|

市场调查报告书

商品编码

1437932

陆上钻机:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Land Drilling Rig - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

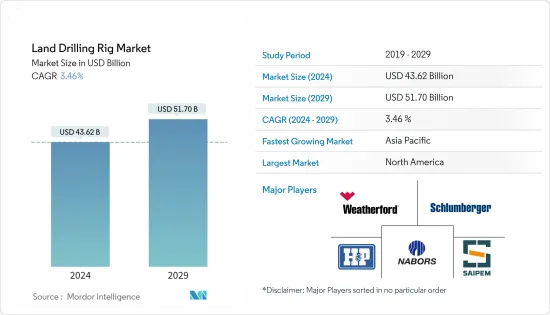

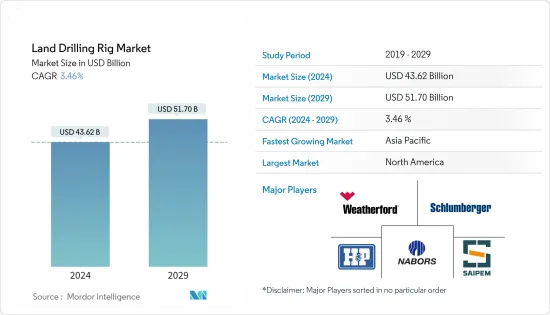

陆上钻机市场规模预计2024年为436.2亿美元,预计到2029年将达到517亿美元,在预测期内(2024-2029年)复合年增长率为3.46%增长。

主要亮点

- 从中期来看,由于大马力和高科技钻机的使用增加钻机大型钻机的需求不断增加,陆地钻机市场近年来发生了显着变化。此外,为满足对原油和天然气不断增长的需求而开发传统型蕴藏量,预计将在预测期内对陆上钻机市场产生巨大需求。

- 另一方面,全球向再生能源来源发电的过渡对石油和天然气产业构成重大威胁,进而成为预测期内陆上钻机市场成长的重大挑战。时期。

- 儘管如此,亚太和中东地区的大容量市场正在大力投资中游基础设施。新的基础设施和相对强劲的资本支出预算为钻机进入/重新进入这些地区提供了机会。

- 北美是陆上钻井钻机最大的市场之一,主导美国为首,主要得益于緻密油和页岩蕴藏量探勘和生产活动的增加。

陆域钻机市场趋势

行动钻机领域占据市场主导地位

- 可携式或移动式钻机是一种安装在卡车上的装置,包括井架、绞车和泥浆泵。可携式钻机的主要优点包括更快的钻孔机安装和停机时间以及较低的卡车租赁要求。

- 可携式钻机经常用于维修作业和钻井深度约 10,000 英尺。钻机可以每天 8、12 或 24 小时使用,与传统钻机相比具有多种优势。

- 许多陆上钻机承包正在升级他们的船队,配备更高马力的新设备,从顶部驱动到自动管道处理和可操作性,以便快速从一个井场移动到另一个井场。到目前为止,我们正在增加具有先进技术能力的更强大的钻机。

- 根据贝克休斯统计,截至2023年10月,陆上钻井钻机总数为736座,约占钻机总数的75%。随着陆上地区钻机数量的增加,钻井和生产活动的需求预计将增加,这将带动陆上钻机市场。

- 此外,随着加拿大、中国、阿根廷(美国以外)等国家传统型蕴藏量钻探逐渐兴起,具有高科技钻机设计和更大马力的可携式钻机在移动钻井中越来越受欢迎。创造重大机会。立即钻机。

- 油价上涨也促进了传统型油田开发的逐步转变。因此,即将推出的传统型蕴藏量计划预计将推动陆地钻探市场的需求。

- 因此,由于上述几点,行动钻机领域预计将在预测期内主导市场。

北美市场占据主导地位

- 石油和天然气价格上涨正在增加北美的钻探活动。 2022年北美陆上钻井钻机数量将达897座,较2021年成长约48%。

- 美国的钻探活动增加,并且拥有最多的运作中钻机数量。截至 2023 年 6 月,活跃钻机数量增加约 9%,达到 687 多个。因此,钻机的需求量很大。

- 水力碾碎技术的改进和较低的盈亏平衡价格支持了该国强劲的钻井活动。结果,国内飞机利用率在经历两年下降后上升至 46%。水平钻井在美国的份额不断增加,对高规格钻机产生了很高的需求。

