|

市场调查报告书

商品编码

1851392

葡萄酒包装:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Wine Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

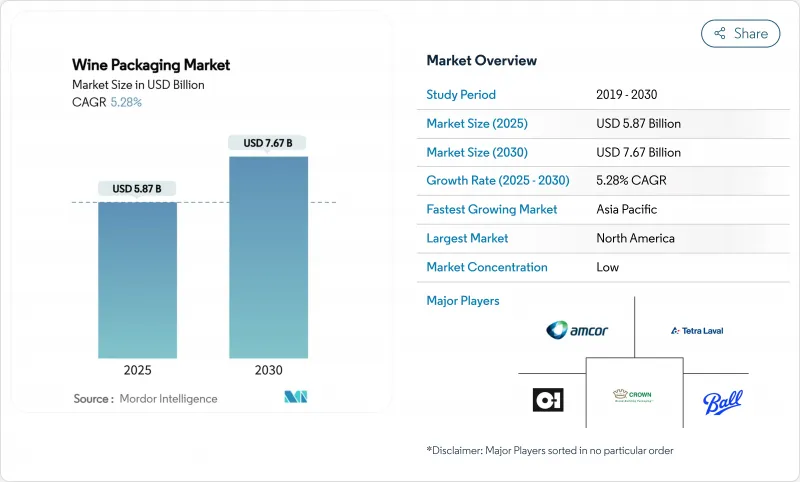

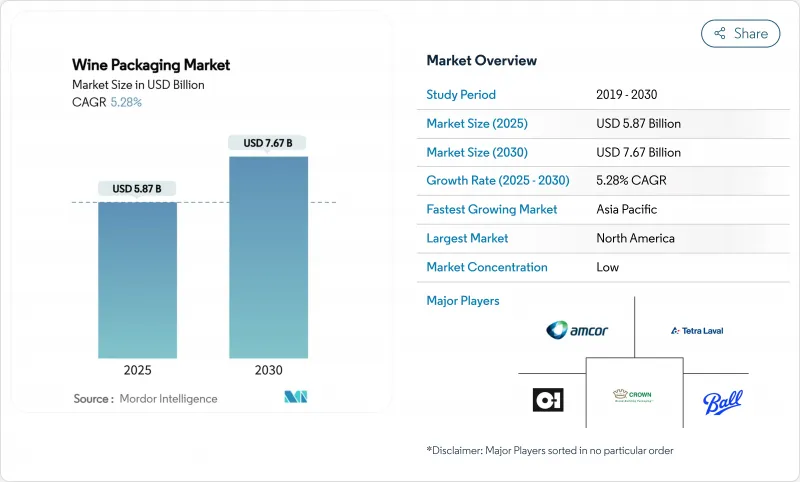

预计到 2025 年,葡萄酒包装市场规模将达到 58.7 亿美元,到 2030 年将达到 76.7 亿美元,在此期间的复合年增长率为 5.28%。

玻璃瓶的强劲需求、对轻量化设计的日益增长的兴趣,以及罐装和盒中袋等替代包装形式的快速普及,共同推动着这一趋势。中国的优质化、欧洲轻质玻璃的推广以及北美直销模式(DtC)的加速发展,正在重塑葡萄酒包装市场的生产规模和物流经济格局。从欧盟到2030年实现100%回收的强制要求,到加州提高回收价值,监管压力持续推动供应商转向循环材料和节能熔炉,即便玻璃价格依然波动。金属包装的可回收性吸引了年轻的行动消费者,而随着葡萄园对其永续性实践进行认证,生物基瓶盖也越来越受欢迎。

全球葡萄酒包装市场趋势与洞察

中国葡萄酒优质化推动了对高檔酒瓶的需求。

中国年轻的都市区消费者重视便利性和价格优势,同时也追求精緻的设计和优良的品质。华东酒庄的桶装葡萄酒和弗朗西亚酒庄的盒装葡萄酒等创新产品,既满足了人们休閒聚会的需求,又没有降低品牌股权,从而提升了葡萄酒包装市场的高端定位。

