|

市场调查报告书

商品编码

1437877

汽车绿色轮胎:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Automotive Green Tires - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

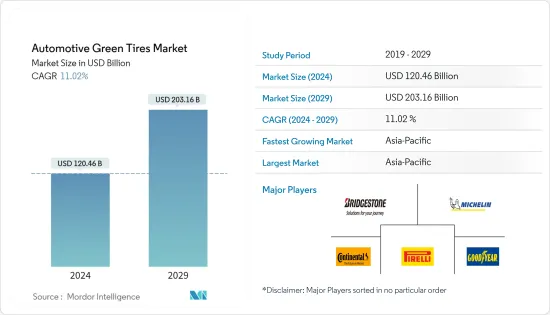

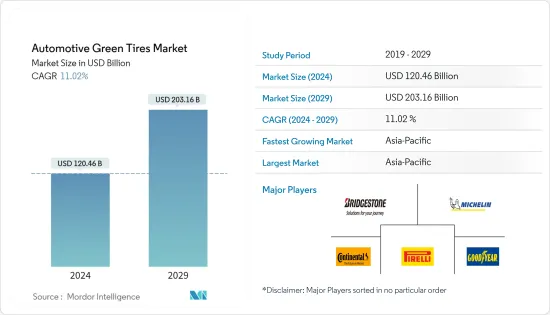

预计2024年汽车绿色轮胎市场规模为1,204.6亿美元,预计2029年将达到2,031.6亿美元,在预测期间(2024-2029年)成长11.02%,复合年增长率为

主要亮点

- 由于政府封锁和限制措施导致汽车产量减少和製造单位关闭,COVID-19感染疾病阻碍了汽车绿色轮胎的成长。此外,供应链中断和贸易限制扰乱了市场,使得轮胎组装和向主要原始OEM的供应比预期更加复杂。然而,随着製造商开始采取必要措施来减轻此类未来风险以及监管的放鬆,市场需求已开始加速,并预计在预测期内将持续下去。

- 从中期来看,电动车销售的成长被认为是推动绿色轮胎需求的关键因素。这些绿色轮胎可将滚动阻力降低 20%,并提高车辆的整体效率。这被视为电动车製造商面临续航里程限制和绿色轮胎问题的关键解决方案。由于效率提高,他们可能会看到电动车远距。

- 二氧化硅有助于减少轮胎在路面变形时的滚动阻力和能量损失。节能提高燃油效率。滚动阻力占小客车消费量的10-15%,但在大型卡车中可占消费量的30%。低滚动阻力轮胎可能只会减少 2-3%,但节省的燃料仍有利于环境。

- 在亚太地区,由于电动车在南亚、中国和日本等国家的普及不断提高,对绿色轮胎的需求预计将增加。此外,消费者偏好的变化和全部区域小客车市场销售的增加正在推动需求。对于绿色轮胎。针对这些因素,轮胎製造商正在改用绿色轮胎,这些轮胎可作为原始设备(OE)使用,同时也经过改造以减少滚动阻力、提高燃油经济性并减少二氧化碳排放,受到关注。

汽车绿色轮胎市场趋势

电动车销售可能推动市场成长

- 儘管去年汽车销量整体下滑,但2022年全球电动车销量较2021年成长约55.5%,首次突破1,000万辆。因此,根据国际能源总署 (IEA) 的数据,2022 年全球购买的七分之一的小客车将是电动车。随着汽车销量尤其是电动车销量的增加,透过OEM销售管道对这些汽车绿色轮胎的需求预计在预测期内将大幅增加。 OEM透过全球分销网路提供产品的快速获取,确保产品品质,并提供有保障的支援服务。这意味着更长的产品寿命。

- 电动车的兴起也导致了汽车产业其他方面的重大变化。对提高效率的需求已将重点转移到为电动车製造电动动力传动系统之外的零件。着眼于效率和续航里程,知名电动车製造商正在与轮胎製造商合作。

