|

市场调查报告书

商品编码

1435974

智慧窗户:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Global Smart Window - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

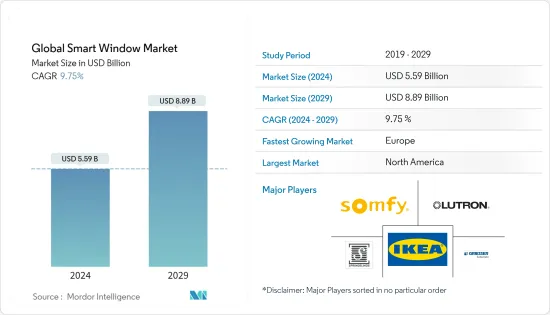

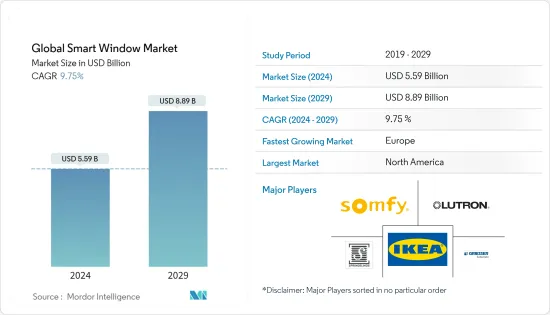

预计2024年全球智慧窗户市场规模为55.9亿美元,预计到2029年将达到88.9亿美元,在预测期内(2024-2029年)成长9.75%,复合年增长率为

许多先进的自动化系统和智慧型设备正在迅速安装在家庭中。供应商正在透过提供连结和自动化解决方案来改进这些众多的帘子和窗帘产品,使窗帘变得聪明。由于语音助理在智慧家庭技术中的普及,预计语音启动的智慧帘子将在未来几年内越来越受欢迎,而带有语音助理的智慧扬声器预计将成为智慧家庭技术的重要组成部分。成为控制中心。

主要亮点

- 虽然大多数传统的家居解决方案在设计和创新方面都经历了各种变化,但用于通风和采光等各种目的的窗户的使用预计将保持不变,从而导致对窗帘的需求增加。增加。 、窗帘、帘子。未来几年,北美和欧洲等地区的家庭平均自付费用预计将增加。

- 据美国围护结构和窗户金属建筑行业协会称,这些地区智慧家居的日益普及预计将增加对智慧窗帘和连网型产品的需求。 2019 年,义大利的这项需求创造了 30 亿欧元的收入。用于住宅建筑的门窗、帷幕墙等。住宅和非住宅建筑的门窗和帷幕墙销售额预计在未来两年内将成长,到 2021 年将分别达到 32 亿欧元和 19 亿欧元。

- 亚太地区是窗帘的主要消费国和生产国。随着经济成长和核心家庭的兴起,对住宅解决方案的需求预计将会增加。随着这些发展,预计该地区提供电动动网窗帘的当地供应商数量将激增。消费者对网路购物的兴趣日益增长,预计将提高消费者的产品意识,这促使供应商专注于在线上平台上提供解决方案。

- 与传统窗帘相比,全电动窗帘装置相对昂贵,这给市场成长带来了挑战。然而,许多新供应商正在提供可以将传统窗帘转变为智慧解决方案的小型设备。最近,推出了SwitchBor窗帘,它可以安装在现有的窗帘导轨上,并利用电动智慧地改变窗帘。

- 2021 年 5 月,印度理工学院古瓦哈蒂分校的研究人员开发了一种材料,可以帮助设计建筑物中的智慧气候控制系统,从而节省能源并减少碳排放。 IIT Guwahati 创造了智慧窗户材料,可以根据施加的电压有效管理穿过窗户的热量和光量。研究人员表示,此类材料可用于开发有效的建筑物自动空调系统。

智慧窗户市场趋势

电动捲帘在不久的将来将获得很大的市场占有率

- 马达捲帘在升高和降低时可提供平稳的旋转运动,营造出友好、高科技的氛围,而不会分散注意力或需要突然的注意。因此,电动捲帘非常适合办公室窗户、客厅和厨房区域。根据美国人口普查局的数据,2022 年 3 月美国住宅建设许可证数量较上月增加约 8,000 套。

