|

市场调查报告书

商品编码

1437480

工业固定设备:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Industrial Static Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

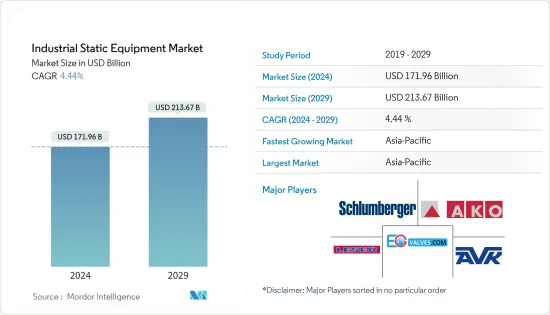

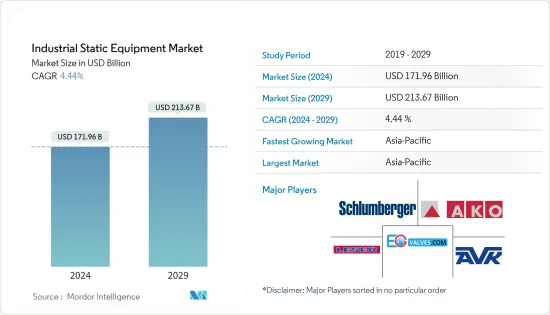

工业固定设备市场规模预计到2024年为1719.6亿美元,预计到2029年将达到2136.7亿美元,在预测期内(2024-2029年)增加44.4亿美元,复合年增长率为%。

世界原油和其他碳氢化合物生产的显着进步导致石油和天然气探勘和精製的增加。随着汽车、医药、通讯、製造等各行各业的革命,大规模工业化、都市化,石油已成为发展的重要因素。

主要亮点

- 本研究提供的市场数据代表了阀门、熔炉/锅炉、热交换器、压力容器等类型的静态工业设备的总体销售。其他市场是最终用户产业,代表多个产业中多种类型静态工业设备的销售,例如石油和天然气、发电、化学和石化、水和废水处理、其他製程工业以及其他离散製造业。也分为。行业。

- 食品饮料产业也是静态设备需求预计进一步成长的重点产业之一。食品加工和食品消费量的增加是该行业成长的主要贡献者之一。根据美国人口普查局的数据,2022年5月至2022年7月零售和食品服务总销售额年增9.2%。

- 石油和天然气产业对几乎所有产业的成长做出了重大贡献。这是因为任何工业设施的运作都需要电力,而在最近可再生资源的开发之前,电力主要由石油和天然气提供。

- 石油和天然气行业是锅炉、熔炉、管道和阀门等静态工业设备的主要消费者之一,因为整个石油探勘和生产活动涉及在不同地点进行的多个流程。

- 冠状病毒感染疾病(COVID-19)的爆发对工业部门的成长产生了重大影响,进而影响了所研究市场的成长。根据欧盟统计局的数据,2020年欧盟工业生产下降了7%。生产活动的下降对关键工业固定设备的需求产生了负面影响,因为关键产业克制了进一步的扩张活动和对新设施的投资。设施。

工业固定设备市场趋势

快速工业化推动市场成长

- 自工业革命开始以来,工业部门一直是世界经济繁荣的引擎。根据世界银行预计,2021年製造业对全球经济付加价值约为17.01%。工业部门预计将在增加工业产品需求方面发挥作用,并透过其产出刺激其他产业的成长。它将在预测期内推动工业部门的发展。

- 锅炉、阀门、热交换器、熔炉等静态工业设备对于帮助实现工业设施内的运营目标发挥着至关重要的作用,因此这些设备也与工业设施有直接的联繫。考虑到两者之间的相关性,我们预期它们将遵循类似的成长模式。

