|

市场调查报告书

商品编码

1436029

药品合约包装:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Pharmaceutical Contract Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

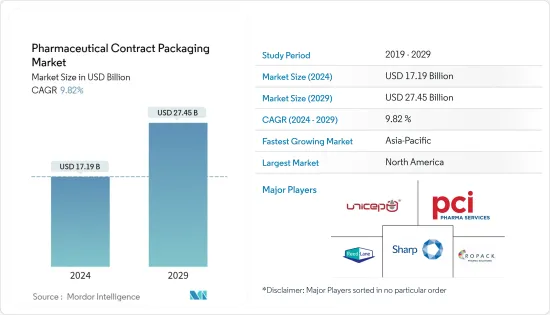

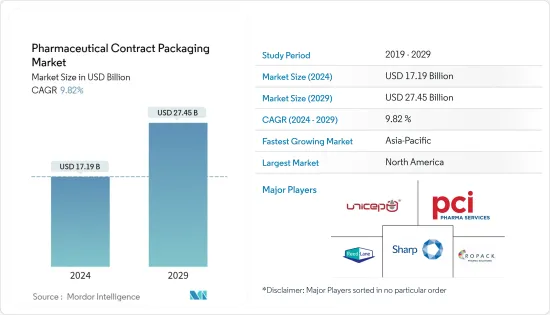

预计 2024 年药品合约包装市场规模为 171.9 亿美元,预计到 2029 年将达到 274.5 亿美元,预测期内(2024-2029 年)复合年增长率为 9.82%。

由于 COVID-19 影响了对管瓶、药品和其他医药产品的需求大幅增长,行业製造商正在争夺资源并推动加速製造和包装流程。疫情爆发的头几个月,市场上 CMO 和 CPO 的材料都严重短缺。这是由于亚太地区面临供应链挑战,该地区是药品和包装行业原材料的主要来源地,导致製造和包装速度放缓。

主要亮点

- 由于全球经济成长、人口成长和老化以及新产品的推出,全球製药业正在快速成长。根据 IQVIA 的数据,2020 年全球医药市场收益为 12,652 亿美元,并且正在稳步成长。随着许多製药供应商意识到将商业和临床包装外包给製药承包可以增加利润,该行业的合约包装正在不断增长。

- 过去几年,美国FDA核准的新药数量大幅增加。例如,根据食品药物管理局(药品评估与研究中心(CDER))的数据,2020年CDER核准的新药总数为53个,而上一年为48个。此外,学名药计划于同年核准或临时核准了 948 件学名药申请。 FDA核准的新药数量不断增加,对全球药品合约包装市场产生正面影响。

- 此外,预计未来几年註射剂将比口服等其他给药途径获得市场占有率。这可能会增加对合约包装中註射剂解决方案的需求,预计主要製药供应商将扩大其在这一领域的能力。

- 例如,2021年1月,诺华对给药公司Credence MedSystems进行策略性投资。这项投资预计将有助于加速 Credence 药物输送系统的开发和扩展,最初将重点放在 Credence Companion 安全注射器系统。

- 此外,大批量市场对外包装瓶服务的需求预计将保持稳定。对泡壳包装和装瓶服务的需求预计将由维持药物的需求和高效的新产品上市包装选项(重点是维持药物的 30-60-90 天简报)推动。

- 此外,欧盟法规要求所有製药公司在向欧盟供应产品时必须遵守欧盟良好生产规范(GMP)。製造商和进口商必须获得成员国主管机关的许可和註册。製造商和进口商定期接受欧盟主管机关或其他核准机构的检查,以确认符合欧盟 GMP。无论製造商位于何处,此过程均适用。当特定公司进口产品时,进口商有责任确保符合 GMP。欧盟药品管理法规总结了欧盟药品管理法规。

药品合约包装市场的趋势

瓶装药品包装可望推动市场成长

- 将药品初级包装到瓶子中需要灌装瓶子。瓶子灌装服务在调查市场中占据很大的市场占有率,因为一些製药公司依赖合约包装公司参与填充程序。

- 由于重量轻等各种优势, 宝特瓶填充预计将在预测期内显着增长,进一步节省空间、运输和货运成本。与玻璃瓶填充的药品不同,塑胶瓶不易破损,这有助于降低玻璃瓶的成本。

- 扩张活动引人注目,因为合约包装公司专注于增加装瓶生产线以提高生产能力,包括将药品填充到玻璃、金属和塑胶瓶中的固态剂型以及液体和液体悬浮液。

- 例如,提供药品合约包装服务的组织 Aphena Pharma Solutions 于 2021 年 1 月宣布,利用在固态剂量合约包装方面的 2,100 万美元投资,增加了 10 条高速装瓶线。该公司还计划在其新收购的 50 万平方英尺工厂中再安装 30 条高速生产线,将面向医药固体剂量包装行业的月产能提高到超过 8,000 万瓶。

