|

市场调查报告书

商品编码

1644427

智慧家庭安全:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Smart Home Safety - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

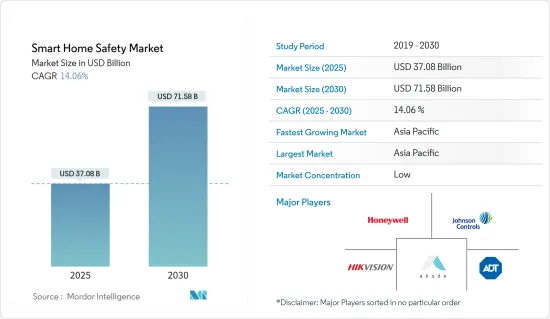

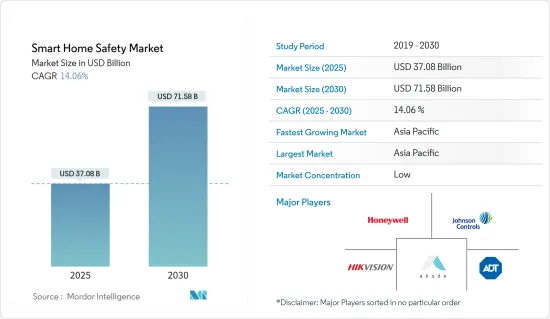

智慧家庭安全市场规模在 2025 年预计为 370.8 亿美元,预计到 2030 年将达到 715.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 14.06%。

近年来,随着越来越多的人希望让自己的家居更加安全,智慧家庭安全设备变得越来越受欢迎。这些设备采用先进技术提供一系列安全功能,包括家庭安全摄影机、烟雾侦测器和可使用智慧型手机或其他行动装置远端控制的智慧锁。智慧家庭安全设备的主要优点之一是能够在世界任何地方监控您的家,有助于预防事故和紧急情况的发生。

关键亮点

- 智慧家庭安全设备连接到 Wi-Fi,可以使用任何智慧型装置(包括智慧型手机、智慧型手錶和语音)从任何地方存取。由于全球犯罪率的上升,智慧家庭安全市场被迫关注安全系统,特别是住宅的安全系统。

- 根据《富比士》杂誌报道,美国平均每年发生超过一百万起抢劫案,财产犯罪是美国最常见的犯罪。

- 此外,大多数窃贼和入室盗窃者都会选择阻力最小的路径来实施犯罪。例如,锁上门窗对于大多数犯罪者来说只能起到很小的阻碍力。因此,家庭安全系统,尤其是结合了外部摄影机、运动侦测和适当照明的系统,被认为是最好的犯罪阻碍力。根据 2022 年美国新闻家庭安全调查,近 2,000 名美国认为自我保护是他们安装家庭安全摄影机最常见的原因,其次是为了阻止犯罪。

- 根据《家庭安全》白皮书,家庭安全选择是最终的价值提案。据《选择就是终极价值主张》称,Ring Alarm、Simplisafe 和 AVODE 等 DIY 安装的安全系统以及康卡斯特和 ADT 等国家品牌提供的 DIY 产品正在扩大消费者对该类别的喜爱度。此外,越来越多的消费者正在寻找经济实惠、易于安装的解决方案来保护他们的家园。

- 随着包括安全设备在内的智慧家庭设备的普及,资料外洩也大幅增加。这导致勒索软体和网路钓鱼被用来窃取个人识别资讯。因此,预计客户在采用智慧家庭安全解决方案时将继续优先考虑隐私,这是限制调查市场成长的主要因素。

- 智慧家庭安全市场受到了COVID-19的严重影响,一些住宅为了避免接触COVID-19的风险,甚至让接线或维修技术人员进入家中,但购买自行安装的安全系统的趋势有所增加。因此,住宅客户希望在家中感到更安全,这为智慧家庭安全市场创造了巨大的商机。