- 2022 年 3 月,线上窗帘零售商 SelectBlinds.com 宣布推出两款采用新 Eve MotionBlinds 和 Apple HomeKit 技术的新型电动Architect 捲帘子产品。 Eve MotionBlinds马达是市面上首款支援 Thread 智慧家庭技术及其蓝牙功能的连动百叶窗和帘子马达。

- 2021 年 11 月,全球窗帘公司 Rollease Acmeda 宣布,其自动电动捲帘室内产品因设计和工程创新而获得中东欧整合家居竞赛的特别奖励。

- 加拿大帘子和百叶窗线上零售商 Zebrablins.ca 正在进入市场,提供更多产品选择,包括比其他竞争对手更便宜的自订电动帘子。该公司的帘子本身以及将帘子与自动技术整合的可能性都受到了消费者的巨大欢迎。由于 COVID-19感染疾病,许多人都请假在家更新资讯。

- 这家总部位于安大略省米西索加的公司根据窗户类型按照自订规格定制帘子。考虑到窗户有各种尺寸和形状,Zebrablins.ca 可以自订恰到好处的帘子,同时提供各种颜色的材料,以匹配几乎任何装饰。

预计欧洲将主导市场占有率

- 智慧家庭产品在英国家庭中的高普及以及先进窗帘产品的日益采用是推动英国智慧窗户市场的一些关键因素。智慧窗户可实现诸如不断更新住宅的「开启/关闭」状态等功能。这引起了英国市场的巨大兴趣。这不仅是因为新技术为住宅管理财产提供了优势,还因为他们还可以关注大型家庭住宅的安全。

- 联合国预测,到2050年,超过十分之七的人将居住在城市。这将鼓励拥有大型多用户住宅、高层建筑和大型公共建筑的特大城市的发展。数位化将在所有这些建筑中发挥关键作用。据欧洲电讯网路营运商协会称,到 2025 年,智慧建筑中将有大约 1.54 亿个活跃的物联网连接。此类数位化政策将推动所研究的市场。

- 最近的冠状病毒感染疾病(COVID-19) 爆发影响了全球製造业,导致英国可以更便宜地进口商品,并且中期内对英国製造的窗帘的需求增加,可能会导致增长。预计这也将鼓励智慧窗户产品的本地製造。

- 近年来,当地製造商对百叶窗和帘子产品进行了创新,并越来越关注全自动产品。智慧窗户解决方案的采用在该国也呈上升趋势,帘子、百叶窗和窗帘创造了互联的家居室内体验,显着提高了舒适度和便利性。

- 此外,德国、义大利、俄罗斯、荷兰、瑞士、丹麦和瑞典等国家近年来智慧窗户的采用显着增加。对多功能产品的需求不断增长、产品创新率高以及语音助理等功能是推动其他欧洲国家智慧窗户成长的其他关键因素。

智慧窗户产业概况

儘管市场分散,有许多大大小小的供应商,但该产品在不同市场区域仍处于实施的早期阶段,并且可能有多家公司提供该产品。已经在该领域开展业务的供应商正在寻求扩大其影响力并推出新的解决方案以及策略併购活动。

- 2022 年 8 月:Josh.ai 与全球室内窗帘和室外遮阳系统管状马达製造商尚飞 (Somfy) 整合,进一步扩大人工智慧在家庭中的功能和覆盖范围。此次合作不仅将两家知名公司聚集在一个自订设计、建构社群的客製化整合管道中,而且还为多家帘子和筛检製造商提供了提案的语音控制平台。

- 2022 年 7 月:智慧家庭业务 Aqara 的改装窗帘解决方案现已在美国和欧洲上市。 Aqara 窗帘调节器 E1 的售价为 89.99 美元,可连接到您现有的窗帘导轨或窗帘桿,以自动打开和关闭窗帘。此前,该产品仅在中国销售。相容于Aqara生态系统,以及Apple的HomeKit、Amazon的Alexa、Google Home和IFTTT。 Aqara 声称,当新的智慧家庭标准在今年秋天晚些时候发布时,它也将与 Matter 相容。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 竞争公司之间的敌意强度

- 替代品的威胁

第五章市场动态

- 市场驱动因素

- 由于人们对智慧家庭的日益关注,对自动百叶窗和帘子的需求强劲

- 市场限制因素

- 缺乏应用和初始成本标准

第六章市场区隔

- 产品类别

- 电动捲帘

- 电动斑马帘子

- 电动窗帘系统

- 其他产品类型(包括可连接的控制器)

- 地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 其他亚太地区

- 世界其他地区

- 北美洲

第七章 竞争形势

- 公司简介

- Inter IKEA Systems BV

- Springblinds

- Lutron Electronics Co. Inc.

