|

市场调查报告书

商品编码

1436141

商业照明:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Commercial Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

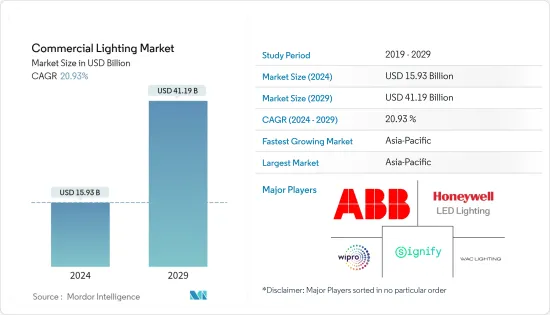

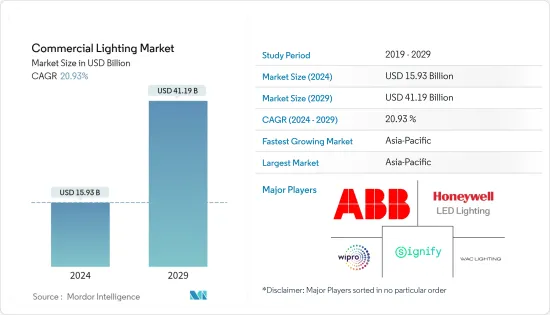

商业照明市场规模预计到 2024 年为 159.3 亿美元,预计到 2029 年将达到 411.9 亿美元,预测期内(2024-2029 年)复合年增长率为 20.93%。

研究市场的成长是由多个国家正在进行和即将开展的智慧城市计划、世界各国政府对能源消耗的日益关注、户外应用 LED 灯和灯具的需求不断增长以及标准的接受度大大加快所推动的。透过扩展照明控制系统通讯协定。

商业照明可以根据应用进行定制,以适应任何设施及其运作。维修需求、亮度等级和保固都是商业照明的重要因素。商业设施允许许多人出于各种目的而停留,包括购物、就业、娱乐和测试。照明设计公司将创建反映设施内发生的活动的设计,确保工人舒适度并确保勒克斯水平要求和能源效率标准适当。

商业照明设计必须考虑灯具的用途、特性和用途。 T5 和紧凑型萤光灯泡是典型的商务用照明灯具,但 LED 照明灯具由于成本较低而变得越来越受欢迎。

精心设计的灯具照亮了房间的周围环境并营造出积极的氛围。医院、饭店、俱乐部、办公室、零售店和其他商业设施的照明设计需要仔细考虑。这是因为企业主使用精心设计的商业照明框架来使他们的场所看起来欢迎客人和客户。

此外,人工智慧和 LED 照明等技术的进步使企业更容易强调其室内装饰和设计功能性工作空间。商业照明产业不断创新以降低能源成本,这对照明产品产生重大影响。

商业照明市场趋势

商业办公板块市场占有率最大化

商业办公室照明是工作环境中最常被忽视和低估的元素之一。选择合适的职场照明设备可能是您做出的最明智的财务决策之一。除了前者之外,它还可以影响客户幸福感、建筑安全、员工士气和生产力。

商业办公室照明经常用于政府办公室、医疗机构、职场、零售商店、机构和其他场所。商业级照明功能强大,可以使用尖端技术来提高效率和易用性。办公室照明可以影响访客和员工的情绪,提高生产力,并改善该区域的视觉吸引力。理想的职场照明符合安全标准,创造舒适的环境,并具有自然光和人造光的正确组合。

商业照明系统还可能包括智慧控制功能,例如感测器、调光器、定时器、可程式设计照明系统和 LED 技术。这些控制器根据占用情况、日光水平和一天中的时间自动更改照明设置,以帮助优化能源消耗并进一步节省能源。商业区域可以受益于智慧照明控制,该控制提供客製化的照明设置、远端控制以及与其他建筑管理系统的互动。

主要的成长动力是针对低效照明系统的更强有力的立法以及政府加强促进永续发展。发光二极体(LED) 价格大幅下降和全球能源政策变化推动了市场上涨。此外,由于政府为使用 LED 照明提供有吸引力的奖励和回扣,需求将会增加。