- 2022 年 4 月,梅赛德斯-奔驰宣布与Bridgestone公司建立令人兴奋的开发合作伙伴关係,为未来的电动车 Mercedes-Benz Vision EQXX 生产轮胎。此次合作旨在为梅赛德斯电动车设计高效的自订Turanza Eco 轮胎,目标是将续航里程延长至 1,000 公里。Bridgestone将继续与目的地设备製造商 (OEM) 密切合作,以实现这一里程碑。

- 为了提高效率,Bridgestone将轻量 ENLITEN 技术融入轮胎设计中。这项创新技术可降低滚动阻力,提高能源效率,并有助于减轻 20% 的轮胎重量。

- 2021 年 12 月,固特异轮胎橡胶公司发表了新款 ElectricDrive GT。此轮胎机型采用固特异的 SoundComfort 技术,可作为整合声屏障,有效降低道路噪音。专专用电动车优化,相容于特斯拉等热门车款。

- 此外,远距旅行的舒适性也带动了全球SUV文化的兴起,吸引了消费者的青睐。因此,轮胎製造商也瞄准了SUV细分市场,提供OEM电池和可靠的轮胎解决方案。

- 例如,2022年2月,横滨宣布将为丰田最新SUVLexusLX供应OEM Geolander X-CV轮胎。此轮胎专为高性能SUV设计的公路地形轮胎,兼具机动性和高速性能。此外,该轮胎将为丰田的下一代LexusLX 增加性能标准,包括降低滚动阻力。

- 世界各国政府对汽车和汽车製造商制定了各种严格的规定。因此,轮胎製造商能够在不影响轮胎轻量化的情况下使用环保原料,显着减轻车辆重量,提高燃油效率并降低消费量。绿色轮胎的所有好处促进了市场对绿色轮胎的需求。

- 最大限度地减少碳排放是世界各国的首要任务之一。对此,主要国家纷纷制定法规来减少碳排放。例如,2022年6月,印度能源效率局启动了轮胎星级标籤计划,类似于电器产品上常见的评级。轮胎等级提供有关滚动阻力和可能的燃油经济性的信息。

- 考虑到OEM製造商和轮胎製造商之间的发展,预计在预测期内对OEM轮胎的需求将保持乐观。

亚太地区主导汽车绿色轮胎市场

- 从地区来看,亚太地区在 2021 年的收益方面占据了重要的市场占有率,预计在预测期内将会成长。该全部区域汽车製造商的大量存在可能会创造利润丰厚的市场机会。从国家来看,中国在亚太地区的汽车绿色轮胎市场中占据主导地位。

- 中国政府推出了许多激励措施来促进汽车销售,并为购买电动车提供补贴,以鼓励该州汽车产业的扩张。

- 例如,根据中国工业协会 (CAAM) 的数据,2021 年中国销售了约 505,000 辆巴士和 430 万辆卡车。这意味着客车销量较上年增长了13%。此外,2022年该国销售的新车中30%是电动车,其中22%是电池式电动车。

- 中国的目标是到 2030 年,国内销售的新车中有 40% 是电动车,这意味着更多的汽车将需要充电基础设施。随着电动车销量的增加,国家计划建设充电基础设施,以满足超过2000万辆电动车的需求。

- 印度正在积极进行广泛的研究和开发倡议,旨在创造创新产品,预计这些产品将在可预见的未来显着促进目标市场的成长。这项进展的一个显着例子是印度领先的汽车製造商马鲁蒂铃木,该公司已正式宣布计划最迟在年终年底推出首款电动车。这项战略倡议显示了印度致力于采用永续和环境友善的交通解决方案。此外,马鲁蒂铃木的母公司铃木马达公司将在古吉拉突邦投资 1,040 亿卢比,在这项转型中发挥关键作用。

- 对燃料排放和安全的日益关注的环境问题也为参与者提供了遵守法规并进行一些研究活动以吸引更喜欢环保产品的消费者的潜在机会。我们鼓励

- 例如,2022年7月,米其林成为印度小客车领域第一个获得印度政府新推出的星级标籤计画认证的轮胎品牌。米其林印度公司是最早在商用车和小客车领域註册的品牌之一,随后其米其林 Latitude Sport 3 和 Pilot Sport 4 SUV 轮胎获得印度首个五星级评级。