- 此外,对注射药物的需求不断增长,极大地推动了製药业玻璃瓶的成长。肿瘤药物和其他强效药物(例如抗体偶联物、类固醇和需要快速起效的静脉注射药物)的强劲市场预计将成为关键的成长动力。

- 此外,糖尿病患者数量的增加是注射药物玻璃瓶成长的主要动力。根据世界卫生组织 (WHO) 统计,全球约有 4.22 亿人患有糖尿病。这种数量的变化将增加对青霉素的需求,这将有助于市场的成长。

北美占最大市场占有率

- 北美药品合约包装市场正在迅速增加采用不同的包装方法,以满足不断变化的消费者偏好的期望。日益严重的环境问题正在推动製药业对永续合约包的需求。

- 除此之外,自动化在药品合约包装中的渗透率不断提高,最大限度地减少了人为处理错误,从而推动了该地区的市场成长。除此之外,消费者可支配收入的增加和健康意识的增强正在增加该地区对药品合约包装的需求。

- 许多合约包装公司已投资扩大其设施和客户群,并透过收购和合作伙伴关係扩大其地理影响力。 2020年9月,益昇华包装宣布收购3C!总部位于北卡罗来纳州的包装公司主要为製药业设计和製造纸箱、文件、标籤和包装。此类收购使 Essentra Packaging 等公司能够巩固其在药品包装领域的地位,并为北美和美国药品製造地提供成长机会。

- 此外,生技药品的扩张预计将对区域市场产生重大影响。例如,2021 年 4 月,康泰伦特在印第安纳州布鲁明顿工厂完成了 1,400 万美元的扩建,以提高生技药品的包装和生产能力。

- 此外,北美还拥有一些最着名的药品供应商和包装解决方案供应商。作为主要成长趋势之一,该地区的 CPO 正在透过 3PL 服务扩展其服务范围。

- 例如,Legacy Pharmaceutical Packaging 于 2020 年 9 月扩大了服务范围,纳入了供应链透明度解决方案和涵盖成药的 3PL 服务。此外,该公司还将其密苏里州圣路易斯总部附近的开放空间设施从 215,000 平方英尺扩大到 500,000 平方英尺。

药品合约包装产业概述

由于供应商众多,全球药品合约包装市场的竞争形势似乎呈现零碎化。拥有大量市场份额的领先公司正在不同地区扩大客户群。此外,许多公司与多家公司进行策略合作,以提高市场占有率和盈利。市场的最新发展包括:

- 2021 年 5 月 - UDG Healthcare plc 旗下的合约包装和临床供应服务公司Sharp Corporation在宾夕法尼亚州康舍霍肯工厂购买了新土地,作为 1700 万美元投资的一部分。此次土地购买将使Sharp Corporation能够在未来增加 cGMP 包装服务产能,并且是其宾州业务 4,300 万美元投资的一部分,使该公司的泡壳包装产能增加 35% 以上。

- 2020 年 6 月-宣布 PCI Pharma 与契约製造组织和药品供应服务公司 Experic 签订合作伙伴协议,探索临床和商业製造、包装和供应链服务,推动双方共同成长。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 竞争公司之间的敌意强度

- 替代产品的威胁

- 产业价值链分析

- 评估 COVID-19 对产业的影响

第五章市场动态

- 市场驱动因素

- 持续努力系列化以支持市场成长

- 最近对产能扩张以及装瓶和灌装服务的投资

- 市场挑战

- 严格的监管要求

第六章市场区隔

- 按服务类型

- 一次

- 瓶子

- 管瓶

- 安瓿

- 泡壳包装

- 其他的

- 中学

- 第三

- 一次

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争形势

- 公司简介

- Ropack Inc.

- Sharp(UDG Healthcare)

- Reed-Lane Inc.

- PCI Pharma Services

- UNICEP Packaging LLC

- Jones Packaging Inc.

- Almac Group

- Assemblies Unlimited Inc.

- AmeriPac

- MJS Packaging

- AbbVie Contract Manufacturing

- Pharma Packaging Solutions

- Nelipak BV

- Aphena Pharma Solutions Inc.

- Southwest Packaging

- MPH Co-Packing

- Tjaopak

- SternMaid GmbH

- Variopack Lohnfertigungen GmbH

- CentralPharma

- Sepha Limited

- DelobrisPharmaceuticals Limited

- Wasdell Group

- DaklaPack Filling

- LABO Phytophar

- Tripak Pharmaceuticals

- Jam Jams

- AsiapackLimited(Elanders Group)

- Finishing Services

第八章投资分析

第9章市场的未来

The Pharmaceutical Contract Packaging Market size is estimated at USD 17.19 billion in 2024, and is expected to reach USD 27.45 billion by 2029, growing at a CAGR of 9.82% during the forecast period (2024-2029).

