|

市场调查报告书

商品编码

1437489

运动控制:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Motion Control - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

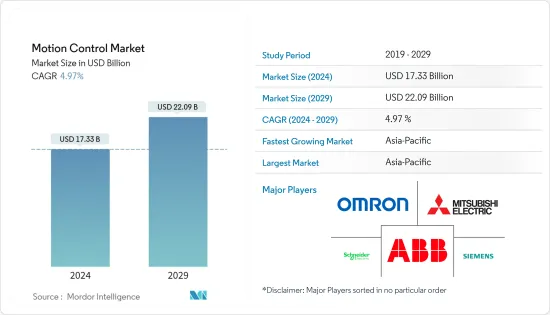

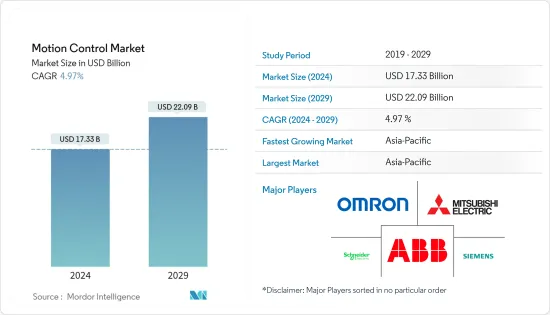

运动控制市场规模预计2024年为173.3亿美元,预计到2029年将达到220.9亿美元,在预测期内(2024-2029年)复合年增长率为4.97%增长。

工业物联网 (IIoT) 的日益普及和智慧工厂数量的增加进一步推动了所研究市场的成长。智慧工厂正成为运动控制产品的重要采用者。工业物联网进一步增加了工业中对连网型机器的需求和需求。光是这些连网机器不足以实现纯粹的数位转型。组织正在开发无缝的人机生态系统来运行最佳化的端到端流程。

主要亮点

- 世界各国政府正在製定各种政策来支援自动化,以提高能源效率,同时大幅降低所产生的成本。例如,马来西亚政府推出了工业4.0(Industry4WRD)国家政策。已拨款超过 12 亿美元帮助企业实施工业 4.0。在分配的预算中,总共分配了7.2亿美元,以工业数位化转型基金的名义加速机器人、自动化和人工智慧(AI)等智慧技术的采用。商业贷款担保计划 (SJPP) 已为计划投资自动化和现代化的中小企业分配了约 4.8 亿美元。

- 此外,随着仓库自动化趋势的增强以及数位双胞胎、边缘运算和预测製造等趋势的发展,先进运动控制设备的空间也在不断发展。机器人已成为全球自动化的重要趋势。机器人已成为先进汽车製造的重要组成部分。亚马逊等公司也大幅增加,协作机器人、AGV等机器人正成为製造业的焦点。

- 同样在2021年1月,资讯科技和工业发展局(ITIDA)透过「埃及製造电子」EME倡议,与工业4.0服务供应商Fraunhofer IPK德国合作,改造传统机制和标准实践,启动了工业4.0实施计画的目的是将电子、家电製造业转型为工业4.0技术与方法转型,带来产业质的转变,维持国际竞争力。这些努力也促进了所研究的市场的发展。

- 2021 年 5 月,运动控制 IC、模组和闆卡提供商 Performance Motion Devices, Inc. (PMD) 宣布推出 ION/CME N 系列数位驱动器,这是高性能 ION 数位驱动器的新成员驱动家族.宣布. -高效能运动控制、网路连线和放大。 N 系列 ION 数位驱动器采用取得专利的超坚固 PCB 安装封装,具有三种功率输出等级:75、300 和 1,000 瓦。所有 ION/CME N 系列数位驱动器均支援无刷直流、直流有刷和步进马达。

- 此外,COVID-19感染疾病的爆发使得製造业必须采用自动化、数位化和人工智慧,因为事实证明它可以提高抵御未来流行病的能力。我就是。由于社交距离规范导致供应链中断和製造活动停止,一些行业相关人员正在探索各种解决方案,以避免未来发生此类情况。在这些情况下引入自动化和机器人技术可以减少对人类的依赖,提高生产力,并降低工厂停工的可能性。引入自动化以及数位化和人工智慧等其他技术将使各行业能够在不需要人工监督的情况下继续生产。