- 在该地区营运的知名轮胎製造商正在采取各种成长倡议,例如扩张、合併、收购、合作和伙伴关係,以重新定位自己在市场中的地位,作为预测期内成长策略的一部分。

- 例如,Bridgestone、住友橡胶和Yokohama Rubber于2022年5月宣布,将为丰田汽车公司的bZ4X电动车(EV)供应轮胎作为原配。Bridgestone将供应Alenza 001和Turanza EL450轮胎。 Alenza 001将安装在专为日本、欧洲和亚洲市场设计的bZ4X上。

- 2022 年 1 月 柬埔寨发展委员会 (CDC) 本週核准了腊塔纳基里省和西哈努克省的两个新投资计划,总资本达 3.03 亿美元。新核准的计划之一属于西哈努克省西哈努克港经济特区的通用智能(柬埔寨)。该公司计划斥资2.97亿美元生产各类车辆轮胎。

- 此外,该地区聚酯的高产量、原材料供应的增加以及分销管道的建立预计将推动市场收益的成长。因此,考虑到这样的市场发展和趋势,亚太汽车绿色轮胎市场预计在预测期内将出现温和成长。

汽车绿色轮胎产业概况

汽车绿色轮胎市场由米其林、Bridgestone、大陆集团、固特异轮胎和橡胶公司以及倍耐力等公司主导。

这几家公司占据了很大的市场份额,并正在投资产能以开发永续的轮胎材料。汽车绿色轮胎製造商持续投资于产品创新、研发、併购和地理扩张,以获得市场竞争优势。

例如,2022年5月,倍耐力在两年内投资1,500万美元,在其位于墨西哥锡劳的工厂旁建立了先进技术和数数位化中心。为未来更电动、永续和连网型的车辆生产轮胎。

2022年4月,Bridgestone宣布宾士公司选择其作为宾士VISION EQXX轮胎的开发合作伙伴。Bridgestone工程师与梅赛德斯-奔驰合作开发了一款自订设计的轮胎,可提高车辆效率,一次充电可实现长达 1,000 公里的实际行驶里程。

2022年4月,玲珑轮胎宣布与太原洁净轮胎环保科技(Clean Tire)签署全面策略合作协议。林隆轮胎与清洁轮胎将共同选择合适的区域建设废旧轮胎回收工厂,加快实现统一布局和管理,全面涵盖轮胎研发、製造、翻新、回收全生命週期。一条产业链。轮胎。

Bridgestone公司和 ENEOS 公司于 2022 年 2 月推出了联合研发计划。两家公司将透过将Bridgestone在轮胎和橡胶业务中培育的先进橡胶和高分子材料设计技术与ENEOS的原油精製技术和基础化工产品製造技术相结合,共同开发废弃轮胎的化学回收技术。

2022 年 1 月,米其林和现代签署了一份谅解备忘录 (MoU),开发针对豪华电动车 (EV) 优化的下一代轮胎。两家公司将共同开发环保轮胎,增加环保材料的使用。

2022年1月,横滨Yokohama Rubber与横滨轮胎东南亚官方经销商YHI International Limited(YHI)合资成立Yokohama Tire Sales Malaysia Sdn. Bhd.。

2021年10月,Bridgestone开始对其位于墨西哥库埃纳瓦卡的轮胎製造工厂进行扩建计划,预计产量将每年增加15%。Bridgestone墨西哥公司将在这项扩建计划中投资超过 1 亿美元,其中包括建造超过 18,000平方公尺的建筑、新的服务和员工设施,以及安装最先进的机械。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 电动车销量增加

- 市场限制因素

- 高成本可能限制市场成长

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争公司之间敌对的强度

第五章市场区隔

- 按车型

- 小客车

- 商用车

- 按最终用户类型

- OEM

- 售后市场

- 按地区

- 北美洲

- 美国

- 加拿大

- 其他的

- 欧洲

- 德国

- 英国

- 法国

- 其他的

- 亚太地区

- 印度

- 中国

- 日本

- 韩国

- 其他的

- 世界其他地区

- 巴西

- 阿拉伯聯合大公国

- 其他的

- 北美洲

第六章 竞争形势

- 供应商市场占有率

- 公司简介

- Bridgestone Corporation

- Continental AG

- Michelin Group

- Apollo Tyres Limited

- Yokohama Tire Corporation

- Goodyear Tire &Rubber Company

- Pirelli &C. Spa

- Toyo Tire Corporation

- MRF Limited

- CEAT Limited

第七章市场机会与未来趋势

- 改变对永续和可再生材料的偏好

The Automotive Green Tires Market size is estimated at USD 120.46 billion in 2024, and is expected to reach USD 203.16 billion by 2029, growing at a CAGR of 11.02% during the forecast period (2024-2029).