欧洲葡萄酒厂采用轻质玻璃瓶来减少二氧化碳排放

勃根地的碳中和蓝图显示,瓶子重量是排放的重要因素,而 Verallia 的 300 克波尔多空气葡萄酒证明,更轻的瓶子可以在保持传统的同时减少高达 40% 的二氧化碳排放,从而鼓励葡萄酒包装市场更广泛地采用这种做法。

欧盟塑胶包装税提高了PET解决方案的成本

PFAS 禁令和再生材料含量强制要求增加了 PET 的合规成本,使其在高端葡萄酒包装市场竞争力下降。

细分市场分析

由于玻璃具有惰性和高端质感,预计到2024年,玻璃将占据葡萄酒包装市场68.22%的份额。轻型熔炉的升级改造和玻璃屑比例的提高,有助于玻璃保持其领先地位,同时减少排放。金属包装8.43%的复合年增长率反映了铝的可回收性和快速冷却的优势,这些优势吸引了热爱户外活动的消费者,并将塑造未来葡萄酒包装市场的偏好。随着监管机构推动100%可回收目标的实现,Frugalpac的纸瓶和PET混合材料正在拓展包装材料的选择范围。

塑胶和纸张技术的进步挑战着长期以来的等级制度。 Frugalpac 的纤维外壳比玻璃瓶减少 77% 的塑胶用量,碳足迹降低 84%。玻璃製造商正透过试验电炉和超轻量设计来应对挑战。铝瓶利用可重复密封的瓶盖来延长保鲜期,而生物基 PET 则整合了高达 30% 的再生 PET (rPET),但仍在等待再生材料供应的扩大。

到2024年,传统瓶装葡萄酒将占总销售量的55.76%,主要用于储存和礼仪场合。同时,罐装葡萄酒正以7.88%的复合年增长率成长,以满足消费者对单次饮用便利性和体育场馆相关规定的需求。盒中袋包装(Bag-in-box)产品线正逐步实现规模经济,占瑞典葡萄酒销售的56%,反映了高端葡萄酒的发展趋势。

宝特瓶凭藉着Alpla的隔离层,成功占据了一席之地,保质期延长了六个月;而软包装则在节日市场抢占了越来越多的份额。符合欧盟数位化要求的智慧标籤被应用于瓶罐包装,增强了葡萄酒包装市场的可追溯性,并强化了全通路策略。

区域分析

北美仍然是最大的销售市场。在加州,直接面向消费者的法律和扩大的回收范围整合了5美分和10美分的押金制度,推动葡萄酒包装市场转向更便于路边回收的设计。欧洲的政策要求在2030年实现100%可回收,这刺激了对电炉和袋中袋包装创新技术的投资,从而减少了运输排放。

亚太地区将在2030年前引领成长。中国的优质化将结合精美玻璃瓶和经济实惠的包装盒,而澳洲的补贴政策将有利于轻质宝特瓶瓶和纸瓶的使用,从而推动该地区葡萄酒包装市场的发展。便捷的生鲜电商将与环保行销结合,吸引年轻消费者。

中东/非洲和南美洲提供了新的发展机会。温暖的气候有利于采用轻盈且抗氧化阻隔性更佳的包装形式,而出口商则采用既能最大限度降低运输成本又能符合欧盟法规的包装。国内生产商探索使用再生PET和罐装生产线来拓展新的消费群体,显示葡萄酒包装领域的创新正在全球蔓延。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 中国葡萄酒优质化推动了对高檔酒瓶的需求。

