|

市场调查报告书

商品编码

1437912

人造板:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Wood-based Panel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

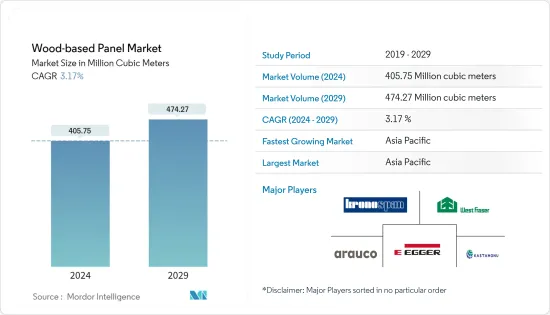

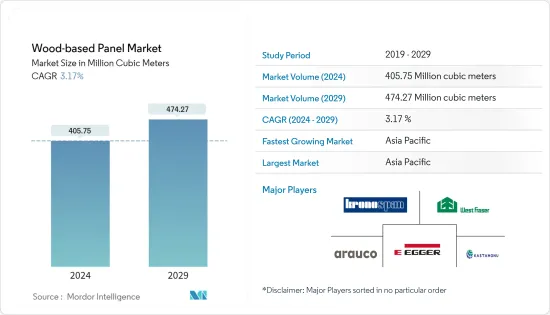

预计2024年人造板市场规模为40575万立方米,预计到2029年将达到47427万立方米,预测期内(2024-2029年)复合年增长率为3.17%。

2020年,市场受到COVID-19感染疾病的负面影响。一些国家对家具中使用的某些类型的进口纤维板征收反倾销税,以支持国内生产商。为了遏制病毒的传播,所有建筑工程和其他活动都被停止,这对市场产生了负面影响。然而,由于建设活动的增加,预计 2021 年市场将稳定成长。

主要亮点

- 短期内,住宅和商业建筑的看涨成长趋势以及家具产业需求的增加是推动所研究市场成长的关键因素。

- 然而,人造板的甲醛排放量是预计在预测期内抑制目标产业成长的关键因素。

- 儘管如此,OSB 在结构绝缘板 (SIPS) 中的应用不断增加可能很快就会为全球市场创造利润丰厚的成长机会。

- 在亚太地区,由于人造板在家具、建筑、包装等最终用途领域的广泛使用,因此预计人造板市场在评估期间将出现健康成长。特性。

人造板市场趋势

家具业需求增加

- 人造板由于多种优点而广泛应用于住宅家具。儘管木製家具的替代品有多种,但木製家具的需求仍处于高峰期。人造板经久耐用、经济、易于清洁且用途广泛。

- 全球家具市场占国内家用家具的65%,其次是商业(包括办公室、饭店等)。亚太地区是全球最大的家俱生产国,其中中国、印度和日本是主要生产国。

- 中国是世界家居产业的主要生产国。随着都市化的推进,中国家具产业不断涌现新的品牌。最忠实的客户是年轻人,他们更有可能接受新趋势并拥有巨大的购买力。此外,由于国家技术的不断进步,家具业正在涌现新一代。宜家于2020年与中国电子商务巨头阿里巴巴合作,在阿里巴巴网站上开设了一家虚拟商店。这是一个非常明智的市场倡议,因为虚拟商店使这家瑞典家具公司能够接触到更多的消费者,并尝试新的方式来推广其产品。

- 印度家具业最大的部分是家居用品。卧室家具在印度家居市场的份额最高,其次是客厅家具。然而,衣柜和厨房是最昂贵的采购项目,顾客在厨房家具上的花费约为 7,000 至 10,000 美元。

- 欧洲家居产业严重依赖亚洲国家的进口产品,最近的供应链中断使筹资策略变得复杂。因此,与亚洲国家相比,零售商正在增加从邻国进口的比例,以降低运输成本和交货时间。

- 2022 年 10 月,MoKo Home+Living 在 B 轮债务股权资金筹措中筹集了 65 亿美元,由美国投资基金 Taranton 和瑞士投资者 Alphamundi Group主导。目的是增加家用家具的产量并保持良好的品质。这项措施促进了该国家居产业的成长。

- 在家工作工作等工作型态的延续增加了对紧凑、耐用且易于操作的家用家具的需求。从办公空间到住宅环境的转变增加了对功能性更强、更灵活的家用家具的需求。一些製造商开始提供使用人造板的高效家具。从符合人体工学的椅子到办公桌和学习桌,在家工作重新引起了人们对家居装饰的关注,导致家具市场的成长。

- 所有上述因素预计将在未来几年推动人造板市场。

亚太地区主导市场

- 亚太地区主导了全球市场占有率。随着中国、印度和日本等国家建设活动的增加和家具需求的增加,该地区对人造板的需求不断增加。

- 根据中国木材及木製品流通协会的数据,中国是最大的人造板生产国,去年的年产量约为3.15亿立方公尺。其中,合板产量占全国人造板总产量的最大份额,产值2.01亿立方公尺。此外,去年纤维板和塑合板的产量分别为6,300万立方公尺和3,300万立方公尺。

