|

市场调查报告书

商品编码

1437910

短纤维热塑性复合材料:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Short Fiber Thermoplastic Composites - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

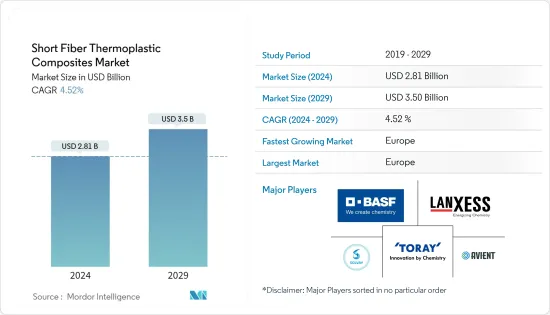

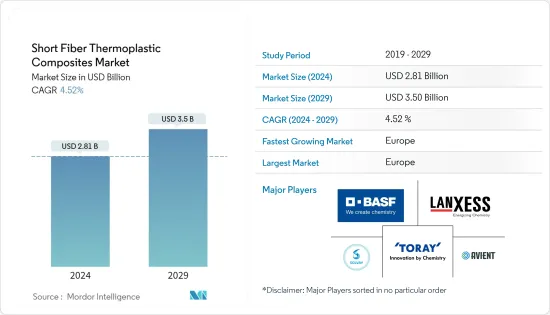

短纤维热塑性复合材料的市场规模预计到2024年为28.1亿美元,预计到2029年将达到35亿美元,在预测期内(2024-2029年)增长45.2亿美元,复合年增长率为%。

儘管COVID-19感染疾病对2020年和2021年的市场产生了负面影响,但由于全球航太、电子和汽车行业的成长,预计在预测期内该市场将稳步增长。

主要亮点

- 回收、易于加工以及在航太和国防领域不断扩大的应用基础可能会推动短纤维热塑性复合材料市场的成长。

- 相反,长纤维热塑性复合材料的优势预计将阻碍市场成长。

- 透过低成本碳纤维复合材料的技术进步进行的创新预计将在所研究的市场中创造新的机会。

- 欧洲主导市场,预计在整个预测期内将继续主导市场。

短纤维热塑性复合材料的市场趋势

运输应用主导市场

- 短纤维热塑性复合材料用于运输应用,因为它们可以减轻车辆的总重量而不影响结构强度。此外,诸如刚度之类的物理特性也得到了改善。这些特性增加了对短纤维热塑性复合材料的需求。

- 除此之外,不断变化的法规和对轻量化车辆的需求增加也是此类轻量化材料需求增加的主要原因。由于环境条件的变化,我们看到主要市场的政府法规和OEM之间发生了一些变化。

- 此外,先进的轻量材料对于提高车辆燃油效率、同时为消费者保持相同的性能和安全性至关重要。重型车辆加速所需的能量大于轻型车加速所需的能量。据估计,车辆重量减轻10%,燃油效率将提高6-8%。

- 在电动车中,车身较轻,可使用较小的电池,同时保持续航里程。减轻车身和电池组的重量对于减轻车辆整体重量具有协同效应。因此,可以使煞车系统和传动系统部件等其他部件小型化。

- 在中国,2021年11月插电式电动车较2020年同期成长106%。此外,市场占有率增至19%,其中纯电动车和4款电动车总合市占率为15%。插电式混合动力汽车的百分比。

- 因此,由于这些因素,预计交通领域的应用将在预测期内主导调查市场。

欧洲主导市场

- 预计未来几年欧洲将占据全球短纤维热塑性复合材料市场的主要份额,其中大部分需求来自德国、法国、义大利和英国。

- 德国航太全国有2,300多家公司,其中最集中在德国北部。该国拥有多个飞机内装零件和材料生产基地,主要位于巴伐利亚州、不来梅州、巴登-符腾堡州和梅克伦堡-前波莫瑞州。据估计,未来20年将有超过30,000至35,000架新飞机投入使用,以满足不断增长的航空需求。

