|

市场调查报告书

商品编码

1437336

日本网路安全市场:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Japan Cybersecurity - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

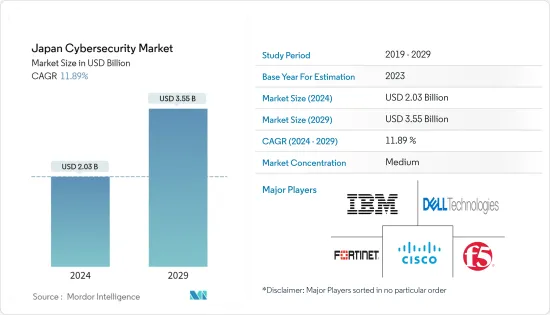

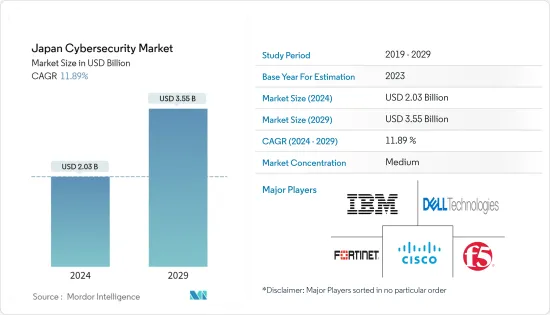

日本网路安全市场规模预计2024年为20.3亿美元,预计到2029年将达到35.5亿美元,在预测期内(2024-2029年)增长11.89%,以复合年增长率增长。

由于新型冠状病毒感染疾病(COVID-19)的爆发,日本企业不得不应对前所未有的勒索软体攻击激增,而自 2020 年初以来,日本企业已转向在家工作,作为应对新冠病毒的对策—— 19. 例如,业务运作关闭,电脑和电子邮件系统被关闭。企业,尤其是那些拥有关键基础设施或与关键基础设施相关的企业,意识到网路安全带来的威胁,并正在投资政府并与政府合作以保护其模型。

主要亮点

- 日本政府和企业对网路安全的兴趣正在迅速增加。针对日本组织的网路攻击的增加促使政府制定新的法律、策略和设施。

- 据国家资讯通讯技术研究所称,针对物联网设备的网路攻击正在显着增加。儘管智慧型手机的普及以及各种电子设备与互联网的日益连接使生活变得更加方便,但人们每天都面临着电脑病毒和资讯盗窃的风险。

- 日本寻求与各国进行双边合作,落实网路安全优先事项,包括与美国国土安全部达成协议,以改善和合作遏制各国政府面临的网路威胁。

- 此外,2021年7月,日本政府制定了未来三年新的网路安全战略,明确指出中国和俄罗斯政府涉嫌参与网路攻击,并呼吁加强阻碍力。日本政府表示,中国进行网路攻击的目的似乎是窃取军事相关企业和拥有先进技术的企业的讯息,而俄罗斯则涉嫌出于军事和政治目的进行网路攻击。

- 此外,日本经济产业省 (METI) 的一份报告显示,IT 专业人员短缺 22 万名,预计到 2025 年将增加到 36 万名。合格工程师、网路专家和安全管理员的短缺增加了对安全管理员为日本中小企业提供承包网路安全解决方案的需求。

日本网路安全市场趋势

资料安全预计将获得显着的市场占有率

- 金融部门被认为是实施适当资讯和资料安全标准的法规结构的最佳采用者。这些确保可靠地提供产品和服务、我们的系统安全地处理资料以及负责任地使用个人资料。

- 资料安全降低了与保护敏感资料免受威胁相关的风险,并帮助组织保持合规性。资料安全平台提供资料风险分析、资料监控和保护解决方案,以保护组织的资料免受资料库漏洞等的影响。

- 透过使用网路安全解决方案以及安装防毒和反间谍软体程式等软体来加强政府对资料安全的要求和规范,预计将在未来几年为网路解决方案创造利润丰厚的机会。

- 此外,合规性预计将成为预防资料外泄解决方案的关键驱动因素。然而,随着企业数位转型策略的实施,特别是云端采用、巨量资料分析和物联网,该地区的企业安全团队现在正在寻求识别和分类关键资料,并在整个组织中重新分配资料安全性。现在正在采用这些产品。管理主要基于资讯的重要性。

BFSI 预计将获得显着的市场占有率

- BFSI 行业是关键基础设施行业之一,由于其庞大的客户群和麵临风险的财务信息,面临多次资料外洩和网路攻击。

- 凭藉相对较低的风险和可检测性,以及可带来惊人利润的高利润营运模式,网路犯罪分子优化了许多邪恶的网路攻击,以削弱金融部门。我就是。这些攻击的威胁形势多种多样,包括木马、恶意软体、ATM 恶意软体、勒索软体、行动银行恶意软体、资料外洩、组织入侵、资料窃取和财务外洩。

