|

市场调查报告书

商品编码

1644594

全球汽车 MCU -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Global Automotive MCU - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

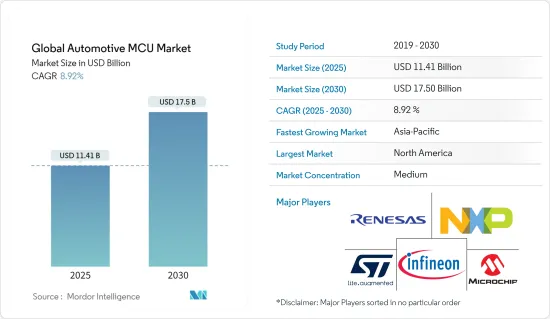

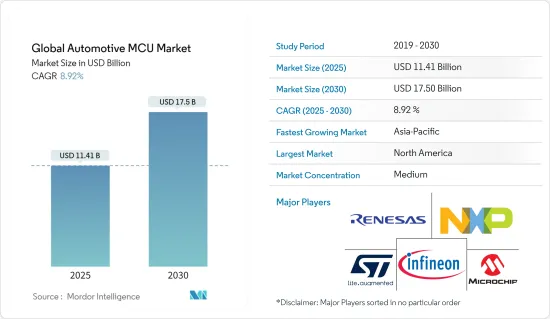

预计2025年全球汽车MCU市场规模为114.1亿美元,预计2030年将达到175亿美元,预测期间(2025-2030年)的复合年增长率为8.92%。

对于能够处理极端操作条件、即使在极端温度下也能提供即时响应和高可靠性、并结合功能安全特性以应对汽车设计挑战的设备的需求不断增长,预计将为研究市场的成长提供丰厚的机会。

关键亮点

- 自动化的进步使得对微控制器处理汽车自动驾驶功能的需求日益增长。 MCU 用于汽车执行自动化功能,例如保持排气系统清洁、为各种车辆部件分配电力以及降低燃料消耗。此外,汽车电气化也带来了对电动车 (EV) 需求进行最佳化的新型专用 MCU 的需求。为了满足电动车需求的激增,市场上的公司正在创新先进产品并投资大规模研发计划。

- 例如,2022 年 2 月,ST 宣布推出针对软体定义电动车优化的新型 Stellar E MCU,为区域架构相关的解决方案提供动力。它基于 32 位元、300 MHz Arm Cortex-M7 核心建构。此 MCU 每个核心具有高达 2MB 的片上快闪记忆体和 16KB 的快取。全新 MCU 是 Stellar 系列的扩展,旨在作为强大的集中式网域区域控制器,简化区域架构车辆的设计和可扩展性。新型 MCU 也旨在让控制碳化硅等宽能带隙电力电子设备变得更加容易,而宽频隙电力电子设备是电动车高效能电力转换的主力。

- 此外,2021 年 7 月,电动马达控制单元製造商 Sterling Gtake E-mobility Ltd. 宣布已从一家领先的电动两轮车製造商订单了价值 60 亿印度卢比的订单。该公司还表示,正在与 20 多家电动车 (EV) 製造商进行讨论,为包括两轮和三轮乘用车和商用车在内的一系列车型提供马达控制单元 (MCU)。

- 同时,就在全球汽车业从新冠疫情导致的销售低迷中復苏之际,新冠疫情危机却为这一復苏带来了阻碍。全球半导体短缺可能会扰乱全球汽车生产并导致新车销售延迟。微控制器是现代资讯娱乐系统、防锁死系统(ABS)、高级驾驶辅助系统(ADAS)和其他电子稳定係统中使用的电控系统的关键组件,目前供不应求,迫使汽车製造商削减产量。因此,汽车製造商会选择性地閒置工厂,直到供不应求缓解。然而,预计不久的将来市场将会迅速发展。

- 此外,汽车 MCU 可能会在极端天气条件下出现故障,再加上设计复杂性,可能会阻碍市场成长。

汽车微控制器市场的趋势

ADAS 需求激增推动市场成长

- 根据世界卫生组织 (WHO) 的数据,道路交通事故每年造成约 130 万人死亡,对大多数国家造成约 3% 的国内生产总值(GDP) 损失。此外,根据国际道路交通安全组织的数据,美国每年有超过 46,000 人死于交通事故。美国的交通死亡率为每十万人12.4人。另有 440 万人伤势严重,需接受治疗。交通事故是美国1至54岁死亡的主要原因。美国也是高所得国家中道路交通事故死亡人数最多的国家,比西欧、加拿大、澳洲和日本等同类国家高出约 50%。

