|

市场调查报告书

商品编码

1690907

RFID:市场占有率分析、产业趋势与统计、成长预测(2025-2030)RFID - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

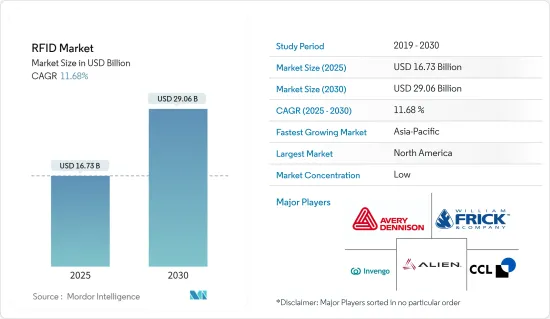

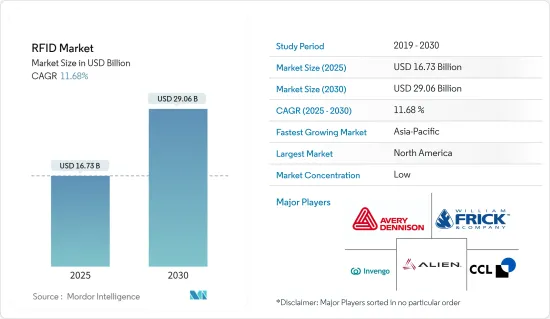

RFID 市场规模在 2025 年预计为 167.3 亿美元,预计到 2030 年将达到 290.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 11.68%。

RFID技术广泛应用于供应链管理和物流。基于感测器的 RFID 技术越来越多地被应用于产品包装中,以追踪产品的来源并防止供应链中出现任何污染源或篡改现象。

主要亮点

- 物流和运输是RFID技术的主要应用领域。仓储、堆场管理、航运和运输、配送中心等是 RFID 追踪技术通常使用的一些领域。

- RFID(无线射频辨识)是一种无线系统,主要由两个主要组件组成:标籤和阅读器。阅读器本质上是一种由一个或多个天线组成的设备,可以发射无线电波并接收来自 RFID 标籤的讯号。标籤使用无线电波将其ID和其他重要资讯传输到附近的读取器,并且有被动和主动两种类型。

- 被动 RFID 标籤主要由读取器供电,没有电池。然而,有源 RFID 标籤是电池供电的。这些 RFID 标籤可以储存各种各样的信息,从单一序号到几页关键资料。 RFID 读取器具有移动形式,可手持、桿式安装或高架安装。

- RFID 技术最常见的用途包括透过供应链追踪货物、在製造生产线中移动时追踪零件、资产追踪、安全和付款系统(客户无需使用现金即可支付货物)。此外,医疗保健产业也频繁使用 RFID 作为病患腕带,为设施存取控制和安全提供防篡改、精确的识别。

- 此外,作为改善计画的一部分,世界各地的多个物流中心和仓库都在投资提高各个流程的效率。这些市场领域的投资预计将推动 RFID 技术的成长和应用。

- COVID-19 疫情为零售商带来了更多挑战。疫情也促使零售商更大规模地采用 RFID。这场疫情加速了已经在进行的数位转型。

RFID 市场趋势

零售领域可望占据主要市场占有率

- 零售业中的 RFID 涉及在商品上使用 RFID 标籤,该标籤将讯号传输到RFID读取器。然后,软体处理 RFID 标籤以提供即时结果,例如交易、库存控制、存量基准和个人客户采购订单历史记录。零售业中的 RFID 减轻了典型的零售库存流程,该流程是手动的、耗时的并且仅在设定的时间间隔内执行。物品追踪是零售商使用 RFID 的主要用途之一。零售业中的 RFID 还可用于防止盗窃和追踪通常被移动且经常被遗忘的商品。

- 许多企业正在采用 RFID 作为管理库存的方法。代表品牌包括 Zara、H&M、Target、Macy's、Uniqlo、Nike、Adidas、Lululemon、Footlocker、Levi's、Tommy Hilfiger、Ralph Lauren 和 Victoria's Secret。电子商务正在推动大部分的应用,因为它需要较高的库存准确性来支援店内履约和 BOPIS(网上购买,店内取货)等流程。

- 经过RFID处理的商品还能提供经营团队阶层事实资料。由于库存准确性对于减少损耗和提高利润至关重要,因此 RFID 可以带来更明智的采购决策,并使经营团队更好地控制费用。