- Somfy Systems Inc.

- Griesser AG

- Hunter Douglas

- The Shade Store LLC

第八章投资分析

第九章市场展望

The Global Smart Window Market size is estimated at USD 5.59 billion in 2024, and is expected to reach USD 8.89 billion by 2029, growing at a CAGR of 9.75% during the forecast period (2024-2029).

Many advanced automation systems and smart devices are rapidly being installed in homes. Vendors are improving their offers with these numerous shades and window coverings by giving linked and automated solutions to make window coverings smart. Due to the increasing penetration of voice assistants in smart home technologies, voice-activated smart shades are projected to gain popularity in the coming years, and smart speakers with voice assistants are expected to be the control hubs for a large part of smart home technologies.

Key Highlights

- Even though a significant share of conventional solutions in households see various changes in terms of design and innovation, the use of windows for various purposes, such as ventilation and light, is expected to remain the same and, in turn, drive the demand for curtains, drapes, and shades. The average household window covering spending is expected to increase in regions, such as North America and Europe, over the coming years.

- The growing smart home penetration in these regions is expected to augment the demand for smart window coverings and connected products, according to the National Union of the Metal Construction Industries of the Envelope and Windows.EUR 3 billion was created in Italy in 2019 from the demand for windows, doors, and curtain walls for residential structures. It was predicted that sales of windows, doors and curtain walls for residential and non-residential buildings would increase during the next two years, reaching EUR 3.2 billion and EUR 1.9 billion, respectively, in 2021.

- Asia-Pacific is one of the major consumers and producers of window coverings. With the growing economies and number of nuclear families, the demand for housing solutions is expected to increase. Due to such developments, the region is expected to see a surge in the number of local vendors offering motorized and connected window coverings. The growing consumer propensity toward online shopping is expected to increase the awareness of products among consumers, thus pushing vendors to focus on offering their solutions on online platforms.

- The complete motorized window covering units are comparatively costlier than the conventional coverings, which challenges the market's growth. However, various new vendors are offering smaller devices capable of turning conventional curtains into smart solutions. Recently, SwitchBor Curtain was released, which fits into the existing curtain rods and turns the curtains into smart ones with its motorized movements.

- In May 2021, Researchers at IIT Guwahati developed materials to aid in the design of smart climate control systems in buildings that save energy and reduce carbon emissions. IIT Guwahati created a smart window material that can effectively manage the quantity of heat and light that passes through the windows in response to a voltage applied. According to the researchers, such materials can aid in the development of effective automatic climate control systems in buildings.

Smart Window Market Trends

Motorized Roller Shades to Hold Significant Market Share in Near Future

- Motorized roller shades give a smooth rolling motion when one raises or lowers them, creating a friendly, high-technology vibe that does not distract or demand sudden attention. This makes motorized roller shades perfect for office windows, living rooms, and kitchen areas. According to U.S. Census Bureau, building permits for new residential construction in the U.S. increased by roughly 8,000 units in March 2022 in comparison to the previous month.

- In March 2022, SelectBlinds.com, an online window decor retailer, announced the release of two new Motorized Architect Roller Shades products, which are driven by new Eve MotionBlinds and Apple HomeKit technology. The Eve MotionBlinds motors are the first linked blinds and shades motors on the market to support Thread smart home technology and their Bluetooth capabilities.

- In November 2021, Rollease Acmeda, a worldwide window coverings company, announced that it's Automated Motorized Roller Shade interior product had won the CEE Integrated Home Competition Special Recognition for Innovation in Design and Engineering Award.

