|

市场调查报告书

商品编码

1437881

包装黏剂:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Packaging Adhesives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

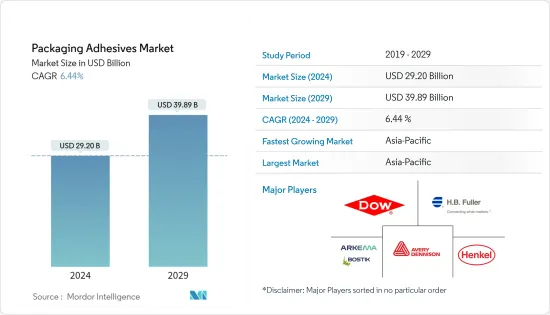

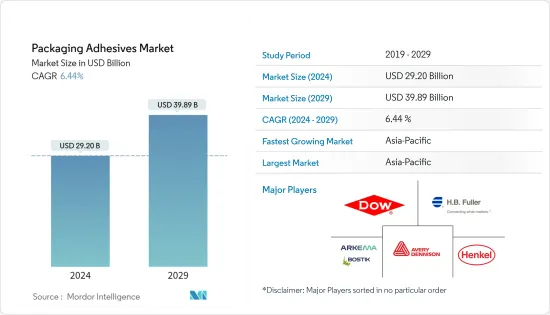

包装黏剂市场规模预计到 2024 年为 292 亿美元,预计到 2029 年将达到 398.9 亿美元,预测期内(2024-2029 年)复合年增长率为 6.44%。

2020年市场受到COVID-19感染疾病的轻微影响。 COVID-19感染疾病限制了外食,导致家庭做饭的数量增加。结果,果汁、水、无酒精饮品和酒精饮料产值的大幅下降几乎被麵粉、乳製品、保健食品、即食食品和即食食品的增加所抵消。

主要亮点

- 推动所研究市场成长的因素包括食品和饮料产业需求的增加、食品安全意识的提高以及污染风险的避免。

- 另一方面,法规对製造黏剂的各种原材料的影响可能会阻碍市场成长。

- 然而,电子商务的快速成长将为市场进一步成长提供机会。

- 亚太地区在市场中占据最高份额,并且可能在预测期内继续主导市场。

包装黏剂市场趋势

软包装应用实现最高成长率

- 在消费者偏好转向新的有吸引力的包装、易用性、永续性和认真的环保理念的推动下,软质包装正在以惊人的速度增长。

- 用于软包装的贴合黏剂有多种技术、黏度和固态浓度可供选择。常用的贴合黏剂有四种基本类别。这些是水基、溶剂基、反应性 100%固体(无溶剂)液体和热熔胶。

- 软包装中使用的溶剂型黏剂一般为双组份聚氨酯贴合黏剂。这些设计用于干层压工艺。

- 软包装也是VAE黏剂最重要的应用类型。另一个大类是层压应用,因为它具有弹性、防潮性和出色的基材黏合力。

- 由于人口成长,美国、中国和印度等国家对食品的需求不断增加,导致全球对软包装的需求增加。

- 根据软包装协会(FPA)统计,截至年终,整个美国软包装产业的年销售额超过356亿美元。软包装产业包括零售和商务用食品以及非食品、医疗和药品包装。 、工业材料、零售购物袋等美国食品工业是软包装的最大部分。

- 此外,包装黏剂也用于盖膜。盖膜是一种软包装薄膜,通常由铝箔、纸、聚酯、聚乙烯等製成,通常用于密封纸板品脱、塑胶容器和食品托盘。乳製品,如茅屋起司和优酪乳。

- 预计到 2022 年,全球食品业将产生 8.8 兆美元的收益。预计2022年至2027年该市场将以4.79%的复合年增长率成长。

- 因此,食品业需求增加和软包装成长等上述因素可能会增加预测期内包装黏剂的市场需求。

亚太地区主导市场

- 目前,由于中国、日本和印度等国家的高需求,亚太地区在包装黏剂市场中占最高份额。

- 中国人均收入的不断上升,加上国内电商巨头的崛起,使其成为包装黏剂消费量第一大国。

- 根据中国国家统计局统计,2020年社会消费品零售总额391,980.7亿元(约2,216.6亿元),黏剂的消耗来自消费品包装和出货活动。

- 此外,中国拥有世界上最大的食品工业。由于微波炉、零食和冷冻食品等食品行业定制包装的兴起以及出口的增加,预计该国在预测期内将持续增长。包装黏剂的使用预计将继续增加。

