|

市场调查报告书

商品编码

1435979

版本控制系统 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Version Control System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

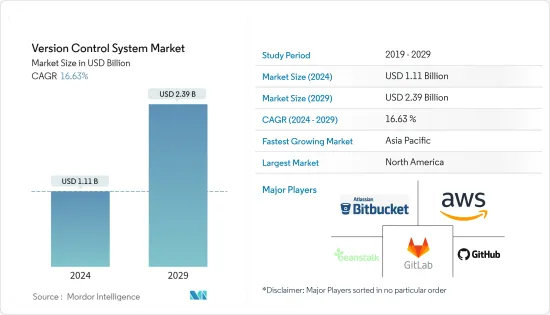

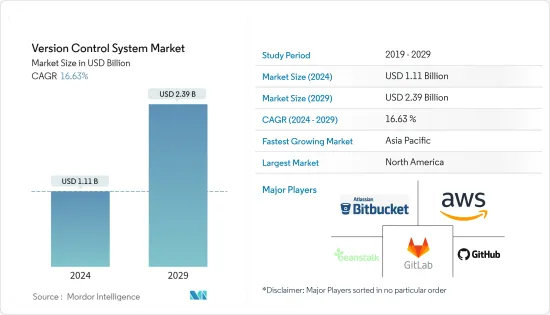

版本控制系统市场规模预计到 2024 年为 11.1 亿美元,预计到 2029 年将达到 23.9 亿美元,在预测期内(2024-2029 年)CAGR为 16.63%。

版本控制软体在该软体团队每天的专业实践中发挥着至关重要的作用。每个在其团队中经常使用功能强大的版本控制系统的软体开发人员通常都了解版本控制的不可思议的价值,即使它用于小型单独专案。

主要亮点

- 随着开发环境的增加,版本控制系统 (VCS) 使软体团队能够更快速、更聪明地运作。它们适合 DevOps 团队,因为它们使他们能够加快成功部署并减少开发时间。程式码的每次变更都由版本控制软体以特定形式的资料库记录。如果发生错误,程式设计师可以及时返回并查看先前的程式码迭代,以帮助修復错误,同时将对整个团队造成的干扰降至最低。

- 几乎所有软体专案的原始码都必须受到保护。对于大多数软体团队来说,原始程式码充当开发人员积累和磨练的有关问题领域的宝贵资讯和理解的储存。原始码受到版本控制的保护,以防止灾难、人为错误的无意影响和偶然降级。

- 此外,由于组织中 IT 基础架构的复杂性不断增加,公司正在寻找解决方案来降低开发和部署软体应用程式的复杂性。这增加了对 VCS 工具的需求,这些工具可以帮助软体开发人员无缝、准确地开发软体应用程式。

- 持续整合 (CI) 是 DevOps 的基础。实施 CI 的一个方面是为开发人员提供即时回馈以提高品质。但它可能会导致 VCS 伺服器运作缓慢。如果客户的版本控制系统不快速且有效,它将无法跟上持续整合的关键方面。为了提高 VCS 软体的效率,公司需要投入大量资金来购买更高阶的系统,这对于市场成长和工具的更快采用来说是一个挑战。

- COVID-19 对市场成长产生了正面影响。在疫情期间,云端运算模式的选择对于任何企业的长期可持续性和盈利能力都至关重要。提供的云端服务模型正在不断扩展,以满足日益集中和客製化的业务模型。企业也正在转向更个人化的虚拟机器服务,更适合他们的需求。预计此类倡议将在未来几年增加版本控制系统的使用。

版本控制系统 (VCS) 市场趋势

BFSI 产业预计将占据重要份额

- 由于行动应用程式和其他软体应用程式在行业中的快速采用,预计 BFSI 行业将在版本控制系统工具的采用中占据很大份额。因此,产业对软体的日益依赖预计将增加产业对 VCS 工具的需求。

- 数位化帮助银行公司透过银行平台提供多项服务,有助于公司大幅降低营运复杂性和成本,并进一步推动创新。它还帮助公司在数位化业务流程和实施关键企业功能的同时进行渐进式转型。

- 云端运算消除了对昂贵的内部 IT 基础架构的需求,改变了企业管理和存取资料和应用程式的方式,从而改善其营运。云端运算在 BFSI(银行、金融服务和保险)产业中显而易见。透过云端服务和虚拟机器软体,BFSI 公司可以使用地理上分散且始终可用的庞大伺服器网路。由于不寻常的设置,该软体可以在所有机器上同时启动,以方便存取。银行或其他金融机构可以利用遍布全国的站点的这项功能为客户提供先进的服务。