- 工业部门一直是美国、中国、日本等主要经济发达国家的支柱。例如,根据联合国统计司(UNSD)提供的资料,美国、日本、德国的付加分别为22720亿美元、10336亿美元和6973亿美元。随着这些国家为加强工业部门而增加投资和建立配套法规,预计在预测期内对静态工业设备的需求也将进一步增加。

- 此外,亚太地区是工业领域的主要参与者,有利的政府法规、大量人口和低成本劳动力吸引了全球公司落脚该地区,预计将成为成长领头羊。中国、台湾和印度等国家是跨国公司最喜欢的目的地之一。例如,根据产业内贸易促进部(DPIIT)的数据,2021-22财年印度收到的外国直接投资(FDI)总额为587.7亿美元,其中汽车行业收到了相当数量的FDI .. 32.84,化学製造业完成194.5亿美元。医药业实际吸收外资194.1亿美元。

- 其他国家也观察到类似的趋势。例如,2022年9月,马来西亚投资发展局(MIDA)宣布,2022年上半年政府在製造业、服务业和一级产业吸引了价值275亿美元的投资核准。

亚太地区预计将成为成长最快的市场

- 预计,由于投资增加、政府采取更强有力的措施加强基础设施和促进液化天然气探勘,以及在该地区包括中国和印度在内的增长中国家开展业务的重要公司的存在,亚太市场预计将快速发展。例如,2021 年 1 月,古尔冈大都会发展局 (GMDA) 在 Vasai 和 Dhanwapur 周围的约 10 个地点启动了水资源管理技术试点计划。该计划的目标是监测、控制和调节城市地下水箱的流量。地下储槽将配备流量控制阀、超音波流体流量计和位准计。

- 中国在石油和天然气探勘方面的支出使其成为亚太地区石油和天然气生产的先驱。印度的石油钻井平台数量最多,其次是印度,该国也在稳步改善。此外,许多研究机构正在多个国家进行研发工作,以提高设备性能并鼓励对该行业的投资。例如,中国计划在2022年3月投资815亿元用于上游开发,特别是顺北地区和大河地区的原油基地以及四川和内蒙古地区的天然气资源。石油和天然气探勘需求的增加将增加对静态设备的需求,推动市场成长。

- 亚太地区是一些世界领先的止回阀製造商的所在地。对更安全应用的需求不断增加,以及与自动阀门相关的研发力度不断加大,是推动亚太地区工业发展的一些关键因素。此外,工业研究,特别是在中国,扩大了阀门在能源电力、化学等许多领域的应用范围。止回阀应用于能源电力、石油天然气、水和废水处理等领域,调节整个网路中的介质流量,以启动、停止或控制运动,以实现安全有效的製程自动化。

- 该地区人口集中、消费者收入高、工业规模大、都市化程度不断提高,是该地区工业阀门扩张的重要驱动力。印度、中国和东南亚国家是该地区成长最快的经济体。该地区不断增长的大都会人口迫切需要现代化和强化的污水处理设施。

- 加强水和污水管理技术的需求不断增加、政府对污水处理的措施不断增加,以及对适当用水的需求不断增长,正在推动亚太地区对静态设备的需求。

工业固定设备产业概况

工业固定设备市场处于适度高位,预计在预测期内保持不变。斯伦贝谢有限公司、AKO Armaturen&Separationstechchink GMBH、AVK Group、EG Valves LeserGMBH &CO. KG 等领先公司也正在建立合作伙伴关係并推出新产品,以维持其市场地位。

- 2022 年 7 月 - 阿法拉伐与瑞典全球钢铁公司 SSAB 合作开发和商业化世界上第一个由无化石钢製成的热交换器。目标是到 2023 年建造第一座氢还原钢装置。此次合作也是阿法拉伐实现 2030 年碳中和目标的重要一步。

- 2022 年 3 月 - AVK 集团推出新系列优质 100 闸阀。 Premium 100 闸阀耐腐蚀、耐磨。非常适合无法进行挖掘或需要长使用寿命和最大安全性的安装。这可能包括繁忙的道路、公共建筑和旅游景点、沿海地区以及受到石油或汽油污染的地区。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 科技趋势