- 此外,食品业是印度包装黏剂的最大消费者之一。包装黏剂的主要最终用户产业包括药品、个人保健产品和电器产品。这些最终用户群体不断增长的需求正在为市场创造巨大的成长潜力。

- 印度的包装业也正在快速成长。它是印度经济第五大部门,也是目前印度成长最快的部门之一。在电子商务蓬勃发展的背景下,印度包装产业蓬勃发展,是成长最快的产业之一。

- 印度包装研究所 (IIP) 的数据显示,过去十年,印度的包装消费量增加了 200%,从每人每年 4.3 公斤 (pppa) 增加到 8.6 公斤 pppa。

- 因此,由于上述因素,亚太地区很可能在预测期内主导调查市场。

包装黏剂产业概况

包装黏剂市场较为分散,因为没有主要参与者占据全球市场的重要份额。全球公司都专注于研发和协作开发新技术,以保持其在市场中的地位和立足点。该市场的主要企业包括汉高股份公司 (Henkel AG &Co. KGaA)、HB Fuller、陶氏化学 (Dow)、阿科玛 (Bostik) 和艾利丹尼森公司 (Avery Dennison Corporation)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 食品和饮料行业需求不断增长

- 提高食品安全意识

- 抑制因素

- 严格的政府法规

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第五章市场区隔

- 依技术

- 水性的

- 溶剂型

- 热熔胶

- 按用途

- 软包装

- 折迭盒和纸箱

- 密封

- 标籤和胶带

- 其他用途

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、合作与协议

- 市场排名分析

- 主要企业采取的策略

- 公司简介

- 3M

- Arkema Group(Bostik)

- AVERY DENNISON CORPORATION

- Ashland

- Dow

- Henkel AG &Co. KGaA

- HB Fuller Company

- Jowat SE

- Paramelt RMC BV

- Wacker Chemie AG

第七章市场机会与未来趋势

- 电子商务产业快速成长

The Packaging Adhesives Market size is estimated at USD 29.20 billion in 2024, and is expected to reach USD 39.89 billion by 2029, growing at a CAGR of 6.44% during the forecast period (2024-2029).

The market was marginally impacted by COVID-19 in 2020. The COVID-19 pandemic limited dining out and led to increases in home cooking. With that, significant drops in the production values of juices, water, soft drinks, and alcoholic beverages were nearly offset by growth in wheat flour, dairy, health foods, and convenience or ready-to-eat foods.

Key Highlights

- The factors driving the growth of the market studied are the growing demand from the food and beverage industry, increasing awareness about food safety , and avoiding risks of contamination.

- On the flip side, the impact of regulations on various raw materials to be used for manufacturing adhesives may hinder the market's growth.

- However, the rapid growth in e-commerce will further provide opportunities for the market to grow.

- Asia-Pacific accounted for the highest share of the market, and it is likely to continue dominating the market during the forecast period.

Packaging Adhesives Market Trends

Flexible Packaging Application to Witness the Highest Growth Rate

- Flexible packaging is growing at an impressive rate, driven by consumer preferences shifting toward new attractive packages, ease of use, sustainability, and conscientious environmental ideals.

- Laminating adhesives for flexible packaging are available in various technologies, viscosities, and solids concentrations. There are four basic categories of laminating adhesives that are commonly used. These are waterborne, solvent-based, reactive 100% solid (solventless) liquid, and hot melt.

- Solvent-based adhesives used in flexible packaging are generally two-component polyurethane laminating adhesives. These are designed for use in the dry lamination process.

- Flexible packaging is also the most significant application type for VAE adhesives. Another large category is laminating applications due to their flexibility, moisture resistance, and superior substrate adhesion.