- 透过制定保护 IT 流程和系统、保护客户关键资料并遵守政府法规的策略,公共和私人银行都致力于实施最新技术来防止网路攻击。此外,客户期望的提高、技术力的提高和监管要求正迫使银行机构采取主动的安全方法。

- 科技的日益普及,与网路银行业务和行动银行等数位管道结合,使网路银行业务成为客户首选的银行服务。银行非常需要利用复杂的身份验证和存取控制流程。

日本网路安全产业概况

日本网路安全市场与大量区域和全球参与者竞争中等。主要企业包括IBM公司、思科系统公司、戴尔技术公司、Intel Security(英特尔公司)等。

- 2022 年 7 月 - 川崎汽船株式会社(K Line)宣布推出基于人工智慧的网路安全平台。该公司引进了Cybereason Japan Corp.的产品“Cybereason”,并采用该公司的监控和分析服务“Cybereason MDR(託管检测和响应)”,以确保其船舶的网路安全的船岸通讯。管理得到加强。

- 2022 年 5 月 - 透过将云端服务确定为经济安全的优先事项,日本旨在减少对大型云端服务供应商的依赖。该国希望该计划能够支持国内供应商在国际公司主导的市场中的发展。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 价值链分析

- 波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌意强度

- COVID-19 对市场的影响

第五章市场动态

- 市场驱动因素

- 对数位化和可扩展IT基础设施的需求不断增长

- 需要因应各种趋势带来的风险,包括第三方供应商风险、MSSP 演变以及云端优先策略的采用

- 市场限制因素

- 网路安全专家短缺

- 高度依赖传统身分验证方法且尚未准备好

- 趋势分析

- 泰国组织越来越多地利用人工智慧来增强网路安全战略

- 转向云端基础的交付模式将导致云端安全性呈指数级增长。

第六章市场区隔

- 按报价

- 安全类型

- 云端安全

- 资料安全

- 身分存取管理

- 网路安全

- 消费者安全

- 基础设施保护

- 其他的

- 服务

- 安全类型

- 按发展

- 云

- 本地

- 按最终用户

- BFSI

- 卫生保健

- 製造业

- 政府/国防

- 资讯科技/通讯

- 其他的

第七章 竞争形势

- 公司简介

- IBM Corporation

- Cisco Systems Inc

- Dell Technologies Inc.

- Fortinet Inc.

- Intel Security(Intel Corporation)

- F5 Networks, Inc.

- AVG Technologies

- FireEye Inc.

- Fujitsu

第八章投资分析

第9章 市场的未来

The Japan Cybersecurity Market size is estimated at USD 2.03 billion in 2024, and is expected to reach USD 3.55 billion by 2029, growing at a CAGR of 11.89% during the forecast period (2024-2029).

With the outbreak of Covid-19 companies in Japan had to tackle an unprecedented spike in ransomware attacks, which suspended business operations and disabled computer and email systems just as Japanese companies shifted to teleworking as a countermeasure against COVID-19 since the start of 2020. Businesses, especially those who own or are related to critical infrastructure, are realizing that the threats posed by cybersecurity and are investing and working with the government to safeguard their models.

Key Highlights

- Cybersecurity is rapidly gaining interest from the Japanese government and enterprises. The increase in cyberattacks on Japanese organizations is prompting the government to establish new legislation, strategies, and facilities.

- According to the National Institute of Information and Communication Technology, there has been a significant increase in the number of cyberattacks on IoT devices. The widespread use of smartphones and the increasing connection of various electrical devices to the Internet have made life more convenient and exposes people to the daily risk of computer viruses and information theft.

- Japan is seeking bilateral cooperation with countries to operationalize its cybersecurity priorities, such as the agreement with the US Department of Homeland Security, to improve and collaborate on curbing cyber threats faced by the governments.

- Further, in July 2021, the Japanese government compiled a new cybersecurity strategy for the next three years stating for the suspected involvement of the Chinese and Russian governments in cyberattacks and calling for enhanced deterrence. Japan's Government stated that China is believed to be conducting cyberattacks to steal information from firms linked to the military and others with advanced technologies, while Russia is suspected of carrying them out for military and political purposes.

- Additionally, a report by Japan's Ministry of Economy, Trade and Industry (METI) identified a shortage of IT professionals at 220,000, which is expected to increase to 360,000 in 2025. This shortage of capable engineers, cyber experts, and security managers has led to an increase in demand of security managers to provide turn-key cybersecurity solutions for small-and-medium-sized enterprises in Japan.