With COVID-19 influencing a significant spike in demand for vials, medicines, and other drugs, manufacturers in the industry scrambled their resources and pushed for faster manufacturing and packaging processes. During the initial months of the pandemic, there was a significant shortage of materials for both CMOs and CPOs in the market; owing to supply chain issues faced in the Asia-Pacific region, which commands a prominent position when it comes to pharmaceutical raw materials as well as packaging industry raw materials which resulted in slower manufacturing and packaging.

Key Highlights

- The global pharmaceutical industry is growing exponentially, driven by global economic growth, a growing and aging population, and new product launches. According to IQVIA, the revenue of the global pharmaceutical market in 2020 stood at USD 1,265.2 billion and growing at a steady pace. As many pharmaceutical vendors recognized that profits could be increased by outsourcing the commercial and clinical packaging to a pharmaceutical contractor, the contract packaging in the industry is expanding.

- Over the past few years, there's been a significant rise in the number of new drugs approved by the US FDA. For instance, the total number of novel drugs approved by CDER in 2020 stood at 53, which was 48 during the previous year, according to Food and Drug Administration (Center for Drug Evaluation and Research (CDER)). Also, the generic drug program approved or tentatively approved 948 generic drug applications during the year. The increase in the number of new drugs approved by the FDA has positively impacted the global pharmaceutical contract packaging market.

- Further, injectables are expected to witness increased market share outpacing other routes of administration such as oral over the coming years; owing to this, the demand for injectable solutions is likely to increase in contract packaging, and significant pharmaceutical vendors are expected to expand their capabilities in this space.

- For instance, in January 2021, Novartis made a strategic investment in drug delivery company Credence MedSystems; the investment is expected to help advance the development and scaling of Credence's drug delivery systems, with an initial focus on the Credence Companion Safety Syringe System.

- Moreover, the demand for outsourcing bottling services is expected to be stable in the larger volume market. The need for blister packaging and bottling services is expected to be driven by the maintenance drugs and demand for efficient go-to-market packaging options for new products, focusing on 30-60-90 day presentations for maintenance drugs.

- Further, the EU regulations mandate all pharmaceutical manufacturers to comply with the EU Good Manufacturing Practices (GMP) if they want to supply products to the EU. Then manufacturers and importers must be authorized and registered by a competent authority from a member state. The manufacturers and importers are regularly inspected by an EU competent authority or other approved authority to check the compliance with the EU GMP. This process applies wherever the manufacturer is located. Where a particular company imports products, the importer stands responsible for ensuring compliance with the GMP. The EU legislation governing pharmaceutical products is compiled in "The Rules Governing Medicinal Products in the European Union."

Pharmaceutical Contract Packaging Market Trends

Bottles Pharmaceutical Packaging is Expected to Drive the Market Growth

- The primary packaging of pharmaceuticals in bottles entails filling the bottles. The bottle filling services hold a significant market share in the studied market as multiple pharmaceutical companies depend on contract packaging companies to partake in the filling procedure.

- Over the forecast period, plastic bottle filling is expected to significantly grow due to its various advantages, including light-weightedness that further saves space and transportation, and freight charges. Unlike pharmaceuticals filled in glass bottles, plastic bottles are not prone to breakage and help with necessary cost-savings associated with glass bottles.

- Both solid dosage and Liquid and liquid suspensions filling pharmaceuticals in glass, metal, and plastic bottles are marked with expansion activities as contract packaging companies focus on adding bottling lines to increase production capacity.

- For instance, Aphena Pharma Solutions, an organization providing pharmaceutical contract packaging services, announced in January 2021 that the company had added ten high-speed bottling lines leveraging its USD 21 million investment in solid dosage contract packaging. The company further intends to install 30 more high-speed lines in its newly acquired 500,000 sq ft facility to increase the monthly capacity to over 80 million bottles to target the pharmaceutical solid dose packaging industry.

- Moreover, the increasing demand for injectable pharmaceuticals is significantly driving the growth of glass bottles in the pharmaceutical sector. The robust market for oncology and other high-potency drugs (such as antibody conjugates, steroids, and IV fluids that require quick onset of action) is expected to be the key growth driver.

- Further, the increasing number of people who have diabetes significantly supports the growth of glass bottles for injectable pharmaceuticals. According to the World Health Organization (WHO), around 422 million people have diabetes worldwide. The change in this number increases the demand for penicillin, which is, thereby, contributing to the growth of the market.

