|

市场调查报告书

商品编码

1437338

商业软体:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Business Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

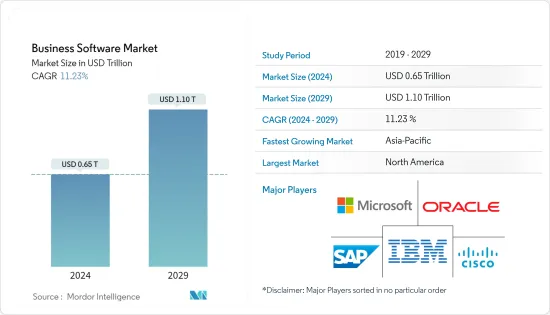

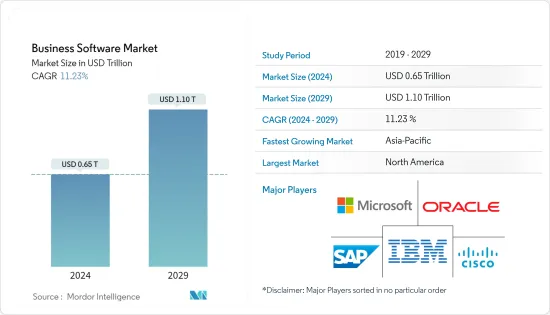

商业软体市场规模预计到 2024 年将达到 6,500 亿美元,预计到 2029 年将达到 1.1 兆美元,在预测期内(2024-2029 年)复合年增长率为 11.23%。

主要亮点

- 业务中越来越多地采用数位化、云端技术进步、多通路接触点快速整合到单一平台、企业资源使用管理,以及对获取洞察以增加企业收益的巨大需求。对大型数据进行分析的需求日益增长大量的业务资料是推动商业软体市场的一些关键因素。

- 商业软体是为执行特定的创造性、财务和日常业务任务而创建和设计的程式和功能的集合。这主要用于自动化公司流程。我们帮助企业和小型企业主开发、行销、销售、管理和扩展他们的公司。

- 在商业中使用软体至关重要,因为它有助于规划和设计、快速决策、采用尖端技术、客户协助、资料分析和供应链管理策略,从而促进公司扩张。

- 库存和原材料价格的大幅降低是使用企业解决方案的另一个好处,使企业能够提高盈利。许多公司正在实施业务解决方案,透过将管理流程整合到单一软体中来提高业务效率。业务解决方案模组整合部门资料并即时更新,提高资料透明度。企业选择最适合其需求的软体和解决方案。

- 不断上升的许可成本和对及时援助的需求可能会阻碍市场成长。值得注意的是,解决方案授权费不仅涵盖软体开发成本。这还包括存取和使用该解决方案的授权费用。典型的软体定价包括解决方案的维护和支援成本,进一步的整合和客製化通常会增加维护和支援费用。

- COVID-19 大流行加速了数位化,增加了资料收集,并需要资料分析。适应远距工作环境也促进了数位化。此外,这种流行病迫使世界各地的企业立即执行一些基本形式的云端迁移。

商业软体市场趋势

云端预计将占据很大份额

- 云端服务在世界各地广泛使用,因为它们消除了手动升级软体的需要,并允许客户轻鬆地从远端位置存取资料。云端基础的服务仅使用您实际需要的资源,使您的企业能够更有效地运作,同时减少能源使用。

- 此外,政府法规鼓励企业使用云端基础的服务来减少碳排放,预计这将改善该行业的成长前景。此外,云端基础的订阅价格非常实惠,因此混合云端的采用预计在预期期间将变得更加普及。

- 云端运算允许企业从任何有网路连线的地方存取资讯。透过云端运算,资料可以在线上存储,而不是储存在您的电脑或职场的伺服器上。这是云端运算对小型企业的主要好处。

- 云端运算是一项新兴技术,允许企业在线上存取和储存资料。云端技术的重要特征包括弹性、扩充性、可靠性和敏捷性。根据使用情况向使用者申请的云端运算服务模式包括软体即服务 (SaaS) 和按需模式。云端基础的应用程式在一定程度上降低了公司的IT基础设施成本。这是企业采用更多云端基础的应用程式的关键驱动力。

预计北美市场将显着成长

- 该地区商业软体市场的扩张是由于对高速资料网路的需求不断增长以及该地区软体供应商的不断增长所推动的。对于区域供应商来说,为了满足供应链映射、供应商风险评估、交易可追溯性、诈欺侦测、弹性规划、即时视觉化和消费者透明度等各种业务需求,需要供应链管理。