智慧家庭安全市场趋势

提高对家庭安全系统的认识

- 消费者对采用和使用连网型设备的日益增长的趋势正在推动所调查市场的需求。例如,根据Jaze Networks的数据,到2030年,全球每人拥有的网路设备数量预计将达到15台。

- 此外,美国国家家庭安全委员会的统计数据显示,47%的美国千禧世代拥有智慧型设备,而70%的已经拥有一种智慧产品的人会选择另一种智慧产品。

- 由于连网型设备为家庭提供了显着的好处和便利,这些趋势将为研究市场的成长创造有利的生态系统。连网型设备带来的新特性、连线性和功能使得实现智慧家庭安全的任务变得更容易、更简单。

- 此外,根据大陆自动化建筑协会(CABA)的数据,预计2023年美国智慧家庭设备安装数量将达到26.918亿台。 Hippo Insurance 最近的一项调查发现,消费者添加智慧家庭设备的最大驱动力是便利性(46%),其中火灾和防盗警报系统被列为最重要的保护设备(37%),其次是 36% 的 35-54 岁男性和女性认为摄影机最能保护他们的家,14% 的 25-34 岁女性选择自动设备作为最具保护性的设备作为最具保护性的 25-34 岁女性。此外,根据 Hippo Insurance 的数据,2022 年最受欢迎的家庭安全产品将是火灾和防盗警报器(34%),其次是摄影机(31%)和可视门铃(16%)。

亚太地区占较大市场占有率

- 在采用最新技术创新方面,中国处于领先地位。人工智慧技术的日益普及正在推动该国智慧家庭市场的需求。中国国务院最近制定了详细的策略,到 2030 年打造价值 1500 亿美元的国家人工智慧产业,成为人工智慧强国。

- 政策利好、物联网的推出为国内智慧家居市场奠定了坚实的基础。 GSMA预计,2025年,中国物联网连线数将达到41亿左右,占全球物联网连线数的近三分之一。此外,智慧城市计划、国家新型都市化规划和中国製造2025战略等倡议预计将刺激中国智慧家居安全市场的发展。

- 随着越来越多的人工智慧保全摄影机被安装到家庭中,各大公司正在争夺市场份额,为住宅提供更完善的安全功能,例如及时发出入侵者警报和亲人回家时的通知。

- 新产品的推出是供应商扩大市场占有率的关键商业策略之一。例如,2022年7月,萤石推出了Wi-Fi云台摄影机EZVIZ TY1,扩大了其在印度的智慧家庭安全解决方案产品线。这款 4MP 摄影机可提供出色的室内家庭安全。借助 360 度视野、智慧追踪功能和 H.265 视讯技术,用户可以随时以 2K 解析度监控他们的场所。

智慧家庭安全产业概况

智慧家庭安全市场高度细分,进入门槛低。更多的策略伙伴关係和创新正在推动产业发展,加速市场在技术和能力方面的变革。主要参与企业包括 ADT Inc.、霍尼韦尔国际公司、杭州海康威视数位技术有限公司和 Abode Systems Inc.

2023 年 5 月,WiZ 宣布推出新的专有家庭监控技术,该技术利用运动侦测和光的力量来帮助用户确保家庭安全。该公司的新型智慧家庭监控室内摄影机是其首批家居监控产品之一,旨在补充其智慧家庭安全解决方案组合。

2023 年 4 月,ADT Inc. 宣布与 Google Nest 智慧家庭产品合作推出全新 ADT Self Setup 智慧家庭安全系统。它是最先进、最完整的 DIY 系统之一,包括视讯验证,可帮助警察更快做出反应并更快地获得帮助。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- COVID-19 对智慧家庭安全市场的影响

第五章 市场动态

- 市场驱动因素

- 提高对家庭安全系统的认识

- 市场限制

- 初始成本高且有网路安全问题

第六章 市场细分

- 依设备类型

- 智慧警报

- 智慧锁

- 智慧感测器和探测器

- 智慧相机和监控系统

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 法国

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 其他亚太地区

- 其他的

- 北美洲

第七章 竞争格局

- 公司简介

- ADT Inc.