LED 照明提供的优势,例如能够在几毫秒内打开和关闭以及节省成本和延长产品寿命的能力,推动了对该技术的市场需求。由于定向受控光的优点,预计需求将会增加。具有紧凑形状和特性(例如日光、占用感应、调光功能和定时器)的灯具和照明的技术发展和各种设计替代方案的可用性预计将对增长产生积极影响。由于政府节能措施为商业环境中的个人和企业提供经济奖励和有吸引力的回扣,该行业得到了进一步发展。

根据 EPRA 的数据,全球商业房地产市场的价值预计到 2022 年将达到 35 兆美元,高于一年前的约 34 兆美元。亚太地区市场规模超过12兆美元,规模超过北美洲。

此外,办公空间正从单独的隔间环境演变为开放式办公环境。在这个新的开放环境中,房间的环境照明着重于在房间和员工之间营造团结感和社区感。

中国成长率为亚太地区最高

照明产品对于基础设施、日常生活和工业都很重要。随着中国经济和生活水准的提高,对当地照明的需求日益增加。由于照明产业的快速发展,中国在过去的二十年里一直是世界第一大照明生产国和消费国。

有机发光二极体(OLED)、紧密型萤光灯(CFL)、无电极放电灯泡(EDL) 和发光二极体(LED) 是一些最受欢迎的产品。为了吸引顾客,中国企业正在加大灯饰商场的投资。办公室、学校和医院的照明都得到了显着改善。

中国正在推动环境保护和节能。 《中华人民共和国节能法》、《关于加速节能环保产业发展的意见》等一系列政策法规正在推动环保服务的发展。同时,节能环保产品的推广增加了对节能照明的需求。我国优先发展节能环保产业,正推动LED照明发展。

此外,LED照明正在中国迅速取代传统照明产品。中国政府也透过为 LED 产品的采用提供大量补贴,大力促进该产业的发展。此外,中国政府也禁止使用白炽灯泡,国家发展与改革委员会于2011年11月首次公布了逐步淘汰白炽灯泡的蓝图。

中国LED照明企业已逐渐成熟,并开始积极开拓海外市场。例如森林照明併购德国LEDVANCE,欧普照明设立多家海外子公司。同时,当地照明企业正透过设立展览中心、增设专卖店等方式拓展国内业务。未来,当地企业可望加大技术创新投入,提高产品付加,并增强竞争力。

商业照明行业概况

市场上主要供应商之间的竞争非常激烈。商业照明产品的供应商种类繁多,这意味着买家有许多供应商可供选择,从而在具有可比产品系列和地理覆盖范围的供应商之间形成了激烈的竞争。此外,公司正在围绕各种连网型照明产品进行创新。 Wipro 和 Signify 等公司正在寻求为零售商店和医院等商业应用提供智慧照明产品。

2022 年 6 月,Wipro Lighting 宣布成立一个新的业务部门,将整合商业照明和座椅解决方案。新组织的成立是为了透过利用 Wipro 的共用经销商网路和提供客户服务来提供更好的协作并推动成长。

2022 年 1 月,着名工业技术公司 Acuity Brands, Inc. 宣布扩大与 Microsoft 的合作伙伴关係,为 Acuity Brands 的高强度照明、建筑自动化解决方案和照明控制引入新功能。透过将微软永续发展云端和微软Azure物联网的功能与Acuity Brands客户解决方案相集成,Acuity Brands和微软将共同使营运各种设施和建筑的最终客户能够方便地计算和预测环境和财务影响。和建筑管理技术。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌意强度

- 产业生态系统分析

- LED贸易分析及中美贸易战对LED市场的影响(定性趋势)

- COVID-19 对 LED 照明和紧急照明市场的影响

第五章市场动态

- 市场驱动因素

- 意识的提高和智慧办公室倡议推动了向节能、连网型照明解决方案的转变

- 随着该领域技术的逐步进步,基于 LED 的照明解决方案现已成为标准化功能

- 市场挑战

- 该行业容易受到更广泛条件的影响,例如建设活动

第六章市场区隔

- 按类型

- 灯

- 照明

- 依照明类型

- 基于 LED 的照明

- 传统的

- 按最终用户

- 商业办公室

- 零售

- 酒店和休閒(餐厅和体育设施)

- 卫生保健

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 拉丁美洲

- 中东和非洲

- 北美洲

第七章 竞争形势

- 公司简介

- Signify NV(Philips Lighting)

- WAC Lighting

- Cree Lighting(IDEAL INDUSTRIES INC.)