- 配备ADAS(高级驾驶辅助系统)的汽车可以检测和分类道路上的物体,并根据道路状况向驾驶员发出警告。此外,这些系统还可以根据情况自动降低车速。安全关键型 ADAS 应用包括行人侦测和避让、车道偏离警告和纠正、交通标誌识别、自动紧急煞车和盲点侦测。这些救生系统对于确保 ADAS 应用的成功至关重要,它采用了最新的介面标准并运行了多种基于视觉的演算法来支援即时多媒体、视觉协处理和感测器融合子系统。

- 根据国家安全委员会的数据,ADAS 技术每年可防止 20,841 人死亡,约占所有交通事故死亡人数的 62%。高阶驾驶辅助系统 (ADAS) 的出现正在改变设计人员使用、指定和製造微控制器 (MCU) 的方式。 ADAS 的演变和复杂性有望为所研究市场提供创新、合作和技术突破的多种机会。

- 例如,2022年4月,中国智慧汽车微晶片设计公司芯驰科技有限公司推出了E3系列微控制器。这款汽车微控制器采用台积电 22nm 汽车级工艺,可用于许多汽车应用领域,包括线传底盘、煞车控制、BMS、ADAS、LCD 面板、HUD、串流系统和 CMS。它的设计着重高稳定性和安全性。车辆规格为AEC-Q100 Grade 1,功能安全标准为ISO 26262 ASIL D。

- 此外,2022年3月,先进半导体解决方案供应商瑞萨电子宣布扩大与本田在ADAS(高级驾驶辅助系统)领域的合作。本田在其 Honda SENSING Elite 系统采用了瑞萨电子的汽车 SoC(系统单晶片)“R-Car”和汽车 MCU“RH850”。 Honda SENSING Elite(搭载于2021年3月发售的Legend)搭载了符合3级自动驾驶(在限定区域内进行有条件自动驾驶)的先进技术。此外,本田还利用在领先技术研发中获得的知识和技术,将 R-Car 和 RH850 应用于其全方位安全驾驶支援系统「Honda SENSING 360」。

亚太地区:预计市场将实现高成长

- 日益增长的环境问题和政府补贴,加上更好的燃油经济性、改进的性能和实惠的价格,推动了亚太地区混合动力电动车的普及。

- 例如,根据 EV-Volumes.com 的数据,2021 年亚太地区售出了约 672,900 辆插电式混合动力电动车 (PHEV)。与 2020 年相比,这一数字有了很大的增长,当时售出了约 264,260 辆插电式混合动力汽车。汽车需求的增加可能会促进该地区汽车 MCU 製造商的成长。

- 此外,亚太地区正成为半导体和半导体设备製造的重要枢纽。例如,世界半导体贸易统计组织(WSTS)估计,2019年亚太地区(日本除外)半导体产业销售额为2,578.8亿美元,2021年将达到2,908.5亿美元。该地区也是着名电子和汽车製造公司的所在地,为研究市场的发展留下了空间。

- 汽车系统设计的未来在于以车辆为中心、以区域为导向的 E/E 架构,这推动了汽车晶片的需求,以应对这些创新架构为未来汽车带来的挑战。该地区的公司正在推出开创性的解决方案来满足消费者的需求。

- 例如,2021 年 11 月,瑞萨电子株式会社(日本东京)宣布推出 RH850/U2B MCU,这是一组功能强大的新型微控制器 (MCU),旨在满足将多个应用程式整合到单一晶片上的日益增长的需求,并为不断发展的电气电子 (E/E) 架构提供整合电控系统(ECU)。跨域 RH850/U2B MCU 旨在处理车辆动力学所需的苛刻工作负载,例如牵引逆变器、连接网关、高端区域控制以及混合内燃机汽车和 xEV 中的域控制应用。

汽车微控制器产业概况

全球汽车 MCU 市场区隔程度适中,主要企业包括英飞凌科技股份公司、美国微晶片科技公司、恩智浦半导体公司和德州仪器公司。预计市场竞争、消费者偏好的频繁变化以及技术的快速进步将在预测期内对市场成长构成威胁。

- 2022 年 1 月 - 英飞凌科技宣布扩展其 AURIX 微控制器系列,并推出其新型 28nm 微控制器 AURIX TC4x 系列的首批样品,用于下一代电动车、ADAS、汽车 E/E 架构和经济实惠的人工智慧 (AI)。这个新系列为我们的旗舰 AURIX TC3x MCU 系列提供了一条向上迁移路径。它透过下一代 TriCore 1.8 和 AURIX 加速器套件实现了可扩展的效能增强。