- 高盛、摩根大通、德意志银行等银行公司越来越多地与解决方案提供者合作,在其银行业务中采用 VCS 解决方案。它帮助银行业降低营运成本,同时为客户提供客製化解决方案。

- 此外,BFSI 公司可以使用中央合约储存库最大限度地发挥其合约储存程序的优势。合约安全地储存在基于云端的储存库中,BFSI 公司可以使用该储存库来组织合约、管理权限、使用文件版本控制、寻找预先存在的合约、监控合约状态、进行通讯等。

北美预计将主导市场

- 该地区由美国和加拿大等技术先进国家组成。美国是全球软体开发中心。它拥有全球数量最多的全球软体服务供应商,这为该国市场创造了机会。根据美国劳工统计局 (BLS) 的项目,从 2020 年到 2030 年,软体开发的就业机会将增加 22%,这大大快于全国所有职业 8% 的平均成长率。软体产业的这种成长率将推动版本控制系统的成长,因为该服务有助于自动化软体开发过程,以实现更好的功能和更快的开发。

- 根据 CompTIA 的数据,美国有超过 557,000 家软体和 IT 服务供应商,包括软体开发商、专业电脑程式服务供应商、建置电脑系统的组织以及属于科技业的设施管理公司。该行业僱用了大约 160 万名软体和网路开发人员,他们都是受过高等教育、技术精湛的美国人。

- 美国许多领先的软体开发公司透过协助客户创建和启动网站、行动应用程式和其他自动化企业流程的选项来展示他们的经验和技术才能。

- 该地区在采用技术创新、与技术创新共同发展以及各行业企业营运数位化方面一直保持着重要地位。此外,区域企业正在投入大量研发资金,为该产业开发新产品,有助于市场成长。

- 此外,许多全球软体开发公司正在与该地区的版本控制系统供应商合作,这正在推动北美市场的发展。例如,2022 年 11 月,美国行销衡量、分析和参与公司 AppsFlyer 使用 Firefly 和 GitLab 的组合管理了超过 250,000 个云端资源和数十个 SaaS 连接器。 Firefly 让我们能够更好地了解其完整的云端足迹,它可以看到资产是如何製作的、谁更改了它以及它目前的状况。该公司使用 GitLab 来自动化管理任何变更的策略,并为其基础设施程式码添加版本控制。

版本控制系统 (VCS) 产业概述

由于该技术正处于发展阶段,因此版本控制系统市场的竞争格局是半巩固的,这为多家解决方案提供者在市场上的出现铺平了道路。此外,市场参与者正在形成策略合作,以提高其市场占有率。

2022 年 10 月,提供资料库 DevOps 解决方案的 Redgate Software 宣布即将对其产品组合进行多项升级,例如 Flyway,这将有助于企业和组织标准化和简化跨资料库开发。凭藉对资料库物件进行版本控制和创建迁移的能力,Redgate 流行的开源迁移工具 Flyway 的企业版将允许用户完全控制资料库更新的部署。

2023 年 1 月 - 为了加速突破性的独立人工智慧研究,微软和 OpenAI 宣布,微软将在开发和部署专用超级运算系统方面加大投资,从而扩大合作伙伴关係。

2022 年 7 月,随着 CircleCI 和 GitLab 的集成,DevOps 工具的数量增加。 CircleCI 增加了对 GitLab SaaS 订阅者的支持,从而实现 GitLab 储存库与 CircleCI 平台的整合。透过这种合作,CircleCI 可以从 GitLab 储存库收集程式码更新,并在应用程式上线前经过测试时执行相关的建置。

2022 年 6 月 - GitHub Enterprise Server 3.5 是该公司用于在私人伺服器上託管和管理储存库的软体的最新版本,包含许多自动化功能、对 GitHub 容器註册表的存取以及程式码安全保护。此版本中的 GitHub Advanced Security 使用者可以存取组织和企业层级的安全概述。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 市场概况

- 市场驱动因素

- 业务流程数位化导致软体的采用

- 降低软体开发和成本优化复杂性的需求不断增加

- 市场限制

- 组织中多样化软体应用程式的使用

- 海量资料产生导致复杂度不断增加

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争激烈程度

- COVID-19 对市场的影响评估

第 5 章:市场细分

- 部署方式

- 本地部署

- 云端

- 最终用户产业

- 资讯科技和电信

- 零售与电子商务

- 医疗保健和生命科学

- BFSI

- 其他最终用户产业(媒体与娱乐、旅游、教育机构)

- 类型

- 分散式版本控制系统

- 集中式VCS

- 地理

- 北美洲

- 欧洲

- 亚太

- 拉丁美洲

- 中东和非洲

第 6 章:竞争格局

- 公司简介

- Github, Inc.