- 产业价值链分析

- COVID-19 对市场的影响

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争公司之间的敌意强度

第五章市场动态

- 市场驱动因素

- 快速工业化

- 石油和天然气探勘活动增加

- 市场限制因素

- 高投资成本和向可再生能源发电过渡

第六章市场区隔

- 按类型

- 阀门

- 门,手套,检查

- 球阀

- 蝴蝶

- 插头

- 消除压力装置

- 熔炉/锅炉

- 热交换器

- 压力容器

- 阀门

- 按最终用户产业

- 油和气

- 发电

- 化学品和石化产品

- 水和污水

- 其他流程工业

- 其他离散製造业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争形势

- 公司简介 - 阀门

- Schlumberger Limited

- AKO Armaturen &Separationstecchink GMBH

- AVK Group

- EG Valves

- Leser GMBH &CO. KG

- Baker Hughes Company

- Emerson Electric CO.

- Flowserve Corporation

- 公司简介 - 热交换器

- Alfa Laval AB

- API Heat Transfer

- Danfoss A/S

- General Electric Company

- Hisaka Works Ltd

- HRS Heat Exchangers

- Johnson Controls International PLC

- 公司简介-压力容器

- Doosan Mecatec(Doosan Corporation)

- IHI Power Services Corp.(IHI Corporation)

- Mitsubishi Heavy Industries Ltd

- Hitachi Zosen Corporation

- Japan Steel Works Ltd

- Shanghai Electric Group Company Limited

- CIMC Enric Holdings Limited

- 公司简介-熔炉/锅炉

- Viessmann Group

- Lennox International Inc.

- Baxi(BDR Thermea Group)

- The Fulton Companies

- Worcester Bosch Group(the Bosch Group)

- Ideal Boilers(ideal Heating)

- Burnham Commercial Boilers

第八章 市场未来展望

The Industrial Static Equipment Market size is estimated at USD 171.96 billion in 2024, and is expected to reach USD 213.67 billion by 2029, growing at a CAGR of 4.44% during the forecast period (2024-2029).

The exploration and refining of oil and gas have increased due to the remarkable progress made in the worldwide production of crude oil and other hydrocarbons. With the massive industrialization and urbanization that has resulted from the revolution in a variety of industries, including the automobile, pharmaceutical, telecommunication, and manufacturing, petroleum is now a crucial component of development.

Key Highlights

- The market numbers provided in the study indicate the overall sales of static industrial equipment across types, such as valves, furnaces/boilers, heat exchangers, and pressure vessels. The further market is also segmented into an end-user industry which indicates the sales of several types of static industrial equipment across several industries such as oil and gas, Power generation, Chemical & petrochemical, Water & Wastewater, Other Process industries, and other discrete industries.

- The food and beverage industry is also among the major industries wherein the demand for static equipment is expected to grow further. The increasing consumption of processed and packaged foods globally is one of the major contributors to the growth of the industry. According to the US Census Bureau, total sales for retail and food services from May 2022 through July 2022 were up by 9.2% from the same period last year.

- The oil and gas industry has been among the key contributors to the growth of almost all industries. This was due to the fact that power is required to run any industrial establishment, and until the recent developments in renewable sources, power was used to be fulfilled primarily by oil and gas.

- The oil and gas industry is among the major consumers of static industrial equipment, such as boilers, furnaces, piping, and valves, as the entire oil exploration and production activity involves several processes that are carried out at different places.

- The outbreak of COVID-19 has had a notable impact on the growth of the industrial sector, which in turn impacted the growth of the studied market. According to Eurostat, industrial production in the European Union declined by 7% in 2020. The decline in production activities has had an adverse impact on the demand for major industrial static equipment as major industries put a hold on future expansion activities and investment in establishing new facilities.

