|

市场调查报告书

商品编码

1435922

聚合物太阳能电池:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Polymer Solar Cells - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

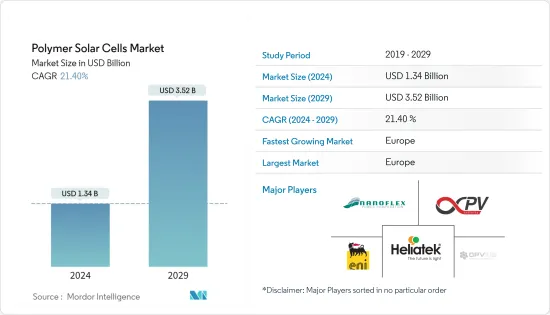

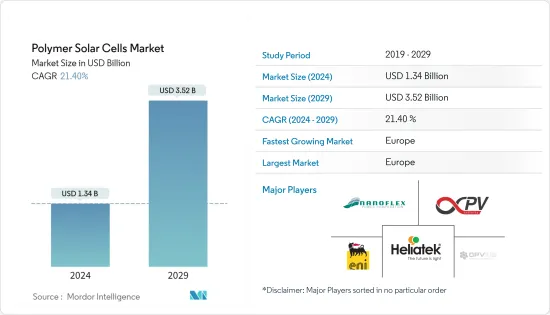

聚合物太阳能电池市场规模预计到2024年为13.4亿美元,预计到2029年将达到35.2亿美元,在预测期内(2024-2029年)增长21.40%,复合年增长率增长。

主要亮点

- 从长远来看,旨在提高转换效率的聚合物太阳能电池技术的进步预计将在预测期内推动市场发展。

- 相反,与硅太阳能电池相比,聚合物太阳能电池的效率较低,预计将阻碍预测期内的市场成长。

- 儘管如此,在预测期内,有关开发具有更高转换效率的新型聚合物的研究和开发预计将成为市场的重大成长机会。

聚合物太阳能电池市场趋势

市场驱动的技术进步

- 聚合物太阳能电池,也称为有机光伏电池(OPV),是使用有机聚合物层将光转化为电能的第三代光伏电池。聚合物太阳能电池重量轻、弹性、可客製化,且对环境的负面影响较小。

- 2022年,全球太阳能光电技术总装置容量约为1046.61吉瓦,较2017年的390.87吉瓦成长近167.7%。随着近年来光伏技术的快速进步,聚合物太阳能电池在2022年的效率将达到18.42%。实验室情况。为了进一步提高效率,具有不同分子结构的各种组织正在深入研究,并预计在不久的将来渗透到太阳能市场。

- 儘管聚合物太阳能电池比硅太阳能电池具有重量轻、成本低、透明、寿命长(超过5000小时)等多项优势,但其低能量转换使得高效的商业应用非常有限。

- Solarmer Energy Inc.表示,由于技术进步,目前聚合物太阳能电池的效率预计将随着时间的推移而提高,技术进步提供了高效的聚合物分子结构,使聚合物太阳能电池能够取代硅基太阳能电池,预计这将提高市场竞争力。和其他替代太阳能电池技术将在预测期内推动市场。

欧洲可能主导市场

- 欧洲是太阳能发电技术最大的市场之一,截至2022年太阳能发电装置容量约225.47GW,高于2017年的109.98GW。随着技术的进步,该地区正在进行各种研究计划,以使太阳能电池板更便宜、更灵活。可以附着在多个表面上。

- Heliatek GmbH 和 OPVIUS GmbH 等公司正在开发聚合物太阳能电池,并已在该地区展示了多个计划。

- 最大的聚合物或有机太阳能电池计划发生在法国。这称为 BiOPV(有机光伏建筑一体化)。该计划包括在屋顶安装约500平方公尺的有机太阳能发电装置,发电量约23.8兆瓦时。

- 截至 2023 年,该地区还有其他几个研发计划正在进行中。 2023 年 10 月,法国和西班牙的调查团队利用高通量射出成型技术开发了一种嵌入塑胶组件中的有机光伏模组。研究人员将热塑性聚氨酯注入模组中,发现它提高了机械稳定性,同时保持了高弹性。研究人员首先使用称为 P3HT:O-IDTBR 的光活性混合物透过卷轴式印刷创建了该模组。选择这种混合物是考虑到型态与后续射出成型过程相关的形态和热稳定性。预计在预测期内完成各个领域和应用的研发将扩大该地区的市场。

聚合物太阳能电池产业概况

聚合物太阳能电池市场将整合。市场主要企业包括(排名不分先后)Eni SpA、NanoFlex Power Corporation、Infinity PV、OPVIUS GmbH、Heliatek GmbH 等。

埃尼研究开发的技术扩大了整合太阳能发电的范围。钙钛矿电池与有机太阳能电池一起可以用半透明薄膜製造,从而降低材料成本和生产技术,使传统太阳能电池以前不可能实现的应用成为可能,例如嵌入建筑物建筑幕墙。除此之外,最近国际和欧盟在建筑能源效率领域的指令促进了这项应用。因此,预计会有广泛的应用。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 调查范围

- 市场定义

- 调查先决条件

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2028年之前的市场规模与需求预测

- 最新趋势和发展

- 政府政策法规

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争公司之间的敌意强度

第五章市场区隔

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 英国

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 北美洲

第六章 竞争形势

- 併购、合资、合作与协议

- 主要企业采取的策略

- 公司简介

- Solarmer Energy Inc.