- 2021 年 4 月 - 新唐科技公司宣布推出新系列汽车级 Arm Cortex-M0 NUC131U 32 位元微控制器,运行速度高达 50MHz,符合 AEC-Q100 2 级标准,并内建 CAN(控制器区域网路)2.0 B 介面。具有6个UART、2个I2C、1个SPI和24通道100MHz PWM的丰富週边装置,可精确控制步进马达或空调压缩机。 12 位元 ADC 提供高达 800k SPS,可感测汽车应用中的电压、电流或温度感测器,从而减少外部外围元件的数量并减小最终产品的外形规格。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

- 研究框架

- 二次调查

- 初步调查

- 主要研究方法及主要受访者

- 资料三角测量与洞察生成

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 价值链分析

- COVID-19 市场影响评估

- 技术简介

第五章 市场动态

- 市场驱动因素

- 物联网 (IoT) 的出现

- 电动车需求激增

- 汽车资讯娱乐越来越受欢迎

- 市场挑战/限制

- 极端天气条件下发生故障

- 设计复杂性

- 市场机会

- 技术进步与创新

第六章 市场细分

- 按产品

- 8 位元

- 16 位元

- 32 位元

- 按应用

- 动力传动系统和底盘

- 安全与保障

- 车身电子

- 远端资讯处理和资讯娱乐

- 按车型

- 搭乘用车内燃机车

- 商用内燃机汽车

- 电动车

- BEV

- HEV

- PHEV

- FCEV

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 其他的

第七章 竞争格局

- 公司简介

- Infineon Technologies AG

- Microchip Technology Inc.

- NXP Semiconductors

- Renesas Electronics Corporation

- STMicroelectronics

- Texas Instruments Incorporated

- Toshiba Electronic Devices & Storage Corporation

- Analog Devices Inc.

- ROHM Semiconductor

- Broadcom Inc.

第八章投资分析

第九章:市场的未来

The Global Automotive MCU Market size is estimated at USD 11.41 billion in 2025, and is expected to reach USD 17.50 billion by 2030, at a CAGR of 8.92% during the forecast period (2025-2030).

An increased demand for devices designed for extreme operating conditions, providing real-time response and high reliability, even in extreme temperatures, and incorporating features for functional safety to meet automotive design challenges, is expected to offer lucrative opportunities for growth of the studied market.

Key Highlights

- The rise in automation has generated a significant need for microcontrollers responsible for the automatic operation of vehicle functions. MCUs are being used in automobiles to perform automatic functions like keeping the exhaust system clean, distributing electricity to various vehicle components, and reducing fuel consumption. Further, the electrification of vehicles is creating a need for new and specialized MCUs that are optimized for the needs of electric vehicles (EVs). To cater to the upsurge in demand for EVs, companies in the market are innovating advanced products and investing in extensive R&D projects.

- For instance, aiming to keep the impetus going for zonal architecture-related solutions, in February 2022, ST released Stellar E MCUs, a new offering optimized for software-defined EVs Built around 32-bit, 300 MHz Arm Cortex-M7 cores. The MCUs feature up to 2 MB of on-chip Flash and 16 Kbyte of cache per core. The new MCUs, an extension of the Stellar family, are meant to be powerful, centralized domain and zone controllers to simplify design and scalability for a zonal architecture automobile. Also, the new MCUs aim to allow for easy control of wide-bandgap power electronics, such as silicon carbide, which has become a mainstay for efficient power conversion in EVs.

- Additionally, in July 2021, Sterling Gtake E-mobility Ltd, a manufacturer of motor control units for electric vehicles, announced that it had bagged an order worth INR 60 crore from a leading electric two-wheeler maker. The company said it is also in the advanced stages of discussions with over 20 electric vehicle (EV) manufacturers to supply motor control units (MCUs) for different vehicle types, including two-wheelers and three-wheelers passenger vehicles and commercial vehicles.

- On the flip side, as the global automotive sector is recovering from a slump in sales caused by Covid-19, another crisis is dampening its revival. A global semiconductor shortage disrupts global automotive production and may cause a delay in the sales of new vehicles. Microcontrollers, a crucial component of electronic control units used in modern infotainment systems, anti-lock braking systems (ABS), advanced driver assist systems (ADAS), and other electronic stability systems are in short supply forcing carmakers to reduce output. Resultantly, the carmakers are selectively idling plants until the shortage eases. However, the market is expected to make quick progress in the near future.