- 此外,COVID-19感染疾病正在对世界各地的小型、中型和大型产业造成经济干扰。此外,上次的全国封锁打击了许多製造业。这导致一些领域对运动控制设备的需求波动。

运动控制市场趋势

石油和天然气产业将经历显着成长

- 在目前的市场情况下,石油和天然气行业面临着性能、营运总成本(TCO)、能源效率以及上下游流程安全等多重问题。除了石油和天然气生产外,该行业还使用石油和天然气进行业务运营,效率的提高将显着减少对该行业的影响。

- 随着传统碳氢化合物能源的枯竭,在更敏感和具有挑战性的环境中生产能源变得越来越复杂。石油和天然气行业对能源效率倡议的关注导致运动控制和马达系统的采用率达到了前所未有的水平。该行业致力于确保石油和天然气的可用性,同时以具有成本效益的方式解决能源安全和环境问题。

- 许多压缩机站使用伺服马达等运动控制装置来旋转离心压缩机。这种类型的压缩不需要使用管道中的天然气。对于涡轮驱动压缩机,专用调速器负责处理燃料阀和涡轮上的其他控制装置,以保持效率。此功能在由伺服马达上的感测器驱动的工业物联网系统中启用。

- 此外,许多石油和天然气公司正在增加对预测性维护的投资,以大幅减少资本支出,预计这将进一步推动对马达和驱动器的需求。例如,在疫情期间,阿布达比国家石油公司 ADNOC 与 AVEVA 合作,透过使用该公司的预测性资产分析解决方案进行预测性维护来减少停机时间。 ADNOC 的控制和监测系统已包含总共总合1000 万个标籤。该公司预计,随着新马达和基于驱动的控制系统的推出,这一数字将会增加。该公司估计,优化可节省 6,000 万美元至 1 亿美元的资本投资。

- 此外,在第二波疫情结束时,印度领先的燃料零售商印度石油公司(IOC)宣布推出该国首个炼油涡轮机远端监控和操作控制系统。专家们基于通用电气、BHEL 和印度石油公司的主动和预测分析合作开发了自动异常检测。该技术将使海得拉巴的远端监控和营运控制中心能够持续分析从印度石油公司全国八家炼油厂的 27 台燃气涡轮机以数位方式接收的燃气涡轮机运行资料。

亚太地区预计将成为成长最快的市场

- 亚太地区是研究市场最重要的市场之一。由于该地区各个最终用户行业越来越多地采用自动化,该地区为所研究的市场供应商提供了巨大的成长潜力。该地区对能源的关注也增加了低压电气设备的采用,促使许多公司开发节能、紧凑的电气设备和装置,并推动了运动控制的成长,我们正在进一步推动这一点。

- 该地区也是许多全球市场的製造地,因此自动化对于这些设施至关重要。製造业对中国经济贡献巨大,正经历快速转型。该国的工业控制系统正在各个领域兴起,包括能源、交通、水利和地方政府。随着物联网的高阶整合和快速发展,网路化控制系统正成为我国工业自动化的发展趋势,运动控制中心的空间进一步拓展。

- 2022年6月,中国政府宣布到2025年中国将成为世界领先的机器人创新来源国。此外,根据工业信部预测,未来三年中国将成为全球机器人最集中的国家。预计这将显着增加该地区对基于伺服马达的机器人运动控制系统的需求。

- 印度计划在2022年可再生能源装置容量达到175GW,其中包括太阳能和风能。目前,印度风电总装置容量为39.25吉瓦(截至2021年3月31日),排名全球第四。 ,由新能源和可再生能源部製定。该国计划到 2030 年将 40% 的能源来自可再生能源。为了实现这些能源製造目标,製造商在政府的支持下大力投资工业自动化解决方案。