Industrial Static Equipment Market Trends

Rapid Industrialization Drives the Market Growth

- The industrial sector has been an engine for the world's economic prosperity since the onset of the industrial revolution. According to the World Bank, the estimated value added by the manufacturing sector to the global economy was around 17.01% in 2021. The growing demand for manufactured products and the role the industrial sector plays in stimulating the growth of other sectors through its outputs are expected to drive the development of the industrial sector during the forecast period.

- As static industrial equipment such as boilers, valves, heat exchangers, furnaces, etc. plays a pivotal role within the industrial establishments to help them achieve their operational targets, they are also expected to follow a similar growth pattern considering their direct co-relation with the industrial sector growth.

- The industrial sector has been the backbone of major economically developed countries such as the United States, China, Japan, etc. For instance, according to the data provided by the United Nations Statistics Division (UNSD), the value added by the manufacturing industry to the GDP of the United States, Japan, and Germany amounted to USD 2,272 billion, USD 1.033.6 billion, and USD 697.3 billion, respectively. As these countries are increasingly investing and framing supportive regulations to bolster the industrial sector, the demand for static industrial equipment is also expected to grow further during the forecast period.

- Additionally, the Asia-Pacific region is expected to be the leader in industrial sector growth, as the favorable government regulations, large populations, and the availability of low-cost labor attract global players to set up their base in the region. Countries like China, Taiwan, India, etc., have been among the favorite destinations of global companies. For instance, According to the Department for Promotion of Industry and Internal Trade (DPIIT), the total foreign direct investment (FDI) received by India in the financial years 2021-22 stood at USD 58.77 billion, of which the automotive industry received FDI worth USD 32.84, chemical manufacturing sector received USD 19.45 billion. The FDI received by the drug and pharmaceutical industry amounted to USD 19.41 billion.

- A similar trend has been observed across other countries as well. For instance, in September 2022, The Malaysian Investment Development Authority (MIDA) announced that the government has attracted approved investment worth USD 27.5 billion in its manufacturing, services, and primary sectors in the first half of 2022.

Asia Pacific is Expected to be the Fastest Growing Market

- The Asia Pacific market is predicted to develop rapidly due to increased investment, increased government measures to enhance infrastructures and promote LNG exploration, and the existence of important firms operating in growing countries, including China and India, in this area. For instance, in January 2021, the Gurugram Metropolitan Development Authority (GMDA) began a trial project for its water management technology in around ten places around Basai and Dhanwapur. The project's goal is to monitor, control, and regulate the flow of the city's underground water tanks. In the subterranean tanks, a flow control valve, an ultrasonic fluid flow meter, and a level meter will be installed as part of the project.

- China is the pioneer in oil & gas production in Asia-Pacific because of its oil & gas exploration expenditure. The nation has the most oil rigs, followed by India, which has also made steady improvements. Furthermore, numerous institutes are conducting research and development initiatives in several nations to increase equipment performance and encourage investment in the industry. For instance, in March 2022, China intends to invest CNY 81.5 billion in upstream exploitation, particularly in the crude oil foundations in the Shunbei and Tahe areas and natural gas resources in Sichuan province and the Interior Mongolia region. Increasing demand for oil & gas exploration will increase the demand for static equipment, boosting the market growth.

- The Asia Pacific area is home to several of the world's major check valve manufacturers. Increasing demand for safer applications and increased R&D efforts linked to automatic valves are some significant factors fueling industry development in the Asia Pacific. Furthermore, industrial research has widened the applicability of valves in many sectors, including energy & power, and chemicals, notably in China. Check valves are employed in the energy & power, oil & gas, and water & wastewater treatment sectors to regulate medium flow throughout the network, commence, stop, or control the movement, and provide secure and effective processing automation.

- The region's concentrated populace, significant consumer income, large-scale industry, and increasing urbanization are important drivers driving the region's industrial valve expansion. India, China, and Southeast Asian countries are among the region's fast-growing economies. Because of the region's growing metropolitan population, there is a strong need for modern and enhanced wastewater treatment facilities.

