chemicals

- 6.4.2 Dow

- 6.4.3 Ercros S.A

- 6.4.4 Mexichem

- 6.4.5 NOVA Chemicals

- 6.4.6 Occidental Petroleum Corporation

- 6.4.7 Olin Corporation

- 6.4.8 Reliance Industries Limited

- 6.4.9 Shin-Etsu PVC B.V.

- 6.4.10 The Axiall Corporation

- 6.4.11 The Chemson Group

- 6.4.12 Tosoh Corporation

- 6.4.13 Vinnolit GmbH & Co. KG

- 6.4.14 Vynova Group

- 6.4.15 Westlake Chemical Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emergence of Bio-Based Vinyl Chloride Monomer

- 7.2 Advancement in the Product through Research and Development

- 7.3 Increase in the Use of Vinyl Chloride Monomer (VCM) as an Additive Material