- 此外,NASSCOM 与Capgemini SA于2022 年3 月合作发布的一份报告强调,印度製造业对云端和物联网等技术的投资不断增加,预计在21 财年实现工业4.0 目标的55%,投资额在65亿美元至65 亿美元之间。政府的这些努力将加强所研究地区的市场。

运动控制产业概况

运动控制市场竞争激烈,由多家主要企业组成。这些拥有显着市场份额的龙头企业也不断扩大海外基本客群。这些公司正在利用策略合作倡议来扩大市场占有率并提高盈利。市场的最新发展包括:

- 2021 年 12 月 - ACS 运动控制为其基于 EtherCAT 的 SPiiPlus 系列动作控制器和马达驱动器发布了两款新产品。 CMxa 和 UDMxa 针对微米到奈米分辨率的应用,并要求雷射微加工、计量、检测、对准和其他精密工业应用中的标准速度控制要求。

- 2021 年 11 月 - 全球运动控制和伺服解决方案公司 STXI Motion 在 SPS 2021 上宣布推出多种适用于分散式架构的低压运动解决方案。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争公司之间的敌意强度

- 替代品的威胁

- 产业价值链分析

- 技术进步

- 评估 COVID-19感染疾病对产业的影响

- 运动控制 - 系统类型分析

- 开放回路

- 闭合迴路

第五章市场动态

- 市场驱动因素

- 製造领域对高精度自动化流程的需求日益增长

- 製造商对工业机器人的需求增加

- 加速与运动控制系统整合的 IIoT 设备的使用

- 市场挑战

- 更换和维护运动控制系统的成本高昂

- 自动化领域缺乏熟练劳动力

- 市场机会

- 製造业采用工业 4.0

第六章市场区隔

- 产品类别

- 马达

- 驾驶

- 位置控制

- 致动器和机械系统

- 感测器和回馈装置

- 最终用户产业

- 电子和半导体

- 製药/生命科学/医疗设备

- 石油天然气

- 金属和采矿

- 食品和饮料

- 其他最终用户产业

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争形势

- 公司简介

- Siemens AG

- Schneider Electric SE

- Mitsubishi Electric Corporation

- ABB Ltd.

- Omron Corporation

- Parker Hannifin Corp

- Yaskawa Electric Corporation

- Robert Bosch GMBH

- Rockwell Automation, Inc.

- Fanuc Corporation

- Novanta Inc.

第八章 市场未来展望

The Motion Control Market size is estimated at USD 17.33 billion in 2024, and is expected to reach USD 22.09 billion by 2029, growing at a CAGR of 4.97% during the forecast period (2024-2029).

The increasing adoption of Industrial IoT (IIoT) and the growing number of smart factories are further expanding the growth of the market studied. Smart factories are becoming significant adopters of motion control products. The industrial IoT further increased the need and demand for connected machines in industries. These connected machines alone are not enough to accomplish pure digital transformation; organizations are developing a seamless ecosystem of humans and machines, performing optimized, end-to-end processes.

Key Highlights

- Governments across the globe have enacted various policies supporting automation to improve energy efficiency while significantly reducing the costs incurred. For instance, the Malaysian government launched a National Policy on Industry 4.0 (Industry4WRD). A budget of over USD 1.2 billion was allocated to help businesses adopt Industry 4.0. Within the allocated budget, a total of USD 720 million was allocated to boost the adoption of smart technologies such as robotics, automation and artificial intelligence (AI) under the name Industry Digitalization Transformation Fund. About USD 480 million was allocated under the Business Loan Guarantee Scheme (SJPP) for SMEs planning to invest in automation and modernization.

- Additionally, the increasing trend of warehouse automation and growth in trends, such as digital twins, edge computing, and predictive manufacturing, is also developing space for advanced motion control devices. Robots have become a significant automation trend across the world. In advanced automotive manufacturing, robots have become an essential component. Companies like Amazon are also heavily increasing, and robots, like collaborative robots and AGVs, are becoming the center of attraction in the manufacturing industry.