- 欧洲葡萄酒厂采用轻质玻璃瓶来减少二氧化碳排放

- 北欧电商通路迅速采用盒中袋包装

- 美国直接面向消费者(DTC)管道的兴起将加速现场包装的发展。

- 大洋洲罐装和PET单份装葡萄酒的零售需求激增

- 葡萄园永续性认证推动生物基瓶塞的普及

- 市场限制

- 欧盟塑胶包装税提高了PET解决方案的成本

- 全球再生材料供不应求限制了rPET葡萄酒瓶的推广应用。

- 替代封口方式有较高的氧气传输风险,阻碍了优质葡萄酒的传播。

- 碱灰价格波动推高了玻璃瓶成本。

- 供应链分析

- 技术展望

- 监理展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 依材料类型

- 玻璃

- 塑胶

- 金属

- 纸

- 依产品类型

- 玻璃瓶

- 宝特瓶

- 衬袋纸盒

- 能

- 小袋

- 按封闭类型

- 天然软木

- 技术/合成软木

- 螺帽

- 皇冠帽

- 其他(T型止动器、Binolock)

- 按葡萄酒类型

- 无气泡葡萄酒

- 气泡酒

- 加烈葡萄酒葡萄酒和甜葡萄酒

- 低酒精/无酒精葡萄酒

- 按产能

- 少于 375 毫升

- 375-750 mL

- 750-1,500 mL

- 1500毫升或更多

- 透过分销管道

- 直销

- 间接销售

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲、纽西兰

- 亚太其他地区

- 中东和非洲

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 埃及

- 其他非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Owens-Illinois Inc.(OI)

- Verallia SA

- Ardagh Group SA

- Saverglass SAS

- Vetropack Holding AG

- BA Glass Group

- Consol Glass Pty Ltd

- Guala Closures Group

- Amorim Cork, SA

- Vinventions LLC(Nomacorc)

- Amcor plc

- Ball Corporation

- TricorBraun Inc.

- Tetra Laval International SA

- SIG Combibloc Group AG

- Scholle IPN(Sealed Air)

- Liqui-Box(Sealed Air)

- International Paper Company

- G3 Enterprises Inc.

- Maverick Enterprises Inc.

- Encore Glass Inc.

- Smurfit WestRock

- Crown Holdings, Inc.

第七章 市场机会与未来展望

The wine packaging market size reached USD 5.87 billion in 2025 and is forecast to climb to USD 7.67 billion by 2030, advancing at a 5.28% CAGR over the period.

Strong glass bottle demand, growing interest in lightweight designs and the rapid adoption of alternative formats such as cans and bag-in-box options are steering this trajectory. Premiumisation in China, lightweight glass roll-outs in Europe, and direct-to-consumer (DtC) acceleration in North America are reshaping production scale and logistics economics across the wine packaging market. Regulatory pressure-from the European Union's 100%-recyclable-by-2030 mandate to California's redemption-value expansion-continues to push suppliers toward circular materials and energy-efficient furnaces, even as glass price volatility persists. Metal packaging's recyclability appeals to younger, mobile consumers while bio-based closures gain traction as vineyards certify sustainability practices.

Global Wine Packaging Market Trends and Insights

Premiumisation of Wine in China Elevating Demand for Designer Bottles

Young urban consumers in China value convenience and affordability yet still associate sophisticated design with quality. Innovations such as Huadong Winery's keg wine and Franzia's boxed offerings support casual gatherings without diluting brand equity, lifting premium-styled alternatives within the wine packaging market.

Lightweight Glass Bottle Adoption by European Wineries to Cut CO2

Bourgogne's carbon-neutral roadmap exposed bottle weight as a critical emissions driver; Verallia's 300 g Bordeaux Air proves that a lighter bottle can retain tradition while trimming up to 40% of CO2, propelling broader adoption across the wine packaging market.