- 我国人造板生产集中在山东、江苏、广西三省,约占总产量的60%。根据中国木材与木製品流通协会统计,去年中国约44%的人造板用于家具製造、装饰和维修。

- 中国正处于建设热潮之中。根据中国国家统计局的数据,中国建筑业产值从2020年的23.27兆元(3.16兆美元)增加至2021年的25.92兆元(4.2兆美元)。此外,到2030年,中国将在建筑方面投资近13兆美元,人造板前景光明。

- 此外,根据印度商务部的数据,2021财年印度胶合板及其产品的出口额为11.5204亿美元,而2020财年为10.8688亿美元。

- 此外,资讯科技 (IT) 持续推动办公空间需求,占去年总租金的 49.2%。银行、金融服务和保险业(BFSI)占办公空间市场总量的 15.2%,与 2020 年相比成长率约为 3%。

- 印度政府的「印度製造」计画吸引了多家跨国公司在该国投资,这将在预计时间内增加对新办公大楼的需求,并生产各种产品,例如塑合板。生产可能会支持对木材的需求。为基础的面板。

- 印度庞大的建筑业预计到2022年将成为世界第三大建筑市场。印度政府实施的各种政策,例如智慧城市计划和到 2022 年实现全民住宅,预计将为放缓的建设产业提供所需的刺激。行业。

- 上述因素导致预测期内该地区人造板消费需求的增加。

人造板产业概况

人造板市场本质上高度分散。主要公司包括 Kronoplus Limited、West Frazer、ARAUCO、EGGER Group 和 Kastamonu Entegre。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 住宅和商业建筑的稳健成长趋势

- 家具业需求增加

- 抑制因素

- 木质板材的甲醛排放量

- 其他限制

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第五章市场区隔

- 产品类别

- 中密度纤维板(MDF)/高密度纤维板(HDF)

- 定向刨花板(OSB)

- 刨花板

- 硬板

- 合板

- 其他产品类型

- 应用

- 家具

- 住宅

- 商业的

- 建造

- 地板和屋顶

- 墙

- 门

- 其他结构

- 包装

- 其他用途

- 家具

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、合作与协议

- 市场排名分析

- 主要企业采取的策略

- 公司简介

- ARAUCO

- CenturyPly

- Dongwha Group

- Dexco SA

- Egger Group

- Georgia-Pacific

- Green panel Industries Ltd

- Kastamonu Entegre

- Kronoplus Limited

- Langboard Inc.

- Louisiana-Pacific Corporation

- Pfleiderer

- Roseburg Forest Products

- Swiss Krono Group

- West Fraser

- Weyerhaeuser Company

第七章市场机会与未来趋势

The Wood-based Panel Market size is estimated at 405.75 Million cubic meters in 2024, and is expected to reach 474.27 Million cubic meters by 2029, growing at a CAGR of 3.17% during the forecast period (2024-2029).

The market was negatively impacted by COVID-19 in 2020. Several countries imposed anti-dumping duty on the import of a certain variety of fiberboard used in furniture in order to aid domestic producers. All the construction work and other activities were put on hold to curb the spreading of the virus, thereby negatively affecting the market. However, the market is projected to grow steadily, owing to increased building and construction activities in 2021.

Key Highlights

- Over the short term, bullish growth trends in residential and commercial construction, coupled with increasing demand from the furniture industry, are major factors driving the growth of the market studied.

- However, formaldehyde emission from wood-based panels is a key factor anticipated to restrain the growth of the target industry over the forecast period.

- Nevertheless, the increasing application of OSB in structural insulated panels (SIPS) is likely to create lucrative growth opportunities for the global market soon.

- Asia-Pacific is estimated to witness healthy growth over the assessment period in the wood-based panel market due to the wide usage of wood-based panels in end-use application segments, such as furniture, construction, and packaging, due to their desirable properties.

Wood Based Panel Market Trends

Increasing Demand from the Furniture Industry

- Due to their several benefits, wood-based panels are extensively used in residential furniture. There are various alternatives to wooden furniture, but the demand for it is still at its peak. Wooden panels are long-lasting, economically friendly, easy-to-clean, and highly versatile.

- The global furniture market comprises 65% of domestic home furniture, followed by commercials (including offices, hotels, and others). Asia-Pacific is the world's largest home furniture producer, among which China, India, Japan, and others are the leading producers.

- China is the leading producer of the home furniture segment globally. As a result of urbanization, new brands have emerged in the Chinese furniture industry. Their most dedicated customers are younger people, who are more likely to adopt new trends and have tremendous purchasing power. Moreover, the growing technological advancement in the country has bought up a new generation in the furniture industry. In 2020, IKEA partnered with the Chinese e-commerce giant Alibaba to open up virtual stores on Alibaba's website. This is an extremely smart market move because the virtual store allows the Swedish furniture company to reach more consumers and experiment with a new manner of promoting their products.

- The Indian furniture industry's largest segment is the home furniture. Bedroom furniture has the highest share of the Indian home furniture market, followed by living room furniture. However, wardrobes and kitchens are the most expensive purchases, with customers spending around USD 7,000-10,000 on kitchen furniture.