Key Highlights

- The COVID-19 pandemic hindered the growth of automotive green tires owing to declined vehicle production and the shutdown of manufacturing units due to lockdowns and restrictions imposed by the government. Furthermore, supply chain disruptions and trade restrictions created chaos in the market, making tire assembly and its supply to major OEMs more complex than expected. However, as manufacturers started taking necessary measures to mitigate such future risks and as restrictions eased, the demand in the market started picking up pace and is expected to continue over the forecast period.

- Over the medium term, rising electric car sales have been cited as a key element driving demand for green tires. These green tires provide 20% less low rolling resistance, increasing total vehicle efficiency. This has been recognized as a primary solution for electric car manufacturers who are experiencing issues with limited range and green tires; they may see longer-range electric vehicles as a result of the improved efficiency supplied by them.

- Silica aids in the reduction of rolling resistance or the energy lost as the tire deforms against the road. Energy conservation improves fuel efficiency. Rolling resistance accounts for 10-15% of fuel consumption in passenger cars but can account for up to 30% of fuel consumption in heavy trucks. While low rolling resistance tires may only cut this by 2 to 3%, fuel savings still assist the environment.

- Asia-Pacific is anticipated to drive the demand for green tires owing to the increased penetration of electric vehicles across South Asian countries, China, Japan, etc. Further, shifting consumer preferences and rising sales of the passenger car segment across the region fuel the demand for green tires. In the wake of these factors, tire manufacturers are seen switching towards green tire, which is available as original equipment (OE), and even gets retrofit to lower the rolling resistance to improve fuel economy and reduce CO2 emission.

Automotive Green Tires Market Trends

Electric Vehicle Sales is Likely to Drive the Market Growth

- Global sales of electric cars increased by around 55.5% in 2022 when compared to the year 2021, surpassing 10 million for the first time, even though car sales broadly were soft last year. As a result, one in every seven passenger cars bought globally in 2022 was an EV, according to the International Energy Agency (IEA). With growing automobile sales, especially electric vehicles, the demand for these automotive green tires through the OEM sales channel is expected to grow significantly during the forecast period. OEMs deliver quick access to products through their global distribution network and ensure product quality and support services with a warranty, which signifies higher product life.

- Remarkable changes have been made to other aspects of the auto industry due to the rise of electric automobiles. The focus on creating components for electric automobiles other than electric powertrains had shifted due to the requirement for greater efficiency. With an emphasis on efficiency and range, prominent electric car manufacturers are working with tire manufacturers.

- In April 2022, Mercedes-Benz announced an exciting development partnership with Bridgestone Corporation for the manufacturing of tires intended for their futuristic electric vehicle, the Mercedes-Benz Vision EQXX. This collaboration aims to design highly efficient custom Turanza Eco tires for Mercedes EVs, with the goal of extending the driving range to an impressive 1,000 km. Bridgestone will work closely with the original equipment manufacturer (OEM) to achieve this milestone.

- To achieve increased efficiency, Bridgestone has incorporated its lightweight ENLITEN technology into the tire design. This innovative technology reduces rolling resistance, resulting in improved energy efficiency, and also contributes to a 20% reduction in tire weight.

- In December 2021, the Goodyear Tire & Rubber Company introduced the new ElectricDrive GT. This tire model features Goodyear's SoundComfort Technology, which acts as an integrated sound barrier to minimize road noise effectively. It has been optimized specifically for electric vehicles and is compatible with popular models like the Tesla Model.