- 此外,北美公司正在优先考虑基于软体和分析的措施。该地区还拥有大量致力于企业解决方案和服务的软体工程师、资料分析师和电脑科学家。由于对高速资料网路的需求不断增长以及该地区软体供应商的强大存在,商业软体和服务市场在预测期内可能会成长。

- 大量中小企业 (SME) 的存在、尖端技术的高采用率以及容易获得具有足够专业知识的合格劳动力等可变因素将维持该地区的发展。

- 全球范围内也正在发生策略联盟和收购,以便从对企业软体解决方案不断增长的需求中受益。例如,会计软体供应商 IRIS Software Group 于 2022 年 7 月宣布收购 Doc。该公司向北美的註册会计师 (CPA) 公司提供文件管理软体。此次收购将使税务专业人士和会计师能够专注于发展业务和提供付加客户服务,而註册会计师事务所将能够减少管理业务并提高生产力。

商业软体产业概况

全球商业软体市场适度分散。该市场由微软公司、国际商业机器公司、甲骨文公司和SAP SE等主要企业组成。

2023 年 2 月,思科系统公司宣布了云端管理网路的新创新,兑现了帮助客户简化 IT 营运的承诺。适用于工业物联网(IoT) 应用的强大全新云端管理工具、用于统一IT 和OT 运营的简化仪表板以及查看和保护所有工业资产的灵活性借助先进的网络智能,思科可提供统一的体验,从而实现真正的业务敏捷性。

2023年2月,微软将ChatGPT等技术合併到其搜寻引擎Bing中,将一项远远落后于Google的网路服务变成了与人工智慧(AI)通讯的新方式。随着第二大微软搜寻引擎的改进,这家软体巨头正在利用全世界对ChatGPT 的兴奋,该工具已经唤醒了数百万人对最新人工智慧技术潜力的认识,并正在寻求将其搜寻引擎扩展到其他高端领域。科技公司。您也许能够在与公司的竞争中占据先机。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌意强度

- 评估 COVID-19 对市场的影响

第五章市场动态

- 市场驱动因素

- 基于云端和网路的进步

- 中小企业需求不断扩大

- 市场挑战

- 与网路攻击和资料外洩相关的安全问题

第六章市场区隔

- 依软体类型

- ERP软体

- 客户关係管理软体

- 商业智慧软体

- 供应链软体

- 按发展

- 云

- 本地

- 最终用户产业

- BFSI

- 卫生保健

- 公共/机构

- 零售

- 运输

- 製造业

- 其他(通讯、国防等)

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争形势

- 公司简介

- Microsoft Corporation

- International Business Machines Corporation

- Oracle Corporation

- SAP SE

- Cisco Systems Inc.

- Epicor Software Corporation

- Infor

- NetSuite Inc.

- Accenture PLC

- Deltek Inc.

第八章投资分析

第9章市场的未来

The Business Software Market size is estimated at USD 0.65 trillion in 2024, and is expected to reach USD 1.10 trillion by 2029, growing at a CAGR of 11.23% during the forecast period (2024-2029).

Key Highlights

- Increasing business adoption of digitalization, technological advancements in the cloud, the quick integration of multichannel touchpoints into a single platform, managing the company's resource usage, and the growing need to analyze vast amounts of business data to derive insights that can boost the company's revenue are some of the key factors driving the business software market.

- Business software is a collection of programs and features created and designed to carry out particular creative, financial, and everyday business tasks. It primarily serves to automate corporate processes. It aids corporations and proprietors of small businesses in developing, marketing, selling, managing, and expanding their companies.

- The use of software in business is essential since it facilitates planning and design, quick decision-making, adoption of cutting-edge technologies, customer assistance, data analysis, and supply chain management strategies that will hasten the expansion of the company.

- A significant decrease in inventory and raw materials price is another benefit of using enterprise solutions, which enables firms to increase their profitability. Many firms are deploying business solutions to boost their operational efficiency by integrating administrative processes into a single piece of software. Business solution modules integrate departmental data to real-time updates, improving data transparency. Businesses pick the software and solutions that best meet their needs.

- Higher authorization costs and the necessity for prompt help could impede the market's growth. It is important to note that the licensing fee for a solution does not solely cover the cost of software development; it also includes the licensing fee for accessing and utilizing the solution. The usual software price includes the cost of solution maintenance and support, and further integration and customizing frequently result in increased maintenance and support charges.

- The COVID-19 pandemic hastened digitalization, increasing data collecting and necessitating data analysis. Adapting to the remote-working environment also enhanced digitalization. Additionally, the pandemic has forced companies worldwide to implement fundamental forms of cloud migration immediately.