North America Accounts for the Largest Market Share

- The pharmaceutical contract packaging market in North America is rapidly increasing the adoption of different packaging methods to meet the expectations of changing consumer preferences. Rising environmental concerns have stimulated the demand for sustainable contract packaging in the pharmaceutical industry.

- In addition to this, the rising penetration of automation in pharmaceutical contract packaging has minimized human handling errors, thereby catalyzing market growth in the region. Apart from this, increased disposable incomes and rising consumer health awareness are propelling the demand for pharmaceutical contract packaging in the area.

- Many contract packaging companies have been investing in expanding their facilities and customer base and enhancing their geographical presence through acquisitions and partnerships. In September 2020, Essentra Packaging announced the purchase of a 3C! Based in North Carolina, Packaging is a designer and manufacturer of cartons, literature, labels, and packaging primarily for the pharmaceutical industry. Such acquisitions allow companies like Essentra Packaging to enhance their position in the pharmaceutical packaging space and provide opportunities to grow in the pharmaceutical manufacturing hub in North America, United States.

- Further, the expansion of biologics is expected to have a significant impact on the regional market. For example, in April 2021, Catalent completed a USD 14 million expansion for increasing biologics packaging capabilities and capacity at its Bloomington, Indiana facility.

- Moreover, North America is home to some of the most prominent pharmaceutical vendors and packaging solution providers; among the key growth trends, CPOs in the region extend their service offering with 3PL services.

- For instance, in September 2020, Legacy Pharmaceutical Packaging expanded its services, including 3PL services, covering supply chain transparency solutions and retail pharma product procurement for over-the-counter medications. In addition to this, the company also expanded its open-space facility near its St Louis, MO, headquarters from 215,000 ft2 to 500,000 ft2.

Pharmaceutical Contract Packaging Industry Overview

The competitive landscape of the global pharmaceutical contract packaging market appears to be fragmented due to the presence of a large number of vendors. The major players with a significant share in the market are expanding their customer base across various regions. In addition, many companies are forming strategic and collaborative initiatives with multiple companies to increase their market share and profitability. Some of the recent developments in the market are:

- May 2021 - Sharp, a contract packaging, clinical supply services company owned by UDG Healthcare plc, purchased new land as part of a USD 17 million investment in its Conshohocken, PA location. This land purchase will enable Sharp to add future capacity for cGMP packaging services and is part of a broader USD 43 million investment into its Pennsylvania operations, increasing the firm's blister packaging capacity by over 35%.

- June 2020 - PCI Pharma has announced that it entered into a partnership agreement with Experic, a contract manufacturing organization, and pharmaceutical supply service company, to explore clinical and commercial manufacturing, packaging, and supply chain services driving collective growth for both parties.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Ongoing efforts towards serialization to aid market growth

- 5.1.2 Recent capacity expansions & investments in expanding bottling and filling services

- 5.2 Market Challenges

- 5.2.1 Stringent Regulatory Requirements

6 MARKET SEGMENTATION

- 6.1 By Service Type

- 6.1.1 Primary

- 6.1.1.1 Bottles

- 6.1.1.2 Vials

- 6.1.1.3 Ampoules

- 6.1.1.4 Blister Packs

- 6.1.1.5 Others

- 6.1.2 Secondary

- 6.1.3 Tertiary

- 6.1.1 Primary

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia Pacific

- 6.2.4 Latin America

- 6.2.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Ropack Inc.

- 7.1.2 Sharp (UDG Healthcare)

- 7.1.3 Reed-Lane Inc.

- 7.1.4 PCI Pharma Services

- 7.1.5 UNICEP Packaging LLC

- 7.1.6 Jones Packaging Inc.

- 7.1.7 Almac Group

- 7.1.8 Assemblies Unlimited Inc.

- 7.1.9 AmeriPac

- 7.1.10 MJS Packaging

- 7.1.11 AbbVie Contract Manufacturing

- 7.1.12 Pharma Packaging Solutions

- 7.1.13 Nelipak BV

- 7.1.14 Aphena Pharma Solutions Inc.

- 7.1.15 Southwest Packaging

- 7.1.16 MPH Co-Packing

- 7.1.17 Tjaopak

- 7.1.18 SternMaid GmbH

- 7.1.19 Variopack Lohnfertigungen GmbH

- 7.1.20 CentralPharma

- 7.1.21 Sepha Limited

- 7.1.22 DelobrisPharmaceuticals Limited

- 7.1.23 Wasdell Group

- 7.1.24 DaklaPack Filling

- 7.1.25 LABO Phytophar

- 7.1.26 Tripak Pharmaceuticals

- 7.1.27 Jam Jams

- 7.1.28 AsiapackLimited (Elanders Group)

- 7.1.29 Finishing Services