- 近年来,法国汽车工业的表现比其他欧洲主要国家好得多。 2020年,国内小客车和轻型商用车产量为1,316,371辆,较2019年的2,175,350辆下降39.5%。然而,2021年该国的产量为1,351,308辆,较2020年的1,316,371辆成长3%,增加了调查市场的需求。

- 在义大利,2020年电脑、电子产品和光学产品收益为120,332.8亿欧元(约合1241,511万美元),而上一年为13,061.63百万欧元(约13,475.42百万美元)。相较之下,2020 年电气设备和非电气家用电器的收益为 268,691.7 亿欧元(约 277.2039 亿美元),而前一年为 249.6954 亿欧元(约 257.6058 亿美元)。

- 英国航太MRO产业约占全球MRO产业的17%。因此,预计英国的大量 MRO 活动和飞机的特定零件製造活动预计将在预测期内为短纤维热塑性复合材料提供潜在市场。

- 因此,由于上述原因,欧洲很可能在预测期内主导调查市场。

短纤维热塑性复合复合材料产业概况

短纤维热塑性复合材料市场适度分散,市场占有率被许多公司瓜分。市场主要企业包括BASFSE、朗盛、索尔维、东丽工业公司、Avient等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 易于回收和加工

- 扩大航太和国防领域的应用基础

- 抑制因素

- LFT相对于SFT的各种优点

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第五章市场区隔

- 纤维类型

- 玻璃纤维

- 碳纤维

- 其他类型纤维

- 树脂类型

- 聚丙烯(PP)

- 聚酰胺 (PA)

- 聚丁烯对苯二甲酸酯(PBT)

- 其他树脂类型

- 应用

- 航太和国防

- 电气和电子

- 交通设施

- 消费品

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、合作与协议

- 市场排名分析

- 主要企业采取的策略

- 公司简介

- Arkema

- AVANCO Group

- Avient

- BASF SE

- Lanxess

- RTP Company

- Solvay

- Sumitomo Bakelite Co. Ltd(SBHPP)

- Sumitomo Chemical Co. Ltd

- Toray Industries Inc.

- Victrex PLC

第七章市场机会与未来趋势

- 透过低成本碳纤维复合材料的技术进步进行创新

The Short Fiber Thermoplastic Composites Market size is estimated at USD 2.81 billion in 2024, and is expected to reach USD 3.5 billion by 2029, growing at a CAGR of 4.52% during the forecast period (2024-2029).

The COVID-19 pandemic had a negative impact on the market in 2020 and 2021, but it is projected to grow steadily in the forecast period owing to growth in the aerospace, electronics, and automotive sectors globally.

Key Highlights

- Ease of recycling, processing, and increasing application base in aerospace and defense are likely to drive the growth of the short fiber thermoplastic composites market.

- On the flip side, the advantages of long fiber thermoplastic composites are expected to hinder the market's growth.

- Innovation led by technological advancements for low-cost carbon fiber composites is expected to unveil new opportunities for the market studied.

- Europe has dominated the market, and it is expected to continue dominating the market through the forecast period.

Short Fiber Thermoplastic Composites Market Trends

Transportation Application to Dominate the Market

- Short thermoplastic composites are used in transportation applications as they can reduce the vehicle's overall weight without compromising structural strength. In addition, they have enhanced physical properties, such as stiffness. Due to such properties, short thermoplastic composites are gaining demand.

- Other than this, changes in regulations and the increasing demand for lightweight vehicles are also significant reasons for the rising demand for such lightweight materials. Owing to the change in environmental conditions, several makeovers can be seen among government regulations and OEMs around the major markets.

- Moreover, advanced lightweight materials are essential for increasing automotive fuel efficiency while maintaining the same performance and safety for consumers. The energy required to accelerate a heavy-weight vehicle is higher than the energy needed to accelerate a lightweight vehicle. It is estimated that a 10% reduction in the weight of vehicles would result in a 6-8% improvement in fuel economy.