Japan Cybersecurity Market Trends

Data Security Expected to Witness Significant Market Share

- The financial sector has been recognized as a prime adopter of regulatory frameworks to implement adequate information and data security standards. These ensure a reliable provision of products and services, safe processing of data by its systems, and responsible use of personal data.

- Data Security helps reduce risks associated with protecting sensitive data from threats and help organizations maintain compliance. The data security platform provides data risk analytics, data monitoring and protection solutions, and protects the organization's data from database vulnerability, etc.

- An increase in government mandates and norms regarding data security, by using cybersecurity solutions and installing software, such as antivirus and antispyware programs, is anticipated to generate lucrative opportunities for cyber solutions in the coming years.

- Further, compliance is expected to be the key driver of Data Loss Prevention solutions. However, an enterprise's digital transformation strategies, most notably, cloud adoption, Big Data analytics, and IoT enablement, are also driving enterprise security teams in the region to adopt these products in order to identify and classify crucial data throughout the organization, andreallocate data security controls primarily based on the criticality of the information.

BFSI Expected to Witness Significant Market Share

- The BFSI industry is one of the critical infrastructure segments that face multiple data breaches and cyber-attacks, owing to the massive customer base that the sector serves and the financial information that is at stake.

- Being a highly lucrative operation model that has phenomenal returns along with the added upside of relatively low risk and detectability, cybercriminals are optimizing a plethora of diabolical cyberattacks to immobilize the financial sector. These attacks' threat landscape ranges from Trojans, malware, ATM malware, ransomware, mobile banking malware, data-breaches, institutional invasion, data thefts, fiscal breaches, etc.

- With a strategy to secure their IT processes and systems, secure customer critical data, and comply with government regulations, both public and private banking institutes are focusing on implementing the latest technology to prevent cyber attacks. Besides, with greater customer expectations, rising technological capabilities, and regulatory requirements, banking institutions are pushed to adopt a proactive security approach.

- With the growing technological penetration, coupled with the digital channels, such as internet banking, mobile banking, etc., online banking has become the preferred choice of customers for banking services. There is a significant need for banks to leverage advanced authentication and access control processes.

Japan Cybersecurity Industry Overview

The Japan Cybersecurity Market is moderately competitive, with a considerable number of regional and global players. Key players include IBM Corporation, Cisco Systems Inc., Dell Technologies Inc., Intel Security (Intel Corporation) among others

- July 2022 - Kawasaki Kisen Kaisha, Ltd. (K Line) announced an AI-based cyber security platform. The company installed Cybereason, a product of Cybereason Japan Corp., and adopted the company's monitoring and analysis service, Cybereason MDR (Managed Detection & Response), to improve the cyber security ship-shore communication in the ships that the organization manages.

- May 2022 - By identifying cloud services as a priority for economic security, Japan aims to decrease its dependency on big cloud service providers. The country expects that the program will support the development of domestic suppliers in a market dominated by international firms.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain Analysis

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of Covid-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Digitalization and Scalable IT Infrastructure

- 5.1.2 Need to tackle risks from various trends such as third-party vendor risks, the evolution of MSSPs, and adoption of cloud-first strategy

- 5.2 Market Restraints

- 5.2.1 Lack of Cybersecurity Professionals

- 5.2.2 High Reliance on Traditional Authentication Methods and Low Preparedness

- 5.3 Trends Analysis

- 5.3.1 Organizations in Thailand increasingly leveraging AI to enhance their cyber security strategy

- 5.3.2 Exponential Growth to be Witnessed in Cloud Security owing to Shift toward Cloud-based Delivery Model.

6 MARKET SEGMENTATION

- 6.1 By Offering

- 6.1.1 Security Type

- 6.1.1.1 Cloud Security

- 6.1.1.2 Data Security

- 6.1.1.3 Identity Access Management

- 6.1.1.4 Network Security

- 6.1.1.5 Consumer Security

- 6.1.1.6 Infrastructure Protection

- 6.1.1.7 Other Types

- 6.1.2 Services

- 6.1.1 Security Type

- 6.2 By Deployment

- 6.2.1 Cloud

- 6.2.2 On-premise

- 6.3 By End User

- 6.3.1 BFSI

- 6.3.2 Healthcare

- 6.3.3 Manufacturing

- 6.3.4 Government & Defense

- 6.3.5 IT and Telecommunication

- 6.3.6 Other End Users

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Cisco Systems Inc

- 7.1.3 Dell Technologies Inc.

- 7.1.4 Fortinet Inc.

- 7.1.5 Intel Security (Intel Corporation)

- 7.1.6 F5 Networks, Inc.

- 7.1.7 AVG Technologies

- 7.1.8 FireEye Inc.

- 7.1.9 Fujitsu