- The European home furniture industry is heavily dependent on products imported from Asian countries, and recent supply chain interruptions complicate their sourcing strategies. As a result, retailers have increased their share of imports from neighboring countries compared to Asian countries to reduce transportation costs and delivery times.

- In October 2022, MoKo Home + Living raised USD 6.5 billion Series B debt-equity funding round, co-led by US-based investment fund Talanton and Swiss investor AlphaMundi Group. The aim is to increase home furniture production and maintain good quality. This initiative has driven the growth of the home furniture segment in the country.

- The ongoing working pattern, such as working from home, has increased the demand for compact, durable, and easy-to-handle home furniture. The shift from office workspaces to house settings has increased the demand for more functional and flexible home furniture. Several manufacturers have started offering efficient furniture using wood panels. Whether it is an ergonomic chair, office desk, and study table, working from home is putting the focus back on home decor, resulting in an increase in the furniture segment.

- All the above factors are expected to drive the market for wood-based panels in the coming years.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region dominated the global market share. With growing construction activities and the increasing demand for furniture in countries such as China, India, and Japan, the demand for wood-based panels is increasing in the region.

- According to the China Timber and Wood Products Distribution Association, China was the largest wood-based panel producer, with annual production accounting for around 315 million cubic meters last year. Out of the total, plywood production accounted for the largest share of the country's total wood-based panel production, with a production value of 201 million cubic meters. Furthermore, last year, fiberboard and particleboard production accounted for 63 million cubic meters and 33 million cubic meters, respectively.

- China's wood-based paneling production is concentrated in the Shandong, Jiangsu, and Guangxi provinces, which account for about 60% of the total production. According to the China Timber and Wood Products Distribution Association, around 44% of China's wood-based panels were used for furniture manufacturing, decoration, or renovation last year.

- China is amid a construction mega-boom. According to the National Bureau of Statistics of China, the construction works output value in the country increased from CNY 23.27 trillion (USD 3.16 trillion) in 2020 to CNY 25.92 trillion (USD 4.02 trillion) in 2021. Furthermore, China is expected to spend nearly USD 13 trillion on buildings by 2030, creating a positive outlook for wood-based panels.

- Furthermore, according to the Department of Commerce (India), the export value of plywood and its products from India accounted for USD 1,152.04 million in FY 2021, compared to USD 1,086.88 million in FY 2020.

- Moreover, information technology (IT) continues to drive the demand for office spaces, with a 49.2% share of total leasing last year. Banking, financial services, and insurance (BFSI) accounted for a 15.2% share of the overall office space market, witnessing a growth rate of about 3% compared to 2020.

- The Make in India initiative by the government attracted several multinational companies to invest in the country, which is likely to increase the demand for new office buildings in the estimated time, supporting the demand for various wood-based panels, such as particle boards for furniture production.

- India's huge construction sector is expected to become the world's third-largest construction market by 2022. Various policies implemented by the Indian government, such as the Smart Cities project and Housing For All by 2022, are expected to bring the needed impetus to the slowing construction industry.

- The aforementioned factors are contributing to the increasing demand for wood-based panel consumption in the region during the forecast period.

Wood Based Panel Industry Overview

The wood-based panel market is highly fragmented in nature. The major players include Kronoplus Limited, West Frazer, ARAUCO, EGGER Group, and Kastamonu Entegre.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Bullish Growth Trends in Residential and Commercial Construction

- 4.1.2 Increasing Demand from the Furniture Industry

- 4.2 Restraints

- 4.2.1 Formaldehyde Emission from Wood-based Panels

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product Type

- 5.1.1 Medium-Density Fiberboard (MDF)/High-Density Fiberboard (HDF)

- 5.1.2 Oriented Strand Board (OSB)

- 5.1.3 Particleboard

- 5.1.4 Hardboard

- 5.1.5 Plywood

- 5.1.6 Other Product Types

- 5.2 Application

- 5.2.1 Furniture

- 5.2.1.1 Residential

- 5.2.1.2 Commercial

- 5.2.2 Construction

- 5.2.2.1 Floor and Roof

- 5.2.2.2 Wall

- 5.2.2.3 Door

- 5.2.2.4 Other Constructions

- 5.2.3 Packaging

- 5.2.4 Other Applications

- 5.2.1 Furniture

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East & Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ARAUCO

- 6.4.2 CenturyPly

- 6.4.3 Dongwha Group

- 6.4.4 Dexco SA

- 6.4.5 Egger Group

- 6.4.6 Georgia-Pacific

- 6.4.7 Green panel Industries Ltd

- 6.4.8 Kastamonu Entegre

- 6.4.9 Kronoplus Limited

- 6.4.10 Langboard Inc.

- 6.4.11 Louisiana-Pacific Corporation

- 6.4.12 Pfleiderer

- 6.4.13 Roseburg Forest Products

- 6.4.14 Swiss Krono Group

- 6.4.15 West Fraser

- 6.4.16 Weyerhaeuser Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Application of OSB in Structural Insulated Panels (SIPS)