- Siteco GmbH

- Wipro Lighting Limited

- Acuity Brands Inc.

- Hubbell Incorporated

- Zumtobel Group AG

- ABB

- Honeywell LED Lighting

第八章投资分析

第9章市场的未来

The Commercial Lighting Market size is estimated at USD 15.93 billion in 2024, and is expected to reach USD 41.19 billion by 2029, growing at a CAGR of 20.93% during the forecast period (2024-2029).

The growth of the studied market is being significantly fueled by the ongoing and upcoming smart city projects in several nations, the increased focus of governments worldwide on energy consumption, the rising demand for LED lights and luminaires for outdoor applications, and the expanding acceptance of standard protocols for lighting control systems.

Commercial lighting may be customized to fit any facility and its operations based on use. Maintenance requirements, brightness level, and warranties are all significant factors in commercial lighting. Many people can be accommodated in a commercial facility for various activities, including shopping, employment, entertainment, and medical inspection. A lighting design company creates designs that reflect the activity carried out in the facility to ensure that workers are comfortable and that the lux level requirements and the energy efficiency criteria are adequate.

Commercial lighting design must consider light fixtures' use, characteristics, and purpose. T5 and compact fluorescent lights are typical business lighting design fixtures, although LED light fixtures are gaining popularity because of their lower prices.

Well-designed lighting fixtures may illuminate a room's surroundings and create a positive atmosphere. The lighting design at hospitals, hotels, clubs, offices, retail stores, and other commercial facilities must be carefully considered. This is so that business owners may make their location seem welcoming to guests or clients by using a well-designed commercial lighting framework.

Furthermore, it is now simpler for firms to highlight their interiors and design a functional workspace thanks to technology advancements like artificial intelligence and LED lighting. The commercial lighting industry always innovates to lower energy costs, greatly impacting lighting products.

Commercial Lighting Market Trends

Commercial Offices segment to maximum market share

Commercial office lighting is one of the work environment's most frequently disregarded and undervalued elements. Picking the appropriate workplace lighting fixtures might be among the wisest financial decisions. It can affect customer happiness, building security, personnel morale, and productivity in addition to the former.

Government structures, medical facilities, workplaces, retail establishments, institutions, and other locations frequently employ commercial office lighting. Commercial-grade lighting is robust and may use cutting-edge technologies to boost efficiency and user-friendliness. Office lighting may influence visitors' and employees' moods, improve productivity, and improve the visual attractiveness of the area. The ideal workplace lighting conforms with safety standards, creates a comfortable environment, and offers an appropriate mix of natural and artificial light.

Commercial lighting systems could also have intelligent controls, including sensors, dimmers, timers, programmable lighting systems, and LED technology. By automatically altering lighting settings based on occupancy, daylight levels, or time of day, these controls can assist in optimizing energy consumption and produce additional energy savings. Commercial areas can benefit from intelligent lighting controls that provide customized lighting settings, remote control, and interaction with other building management systems.

The main growth drivers are tightening laws regarding inefficient lighting systems and increasing government initiatives to promote sustainable development. The market's rise has been fueled by a sharp reduction in Light-Emitting Diode (LED) pricing and global energy policy changes. Furthermore, using attractive incentives and rebates offered by the governments of various nations for the use of LED lighting would boost demand.

The advantages that LED lighting provides, like its ability to switch on and off in a millisecond and its capacity to save money and extend product life, drive market demand for the technology. Demand is predicted to increase due to the benefit of directed, controlled light. Technological developments and the availability of different design alternatives for fixtures and lights owing to their compact shape and characteristics, such as daylighting, occupancy sensing, dimmability, and timer, are projected to affect the growth favorably. The industry has grown further due to governments' energy conservation initiatives, which offer financial incentives and enticing refunds to people and businesses in commercial settings.

According to EPRA, The value of the worldwide commercial real estate market is predicted to reach USD 35 trillion in 2022, up from around USD 34 trillion the previous year. With a market size of over USD 12 trillion, the Asia-Pacific area outpaced North America in terms of size.

Moreover, office spaces are evolving away from the individual cubicle setting in favor of an open-office environment. In this new, open environment, the ambient room lighting is focused on creating a sense of unity and community in the room and among workers.