- 使用 RFID 有可能改善整体库存管理。透过更轻鬆地确认已完成的销售,它还可以增加营业收益。简而言之,无论货物储存在何处,RFID 都能实现更准确的核算,确保更盈利的业务绩效。

- 世界各地的零售商正在广泛使用 RFID 技术,尤其是在服装业。加拿大 Logistik Unicorp 公司采用无线射频辨识技术,确保加拿大军装快速送达,并保证符合严格的品质要求。这使得产品运输时间减少了 35%。这些努力将会促进市场上 RFID 的新机会、发展和应用,减少对零售产品的依赖。

- 满足所有销售管道客户需求的全通路零售策略已成为生存的首要任务。 RFID 扩大了零售商商店、企业和配送中心的产品可见性,以满足不断变化的消费者需求。

亚太地区可望成为成长最快的市场

- 亚太地区占据了市场的大部分份额,预计在预测期内将显着增长。自动化领域的快速采用和研究以及工业4.0的显着扩张正在推动该地区对RFID解决方案的需求。

- 该地区的成长主要得益于製造设备越来越多地采用 RFID 系统来提高生产力。电子ID卡和智慧卡中RFID标籤的日益接受也推动了该地区RFID市场的成长。

- 随着零售业的扩张,零售商越来越多地转向数位技术来改善客户购物体验并优化仓库管理流程。这也是推动RFID市场成长的关键因素之一。 RFID 是一种用于在生产环境中处理货物和材料的有效技术。

- 该地区製造业格局不断扩大,加上自动化和物联网 (IIoT) 解决方案的日益采用,正在推动市场成长。此外,各垂直产业组织对资产管理的投资不断增加、对非接触式基础设施的需求不断增长,再加上智慧城市等政府倡议,将在预测期内进一步推动市场成长。

- 此外,公共交通是预测期内市场预计会扩张的行业之一。然而,一些限制因素正在阻碍市场成长。部署 RFID 系统的高成本可能会对市场的成长构成挑战。此外,设备互通性问题也可能阻碍预测期内的市场成长。

- 在印度等国家,随着产业的成熟,RFID 技术的采用预计将激增,而 COVID-19 疫情增加了对非接触式解决方案的需求。

RFID 产业概况

RFID市场复杂且竞争激烈,主要参与者包括Avery Dennison Corporation、Alien Technology Corporation、CCL Industries Inc.和William Frick & Company。大公司正致力于扩大海外基本客群。两家公司正在利用策略联合措施来增加市场占有率并提高盈利。预计竞争、快速的技术进步以及消费者偏好的频繁变化将在预测期内对公司的市场成长构成威胁。

- 2023 年 5 月-CCL Industries INC. 宣布已收购 eAgile Inc. 和 Alert Systems 的智慧财产权。 5,400 万美元的购买金额包括分五年延期支付的 700 万美元和 100 万美元的净现金。新业务将成为 CCL Label 医疗保健和专业业务不可或缺的一部分,为整个公司增添 RFID 专业知识。

- 2023 年 2 月 - Avery Dennison Smartrac 将投资 1 亿美元建造 RFID 标籤新製造能力。这项投资支持了 AIPIA 会员的目标,即为每件物品提供唯一的数位 ID,满足对无源超高频 RFID 标籤日益增长的需求,并加快订单的完成速度。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业相关人员分析

- RFID 标籤的类型

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- RFID 法规和标准

- RFID 和物联网

- COVID-19 对 RFID 及相关市场的影响

- RFID 实施的关键成功因素

- 差距分析

第五章 市场动态

- 市场驱动因素

- 政府支持数位发展的政策

- 製造设备越来越多地采用 RFID 来提高生产率和实现安全/存取控制应用

- 市场挑战

第六章 市场细分

- 依技术分类

- RFID 标籤

- RFID 读取器

- RFID 软体/服务

- 主动式RFID/RTLS

- 按应用

- 零售

- 医疗保健和医药

- 客运/汽车

- 製造业

- 消费性产品

- 其他用途

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Avery Dennison Corporation

- Alien Technology Corporation

- William Frick & Company

- Invengo Technology Pte Ltd.

- Impinj Inc.

- CCL Industries Inc.