- Honeywell International Inc.

- Johnson Controls International PLC

- Hangzhou Hikvision Digital Technology Co. Ltd.

- Abode Systems Inc.

- Frontpoint Security Solutions LLC

- Vivint Smart Home Inc

- Simplisafe Inc.

- CPI Security Systems Inc.

- Ring Inc.(Amazon.com Inc.)

第八章投资分析

第九章 市场机会与未来趋势

The Smart Home Safety Market size is estimated at USD 37.08 billion in 2025, and is expected to reach USD 71.58 billion by 2030, at a CAGR of 14.06% during the forecast period (2025-2030).

Smart home safety devices have been gaining popularity in recent years as more and more people seek to make their homes safer and more secure. These devices use advanced technology to provide a range of safety features, such as home security cameras, smoke detectors, and smart locks, that can be controlled remotely using a smartphone or other mobile device. One of the main advantages of smart home safety devices is that they allow homeowners to monitor their homes from anywhere in the world and also help to prevent accidents and emergencies from occurring in the first place.

Key Highlights

- Smart home safety devices can be connected to Wi-Fi and accessed from anywhere using smart devices, such as smartphones, smartwatches, or voices. The smart home safety market is driven by the increasing crime rates worldwide, forcing people to focus on security and safety systems, especially in residential areas.

- According to the Forbes Magazine, on average, over one million home burglaries happen annually in the U.S. and property crimes are the most common type of crime in the U.S. Notably, americans spend over USD 20 billion annually on security devices and systems to protect themselves and their property.

- Furthermore, a majority of burglars or home invaders significantly choose the path of least resistance to commit their crime. For instance, locked doors and windows are only a slight deterrent for most criminals. Thus, home security systems, especially ones that incorporate exterior cameras, motion detection and adequate lighting, are considered the best criminal deterrents. As per the US News home security survey done in 2022, about 2,000 U.S.having home security cameras pension the leading reason to do self-protection followed by another answer which was to deter criminals.

- According to The whitepaper, Home Security: Choice is the Ultimate Value Proposition, DIY-installed security systems, like Ring Alarm, SimpliSafe and Abode, and DIY offerings from national brands such as Comcast and ADT, have expanded consumer familiarity with the category. Moreover, a growing number of consumers are seeking affordable, easy-to-install solutions to protect their homes.

- With the growing adoption of smart home devices, including safety devices, data leaks have also been observed to have increased significantly. This has been led by using ransomware and phishing to expose personally identifiable information. Therefore, customers are expected to continue to prioritize privacy for smart home safety solution adoption, which is a key restraining factor to the studied market's growth.

- The smart home security market has observed a significant impact of COVID-19 as some householders were reluctant to risk exposure to COVID-19, avoiding connection and even repair technicians entering their homes, but heightening the inclination to acquire self-install security systems. Thus, housing customers wanted to increase their sense of security while at home, due to which the smart home security market became a huge opportunity.

Smart Home Safety Market Trends

Growing Awareness Regarding Home Security Systems

- The growing consumer propensity toward adopting and using connected devices is augmenting the demand in the market studied. For instance, as per Jaze Networks, the global internet-connected devices per person is expected to reach 15 by 2030.

- Furthermore, the statistics from the National Council for Home Safety and Security suggest that 47% of millennials in the United States own smart devices, while 70% of those who already have one smart product portray a likeliness to opt for other smart devices.

- Such trends create an ecosystem more favorable to the growth of the studied market, as connected devices offer a significant benefit and convenience at home. The new features, connectivity capabilities, and functionalities they bring make the implementation task of smart home safety devices easier and simpler.