- 一些大型承包不仅接受新钻机的订单,而且还升级钻机以满足这些要求。随着未来几年美国钻探业的改善,对高规格钻机的需求预计将会增加。

- 此外,由于计划启动和扩建众多油砂计划,加拿大的钻机需求可能会大幅增长,从而导致预测期内陆上钻机市场的发展。

- 因此,基于上述因素,预计北美在预测期内将主导全球陆地钻机市场。

陆上钻机产业概况

陆地钻机市场适度整合。市场主要企业(排名不分先后)包括 Nabors Industries Ltd、Helmerich & Payne Inc.、Schlumberger Limited、Saipem SpA、Weatherford International PLC 等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 调查范围

- 市场定义

- 调查先决条件

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2028年之前的市场规模和需求预测(金额)

- 全球主要国家陆上运作钻井钻机数量(截至2022年)

- 2028年之前境内资本投资预测(金额)

- 最新趋势和发展

- 政府政策法规

- 市场动态

- 促进因素

- 更多使用大马力和高科技钻机

- 传统型蕴藏量利用

- 抑制因素

- 世界向再生能源来源的过渡

- 促进因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌意强度

第五章市场区隔

- 类型

- 传统的

- 智慧型手机

- 驱动系统

- 机械的

- 电

- 化合物

- 地区

- 北美洲

- 美国

- 加拿大

- 其他的

- 欧洲

- 英国

- 法国

- 义大利

- 德国

- 其他的

- 亚太地区

- 中国

- 印度

- 韩国

- 其他的

- 南美洲

- 巴西

- 阿根廷

- 其他的

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 伊朗

- 伊拉克

- 卡达

- 其他的

- 北美洲

第六章 竞争形势

- 併购、合资、合作与协议

- 主要企业采取的策略

- 公司简介

- Nabors Industries Ltd

- Helmerich &Payne Inc.

- Eurasia Drilling Company Limited

- Ensign Energy Services Inc.

- Precision Drilling Corp.

- Patterson-UTI Energy Inc.

- Schlumberger Limited

- Saipem SpA

- Weatherford International PLC

- KCA Deutag Group

第七章市场机会与未来趋势

- 新基础设施和相对稳健的资本支出预算

简介目录

Product Code: 62664

The Land Drilling Rig Market size is estimated at USD 43.62 billion in 2024, and is expected to reach USD 51.70 billion by 2029, growing at a CAGR of 3.46% during the forecast period (2024-2029).

Key Highlights

- Over the medium period, the land rig market has evolved significantly in recent years with the increasing use of high horsepower and hi-tech rigs and the increasing demand for heavy rigs. Moreover, exploiting unconventional reserves to meet the increasing demand for crude oil and natural gas is expected to create significant demand for the land drilling rig market during the forecast period.

- On the other hand, the global shift towards renewable energy sources for electricity generation poses a huge threat to the oil and gas sector, which, in turn, is expected to be a major challenge for the growth of the land drilling rig market during the forecast period.

- Nevertheless, the high-volume and demand markets in Asia-Pacific and the Middle Eastern regions are investing highly in midstream infrastructure. New infrastructure and relatively robust CAPEX budgets provide rigs opportunities to enter/re-enter these geographies.

- North America is one of the largest markets for land drilling rigs, led by the United States, mainly due to increased exploration and production activities of its tight oil and shale reserves.

Land Drilling Rigs Market Trends

The Mobile Rig Segment to Dominate the Market

- A portable or mobile rig is a truck-mounted unit that contains the derrick, draw-works, and mud pumps. The principal advantage of the portable rig includes low rig-up and rig-down time, as well as lower truck hire requirements.

- Portable rigs are used frequently in workover operations and when drilling to depths of about 10,000 ft. The rigs may be used on an 8, 12, or 24-hr/day basis and have several advantages over conventional rigs.

- Many land rig contractors have upgraded their fleet with higher-horsepower new builds, adding more powerful rigs with advanced technological capabilities, from top drives to automated pipe handling and the mobility to quickly move from one well site to another.