- Also, in January 2021, The Information Technology Industry Development Agency (ITIDA), through the 'Egypt Makes Electronics' EME Initiative, launched the Industry 4.0 Implementation program in cooperation with Industry 4.0 service provider Fraunhofer IPK Germany aiming at transforming traditional mechanisms and standard practices of manufacturing electronics and home appliances to industry 4.0 techniques and methods, to bring about a qualitative transformation in the industry and to keep up with the international competition. These initiatives are also boosting g the studied market.

- In May 2021, Performance Motion Devices, Inc. (PMD), a provider of motion control ICs, modules, and boards, announced the availability of ION/CME N-Series Digital Drives, new members of the ION Digital Drive family that provide high-performance motion control, network connectivity and amplification. N-Series ION digital drives feature a patented, ultra-rugged PCB-mountable package with three power output levels - 75, 300, and 1,000 watts. All ION/CME N-Series Digital Drives support Brushless DC, DC Brush, and step motors.

- Further, the outbreak of the COVID-19 pandemic has necessitated the implementation of automation, digitalization, and AI, in the manufacturing sector as these are proven to improve resilience to future pandemics. Due to the disruptions in the supply chain and the suspension of manufacturing activities attributed to social distancing norms, several industry players are looking for different solutions to avoid such situations in the future. Adopting automation and robotics in such a situation can reduce dependence on human labor, increase productivity, and reduce the chances of plant shutdowns. Adopting automation and other technologies, such as digitization and AI, will help industries continue their production without the need for human supervision.

- Moreover, the COVID-19 pandemic has created economic turmoil for small, medium, and large-scale industries worldwide. Additionally, the previous country-wide lockdown has drilled many manufacturing industries. This has fluctuated the demand for motion control devices across some sectors.

Motion Control Market Trends

Oil & Gas Segment to Witness Considerable Growth

- In the current market scenario, oil & gas industries face multiple issues related to business performance, the total cost of operation (TCO), energy efficiency, and safety in upstream and downstream processes. In addition to producing oil & gas, the industry also uses oil & gas in its operations, and efficiency can significantly reduce the industry's impact.

- As traditional hydrocarbon energy resources are depleted, energy production from ever more sensitive and challenging environments is becoming increasingly complex. Motion control and motor systems are observing an unprecedented adoption rate by the oil & gas industry as it focuses efforts on energy efficiency. The industry strives to ensure the availability of oil & gas while addressing energy security and environmental concerns cost-effectively.

- Many compressor stations use motion control devices like servo motors to turn the centrifugal compressor. This type of compression does not require using any natural gas from the pipe. For turbine-driven compressors, a dedicated speed governor handles the fuel valves and other controls on the turbine to maintain efficiency. This function is enabled with IIOT systems driven by sensors for servo motors.

- Moreover, many oil & gas firms are increasingly investing in predictive maintenance to realize significantly less CAPEX, which is further anticipated to propel the demand for motors and drives. For instance, during the time of the pandemic, the state-owned oil company of Abu Dhabi, ADNOC, collaborated with AVEVA on reducing downtime through predictive maintenance with the company's predictive asset analytics solution. ADNOC's control and monitoring systems already encompass some 10 million tags in total. The company expects the number to increase because of the new motor and drive-based control system deployment. The company estimates USD 60 to USD100 million in CAPEX savings through optimization.

- Further, at the end of the second pandemic wave, Indian Oil Corp (IOC), India's leading fuel retailer, announced the launch of the country's first remote monitoring and motion control system for oil refinery turbines. Professionals jointly developed automated Anomaly Detection based on Proactive Predictive Analytics from General Electric, BHEL, and IndianOil. This technology will allow the Remote Monitoring and Motion Controlling Center in Hyderabad to continuously analyze the Gas Turbine Operational Data coming in digitally from the 27 gas turbines of the eight IndianOil refineries throughout the nation.

Asia-Pacific is Expected to be the Fastest Growing Market

- Asia-Pacific is one of the most important markets for the market studied. The region offers massive growth potential to the studied market vendors, owing to the growing adoption of automation across the various end-user industries in the region. The energy concern in the region is also increasing the adoption of low voltage electrical equipment and motivating many companies to develop energy-efficient and compact electrical equipment and devices, further driving the motion control growth.