- Nedap NV

- Zebra Technologies Corporation

- Trace-Tech ID Solutions SL

- Hangzhou Century Co. Ltd.

- SML Group Limited

- Honeywell Productivity and Workflow Solutions

- CHILITAG Technology Ltd

- Ceyon Technology Co. Ltd.

- JADAK Technologies Inc.

第八章投资分析

第九章:市场的未来

The RFID Market size is estimated at USD 16.73 billion in 2025, and is expected to reach USD 29.06 billion by 2030, at a CAGR of 11.68% during the forecast period (2025-2030).

Supply chain management and logistics make widespread usage of RFID technology. Sensor-based RFID technology is being increasingly integrated into product packaging to track and trace the origin of the product and prevent any source of contamination or tampering within the supply chain.

Key Highlights

- Logistics and transportation are major areas of implementation for RFID technology. Warehouse management, yard management, shipping and freight, and distribution centers are some of the areas where RFID tracking technology is usually used.

- Radiofrequency identification (RFID) primarily refers to a wireless system comprising two major components: tags and readers. The reader is basically a device comprising one or more antennas that emits radio waves and receive signals back from the RFID tags. The tags, which make use of radio waves to communicate their identity and other crucial information to the nearby readers, can be passive or active type.

- The passive RFID tags are mainly powered by the readers and do not have a battery. However, the active type RFID tags are powered by batteries. These RFID tags can store a wide range of information, right from one serial number to several pages of crucial data. The RFID readers are offered in a mobile form factor so that they can be carried by hand or can either be mounted on a post or overhead.

- One of the most common usages of RFID technology has been tracking goods in the supply chain, tracking parts moving to a manufacturing production line, tracing assets, security, and payment systems that let clientele pay for items without using cash. In addition, RFID is frequently used in the healthcare industry on patient wristbands to offer tamper-proof, exact identification for facility access control and security.

- Moreover, multiple distribution centers and warehouses around the globe have been investing in improving their process efficiency to increase the efficiency of the overall processes as a part of their improvement programs. Such investments in the market landscape are anticipated to drive the growth and implementation of RFID technology.

- The COVID-19 pandemic has increased challenges for retailers. The pandemic also pushed retailers to adopt RFID on a much larger scale. The pandemic became an accelerator of the digital transformation trend, which was already underway.

RFID Market Trends

Retail Segment is Expected to Hold a Major Market Share

- RFID in retail involves the utilization of RFID tags on items that emit signals to RFID readers, which are then processed by the software, providing real-time results for transactions, stock taking, inventory levels, or individual customer purchase order history. RFID in retail eases the typical retail inventory process, which is manual, time-consuming, and only performed at predetermined intervals. Item tracking is one of the major applications that retailers use RFID. RFID in retail can also be used to prevent theft and track items that are usually moved and often misplaced.

- Several companies have adopted RFID as an approach to control inventories. Leaders include Zara, H&M, Target, Macy's, Uniqlo, Nike, Adidas, Lululemon, Footlocker, Levi's, Tommy Hilfiger, Ralph Lauren, and Victoria's Secret. E-commerce is fueling much of the adoption, with high inventory accuracy levels required to support processes like store fulfillment and BOPIS (buy online, pick up in-store).

- RFID-processed merchandise also makes factual data available to management. It may lead to smarter purchase decisions and give management better expense control, as inventory accuracy is crucial to lowering shrinkage, thus, better profits.

- Usage of RFID may improve overall merchandise management; accurate tracking of inventory and its location saves money. It also drives greater topline revenues, as it becomes easier to assure that sales are completed. Bottom line, adoption of the system ensures more profitable performance, as there is a more accurate accounting of the merchandise wherever it is stored.

- Retailers across the world have been making extensive use of RFID technology, especially in the Apparel business. The Canada-based company, Logistik Unicorp, has been using radio frequency identification as a tool to ensure that Canadian military uniforms are delivered swiftly, along with the guarantee of meeting strict quality requirements. It has been able to reduce the time required to ship goods by 35%. Such initiatives encourage new opportunities and developments and initiatives for RFID in the market and decrease the dependency on retail goods.

- Omnichannel retail strategies to meet the customers' needs on all sales channels became a priority for survival. RFID extended retailers' visibility of merchandise across the stores and the enterprise and distribution centers to meet ever-changing consumer demands.