- In electric vehicles, a lower-weight vehicle body allows for downsizing batteries while maintaining the range of the vehicle. Reducing vehicle body and battery pack weight leads to a compounding effect on weight reduction of the overall vehicle. Hence, this enables the downsizing of other parts, such as brake systems and drivetrain parts.

- In China, a growth of 106% in battery-plugged-in electric vehicles was witnessed in November 2021 compared to the same period in 2020. In addition, the market share also increased to 19%, including 15% of all-electric and 4% of plug-in hybrid cars.

- Hence, owing to such factors, the application in transportation is expected to dominate the market studied during the forecast period.

Europe to Dominate the Market

- Europe is expected to dominate the global short fiber thermoplastic composites market with a major share in the coming years, with most of the demand coming from Germany, France, Italy, and the United Kingdom.

- The German aerospace industry includes more than 2,300 firms across the country, with northern Germany recording the highest concentration of firms. The country hosts many production bases for aircraft interior components and materials, mainly in Bavaria, Bremen, Baden-Wurttemberg, and Mecklenburg-Vorpommern. Over 30 to 35 thousand new aircraft have been estimated to be operational by the next 20 years to meet the rising aviation demand.

- The French automobile industry has fared much better compared to other major European economies in the past few years. In 2020, the country produced 1,316,371 cars and light commercial vehicles compared to 2,175,350 vehicles produced in 2019, which declined by 39.5%. However, in 2021, the country produced 13,51,308 vehicles, which increased by 3%, compared to 13,16,371 vehicles built in 2020, thereby increasing the demand for the market studied.

- In Italy, the revenue from the computer, electronic, and optical products declined to EUR 12,033.28 million (~USD 12,415.11 million) in 2020, compared to EUR 13,061.63 million (~USD 13,475.42 million) in the previous year. In contrast, the revenue from electrical equipment and non-electric domestic appliances increased to EUR 26,869.17 (~USD 27,720.39 million) in 2020, compared to EUR 24,969.54 million (~USD 25,760.58 million) in the previous year.

- The aerospace MRO industry in the United Kingdom accounts for about 17% of the global MRO industry. Hence, many MRO activities for aircraft in the United Kingdom and the manufacturing activities of specific components are expected to provide a potential market for short fiber thermoplastic composites over the forecast period.

- Hence, due to the aforementioned reasons, Europe will likely dominate the market studied during the forecast period.

Short Fiber Thermoplastic Composites Industry Overview

The short fiber thermoplastic composites market is moderately fragmented as the market share is divided among many players. The key players in the market include BASF SE, LANXESS, Solvay, Toray Industries Inc., and Avient, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Ease of Recycling and Processing

- 4.1.2 Increasing Application Base in Aerospace and Defense

- 4.2 Restraints

- 4.2.1 Various Advantages of LFT over SFT

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Fiber Type

- 5.1.1 Glass Fiber

- 5.1.2 Carbon Fiber

- 5.1.3 Other Fiber Types

- 5.2 Resin Type

- 5.2.1 Polypropylene (PP)

- 5.2.2 Polyamide (PA)

- 5.2.3 Polybutylene Terephthalate (PBT)

- 5.2.4 Other Resin Types

- 5.3 Application

- 5.3.1 Aerospace and Defense

- 5.3.2 Electrical and Electronics

- 5.3.3 Transportation

- 5.3.4 Consumer Goods

- 5.3.5 Other Applications

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles*

- 6.4.1 Arkema

- 6.4.2 AVANCO Group

- 6.4.3 Avient

- 6.4.4 BASF SE

- 6.4.5 Lanxess

- 6.4.6 RTP Company

- 6.4.7 Solvay

- 6.4.8 Sumitomo Bakelite Co. Ltd (SBHPP)

- 6.4.9 Sumitomo Chemical Co. Ltd

- 6.4.10 Toray Industries Inc.

- 6.4.11 Victrex PLC

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Innovation Led by Technological Advancements for Low-cost Carbon Fiber Composites