- With the growing population in countries such as the United States, China, and India, the requirement for food is increasing, thus resulting in increased demand for flexible packaging worldwide.

- According to the Flexible Packaging Association (FPA), the total US flexible packaging industry registered more than USD 35.6 billion in annual sales by the end of 2020. The flexible packaging industry includes packaging for retail and institutional food and non-food, medical and pharmaceutical, industrial materials, and retail shopping bags, among others. The US food industry is the largest segment for flexible packaging.

- Furthermore, packaging adhesives are also used in lidding films, which are a type of flexible packaging film commonly made by using foils, paper, polyester, polyethylene, and others generally used to seal paperboard pints, plastic containers, and trays for food items, including dairy products such as cottage cheese, sour cream, and others.

- The food industry worldwide is estimated to generate a revenue of USD 8.8 trillion in 2022. The market is expected to register a CAGR of 4.79% during 2022-2027.

- Hence, the factors above, such as increasing demand from the food industry and growing flexible packaging, will likely boost the market demand for packaging adhesives during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific currently accounts for the highest share of the packaging adhesives market, owing to the high demand from countries like China, Japan, India, etc.

- China is the leading country in the consumption of packaging adhesives due to growing per capita income, coupled with rising e-commerce giants in the country.

- According to the National Bureau of Statistics of China, the total retail sales revenue of consumer goods accounted for CNY 39,198.07 billion (~ USD 5532.31 billion) in 2020, which rose to CNY 44,082.34 billion (~ USD 6221.66 billion) in 2021, thereby enhancing the consumption of adhesives from consumer goods packaging and shipping activities.

- Additionally, China has one of the largest food industries globally. The country is expected to witness consistent growth during the forecast period due to the rise of customized packaging in the food segment, like microwave, snack, and frozen foods, and increasing exports. The use of packaging adhesives is expected to increase in the future.

- Furthermore, In India, the food industry is among the largest consumers of packaging adhesives. Some key end-user sectors of packaging adhesives include pharmaceuticals, personal care products, consumer electronics, etc. Increasing demand from these end-user segments is creating a huge market growth potential.

- In India, the packaging industry is also increasing at a rapid rate. It is the fifth-largest sector in India's economy and is currently one of the fastest and highest-growing sectors in the country. Amid the e-commerce surge, the Indian packaging industry is witnessing steep growth and is one of the strongest growing segments.

- According to the Indian Institute of Packaging (IIP), packaging consumption in India increased by 200% in the past decade, from 4.3 kgs per person per annum (pppa) to 8.6 kgs pppa.

- Hence, owing to the above-mentioned factors, Asia-Pacific is likely to dominate the market studied during the forecast period.

Packaging Adhesives Industry Overview

The packaging adhesives market is fragmented, as no major company holds a significant share of the global market. Global companies are significantly focusing on R&D and collaborations to develop new technologies to maintain their market presence and foothold. Some of the key players in the market include Henkel AG & Co. KGaA, H.B. Fuller, Dow, Arkema (Bostik), and Avery Dennison Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from the Food and Beverage Industry

- 4.1.2 Increasing Awareness for Food Safety

- 4.2 Restraints

- 4.2.1 Strict Government Regulations

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Technology

- 5.1.1 Water-based

- 5.1.2 Solvent-based

- 5.1.3 Hot-melt

- 5.2 By Application

- 5.2.1 Flexible Packaging

- 5.2.2 Folding Boxes and Cartons

- 5.2.3 Sealing

- 5.2.4 Labels and Tapes

- 5.2.5 Other Applications

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Arkema Group (Bostik)

- 6.4.3 AVERY DENNISON CORPORATION

- 6.4.4 Ashland

- 6.4.5 Dow

- 6.4.6 Henkel AG & Co. KGaA

- 6.4.7 H.B. Fuller Company

- 6.4.8 Jowat SE

- 6.4.9 Paramelt RMC B.V.

- 6.4.10 Wacker Chemie AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rapid Growth of the E-commerce Industry