Asia Pacific is Expected to be the Fastest Growing Market

- The Asia Pacific region is anticipated to hold a significant share of the market and is expected to witness significant growth over the forecast period. The rapidly increasing implementation and research work in the field of automation and a significant expansion of industry 4.0 have been driving the demand for RFID solutions in the region.

- The region's growth has been significantly driven by the increasing installation of these RFID systems in manufacturing units in order to improve productivity. The growing acceptance of electronic identity cards and RFID tags that are located in smart cards is also acting as a driver for the growth of the RFID market in the region.

- The expanding retail sector, along with the rising retailers' focus on embracing digital technologies in order to enhance the customer's shopping experience and optimize the warehouse management process, has also been one of the key factors contributing to the growth of the RFID market. RFID has been one of the efficient technologies used to handle goods and materials in the production environment.

- The expanding manufacturing landscape in the region, coupled with the increasing adoption of automation and Industrial Internet of Things (IIoT) solutions in the sector, has been propelling the market's growth. Also, the growing investments in asset management by organizations across various verticals and the rising need for contactless infrastructure coupled with government initiatives such as smart cities will further drive the growth of the market during the forecast period.

- Moreover, the public transportation sector is anticipated to be one of the areas in which the market is expected to expand over the forecast period. However, some restraints are limiting the growth of the market. The higher cost associated with installing RFID systems may challenge the market's growth. The device interoperability issues can also hinder the growth of the market over the forecasted period.

- Countries such as India are expected to witness a surge in the adoption of RFID technology as industries mature, and the COVID-19 pandemic is increasing the need for contactless solutions.

RFID Industry Overview

The RFID Market is fragemented and highly competitive and consists of several major players like Avery Dennison Corporation, Alien Technology Corporation, CCL Industries Inc., William Frick & Company, etc. The major players are focusing on expanding their customer base across foreign countries. The companies are leveraging strategic collaborative initiatives to increase their market share and increase their profitability. The competition, rapid technological advancements, and frequent changes in consumer preferences are expected to pose a threat to the market's growth of the companies during the forecast period.

- May 2023 - CCL Industries INC, announced it has acquired eAgile Inc. and the intellectual property of Alert Systems with the USD 54 million purchase price includes an estimated USD 1 million net cash assumed with USD 7 million deferred for five years. The new business will become an integral part of CCL Label's Healthcare & Specialty business while adding RFID know-how across the company.

- Februray 2023 - Avery Dennison Smartrac invests USD 100milion in new RFID tag making capacity, The investment supports the AIPIA member's ambition of giving every item a unique digital identity and meeting the growing demand for passive UHF RFID tags as well as increasing how quickly it can fulfil orders.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Stakeholder Analysis

- 4.3 RFID Tag Types

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 RFID Regulations and Standards

- 4.6 RFID and IoT

- 4.7 Impact of COVID-19 on RFID and Allied Markets

- 4.8 Critical Success Factors for RFID Implementation

- 4.9 Gap Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Government Policies Favoring Digital Development

- 5.1.2 Increasing Installation of RFID in Manufacturing Units for Productivity Improvement and Security and Access Control Applications

- 5.2 Market Challenges

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 RFID Tags

- 6.1.2 RFID Interrogators

- 6.1.3 RFID Software/Services

- 6.1.4 Active RFID/RTLS

- 6.2 By Application

- 6.2.1 Retail

- 6.2.2 Healthcare and Medical

- 6.2.3 Passenger Transport/Automotive

- 6.2.4 Manufacturing

- 6.2.5 Consumer Products

- 6.2.6 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Avery Dennison Corporation

- 7.1.2 Alien Technology Corporation

- 7.1.3 William Frick & Company

- 7.1.4 Invengo Technology Pte Ltd.

- 7.1.5 Impinj Inc.

- 7.1.6 CCL Industries Inc.

- 7.1.7 Nedap NV

- 7.1.8 Zebra Technologies Corporation

- 7.1.9 Trace-Tech ID Solutions SL

- 7.1.10 Hangzhou Century Co. Ltd.

- 7.1.11 SML Group Limited

- 7.1.12 Honeywell Productivity and Workflow Solutions

- 7.1.13 CHILITAG Technology Ltd

- 7.1.14 Ceyon Technology Co. Ltd.

- 7.1.15 JADAK Technologies Inc.