EU Plastic Packaging Taxes Increasing Cost of PET Solutions

Mandatory recycled-content quotas and PFAS bans inflate compliance costs, making PET less competitive for premium lines within the wine packaging market.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Uptake of Bag-in-Box Formats in the Nordics' E-grocery Channel

- Rise of DtC Channels in the US Accelerating On-premise Ready-to-Ship Packaging

- Global Recyclate Supply Shortages Limiting rPET Wine Bottle Roll-outs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Glass accounted for 68.22% of the wine packaging market in 2024 due to its inert nature and premium perception. Lightweight furnace upgrades and higher cullet ratios help maintain leadership while cutting emissions. Metal's 8.43% CAGR reflects aluminum's recyclability and chill-speed advantages, luring outdoor-oriented consumers and shaping future preference across the wine packaging market. Paper bottles from Frugalpac and PET hybrids broaden the material field as regulators push 100% recyclable targets.

Plastic and paper advances test longstanding hierarchies. Frugalpac's fibre shell uses 77% less plastic and holds an 84% lower carbon footprint than glass, making it an attractive alternative in the wine packaging industry. Glass manufacturers counter by piloting electric furnaces and ultra-light designs. Aluminum bottles leverage resealable tops to extend freshness, while bio-based PET integrates up to 30% rPET yet awaits greater recyclate supply.

Traditional bottles delivered 55.76% of 2024 revenue, an anchor for cellaring and ritual. Still, cans are growing at 7.88% CAGR, meeting single-serve convenience and stadium regulations within the wine packaging market. Bag-in-box lines achieve scale benefits and hold 56% of Swedish volume, illustrating premium-grade evolution.

PET bottles secure niche roles with six-month shelf life thanks to ALPLA's barrier layers, while pouches win festival share. Smart labels that satisfy EU digital mandates surface on bottles and cans alike, enriching traceability and reinforcing the wine packaging market's omnichannel strategy.

The Wine Packaging Market Report is Segmented by Material Type (Glass, Plastic, and More), Product Type (Glass Bottles, Plastic Bottles, and More), Closure Type (Natural Cork, and More), Wine Type (Still Wine, Sparkling Wine, and More), Capacity ( Less Than Equal To 375 ML, 375-750 ML, and More), Distribution Channel (Direct Sales, Indirect Sales), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America remain the largest revenue contributor. Robust DtC laws and recycling expansion in California integrate 5- and 10-cent deposits that steer the wine packaging market toward curbside-compatible designs. European policies dictate 100% recyclability by 2030, sparking investment in electric furnaces and bag-in-box innovation that lowers freight emissions.

Asia-Pacific leads growth through 2030. China's premiumisation mixes designer glass with cost-effective boxes, while Australian grants back lightweight PET and paper bottles, accelerating regional momentum for the wine packaging market. E-grocery convenience intertwines with environmental marketing to convert younger consumers.

Middle East and Africa and South America provide emerging pathways. Warmer climates lean toward lighter, oxidation-barrier formats, and exporters deploy packaging that meets EU rules while minimizing freight. Domestic producers explore rPET and canning lines to reach new drinkers, illustrating the global spread of the wine packaging industry's innovations.

- Owens-Illinois Inc. (O-I)

- Verallia SA

- Ardagh Group SA

- Saverglass SAS

- Vetropack Holding AG

- BA Glass Group

- Consol Glass Pty Ltd

- Guala Closures Group

- Amorim Cork, S.A.

- Vinventions LLC (Nomacorc)

- Amcor plc

- Ball Corporation

- TricorBraun Inc.

- Tetra Laval International SA

- SIG Combibloc Group AG

- Scholle IPN (Sealed Air)

- Liqui-Box (Sealed Air)

- International Paper Company

- G3 Enterprises Inc.

- Maverick Enterprises Inc.

- Encore Glass Inc.