- According to Baker Hughes, as of October 2023, the total land rig counts accounted for 736 units, approximately 75% of the total rig counts. With the increasing rig counts on the land region, drilling and production activity are expected to be in demand, which, in turn, will drive the land drilling rig market.

- Moreover, as drilling in unconventional reserves is gradually gaining momentum in countries (other than the United States) such as Canada, China, and Argentina, portable rigs with high-tech rig designs and bigger horsepower are expected to create a significant opportunity for the mobile rigs soon.

- Also, the increasing crude oil prices have favored the gradual shift towards developing unconventional fields. As a result, the upcoming projects in unconventional reserves are expected to drive the demand in the land drilling market.

- Thus, owing to the above points, the mobile rig segment is expected to dominate the market in the forecast period.

North America to Dominate the Market

- Drilling activities in North America have increased amid rising oil and gas prices. The North American land rig count reached 897 in 2022, i.e., an increase of around 48% from 2021.

- The United States has increased its drilling activity and has the highest active rig counts. As of June 2023, the active rig count increased by around 9%, i.e., the count crossed 687, resulting in high demand for drilling rigs.

- Technological improvements in hydraulic fracturing and low breakeven prices support the robust drilling activity in the country. As a result, fleet utilization in the country rose to 46% after two years of decline. The increasing share of horizontal drilling in the United States has resulted in high demand for high-specification drilling rigs.

- In addition to receiving new rig orders, some large contractors upgrade their rigs to meet these requirements. As the United States drills better in the coming years, the demand for high-spec drilling rigs is expected to grow.

- Also, there is a significant potential growth for rig demand in Canada, driven by the start-up and expansion of numerous planned oil sand projects, leading to the development of the land drilling rig market during the forecast period.

- Therefore, based on the factors mentioned above, North America is expected to dominate the global land drilling rig market during the forecast period.

Land Drilling Rigs Industry Overview

The land drilling rig market is moderately consolidated. The key players in the market (in no particular order) include Nabors Industries Ltd, Helmerich & Payne Inc., Schlumberger Limited, Saipem SpA, and Weatherford International PLC, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Global Onshore Active Rig Count of Major Countries, till 2022

- 4.4 Onshore CAPEX Forecast in USD billion, till 2028

- 4.5 Recent Trends and Developments

- 4.6 Government Policies and Regulations

- 4.7 Market Dynamics

- 4.7.1 Drivers

- 4.7.1.1 Increasing Use of High Horsepower and Hi-Tech Rigs

- 4.7.1.2 Exploiting Unconventional Reserves

- 4.7.2 Restraints

- 4.7.2.1 The Global Shift Towards Renewable Energy Sources

- 4.7.1 Drivers

- 4.8 Supply Chain Analysis

- 4.9 Porter's Five Forces Analysis

- 4.9.1 Bargaining Power of Suppliers

- 4.9.2 Bargaining Power of Consumers

- 4.9.3 Threat of New Entrants

- 4.9.4 Threat of Substitutes Products and Services

- 4.9.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Conventional

- 5.1.2 Mobile

- 5.2 Drive Mode

- 5.2.1 Mechanical

- 5.2.2 Electrical

- 5.2.3 Compound

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States of America

- 5.3.1.2 Canada

- 5.3.1.3 Rest of the North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 France

- 5.3.2.3 Italy

- 5.3.2.4 Germany

- 5.3.2.5 Rest of the Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 South Korea

- 5.3.3.4 Rest of the Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of the South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Iran

- 5.3.5.4 Iraq

- 5.3.5.5 Qatar

- 5.3.5.6 Rest of the Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Nabors Industries Ltd

- 6.3.2 Helmerich & Payne Inc.

- 6.3.3 Eurasia Drilling Company Limited

- 6.3.4 Ensign Energy Services Inc.

- 6.3.5 Precision Drilling Corp.

- 6.3.6 Patterson-UTI Energy Inc.

- 6.3.7 Schlumberger Limited

- 6.3.8 Saipem SpA

- 6.3.9 Weatherford International PLC

- 6.3.10 KCA Deutag Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 New Infrastructure and Relatively Robust CAPEX Budgets

02-2729-4219

+886-2-2729-4219