- The region is also a manufacturing hub for many global markets, and automation has become essential in these facilities. Manufacturing is a significant contributor to China's economy and is undergoing a rapid transformation. The industrial control system in the country has emerged across various fields, like the energy, transportation, water, and municipal sectors. Due to the deep integration and rapid development of the IoT, the networked control system is becoming the development trend of industrial automation in China, further developing space for motion control centers.

- In June 2022, the Chinese government announced that the country would be a key source of global robotics innovation by 2025. Further, per the Ministry of Industry and Information Technology, China will become the most robot-intensive country in the world within the next three years, which is expected to accelerate the demand for servo motors-based motion control systems for robotics in the region considerably.

- India is planning to achieve 175 GW of installed renewable capacity, which includes solar and wind power, by 2022. Currently, India has a total wind installed capacity of 39.25 GW (as of 31st March 2021), which is the fourth highest in the world, per the Ministry of New and Renewable Energy. The country plans to derive 40% of its energy from renewable sources by 2030. To achieve these energy manufacturing goals, manufacturers, along with the government's help, are making significant investments in industrial automation solutions.

- Further, a report published in March 2022 by NASSCOM, in collaboration with Capgemini, highlights the increased investment in technologies like cloud and IoT by the Indian manufacturing sector, with USD 5.5 - USD 6.5 billion spent on Industry 4.0 in FY21. These initiatives by the government will bolster the studied market in the region.

Motion Control Industry Overview

The motion control market is highly competitive and consists of several major players. These major players with a prominent share in the market are expanding their customer base across foreign countries. These companies are leveraging on strategic collaborative initiatives to increase their market share and increase their profitability. Some of the recent developments in the market are:

- December 2021 - ACS Motion Control has released two new products in the SPiiPlus series of EtherCAT-based motion controllers and motor drives. The CMxa and UDMxa are intended for micron to nanometer resolution applications and demand velocity control requirements standard in laser micromachining, metrology, inspection, alignment, and other high-precision industrial applications.

- November 2021 - STXI Motion, a global motion control and servo solution company, presented a range of low-voltage motion solutions for decentralized architecture at SPS 2021.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Technological Advancements

- 4.5 An Assessment of the Impact of COVID-19 on the Industry

- 4.6 Motion Control - Systems Types Analysis

- 4.6.1 Open Loop

- 4.6.2 Closed Loop

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing need for high-precision automated processes in manufacturing sector

- 5.1.2 Increasing demand for industrial robots by manufacturers

- 5.1.3 Accelerating utilization of IIoT devices integrated with motion control systems

- 5.2 Market Challenges

- 5.2.1 High replacement and maintenance costs of motion control systems

- 5.2.2 Lack of skilled workforce in automation field

- 5.3 Market Opportunities

- 5.3.1 Adoption of Industry 4.0 by manufacturing firms

6 MARKET SEGMENTATION

- 6.1 Product Type

- 6.1.1 Motors

- 6.1.2 Drives

- 6.1.3 Position Controls

- 6.1.4 Actuators & Mechanical Systems

- 6.1.5 Sensors and Feedback Devices

- 6.2 End-user Industry

- 6.2.1 Electronics & Semiconductor

- 6.2.2 Pharmaceutical/Life Sciences/Medical Devices

- 6.2.3 Oil & Gas

- 6.2.4 Metal & Mining

- 6.2.5 Food & Beverage

- 6.2.6 Other End-user Industries

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Siemens AG

- 7.1.2 Schneider Electric S.E

- 7.1.3 Mitsubishi Electric Corporation

- 7.1.4 ABB Ltd.

- 7.1.5 Omron Corporation

- 7.1.6 Parker Hannifin Corp

- 7.1.7 Yaskawa Electric Corporation

- 7.1.8 Robert Bosch GMBH

- 7.1.9 Rockwell Automation, Inc.

- 7.1.10 Fanuc Corporation

- 7.1.11 Novanta Inc.