China in the Asia-Pacific region to exhibit highest growth rate

Products for lighting are crucial for infrastructure, daily living, and industry. The mainland's need for illumination is growing along with China's economy and rising living standards. China has been the world's top producer and consumer of lighting for the past 20 years because of the lighting industry's fast development.

Organic light-emitting diodes (OLEDs), compact fluorescent lamps (CFLs), electrodeless discharge lamps (EDLs), and light-emitting diodes (LEDs) are some of the most popular items. To draw clients, Chinese businesses are investing more money in lighting malls. Office, school, and hospital lighting have all significantly improved.

China has been promoting environmental protection and energy conservation. A succession of policies and regulations, such as The Energy Conservation Law of the People's Republic of China and Opinions on Accelerating the Development of Energy-saving and Environmental Protection Industries, is driving the development of environmental protection services. At the same time, promoting energy-saving and eco-friendly products is creating greater demand for energy-efficient lighting. The priority given by China to the policy of developing energysaving and environmental protection industries is propelling the development of LED lighting.

Moreover, LED lights are rapidly replacing conventional lighting products in China. The Chinese government is also significantly driving the sector's growth by offering large-scale subsidies for adopting LED products. Moreover, the Chinese government has also banned incandescent bulbs, with the National Development and Reform Commission first announcing the country's incandescent bulb phase-out roadmap in November 2011.

As China's LED Lighting enterprises have gradually come of age, they have begun aggressively developing overseas markets. For example, Forest Lighting has merged with Germany's LEDVANCE, while Opple Lighting has set up several overseas subsidiaries. Meanwhile, mainland lighting companies have expanded their domestic presence by setting up display centers and adding specialty stores. In the future, mainland enterprises are expected to invest more in technology and innovation to increase the added value of their products and raise their competitiveness.

Commercial Lighting Industry Overview

There is intense competition among major vendors in the market. Due to a broad range of suppliers of commercial lighting products, buyers can choose from numerous vendors, creating cut-throat competition among vendors of equal caliber in product portfolio and geographical reach. Further, companies are innovating in terms of various connected lighting products. Players like Wipro and Signify are trying to provide smart lighting products for commercial applications like retail, hospitals, etc.

In June 2022, Wipro Lighting announced the establishment of a new business unit integrating Commercial Lighting and Seating solutions. Utilizing Wipro's shared dealership network and providing customer service, the new entity was established to provide better alliances and expedite growth.

In January 2022, Acuity Brands, Inc., a prominent industrial technology company, announced that it is expanding its partnership with Microsoft to bring new capabilities to Acuity Brands' bright lighting, building automation solutions, and lighting controls. By integrating the power of Microsoft's Cloud for Sustainability and Microsoft Azure IoT with Acuity Brands customer solutions, Acuity Brands and Microsoft would jointly facilitate end customers, operating numerous types of facilities and buildings, to calculate and forecast the environmental and financial impacts that these new lighting and building management technologies deliver.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Ecosystem Analysis

- 4.4 LED Trade Analysis and the Impact of US-China Trade War on the LED Market (Qualitative Trends)

- 4.5 Impact of COVID-19 on the LED Lighting/Emergency Lighting Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Move toward Energy-efficient and Connected Lighting Solutions driven by Growing Awareness and Smart Office Initiatives

- 5.1.2 Availability of LED-based Lighting Solutions as a Standardized Feature Coupled with Incremental Technological Advancements in the Sector

- 5.2 Market Challenges

- 5.2.1 The Sector is Susceptible to Broader Conditions, such as Construction Activity

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Lamps

- 6.1.2 Luminaries

- 6.2 By Lighting Type

- 6.2.1 LED-based lighting

- 6.2.2 Traditional

- 6.3 By End-user

- 6.3.1 Commercial Offices

- 6.3.2 Retail

- 6.3.3 Hospitality and Leisure (Restaurants and Sporting facilities)

- 6.3.4 Healthcare

- 6.3.5 Other End-users

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 Rest of the Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Signify NV (Philips Lighting)

- 7.1.2 WAC Lighting

- 7.1.3 Cree Lighting (IDEAL INDUSTRIES INC,)

- 7.1.4 Siteco GmbH

- 7.1.5 Wipro Lighting Limited

- 7.1.6 Acuity Brands Inc.

- 7.1.7 Hubbell Incorporated

- 7.1.8 Zumtobel Group AG

- 7.1.9 ABB

- 7.1.10 Honeywell LED Lighting