|

市场调查报告书

商品编码

1437954

移动式起重机:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Mobile Crane - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

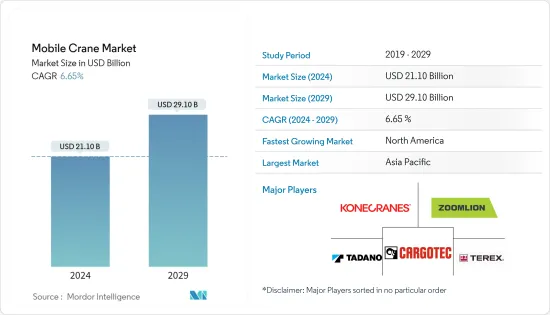

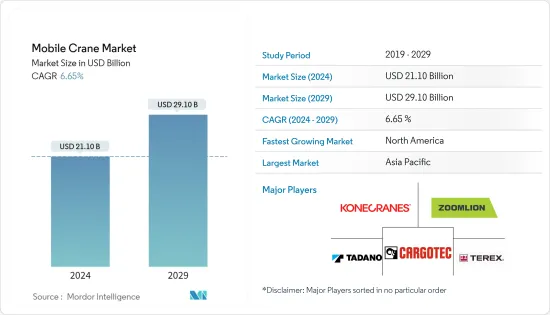

移动式起重机市场规模预计到 2024 年为 211 亿美元,预计到 2029 年将达到 291 亿美元,在预测期内(2024-2029 年)复合年增长率为 6.65%。

COVID-19感染疾病对移动式起重机市场产生了轻微影响。最初,世界各地的许多建筑和基础设施工地(克瑞的主要营运地点)因政府封锁令而关闭。然而,移动式起重机的商机仍然存在,因为采矿活动在某些地区已被宣布为必需,并且在封锁期间仍在继续。

从中期来看,基础设施开发计划的增加和建设公司的高额投资将增加预测期内对移动式起重机的需求。具有环保功能的先进机械的开发以及车队管理、GPS 追踪等先进技术的进一步采用可能会推动市场成长。

此外,施工机械和重型设备公司越来越多地转向租赁服务,并使用二手设备来经营业务,这势必会阻碍原始设备製造OEM製造新设备。

预计亚太地区中期内将占全球建筑支出的大部分,这主要是由于中国和印度基础设施发展的成长。亚洲地区中小型计划弹性将在预测期内进一步促进市场需求。为了进一步促进市场成长,政府资金增加,领先製造商积极参与北美和欧洲市场。

移动式起重机市场趋势

全球建筑和维修活动增加以推动市场需求

建筑和采矿业高度活跃,整体经济、预算和全球经济状况等许多因素都会影响市场成长。由于大型基础设施计划的前景和劳动力关係的变化,预计在预测期内对施工机械的需求将增长。

此外,一些国家在建筑业拥有大量外国直接投资 (FDI)。例如,2020年,澳洲建筑业的外国直接投资约为22亿澳元。

过去几年,世界各地活跃于该领域的政府和公司的基础设施支出显着增加,从而增加了建筑领域对机械和设备的需求。此外,公共和私人基础设施投资也在进行中,例如印尼国家中期发展计划(4600亿美元)、越南社会经济发展计划(615亿美元)和菲律宾发展计划“大建特建” .” 「建筑」(718亿美元)预计将增加这些地区对施工机械的需求。

其他几个国家的政府措施也正在推动施工机械市场的发展。这将推动未来几年建设产业的成长。例如,

- 2020 年 3 月,英国政府宣布计划在 2020 年至 2025 年间支出总计 6,400 亿欧元(8,250 亿美元)。其中约 109 亿欧元将用于建造住宅,到 2025 年将建成 100 万套住宅。

- 2021年7月,加拿大宣布将在加拿大基础建设计划投资超过330亿美元,并在未来12年内投资超过1,800亿美元发展该国基础建设。 2020年,美国97个城市宣布了304个基础建设计划,价值256亿美元。 2021 年 7 月,联邦政府宣布了价值 5,500 亿美元的道路、桥樑、水利基础设施等计划。

预计北美将占据很大的市场份额

在强劲的经济基本面、政府对基础设施发展的关注以及紧缩的货币政策的支持下,北美的建筑业预计将实现稳健增长,这将导致国内外市场的资本强劲流入。事实确实如此。市场。

在过去几年中,疫情导致建设活动停止并减少了需求,但由于正在进行的计划和有利的政府政策公告,预计在预测期内将获得动力。例如,

- 2021年11月,美国国会通过了1兆美元的基础建设支出法案。 《基础设施法案》提案未来八年在美国新增 5.5 亿美元联邦支出,用于维修道路、桥樑和高速公路,以及实现城市交通系统和铁路客运网络的现代化。

