|

市场调查报告书

商品编码

1436014

汽车电热塞 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029 年)Automotive Glow Plugs - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

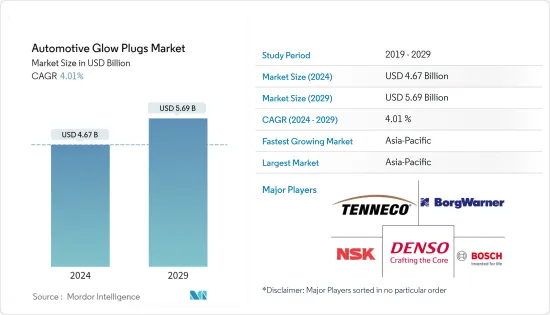

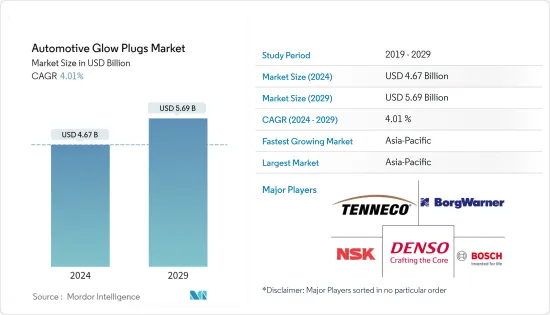

2024年汽车电热塞市场规模估计为46.7亿美元,预计到2029年将达到56.9亿美元,在预测期内(2024-2029年)CAGR为4.01%。

COVID-19 大流行对汽车电热塞市场的打击更快、更严重。它始于中国国内的供应危机,从而迅速演变成全球售后市场需求有史以来最大的跌幅,零件产业跌幅接近20%。售后市场业务的主要公司将目标从生产恢復计画转向保护员工、节省成本和保障流动性。

电热塞是柴油点火系统的一个组成部分。儘管 2019 年全球汽车产量略有下降,但由于售后市场管道在该公司的销售中保持活跃,预计对电热塞的需求将持续到预测期内。

根据欧盟统计局的数据,欧盟境内约 75% 的内陆货物运输(即约 17,500 亿吨公里 (t km))是透过公路进行的。在一些欧洲国家,这一比例高达 90% 或更高。因此,由于物流业的发展和轻型商用车(例如货车(用于小型货车))的使用不断增加,该地区对商用车以及随后来自OEM和售后市场渠道的电热塞的需求不断增加。乘车服务)。

东协国家等一些发展中经济体的柴油引擎汽车销售量很大。例如,在东协市场,最畅销的乘用车和皮卡车均采用柴油引擎。福特Ranger是2020年东协市场最畅销的乘用车之一。

汽车电热塞市场趋势

全球对商用车的高需求

全球商用车的需求量大,产能利用率和获利能力高,推动了车队更新和扩张活动的动能。全球强劲且持续的货运需求以及电子商务行业的成长正在推动营运商购买新的商用车辆。整体宏观经济环境良好,营运商的利用率和获利能力强劲,加速了机队更新和扩张。

过去几年以来,皮卡车的需求也有所增长,尤其是在北美和欧洲,因为买家对多用途实用性和更好的舒适性的偏好日益增强。近年来,汽车製造商见证了该领域的加速成长,开始推出性能和效率更高的新车型。例如,2020 年 6 月,福特推出了 2021 年 F-150 皮卡车,其中包括具有新功能的混合动力版本,例如分段首创的免持高速公路驾驶系统、12 吋萤幕和无线更新。据称,新款皮卡还具有更好的燃油效率和性能。

商用车市场在 2020 年出现下滑,这主要是由于 COVID-19 大流行以及相关的封锁导致大多数国家的车辆生产和销售活动停止。然而,商用车的需求可能会在 2021 财年之后恢復成长。在 COVID-19 爆发之前,全球商用车的销售量一直在成长。例如,2018年和2019年,全球商用车销量较去年同期分别成长8.01%和0.19%。

此外,对环境污染的日益关注正在鼓励管理机构采取措施限製商用车辆的排放。因此,这可能会推动对有助于高效燃料燃烧并提高车辆燃油效率的电热塞的需求。

亚太地区预计将引领市场

中国是全球最大的汽车市场。 2008年至2019年,中国汽车产量占全球汽车产量的比重翻了两倍,从13%增至2019年的28%。同时,中国汽车销量大幅增长,同期年增长率也不同,达到2009 年达到高峰45%。然而,自2018 年以来一直在萎缩。儘管如此,随着经济刺激缓解了COVID-19 大流行的打击,2020 年中国汽车市场仅萎缩了1.9%。