- Canadian online retailer of shades and blinds Zebrablinds.ca is making inroads into the market with an expanded assortment of products, including its custom-made motorized roller window shades that are less costly than the other competitors. The company witnessed a huge hit with consumers, both for the shades themselves and the potential to integrate the shades with automatic technology. This comes when many update their homes while off work, owing to the COVID-19 pandemic.

- Based in Mississauga, Ontario, the company custom makes the shades to the ordered specifications depending on the window type. Given that windows come in different sizes and shapes, Zebrablinds.ca can custom-make shades that would fit while offering a wide range of materials in colors that would go with almost any decor.

Europe Expected to Dominate Market Share

- High penetration of smart home products among UK households and growing adoption of advanced window covering products are some of the major factors driving the smart windows market in the United Kingdom. Smart Windows are enabling features such as constantly updating homeowners regarding their windows' 'open or close' status. This has developed a tremendous interest in the UK market, not just because of the benefits the new technology offers to the homeowner in caring for their property but also of the fact that they can watch over the security of their extended families' homes too.

- According to the United Nations projections, by the year 2050, more than seven out of ten people will live in cities. This will push the development of megacities with large apartment blocks, high-rise buildings, and massive public buildings. Digitalization will play a crucial role in all of these buildings. According to the European Telecommunications Network Operators' Association, by 2025, there will be around 154 million active IoT connections in smart buildings. Such Digitalization policies will drive the studied market.

- The recent COVID-19 outbreak has affected global manufacturing, hence the availability of cheaper imports into the United Kingdom, which could lead to increased demand for UK-produced window coverings products in the medium-term. This is also expected to boost the local manufacturing of smart window products.

- In recent years, local manufacturers have been innovating blinds & shades products with their increasing focus on fully automated products. The adoption of smart window solutions is also rising in the country as it brings home interior experiences with connected shades, blinds, and curtains, significantly enhancing comfort and convenience.

- Furthermore, countries like Germany, Italy, Russia, Netherlands, Switzerland, Denmark, and Sweden, among others, have witnessed a significant rise in the adoption of smart windows in recent years. The growing demand for multifunctionality products, high rate of product innovation, and features like voice assistants are some of the major factors driving the growth of smart windows in the rest of Europe.

Smart Window Industry Overview

Though the market is fragmented and is home to numerous small and large vendors, the product, in its initial stages of adoption in various regions of the market, is open to several players offering their products. The vendors that are already operating in this space are looking to expand their presence and launch new solutions, along with strategic M&A activities.

- August 2022: Josh.ai has integrated with Somfy, the producer of tubular motors for indoor window coverings and outside shading systems in the world, to further increase the capabilities and scope of artificial intelligence in the home. The collaboration not only unites two well-known firms in the design-build community-focused custom integration channel, but it also offers several shades and screening fabricators a suggested voice control platform.

- July 2022: The retrofit curtain solution from smart home business Aqara is now available in the US and Europe. The Aqara Curtain Driver E1 costs USD 89.99 and fits into an existing curtain track or rod to automatically open and close curtains. It was previously only available in China. It is compatible with the Aqara ecosystem as well as HomeKit from Apple, Alexa from Amazon, Google Home, and IFTTT. Aqara claims that when the new smart home standard launches later this fall, it will also be compatible with Matter.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Prominence of Smart Homes Drives Strong Demand for Automated Blinds and Shades

- 5.2 Market Restraints

- 5.2.1 Lack of Standards in Applications and Initial Costs

6 MARKET SEGMENTATION

- 6.1 Product Type

- 6.1.1 Motorized Roller Shades

- 6.1.2 Motorized Zebra Shades

- 6.1.3 Motorized Drapery Systems

- 6.1.4 Other Product Types (Includes Connectable Controllers)

- 6.2 Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 France

- 6.2.2.3 Rest of Europe

- 6.2.3 Asia Pacific

- 6.2.3.1 China

- 6.2.3.2 Rest of Asia Pacific

- 6.2.4 Rest of the World

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Inter IKEA Systems BV

- 7.1.2 Springblinds

- 7.1.3 Lutron Electronics Co. Inc.

- 7.1.4 Somfy Systems Inc.

- 7.1.5 Griesser AG

- 7.1.6 Hunter Douglas

- 7.1.7 The Shade Store LLC