- 儘管新的基础设施支出法案低于最初提案的2.3兆美元,但出版商预计1兆美元将用于美国各个基础设施部门,并且该国的建设将在未来四到八个季度继续增长。我们预计这将继续支持建设产业成长。

随着美国港口对货物和海上贸易的需求增加,製造商和港口所有者正在投资现金进行港口采购和移动式起重机存储,以促进货物的流动。例如:

- SeaPortManatee 与码头营运商 Logistec USA Inc. 一起要求增加两台移动式港口起重机,该起重机于 4 月 22 日抵达。两台起重机可在港口起吊125吨货物,合起来可起吊200吨货物。此外,这些移动式起重机可以提高海牛港的货物处理能力。

- 2022 年 4 月,传统和电动车推进解决方案的领先设计商和製造商艾里逊变速箱与贝尔设备集团服务公司 (BELL) 签订了建设性协议,以评估和整合艾里逊经过验证的 4000 Series™ ,我们已达成合作关係。 TerraTran 是一款多用途车辆,专为铰接式自动卸货卡车、移动式起重机和宽体矿用自动卸货卡车应用而设计。

随着加拿大和墨西哥重组被野火损坏的基础设施,预计住宅市场的需求也会增加。油价上涨和北极冰盖融化预计将开闢新的贸易路线并引发新的探勘活动,预计将增加预测期内对海上和近海起重机的需求。

移动式起重机产业概况

移动式起重机市场的主要企业包括利勃海尔、卡哥特科、多田野、马尼托瓦克和帕尔菲格。这些公司正在利用建筑、采矿和工业领域主要企业对可靠起重机的巨大需求。就层级和层级供应链以及中小型应用供应而言,所研究的市场与区域参与者相当整合。

知名公司大幅增加了研发支出,将创新与卓越性能结合。由于对高性能、高效率和安全装卸设备的需求,预计所研究的市场在预测期内将变得更具竞争力和活力。

- 2021年5月,中联重科在义大利曼图亚开设了生产工厂,以更好地服务客户并作为公司全球扩张的一部分。透过此次扩张,该公司预计将进一步提高其在欧洲的立足点和全球整体影响力。

- 2021 年 4 月,利勃海尔推出了一款紧凑型单人出租车起重机 MK 73-3.1 移动式建筑起重机。这款最新机器旨在满足市场对小型、紧凑、灵活、快速和敏捷的移动式建筑起重机的需求。

- 2021年2月,美国Manitex International旗下义大利Manitex Valla推出了全新电池供电、远端控制的电动移动式起重机V 110 R。这台机器适合在狭窄和拥挤的区域工作,同时即使在最关键和最苛刻的操作环境中也能确保最大的机动性和弹性。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 市场约束

- 产业吸引力-波特五力分析

- 买方议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争公司之间敌对的强度

第五章市场区隔(市场规模、金额)

- 按机器类型

- 移动式起重机

- 固定式起重机

- 海事和港口起重机

- 按使用类型

- 建造

- 采矿和钻探

- 海洋和海洋

- 工业用途

- 其他使用类型

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 美国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 世界其他地区

- 南美洲

- 中东和非洲

- 北美洲

第六章 竞争形势

- 供应商市场占有率

- 公司简介

- Konecranes PLC

- Cargotec

- Manitowoc

- Terex Corporation

- Tadano Limited

- Kobelco Cranes Co. Limited

- Palfinger AG

- Liebherr-International AG

- Zoomlion Heavy Industry Science and Technology Co. Limited

- Favelle Favco Group

- Sumitomo Heavy Industries Construction Cranes Co. Ltd

第七章市场机会与未来趋势

The Mobile Crane Market size is estimated at USD 21.10 billion in 2024, and is expected to reach USD 29.10 billion by 2029, growing at a CAGR of 6.65% during the forecast period (2024-2029).

The COVID-19 pandemic had a mild impact on the mobile cranes market. Initially, many construction and infrastructure sites across the world, which are major business sites for cranes, were shut down due to the lockdown orders of governments. However, in some regions, as mining activities were declared essential and running through the lockdown, the business opportunity for mobile cranes still survived.

Over medium-term, rising infrastructural development projects and high-level investments by construction companies drive demand for mobile cranes during the forecast period. The development of advanced machinery with eco-friendly features and further growing adoption of advanced technologies like fleet management, GPS tracking, and others are likely to augment the market's growth.