- The increasing demand for enhanced water and wastewater management techniques, rising government initiatives for treating wastewater, and the growing necessity for appropriate water usage are driving the need for static equipment in the Asia-Pacific region.

Industrial Static Equipment Industry Overview

Industrial Static Equipment Market is expected to be moderately high and remains the same over the forecast period. Major companies like Schlumberger Limited, AKO Armaturen& Separationstecchink GMBH, AVK Group, EG Valves LeserGMBH & CO. KG are also making partnerships and launching new products to retain their market position.

- July 2022 - Alfa Laval collaborated with SSAB, the global Swedish steel company, on developing and commercializing the world's first heat exchanger made of fossil-free steel. The goal is to have the first hydrogen-reduced steel unit ready by 2023. The collaboration is also a significant step toward Alfa Laval's goal of becoming carbon neutral by 2030.

- March 2022 - AVK Group launched a new line of premium 100 gate valves. Premium 100 gate valves offer corrosion and wear resistance. They are ideal for installation in locations where excavation is not feasible and where long life and maximum safety are required. This could include busy roads, public and tourist attractions, coastal areas, or areas contaminated with oil or gasoline.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Technological Trends

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on The Market

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Industrialization

- 5.1.2 Increasing Oil and Gas Exploration Activities

- 5.2 Market Restraints

- 5.2.1 High Investment Cost and Shift Toward Renewable Energy Generation Sources

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Valves

- 6.1.1.1 Gate, Globe, and Check

- 6.1.1.2 Ball Valves

- 6.1.1.3 Butterfly

- 6.1.1.4 Plug

- 6.1.1.5 Pressure Relief

- 6.1.2 Furnaces/Boilers

- 6.1.3 Heat Exchangers

- 6.1.4 Pressure Vessels

- 6.1.1 Valves

- 6.2 By End-user Industry

- 6.2.1 Oil and Gas

- 6.2.2 Power Generation

- 6.2.3 Chemicals and Petrochemicals

- 6.2.4 Water and Wastewater

- 6.2.5 Other Process Industries

- 6.2.6 Other Discrete Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles - Valves

- 7.1.1 Schlumberger Limited

- 7.1.2 AKO Armaturen & Separationstecchink GMBH

- 7.1.3 AVK Group

- 7.1.4 EG Valves

- 7.1.5 Leser GMBH & CO. KG

- 7.1.6 Baker Hughes Company

- 7.1.7 Emerson Electric CO.

- 7.1.8 Flowserve Corporation

- 7.2 Company Profiles - Heat Exchangers

- 7.2.1 Alfa Laval AB

- 7.2.2 API Heat Transfer

- 7.2.3 Danfoss A/S

- 7.2.4 General Electric Company

- 7.2.5 Hisaka Works Ltd

- 7.2.6 HRS Heat Exchangers

- 7.2.7 Johnson Controls International PLC

- 7.3 Company Profiles - Pressure Vessels

- 7.3.1 Doosan Mecatec (Doosan Corporation)

- 7.3.2 IHI Power Services Corp. (IHI Corporation)

- 7.3.3 Mitsubishi Heavy Industries Ltd

- 7.3.4 Hitachi Zosen Corporation

- 7.3.5 Japan Steel Works Ltd

- 7.3.6 Shanghai Electric Group Company Limited

- 7.3.7 CIMC Enric Holdings Limited

- 7.4 Company Profiles - Furnaces/Boilers

- 7.4.1 Viessmann Group

- 7.4.2 Lennox International Inc.

- 7.4.3 Baxi (BDR Thermea Group)

- 7.4.4 The Fulton Companies

- 7.4.5 Worcester Bosch Group (the Bosch Group)

- 7.4.6 Ideal Boilers (ideal Heating)

- 7.4.7 Burnham Commercial Boilers