- Moreover, according to the Continental Automated Buildings Association (CABA), the installed bases of smart home devices in the United States are expected to reach 2691.8 million in 2023. According to a recent survey by Hippo Insurance, convenience is the most significant factor for consumers to add smart home devices (46%), with fire-theft alarm systems ranking as the top protective device( 37%) followed by 36% of men and women ages 35 to 54 having a thought that cameras provide the most protection for their homes, while 14% of women ages 25 to 34 opting automatic locks as the most protective smart home device. Additionally, according to Hippo Insurance, in 2022, fire and theft alarm was among the most demanded (34%) home security product, followed by Camera (31%), and Video doorbells (16%), among others.

Asia-Pacific Accounts for Significant Market Share

- China is at the forefront when it comes to the adoption of the latest technological innovation. The increasing adoption of AI technology leads to a rise in demand for the smart home market in the country. The State Council of China recently detailed its strategy to become the leading AI superpower by 2030 by building a USD 150 billion national AI industry.

- The favorable policies and the onset of IoT laid a solid foundation for the smart home market in the country. GSMA estimates that China may account for approximately 4.1 billion IoT connections, almost one-third of the global IoT connections, by 2025. Furthermore, initiatives such as Smart Cities Projects, National New-type Urbanization Plan, and the Made in China 2025 strategy are expected to fuel China's smart home safety market.

- Companies are fighting for a stake in this market as more AI-powered security cameras are installed in homes, providing homeowners with improved security features, including timely intruder alerts or notifications when their loved ones arrive home.

- New product launches are among vendors' major business strategies to expand their market presence. For instance, in July 2022, EZVIZ expanded its product line of smart home safety solutions in India with the EZVIZ TY1, Wi-Fi Pan & Tilt Camera. This 4MP camera provides a superior indoor home security experience. With a 360-degree field of vision, smart tracking function, and H.265 Video Technology, these products allow users to monitor their premises in 2k resolution at all times.

Smart Home Safety Industry Overview

The Smart Home Security Market is highly fragmented due to low entry barriers. Further strategic partnerships and innovations are the driving force for the industry, and the market is evolving faster in terms of technology and features. Key players are ADT Inc., Honeywell International Inc., Hangzhou Hikvision Digital Technology Co. Ltd., and Abode Systems Inc., among others.

In May 2023, WiZ announced the launch of a new unique home monitoring technology that uses motion detection and the power of light to help a user keep his home safe. The company's new smart home monitoring indoor camera is among the first home monitoring products to complement its portfolio of smart home safety solutions.

In April 2023, ADT Inc, in collaboration with Google Nest smart home products, announced the availability of the new ADT Self Setup smart home security system, which is one of its most advanced and complete DIY systems, including Video Verification and helps police to respond faster, to get help sooner.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Smart Home Safety Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Awareness Regarding Home Security Systems

- 5.2 Market Restraints

- 5.2.1 High Initial Costs and Cybersecurity Concerns

6 MARKET SEGMENTATION

- 6.1 By Device Type

- 6.1.1 Smart Alarms

- 6.1.2 Smart Locks

- 6.1.3 Smart Sensors and Detectors

- 6.1.4 Smart Camera and Monitoring Systems

- 6.1.5 Other Device Types

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 Unites States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 France

- 6.2.2.3 Spain

- 6.2.2.4 Rest of Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 Rest of Asia-Pacific

- 6.2.4 Rest of the World

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ADT Inc.

- 7.1.2 Honeywell International Inc.

- 7.1.3 Johnson Controls International PLC

- 7.1.4 Hangzhou Hikvision Digital Technology Co. Ltd.

- 7.1.5 Abode Systems Inc.

- 7.1.6 Frontpoint Security Solutions LLC

- 7.1.7 Vivint Smart Home Inc

- 7.1.8 Simplisafe Inc.

- 7.1.9 CPI Security Systems Inc.

- 7.1.10 Ring Inc. (Amazon.com Inc.)