该国的主要公司正在投资提高产能。例如,2021年4月,一汽解放汽车在四川省广汉市动工兴建商用车生产基地。该工厂占地552,000平方米,预计将成为商用车生产基地,年产能为10万辆。第一期投资16亿元,规划年产能5万台。 J6系列车型预计将在该工厂初期运作期间生产。

汽车是印度经济的核心部门之一,在很大程度上是该国的主导产业之一。印度政府对 2020 年 4 月 1 日后销售的汽车实施 BS-VI 规范。电热塞製造商正在推出符合监管规范的最新产品,以保持领先于同行并赢得市场份额。例如,2020 年 2 月,NGK Spark Plugs India Private Limited 在该国推出了一系列新的 BS-6 Ready 和符合 BS-6 标准的柴油车电热塞。该公司是印度领先的两轮车和四轮车原始设备製造商的火星塞、电热塞和氧气感知器的领先供应商。在零售领域,NGK 印度在整个印度拥有强大的影响力,约有200 多家经销商向零售商和机械师销售NGK 高品质产品,以满足两轮车、三轮车和四轮车细分市场的需求。

汽车电热塞产业概述

汽车电热塞市场略有整合,市场上出现了全球主要参与者。电热塞市场由 DENSO Corporation、NGK Spark Plug、Robert Bosch GmbH、BorgWarner Inc. 和 Tenneco Inc. 等几家公司主导。这些公司一直在透过新型创新汽车零件拓展业务,从而获得优势超过他们的竞争对手。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 市场驱动因素

- 市场限制

- 产业吸引力-波特五力分析

- 买家/消费者的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争激烈程度

第 5 章:市场细分

- 依产品类型

- 金属预热塞

- 陶瓷电热塞

- 按车型分类

- 搭乘用车

- 商务车辆

- 按销售管道

- OEM

- 售后市场

- 按地理

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 亚太地区其他地区

- 世界其他地区

- 巴西

- 阿根廷

- 阿拉伯聯合大公国

- 其他国家

- 北美洲

第 6 章:竞争格局

- 供应商市占率

- 公司简介

- Denso Corporation

- NGK Spark Plug Co. Ltd

- Robert Bosch GmbH

- BorgWarner Inc.

- Autolite (Fram Group LLC)

- Tenneco Inc.

- ACDelco Corporation

- KLG Spark Plugs

- Wellman Glow Plugs Co. (WAP Inc.)

第 7 章:市场机会与未来趋势

The Automotive Glow Plugs Market size is estimated at USD 4.67 billion in 2024, and is expected to reach USD 5.69 billion by 2029, growing at a CAGR of 4.01% during the forecast period (2024-2029).

The COVID-19 pandemic has hit the automotive glow plug market more quickly and severely. It started as a domestic supply crisis in China, thereby, rapidly turning into the biggest ever drop in global aftermarket demand, approaching a 20% drop in the parts and components industry. Major companies in the aftermarket business shifted their aim from production recovery plans to protecting employees, cost savings, and safeguarding liquidity.

Glow plugs are an integral part of diesel ignition systems. Despite a slight decline in a global vehicle production number in 2019, the demand for glow plugs is anticipated to continue till the forecast period, as the aftermarket channel has been consistently active in the firm's sales.

According to Eurostat, about 75% of inland cargo transports within the European Union, which translates to about 1,750 billion metric ton-kilometers (t km), takes place by road. In some European countries, this percentage goes as high as 90%, or more. As a result, the demand for commercial vehicles, and subsequently, the glow plugs from OEM and aftermarket channels, has been continually increasing in the region, owing to the growing logistics industry and the increasing usage of light commercial vehicles, such as vans (for ride-hailing services).

Several developing economies, such as ASEAN countries, witness a significant number of diesel engine-powered vehicle sales. For instance, in the ASEAN market, top-selling passenger vehicles and pick-up trucks are powered by diesel engines. Ford Ranger was among the top-selling passenger vehicles in the ASEAN market in 2020.

Automotive Glow Plugs Market Trends

High Demand for Commercial Vehicles Across the World

Commercial vehicles are witnessing high demand, worldwide, with high-capacity utilization and profitability driving the momentum for fleet renewal and expansion activities. Strong and sustained freight demand, worldwide, and the growth of the e-commerce industry are propelling the operators to purchase new commercial vehicles. The overall macroeconomic environment has been favorable, with robust utilization and profitability across operators, boosting fleet renewals and expansions at an accelerated pace.