- Gitlab, Inc.

- Bitbucket.org (Atlassian Corporation Plc)

- Beanstalk (Wildbit, LLC)

- Amazon Web Services, Inc.

- CollabNet, Inc.

- Microsoft Corporation

- Perforce Software, Inc.

- APAChe Software Foundation

- Dynamsoft Corporation

第 7 章:投资分析

第 8 章:市场机会与未来趋势

The Version Control System Market size is estimated at USD 1.11 billion in 2024, and is expected to reach USD 2.39 billion by 2029, growing at a CAGR of 16.63% during the forecast period (2024-2029).

Version control software plays a crucial role in the professional practices of this Software Team each and every day. Every software developer who regularly works with a capable version control system in his or her team usually understands the incredible value of Version Control even when it is used for small solo projects.

Key Highlights

- Version control systems (VCS) enable software teams to operate more swiftly and intelligently as development environments have increased. They are accommodating for DevOps teams because they enable them to speed up successful deployments and reduce development time. Every change to the code is recorded by version control software in a particular form of a database. If a mistake is made, programmers can go back in time and review prior iterations of the code to help fix it while causing the least amount of interruption to the entire team.

- The source code for practically all software projects must be secured. For most software teams, the source code serves as a store for the invaluable information and comprehension the developers have amassed and honed about the issue domain. Source code is shielded by version control against disaster, the unintentional effects of human error, and casual degradation.

- Moreover, due to the increasing complexity of IT infrastructure in organizations, companies are looking for solutions to reduce complexities in developing and deploying software applications. This increases the demand for VCS tools, which assist software developers in seamlessly and accurately developing software applications.

- Continuous Integration (CI) is the foundation of DevOps. An aspect of implementing CI is providing developers with real-time feedback to improve quality. But it might cause the VCS server to run slowly. If the customers' version control system isn't quick and effective, it won't be able to keep up with this crucial aspect of continuous integration. To increase the efficiency of the VCS software, companies need to invest much to go for higher-end systems, which is a challenge for the market growth and faster adoption of the tools.

- COVID-19 positively affected the market growth. Amidst the pandemic, the choice of cloud computing models is vital to any business's long-term sustainability and profitability. The cloud service models on offer are expanding to meet increasingly focused and bespoke business models. Businesses are also moving towards more personalized virtual machine services better suited to their needs. Such initiatives are expected to increase the usage of version control systems in the coming years.

Version Control Systems (VCS) Market Trends

BFSI Industry Expected to Hold Significant Share

- The BFSI industry is expected to depict a significant share of adoption of version control system tools, owing to the rapid adoption of mobile applications and other software applications in the industry. Hence, the increasing dependency on software in the industry is expected to proliferate the demand for VCS tools in the industry.

- Digitization helps banking companies provide several services through a banking platform, which helps the companies significantly reduce the complexity and cost of operations and further drive innovation. It also helps companies undergo a progressive transformation while digitizing business processes and implementing key enterprise capabilities.

- Cloud computing has transformed how businesses manage and access data and apps to improve their operations by removing the need for expensive in-house IT infrastructures. Cloud computing is readily apparent in the BFSI (Banking, Financial Services, and Insurance) industry. Through cloud services and virtual machine software, BFSI firms can use a vast network of servers that is geographically dispersed and always available. Because of the unusual setup, the software can be launched simultaneously on all machines for convenient access. Banks or other financial institutions can use this capability with sites across the country to provide customers with advanced services.

- Banking companies like Goldman Sachs, J.P. Morgan Chase, Deutsche Bank, and many more are increasingly collaborating with solution providers to adopt VCS solutions in their banking operations. It helps the banking industry lower operational costs while providing customized solutions to its customers.

- Further, BFSI firms can maximize the benefits of their contract storage procedure using a central contract repository. Contracts are safely stored in a cloud-based repository that BFSI firms may use to organize contracts, manage permissions, use document version control, find pre-existing contracts, monitor contract status, communicate, and more.