- NanoFlex Power Corporation

- Infinity PV

- OPVIUS GmbH

- Heliatek GmbH

- Eni SpA

第七章市场机会与未来趋势

The Polymer Solar Cells Market size is estimated at USD 1.34 billion in 2024, and is expected to reach USD 3.52 billion by 2029, growing at a CAGR of 21.40% during the forecast period (2024-2029).

Key Highlights

- Over the long term, technological advancements in polymer solar cell technology aimed at increasing conversion efficiency are expected to drive the market during the forecast period.

- On the flip side, the lower efficiency of polymer solar cells as compared to silicon solar cells is expected to hinder market growth during the forecasting period.

- Nevertheless, research and development into the development of new polymers with higher conversion efficiencies is expected to be a significant growth opportunity for the market beyond the forecast period.

Polymer Solar Cells Market Trends

Technological Advancements to Drive the Market

- Polymer solar cells, also called organic photovoltaic (OPV), are third-generation PV cells that use an organic polymer layer to convert light into electricity. Polymer solar cells are lightweight, flexible, customizable, and have a less adverse environmental impact.

- In 2022, global solar PV technology had a total installed capacity of around 1046.61 GW, growing by nearly 167.7% from 390.87 GW in 2017. With rapid improvements in PV technology in recent years, polymer solar cells achieved an efficiency of 18.42% in 2022 under lab conditions. In order to further increase efficiency, various organizations with different molecular structures are performing intensive research and are expected to penetrate the solar PV market in the near future.

- Polymer solar cells have a few advantages over silicon solar cells, like being lighter in weight, cheaper in cost, transparent, and having a longer lifetime (greater than 5000 hrs), but due to their low energy conversion, efficient commercial applications are very limited.

- As per Solarmer Energy Inc., the present efficiency of polymer solar cells is estimated to improve over time due to technological improvement, which is expected to provide efficient polymer molecular structure and make polymer solar cells more competitive in the market with silicon-based solar cells and other alternative solar cell technologies, driving the market during the forecast period.

Europe is Likely to Dominate the Market

- Europe was one of the largest markets for solar PV technology, with around 225.47 GW of solar PV installations as of 2022, up from 109.98 GW in 2017. With technological advancements, the region is doing various research projects to achieve cheaper and more flexible solar panels that can be installed on multiple surfaces.

- Companies like Heliatek GmbH and OPVIUS GmbH are developing polymer solar cells and have demonstrated a few projects in the region.

- The largest polymer or organic solar cell project was in France. It is called the BiOPV (Building Integrated Organic Photovoltaic). The project includes the installation of organic photovoltaics on the roof of around 500 square meters that generate nearly 23.8 MWh of electricity.

- As of 2023, a few other R&D projects were going on in the region. In October 2023, a French-Spanish research team developed organic photovoltaic modules embedded into plastic parts through high throughput injection molding. The researchers injected thermoplastic polyurethane into the modules and found it enhanced their mechanical stability while keeping a high flexibility. The researchers first created modules in roll-to-roll printing using a photoactive blend known as P3HT: O-IDTBR. This blend was chosen due to its morphological and thermal stability, which are relevant to the later injection molding process. The completion of R&D in various sectors and applications is expected to expand the market in the region during the forecast period.

Polymer Solar Cells Industry Overview

The polymer solar cells market is consolidated. Some of the key players in the market (in no particular order) include Eni SpA, NanoFlex Power Corporation, Infinity PV, OPVIUS GmbH, and Heliatek GmbH, among others.

Eni's research developed a technology that widens the horizons of integrated photovoltaics. Together with organic photovoltaic cells, perovskite cells can be made in semi-transparent thin film with reduced material costs and production techniques, enabling applications that have hitherto been impossible for conventional solar cells, such as embedding on building facades. Among other things, this application is promoted by recent international and EU directives in the area of energy efficiency for buildings. It is, therefore, destined to have an extensive range of uses.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecasts in USD million, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Geography

- 5.1.1 North America

- 5.1.1.1 United States

- 5.1.1.2 Canada

- 5.1.1.3 Mexico

- 5.1.2 Europe

- 5.1.2.1 Germany

- 5.1.2.2 France

- 5.1.2.3 United Kingdom

- 5.1.2.4 Rest of Europe

- 5.1.3 Asia-Pacific

- 5.1.3.1 China

- 5.1.3.2 India

- 5.1.3.3 Japan

- 5.1.3.4 South Korea

- 5.1.3.5 Rest of Asia-Pacific

- 5.1.4 South America

- 5.1.4.1 Brazil

- 5.1.4.2 Argentina

- 5.1.4.3 Rest of South America

- 5.1.5 Middle-East and Africa

- 5.1.5.1 Saudi Arabia

- 5.1.5.2 United Arab Emirates

- 5.1.5.3 South Africa

- 5.1.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Solarmer Energy Inc.

- 6.3.2 NanoFlex Power Corporation

- 6.3.3 Infinity PV

- 6.3.4 OPVIUS GmbH

- 6.3.5 Heliatek GmbH

- 6.3.6 Eni SpA