- Moreover, the possibilities of operational failure of the automotive MCUs in extreme climatic conditions, coupled with their design complexity, might hamper the growth of the studied market.

Automotive Microcontrollers Market Trends

Surging Demand for ADAS is Likely to Drive the Market Growth

- According to World Health Organization (WHO), approximately 1.3 million people die each year due to road traffic crashes which cost most countries approximately 3% of their gross domestic product (GDP). Further, according to Safe International Road Travel, more than 46,000 people die in crashes on U.S. roadways every year. The U.S. traffic fatality rate is 12.4 deaths per 100,000 inhabitants. An additional 4.4 million are injured seriously enough to require medical attention. Road crashes are the leading cause of death in the U.S. for people aged 1-54. Also, the U.S. suffers the most road crash deaths of any high-income country, about 50% higher than similar countries in Western Europe, Canada, Australia, and Japan.

- Vehicles installed with Advanced Driver Assistance Systems (ADAS) can detect and classify objects on the road and alert drivers according to the road conditions. Additionally, these systems can automatically decelerate vehicles, depending on the situation. A few essential safety-critical ADAS applications include pedestrian detection/avoidance, lane departure warning/correction, traffic sign recognition, automatic emergency braking, blind-spot detection, etc. These lifesaving systems are crucial to ensuring the success of ADAS applications, incorporating the latest interface standards, and running multiple vision-based algorithms to support real-time multimedia, vision co-processing, and sensor fusion subsystems.

- According to National Safety Council, ADAS technologies have the potential to prevent 20,841 deaths per year, or about 62% of total traffic deaths. The emergence of advanced driver assistance systems (ADAS) is changing how designers use, specify, and manufacture microcontrollers (MCUs). The evolving and complex nature of ADAS is expected to offer several opportunities for innovation, collaborations, and technological breakthroughs in the studied market.

- For instance, in April 2022, SemiDrive Technology Ltd., a Chinese smart car microchip designer, released its E3 series microcontrollers. The automotive microcontroller adopts a TSMC 22nm automotive grade which can be used in many automotive application fields such as chassis by wire, brake control, BMS, ADAS, LCD panel, HUD, streaming media system, and CMS, among others. It is designed to reach high stability and safety levels. Its vehicle specification is AEC-Q100 Grade 1, and the functional safety standard is ISO 26262 ASIL D.

- Moreover, in March 2022, Renesas Electronics, a supplier of advanced semiconductor solutions, announced the expansion of its collaboration with Honda in the field of advanced driver-assistance systems (ADAS). Honda adopted Renesas' R-Car automotive system on a chip (SoC) and RH850 automotive MCU for its Honda SENSING Elite system. Honda SENSING Elite (featured in the Legend, which went on sale in March 2021) incorporates advanced technology that qualifies for Level 3 automated driving (conditional automated driving in limited areas). Further, Honda has selected R-Car and RH850 for use in the Honda SENSING 360 omnidirectional safety and driver assistance system, which builds on the knowledge and expertise gained through research and development work on the earlier technology.

The Asia Pacific Region is Expected to Witness a High Market Growth

- The growing environmental concerns and rising government subsidy programs, coupled with factors such as better fuel economy, enhanced performance, and reasonable cost, are augmenting the penetration rate of hybrid electric vehicles in the Asia-Pacific region.

- For instance, according to EV-Volumes.com, approximately 672.9 thousand plug-in hybrid electric vehicles (PHEVs) were sold across the Asia-Pacific region in 2021. This was a dramatic increase from 2020 when around 264.26 thousand plug-in hybrid electric vehicles were sold. The increasing demand for these vehicles is likely to boost the maker growth of automotive MCUs in the region.

- Further, the Asia Pacific has emerged as a significant hub for manufacturing semiconductors and semiconductor-based devices. For instance, according to World Semiconductor Trade Statistics (WSTS) estimates, the semiconductor industry revenue in the Asia Pacific region (excluding Japan) was USD 257.88 billion in 2019 and USD 290.85 billion in 2021. The region is also home to prominent electronics and automotive manufacturing companies, thus, offering scope for the evolution of the studied market.

- The future of automotive system design lies in a vehicle-centralized, zone-oriented E/E architecture, which heightens the need for automotive chips that address the challenges these innovative architectures create for future vehicle generations. The companies in the region are launching advanced solutions to cater to the needs of their consumers.