- Smurfit WestRock

- Crown Holdings, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Premiumisation of Wine in China Elevating Demand for Designer Bottles

- 4.2.2 Light-weight Glass Bottle Adoption by European Wineries to Cut CO2

- 4.2.3 Rapid Uptake of Bag-in-Box Formats in the Nordics' E-grocery Channel

- 4.2.4 Rise of Direct-to-Consumer (DtC) Channels in the US Accelerating On-premise Ready-to-Ship Packaging

- 4.2.5 Surge in Canned and PET-Single-Serve Wines for Outdoor Consumption in Oceania

- 4.2.6 Vineyard Sustainability Certifications Driving Bio-based Closures Adoption

- 4.3 Market Restraints

- 4.3.1 EU Plastic Packaging Taxes Increasing Cost of PET Solutions

- 4.3.2 Global Recyclate Supply Shortages Limiting rPET Wine Bottle Roll-outs

- 4.3.3 Higher Oxygen Transmission Risk in Alternative Closures Capping Premium-Wine Penetration

- 4.3.4 Volatility in Soda-ash Pricing Inflating Glass Bottle Costs

- 4.4 Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Regulatory Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material Type

- 5.1.1 Glass

- 5.1.2 Plastic

- 5.1.3 Metal

- 5.1.4 Paper

- 5.2 By Product Type

- 5.2.1 Glass Bottles

- 5.2.2 Plastic Bottles

- 5.2.3 Bag-in-Box

- 5.2.4 Cans

- 5.2.5 Pouches

- 5.3 By Closure Type

- 5.3.1 Natural Cork

- 5.3.2 Technical/Synthetic Cork

- 5.3.3 Screw Caps

- 5.3.4 Crown Caps

- 5.3.5 Others (T-stoppers, Vino-Lok)

- 5.4 By Wine Type

- 5.4.1 Still Wine

- 5.4.2 Sparkling Wine

- 5.4.3 Fortified and Dessert Wine

- 5.4.4 Low and No-Alcohol Wine

- 5.5 By Capacity

- 5.5.1 Less than 375 mL

- 5.5.2 375-750 mL

- 5.5.3 750-1,500 mL

- 5.5.4 More than 1,500 mL

- 5.6 By Distribution Channel

- 5.6.1 Direct Sales

- 5.6.2 Indirect Sales

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 United Kingdom

- 5.7.2.3 France

- 5.7.2.4 Italy

- 5.7.2.5 Spain

- 5.7.2.6 Russia

- 5.7.2.7 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 India

- 5.7.3.3 Japan

- 5.7.3.4 South Korea

- 5.7.3.5 Australia and New Zealand

- 5.7.3.6 Rest of Asia-Pacific

- 5.7.4 Middle East and Africa

- 5.7.4.1 Middle East

- 5.7.4.1.1 United Arab Emirates

- 5.7.4.1.2 Saudi Arabia

- 5.7.4.1.3 Turkey

- 5.7.4.1.4 Rest of Middle East

- 5.7.4.2 Africa

- 5.7.4.2.1 South Africa

- 5.7.4.2.2 Nigeria

- 5.7.4.2.3 Egypt

- 5.7.4.2.4 Rest of Africa

- 5.7.5 South America

- 5.7.5.1 Brazil

- 5.7.5.2 Argentina

- 5.7.5.3 Rest of South America

- 5.7.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Owens-Illinois Inc. (O-I)

- 6.4.2 Verallia SA

- 6.4.3 Ardagh Group SA

- 6.4.4 Saverglass SAS

- 6.4.5 Vetropack Holding AG

- 6.4.6 BA Glass Group

- 6.4.7 Consol Glass Pty Ltd

- 6.4.8 Guala Closures Group

- 6.4.9 Amorim Cork, S.A.

- 6.4.10 Vinventions LLC (Nomacorc)

- 6.4.11 Amcor plc

- 6.4.12 Ball Corporation

- 6.4.13 TricorBraun Inc.

- 6.4.14 Tetra Laval International SA

- 6.4.15 SIG Combibloc Group AG

- 6.4.16 Scholle IPN (Sealed Air)

- 6.4.17 Liqui-Box (Sealed Air)

- 6.4.18 International Paper Company

- 6.4.19 G3 Enterprises Inc.

- 6.4.20 Maverick Enterprises Inc.

- 6.4.21 Encore Glass Inc.

- 6.4.22 Smurfit WestRock

- 6.4.23 Crown Holdings, Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space and Unmet-need Assessment