- Moreover, the increasing trend for SUV culture globally, owing to its comfort in longer journeys, has attracted consumer preferences. Thus, tire manufacturers also aim to target the SUV segment to offer OEM batter and reliable tire solutions.

- For instance, in February 2022, Yokohama announced that it would supply its Geolandar X-CV tires to OEM Toyota's latest Lexus LX SUV. The tires are designed as highway terrain tires for high-performance SUVs to deliver maneuverability and high-speed performance characteristics. In addition, the tires would add high-performance standards, including lower rolling resistance in Toyota's upcoming Lexus LXs.

- Governments of various countries are coming up with various stringent regulations for vehicles and vehicle manufacturers. As a result, tire manufacturers adopt environment-friendly raw materials without compromising on lighter tires, significantly reducing vehicle weight and providing higher fuel efficiency and less consumption. All advantages of green tires will propel the demand for green tires in the market.

- Minimizing carbon emissions is one of the utmost priorities of countries across the globe. In the wake of this, prominent countries are framing regulations to reduce carbon emissions. For instance, in June 2022, The Bureau of Energy Efficiency, India, launched the Star Labeling Program for tires, similar to the rating we often see for electrical appliances. The tire rating gives information about rolling resistance and possible fuel economy.

- Considering the developments between OEM and tire manufacturers, demand for OEM tires is expected to remain positive during the forecast period.

Asia-Pacific is dominating the Automotive Green Tire Market

- Based on geography, Asia-Pacific holds a significant market share in revenue in 2021 and is projected to grow during the forecast period. The major presence of vehicle manufacturers across the region may likely create lucrative market opportunities. In terms of country, China is dominating the automotive green tire market in Asia-Pacific.

- The China government of China has introduced many incentive plans to bolster auto sales and has also offered subsidies for the purchase of electric vehicles to encourage the expansion of the automotive industry in the county.

- For instance, according to the China Association of Automobile Manufacturers (CAAM), In 2021, approximately 505,000 busses and 4.3 million trucks were sold in China. This represented a 13% increase in bus sales .compared to the previous year. Further, a remarkable 30% of new automobiles sold in the nation in 2022 were electric vehicles, and 22% of those were battery-electric vehicles.

- By 2030, China wants 40 percent of all new cars sold there to be electric vehicles, which means a lot more cars will need charging infrastructure. Owing to increased sales of EVs country has planned to establish charging infrastructure to meet the needs of more than 20 million EV cars.

- India is actively engaging in extensive research and development initiatives aimed at creating innovative products that are expected to significantly boost the growth of the target market in the foreseeable future. A noteworthy example of this progress is India's leading automaker, Maruti Suzuki, which has officially announced its plans to launch its inaugural electric vehicle no later than the end of 2025. This strategic move demonstrates India's commitment to embracing sustainable and eco-friendly transportation solutions. Furthermore, Maruti Suzuki's parent company, Suzuki Motor Corporation, is set to play a crucial role in this transformation by investing a substantial amount of Rs 10,400 crore in the state of Gujarat.

- Increasing environmental concerns about fuel emissions and safety will also provide potential opportunities for players and encourages them to stick to the regulations and conduct several research activities to attract consumers who prefer eco-friendly products.

- For instance, in July 2022, Michelin became the first tire brand in the passenger vehicle segment in India to be accredited with the newly introduced star labeling program by the Government of India. Michelin India is one of the first brands to register for both commercial vehicle and passenger car segments and was subsequently awarded India's first five-star rating for Michelin Latitude Sport 3 and Pilot Sport 4 SUV tires.

- The prominent tire manufacturers operating in the region are adopting various growth strategies, such as expansion, mergers, acquisitions, collaborations, partnerships, etc., to realign their position in the market as part of their growth strategies over the forecast period.

- For instance, in May 2022, Bridgestone Corporation, Sumitomo Rubber, and Yokohama Rubber announced that they would supply their tires as original equipment for the bZ4X electric vehicle (EV) launched by Toyota Motor Corporation. Bridgestone will supply the Alenza 001 and Turanza EL450 tires. The Alenza 001 is expected to be fitted on the bZ4X designed for the Japanese, European, and Asian markets.