- For instance, in November 2021, Renesas Electronics Corporation (Tokyo, Japan) introduced a powerful new group of microcontrollers (MCUs), the RH850/U2B MCUs, designed to address the growing need to integrate multiple applications into a single chip and realize a unified electronic control unit (ECU) for the evolving electrical-electronic (E/E) architecture. Delivering a combination of flexibility, high performance, freedom from interference, and security, the cross-domain RH850/U2B MCUs are built for the rigorous workloads required by vehicle motion in terms of hybrid ICE and xEV traction inverter, connected gateway, high-end zone control, and domain control applications.

Automotive Microcontrollers Industry Overview

The global automotive MCU market is moderately fragmented with the presence of prominent players like Infineon Technologies AG, Microchip Technology Inc., NXP Semiconductors, Texas Instruments Incorporated, etc. The competition, frequent changes in consumer preferences, and rapid technological advancements are expected to pose a threat to the market's growth during the forecast period.

- January 2022 - Infineon Technologies announced the extension of its AURIX microcontroller family and the availability of the first samples of its new AURIX TC4x family of 28nm microcontrollers for next-generation eMobility, ADAS, automotive E/E architectures, and affordable artificial intelligence (AI) applications. The new family delivers an upward migration path for the company's leading AURIX TC3x MCU family. It features the next-generation TriCore 1.8 and scalable performance enhancements from the AURIX accelerator suite.

- April 2021 - Nuvoton Technology Corporation launched a new series of Arm Cortex-M0 NUC131U 32-bit microcontrollers for automotive applications, running up to 50 MHz, qualified by AEC-Q100 Grade 2 and build-in Controller Area Network (CAN) 2.0 B interface. It is equipped with a rich peripheral comprising six sets of UARTs, two sets of I2Cs, 1 set of SPI, and 24 channels of 100 MHz PWM to make accurate control to drive both stepping motor or HVAC compressor. 12-bit ADC delivers up to 800 k SPS to sense voltage, current, or temperature sensors for automotive applications to reduce the number of external peripheral components and the form factor of the end product.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption And Market Defination

- 1.2 Scope of the study

2 RESEARCH METHODOLOGY

- 2.1 Research Framework

- 2.2 Secondary Research

- 2.3 Primary Research

- 2.4 Primary Research Approach And Key Respondents

- 2.5 Data Triangulation And Insight Generation

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power Of Suppliers

- 4.2.2 Bargaining Power Of Buyers

- 4.2.3 Threat Of New Entrants

- 4.2.4 Threat Of Substitutes

- 4.2.5 Intensity Of Competitive Rivalry

- 4.3 Value Chain Analysis

- 4.4 Assessment of the Impact of Covid-19 on the Market

- 4.5 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Emergence of Internet of Things (IoT)

- 5.1.2 Surge in demand for electronic vehicles (Evs)

- 5.1.3 Increasing popularity of infotainment in automobiles

- 5.2 Market Challenges/Restraints

- 5.2.1 Operational failure in extreme climatic conditions

- 5.2.2 Design Complexity

- 5.3 Market Opportunities

- 5.3.1 Technological Advancements and Innovations

6 MARKET SEGMENTATION

- 6.1 Segmentation - By Product

- 6.1.1 8-bit

- 6.1.2 16-bit

- 6.1.3 32-bit

- 6.2 Segmentation - By Application

- 6.2.1 Powertrain and Chassis

- 6.2.2 Safety and Security

- 6.2.3 Body Electronics

- 6.2.4 Telematics and Infotainment

- 6.3 Segmentation - By Vehicle Type

- 6.3.1 Passenger ICE vehicle

- 6.3.2 Commercial ICE vehicle

- 6.3.3 Electric Vehicle

- 6.3.3.1 BEV

- 6.3.3.2 HEV

- 6.3.3.3 PHEV

- 6.3.3.4 FCEV

- 6.4 Segmentation - By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Infineon Technologies AG

- 7.1.2 Microchip Technology Inc.

- 7.1.3 NXP Semiconductors

- 7.1.4 Renesas Electronics Corporation

- 7.1.5 STMicroelectronics

- 7.1.6 Texas Instruments Incorporated

- 7.1.7 Toshiba Electronic Devices & Storage Corporation

- 7.1.8 Analog Devices Inc.

- 7.1.9 ROHM Semiconductor

- 7.1.10 Broadcom Inc.