Business Software Market Trends

Cloud is Expected to Hold Significant Share

- Cloud services are widely used globally since manual software upgrades are no longer required, and clients can easily access data from remote locations. Cloud-based services enable businesses to function more effectively while using less energy because they only use the resources they actually need.

- Additionally, businesses are encouraged to use cloud-based services by government rules to reduce carbon emissions, which is anticipated to improve the segment's growth prospects. Furthermore, because cloud-based subscriptions are so reasonably priced, hybrid cloud deployment is expected to become more widespread during the projected period.

- Cloud computing allows businesses to access information from any location with an internet connection. With cloud computing, data is stored online rather than on your computer or a server at your place of business. It is the main advantage of cloud computing for smaller companies.

- A developing technology, cloud computing enables businesses to access and store data online. Among the key attributes of cloud technology are flexibility, scalability, reliability, and agility. Some of the cloud computing service models, where users are charged based on their consumption, include software-as-a-service (SaaS) and on-demand. Cloud-based apps somewhat reduce the expense of the company's IT infrastructure. This is the main factor driving businesses to adopt more cloud-based apps.

North America is Expected to Witness Significant Growth in the Market

- The expansion of the business software market in this region is being fueled by the increased need for high-speed data networks and the substantial presence of software vendors in the area. For the regional vendors to meet various business requirements, such as supply chain mapping, supplier risk assessment, transaction traceability, fraud detection, resilience planning, real-time visualization, and consumer-facing transparency, supply chain management is required.

- Additionally, software and analytics-based initiatives are given priority by North American firms. There are also many software engineers, data analysts, and computer scientists in the area who deal with enterprise solutions and services. Due to the expanding need for high-speed data networks and the significant presence of software providers in the region, the market for business software and services may grow over the projection period.

- Due to variables, including the presence of a sizable number of small and medium-sized enterprises (SMEs), a high adoption rate for cutting-edge technology, and the accessibility of a qualified workforce with sufficient domain knowledge, the region is anticipated to maintain its supremacy over the projection period. Regional expansion is also predicted to be fueled by SMBs' rising desire for cloud-based business management software as a result of affordability difficulties over the forecast period.

- Strategic alliances and acquisitions are also occurring on a worldwide level to benefit from the rising demand for corporate software solutions. For instance, IRIS Software Group, a provider of accounting software, announced the acquisition of Doc in July 2022. It is a supplier of document management software to certified public accountant (CPA) companies in North America. Tax experts and accountants will be able to concentrate on expanding their businesses and offering value-added customer services thanks to the acquisition, which will enable CPA firms to decrease administrative duties and increase productivity.

Business Software Industry Overview

The global business software market is moderately fragmented. The market consists of major players, such as Microsoft Corporation, International Business Machines Corporation, Oracle Corporation, and SAP SE.

In February 2023, Cisco Systems announced new innovations in cloud-managed networking, delivering on its promise to help customers simplify their IT operations. With powerful new cloud management tools for industrial Internet of Things (IoT) applications, simplified dashboards to converge IT and OT operations, and flexible network intelligence to see and secure all industrial assets, Cisco delivers a unified experience that provides true business agility.

In February 2023, Microsoft fused ChatGPT-like technology into its search engine Bing, transforming an Internet service that trails far behind Google into a new way of communicating with artificial intelligence (AI). The revamping of Microsoft's second-place search engine could give the software giant a head start against other tech companies in capitalizing on the worldwide excitement surrounding ChatGPT, a tool that's awakened millions of people to the possibilities of the latest AI technology.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 An Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Cloud & Networking-Based Advancements

- 5.1.2 Growing Demand from SMEs

- 5.2 Market Challenges

- 5.2.1 Security Concerns Related to Cyber Attacks and Data Breaches

6 MARKET SEGMENTATION

- 6.1 By Software Type

- 6.1.1 ERP Software

- 6.1.2 CRM Software

- 6.1.3 BI Software

- 6.1.4 Supply chain Software

- 6.2 By Deployment

- 6.2.1 Cloud

- 6.2.2 On-Premise

- 6.3 By End-User Vertical

- 6.3.1 BFSI

- 6.3.2 Healthcare

- 6.3.3 Public & Institutions

- 6.3.4 Retail

- 6.3.5 Transportation

- 6.3.6 Manufacturing

- 6.3.7 Other End-User Verticals (Telecom, Defense, etc.)

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Microsoft Corporation

- 7.1.2 International Business Machines Corporation

- 7.1.3 Oracle Corporation

- 7.1.4 SAP SE

- 7.1.5 Cisco Systems Inc.

- 7.1.6 Epicor Software Corporation

- 7.1.7 Infor

- 7.1.8 NetSuite Inc.

- 7.1.9 Accenture PLC

- 7.1.10 Deltek Inc.