- In January 2022, the Council for the Development of Cambodia (CDC) approved two new investment projects with a total capital of USD 303 million in the Rattanakiri and Preah Sihanouk provinces this week. One of the newly approved projects belongs to General Intelligence (Cambodia) Co. Ltd in Sihanoukville Special Economic Zone, Preah Sihanouk province. The firm plans to inject USD 297 million into producing all kinds of vehicle tires.

- Further, the high production of polyester, an increasing supply of raw materials, and a well-established distribution channel in the region are expected to drive revenue growth in the market. Thus, considering such developments and trends in the market, Asia-Pacific automotive green tires market to have moderate growth during the forecast period.

Automotive Green Tires Industry Overview

The Automotive green tires market is dominated by players such as Michelin, Bridgestone, Continental, Goodyear Tire & Rubber Company, Pirelli & C. SpA, and many others.

Such few players hold a major share of the market and invest in their production capabilities to develop sustainable tire materials. Automotive green tire manufacturers are constantly investing in product innovation, research and development, mergers & acquisitions, and geographic expansion to attain a competitive edge in the market.

For instance, in May 2022, Pirelli invested USD 15 million over two years to build an advanced technology and digitalization center next to its plant in Silao, Mexico. It will produce tires for the future's more electric, sustainable, and connected vehicles.

In April 2022, Bridgestone announced that Mercedes-Benz AG had selected it as the development partner for tires for the Mercedes-Benz VISION EQXX. Bridgestone engineers collaborated with Mercedes-Benz to create custom-designed tires that have increased the vehicle's efficiency and a real-world driving range of 1,000km on a single charge.

In April 2022, Linglong Tire announced that it had signed a comprehensive strategic cooperation agreement with Taiyuan Clean Tire Environmental Protection Technology Co. Ltd (Clean Tire). Linglong Tire and Clean Tire will jointly select a suitable area to build a waste tire recycling plant, accelerate the realization of unified distribution and management, and build a comprehensive industrial chain of tire research and development, manufacturing, retreading, and recycling throughout the life cycle of tires.

In February 2022, Bridgestone Corporation and ENEOS Corporation jointly launched a research and development project. Both companies are expected to jointly develop chemical recycling technologies for used tires by merging the advanced rubber and polymer material design technologies Bridgestone has cultivated through its tire and rubber business with the crude oil refining technologies and foundational basic chemical product manufacturing technologies of ENEOS.

In January 2022, Michelin and Hyundai Motor signed a memorandum of understanding (MoU) to develop next-generation tires optimized for premium electric vehicles (EVs). Both companies will jointly develop eco-friendly tires with increased use of eco-friendly materials.

In January 2022, Yokohama Rubber Co. Ltd formed a joint venture with YHI International Limited (YHI), the official distributor of Yokohama tires in Southeast Asia, to form Yokohama Tire Sales Malaysia Sdn Bhd.

In October 2021, Bridgestone inaugurated the expansion project of its tire manufacturing plant, located in Cuernavaca, Mexico, with which it will increase its production by 15% annually. Bridgestone Mexico invested more than USD 100 million in this expansion project, which includes the construction of more than 18,000 square meters of buildings, new service facilities and facilities for its employees, and the installation of state-of-the-art machinery.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Electric Vehicle Sales

- 4.2 Market Restraints

- 4.2.1 High Cost May Restrict the Market Growth

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD Billion)

- 5.1 By Vehicle Type

- 5.1.1 Passenger Vehicles

- 5.1.2 Commercial Vehicles

- 5.2 By End-User Type

- 5.2.1 OEM

- 5.2.2 Aftermarket

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 Brazil

- 5.3.4.2 United Arab Emirates

- 5.3.4.3 Other Countries

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Bridgestone Corporation

- 6.2.2 Continental AG

- 6.2.3 Michelin Group

- 6.2.4 Apollo Tyres Limited

- 6.2.5 Yokohama Tire Corporation

- 6.2.6 Goodyear Tire & Rubber Company

- 6.2.7 Pirelli & C. Spa

- 6.2.8 Toyo Tire Corporation

- 6.2.9 MRF Limited

- 6.2.10 CEAT Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Shifting Preferences Towards Sustainable and Renewable Materials