North America Expected to Dominate the Market

- The region consists of technologically advanced countries such as the USA and Canada. The USA is a global hub for software development. It has the maximum number of global software-based service providers across the globe, which is creating an opportunity for the market in the country. According to the US Bureau of Labor Statistics (BLS) projects, software development will have 22% more employment possibilities from 2020 to 2030, which is substantially faster than the 8% national average growth rate for all professions. This growth rate in the software industry will drive the growth of version control systems because the service helps to automate the software development process for better functioning and faster development.

- According to CompTIA, there are more than 557,000 software and IT service providers in the USA, including Software developers, providers of specialized computer programming services, organizations that build computer systems, and facility management firms that are all part of the technology sector. The sector employs approximately 1.6 million software and web developers, who are all highly educated and skilled Americans.

- Many of the leading software development firms in the United States demonstrate their experience and technical talents by assisting their clients in creating and launching websites, mobile applications, and other options for automating corporate processes.

- The region has continuously held a significant position in adopting technology innovations, developing with them, and digitizing corporate operations in various industries. Additionally, regional businesses are spending significant capital on R&D to develop new products for the sector, which helps the market growth.

- Further, many global software development companies are partnering with the version control system providers in the region, which is driving the market in North America. For instance, In November 2022, AppsFlyer, an American marketing measurement, analytics, and engagement company, managed over 250,000 cloud resources and dozens of SaaS connectors using a combination of Firefly and GitLab. Firefly gives us better visibility into its complete cloud footprint, and it can see how an asset was made, who changed it, and how it currently stands. The company used GitLab to automate policies governing any changes and add version control to its infrastructure code.

Version Control Systems (VCS) Industry Overview

The competitive landscape of the Version Control System Market is Semi-consolidated as the technology is in its development stage, which is paving the way for several solution providers to emerge in the market. Also, the market players are forming strategic collaborations to boost their market presence.

In October 2022, Redgate Software, a company that provides database DevOps solutions, announced many upcoming upgrades to its portfolio, such as Flyway, that would help businesses and organizations standardize and streamline cross-database development. With the ability to version-control database objects and create migrations, Redgate's corporate version of the popular open-source migrations tool Flyway would allow users complete control over the deployment of database updates.

In Januray 2023 - In order to speed up breakthrough independent AI research, Microsoft and OpenAI announced that the partnership will be extended with greater investments made by Microsoft in developing and deploying specialised supercomputing systems.

In July 2022, The number of DevOps tools increased with the integration of CircleCI and GitLab. CircleCI added support for GitLab SaaS subscribers enabling the integration of GitLab repositories with the CircleCI platform. Due to this collaboration, CircleCI could collect code updates from GitLab repositories and run the associated builds as applications have been tested before going live.

June 2022 - GitHub Enterprise Server 3.5, the most recent version of the company's software for hosting and managing repositories on private servers, has included many automation features, access to the GitHub Container Registry, and code security protections. GitHub Advanced Security users in this version could get access to a security overview at the organizational and enterprise levels.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Digitization of Business Processes Leading to Adoption of Software

- 4.2.2 Increasing Demand for Reduced Complexities in Software Development and Cost Optimization

- 4.3 Market Restraints

- 4.3.1 Use of Diversified Software Applications in Organizations

- 4.3.2 Growing Complexity Due to Massive Data Generation

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Assessment of Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 Deployment Mode

- 5.1.1 On-Premise

- 5.1.2 On-Cloud

- 5.2 End-user Industry

- 5.2.1 IT and Telecom

- 5.2.2 Retail & E-commerce

- 5.2.3 Healthcare and Life Sciences

- 5.2.4 BFSI

- 5.2.5 Other End-user Industries (Media and Entertainment, Travel and Tourism, Educational Institutions)

- 5.3 Type

- 5.3.1 Distributed VCS

- 5.3.2 Centralized VCS

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 Latin America

- 5.4.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles*

- 6.1.1 Github, Inc.

- 6.1.2 Gitlab, Inc.

- 6.1.3 Bitbucket.org (Atlassian Corporation Plc)

- 6.1.4 Beanstalk (Wildbit, LLC)

- 6.1.5 Amazon Web Services, Inc.

- 6.1.6 CollabNet, Inc.

- 6.1.7 Microsoft Corporation

- 6.1.8 Perforce Software, Inc.

- 6.1.9 APAChe Software Foundation

- 6.1.10 Dynamsoft Corporation