The demand for pickup trucks is also picked growth since the past few years, especially in North America and Europe, due to the growing preference for multi-purpose utility and better comforts among buyers. Witnessing an accelerated growth in the segment, automakers, in recent years, have started introducing new vehicle models with enhanced performance and efficiency. For instance, in June 2020, Ford unveiled the 2021 F-150 pickup truck, including a hybrid version with new features, like a segment-first hands-free highway driving system, 12-inch screens, and over-the-air updates. The new pickup truck is also claimed to have better fuel efficiency and performance.

The commercial vehicle market witnessed a decline in 2020, which was primarily attributed to the COVID-19 pandemic and associated lockdown that halted vehicle production and sales activities in the majority of the countries. However, the demand for commercial vehicles is likely to resume its growth post FY21. Before COVID-19 hit, the sales of commercial vehicles were growing across the world. For instance, in 2018 and 2019, global commercial vehicle sales increased by 8.01% and 0.19%, respectively, as compared to the previous year.

Furthermore, the rising concerns about environmental pollution are encouraging the governing bodies to take steps to curb emissions occurring from commercial vehicles. Thus, this is likely to drive the demand for glow plugs that helps in efficient fuel combustion and enhances vehicle fuel efficiency.

Asia Pacific is Expected to Lead the Market

China is of the largest markets for automotive vehicles, worldwide. From 2008 to 2019, the share of China in global vehicle production experienced a two-fold increase from 13% to 28% in 2019. Meanwhile, vehicle sales in China went up significantly, and the annual growth rate varied over the same period, reaching a peak of 45% in 2009. However, it has been experiencing a contraction since 2018. Nonetheless, the Chinese automobile market shrank by only 1.9% in 2020, with economic stimulus softening the blow of the COVID-19 pandemic.

Major companies in the country are investing in increasing their production capacities. For instance, in April 2021, FAW Jiefang Automotive Co. Ltd (FAW Jiefang) started constructing its commercial vehicle manufacturing site in the city of Guanghan in Sichuan Province. The 552,000 sq. m facility is likely to be a commercial vehicle manufacturing site, with an annual production capacity of 100,000 units. With an investment of CNY 1.6 billion, the first phase has a planned annual capacity of 50,000 units. The J6-series models are anticipated to be manufactured during the initial operation period of the site.

Automotive is one of the core sectors of the Indian economy and, to a great extent, serves as one of the leading industries in the country. The Government of India implemented BS-VI norms for automobiles to be sold after April 1, 2020. The glow plug manufacturers are launching the latest products to meet the regulatory norms to stay ahead of their peers and gain market share. For instance, in February 2020, NGK Spark Plugs India Private Limited launched a new range of BS-6 Ready and BS-6 compliant glow plugs for diesel vehicles in the country. The company is a leading supplier of spark plugs, glow plugs, and oxygen sensors to leading 2-wheeler and 4-wheeler OEMs in India. In the retail sector, NGK India has a strong pan-India presence, with approximately 200 plus distributors selling NGK high-quality products to retailers and mechanics catering to the 2-wheeler, 3-wheeler, and 4-wheeler segments.

Automotive Glow Plugs Industry Overview

The market for automotive glow plugs is slightly consolidated, with the presence of major global players in the market. The glow plugs market is dominated by several players, such as DENSO Corporation, NGK Spark Plug Co. Ltd, Robert Bosch GmbH, BorgWarner Inc., and Tenneco Inc. These companies have been expanding their business with new innovative auto parts so that they can have the edge over their competitors.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Buyers/Consumers

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Metal Glow Plug

- 5.1.2 Ceramic Glow Plug

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 By Sales Channel

- 5.3.1 OEM

- 5.3.2 Aftermarket

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 South Korea

- 5.4.3.4 India

- 5.4.3.5 Rest of Asia Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 United Arab Emirates

- 5.4.4.4 Other Countries

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Denso Corporation

- 6.2.2 NGK Spark Plug Co. Ltd

- 6.2.3 Robert Bosch GmbH

- 6.2.4 BorgWarner Inc.

- 6.2.5 Autolite (Fram Group LLC)

- 6.2.6 Tenneco Inc.

- 6.2.7 ACDelco Corporation

- 6.2.8 KLG Spark Plugs

- 6.2.9 Wellman Glow Plugs Co. (WAP Inc.)