Additionally, the increasing preference of construction and heavy equipment companies to use rental or lease services and inclination towards used equipment for their operations is bound to hinder the new equipment-producing OEMs.

The Asia Pacific is likely to hold a majority share of the global construction spending by the mid-term, primarily driven by the growth in infrastructure development in China and India. The increased flexibility in small-sized and medium-sized projects in the Asia region to further contribute to demand in the market over forecast period. Growing government funding and the active presence of key manufacturers across North America and Europe to further enhance the growth of the market.

Mobile Crane Market Trends

Increase in Construction and Renovation Activities Globally to Drive Demand in the Market

The construction and mining industry is highly dynamic, and numerous factors, such as the overall economy, budgets, and global economic scenario, are influencing the market's growth. With the prospects of large infrastructure projects and shifting labor dynamics, the demand for construction equipment is expected to witness growth during the forecast period.

Moreover, several countries are witnessing significant foreign direct investment (FDI) across the construction sector. For instance, In 2020, there was approximately AUD 2.2 billion in foreign direct investment into the construction sector in Australia.

Infrastructure spending by governments worldwide and players operating in this sector are witnessing a notable rise over the past few years, thereby pushing the demand for machinery and equipment in the construction sector. In addition, the investments in infrastructure, both public and private, such as the Indonesian National Medium-term Development Plan (USD 460 billion), Vietnam Socio-Economic Development Plan (USD 61.5 billion), and the Philippine Development Plan 'Build, Build, and Build' (USD 71.8 billion), are expected to increase the demand for construction machinery demand in these regions.

Government initiatives in several other countries are also driving factors in the construction machinery market. This, in turn, will help the construction industry grow in the upcoming years. For instance,

- In March 2020, the United Kingdom government announced its plan to spend a total of EUR 640 billion (USD 825 billion) between 2020 and 2025. Around EUR 10.9 billion of this spending will be allocated for the construction of new homes, with the aim of building one million new homes by 2025.

- In July 2021, Canada announced over USD 33 billion investment into Canada's infrastructure projects and over USD 180 billion in the next 12 years for the development of the country's infrastructure. In 2020, 97 cities across the United States announced 304 infrastructure projects valued at USD 25.6 billion. In July 2021, USD 550 billion worth of projects were announced by the federal government for roads and bridges, water infrastructure, and others.

North America Expected to Occupy Significant Share in the Market

The construction sector across North America is expected to experience solid growth, backed by strong economic fundamentals, the government's focus on creating infrastructure, and the tightening of monetary policy, which is expected to result in strong capital inflows from the external markets as well as domestic markets.

Though construction activities halted and demand declined over past years due to the pandemic, it is expected that it will gain traction over the forecast period in the wake of ongoing projects and announcements of favorable policies by the government. For instance,

- In November 2021, the US Congress passed a USD 1 trillion infrastructure spending bill. The infrastructure legislation proposes USD 550 million in new federal expenditure over the next eight years in the United States for the upgrade of roads, bridges, and highways and to modernize the city transit systems and passenger rail networks.

- While the new infrastructure spending bill falls short of the original USD 2.3 trillion proposals, the publisher expects 1 trillion spending on various United States infrastructure sectors to keep supporting the growth of the construction industry over the next four to eight quarters in the country.

With the increase in demand for cargo and maritime trade at the United States ports, manufacturers and port owners are seeing investing cash in procuring ports and harboring mobile cranes to felicitate the goods transportation. For instance:

- SeaPortManatee, along with terminal operator Logistec USA Inc. has demanded the addition of two mobile harbor cranes which has been arrived on 22 April. Both of the cranes are capable of lifting 125 metric tons of goods load at the port and together can be able to lift 200 metric tons load. Furthermore, these mobile cranes shall be able to increase cargo handling capabilities at SeaPort Manatee.

- In April 2022, Allison Transmission, a leading designer and manufacturer of conventional and electrified vehicle propulsion solutions, came under a constructive alliance with Bell Equipment Group Services (BELL) to evaluate and integrate Allison's proven 4000 SeriesTM. The TerraTran is a multi-purpose vehicle built for applications such as articulated dump trucks, mobile cranes, and wide-body mining dump trucks.

The Canadian and Mexico markets are also likely to experience demand from the residential sector as the country is rebuilding its infrastructure damaged by wildfires. The rise in prices of oil and the melting of ice caps in the Arctic is expected to open new trade routes and lead to new exploration activities, which are expected to increase the demand for marine and offshore cranes during the forecast period.

Mobile Crane Industry Overview

Major players operating in the mobile crane market are Liebherr, Cargotec, Tadano, Manitowoc, and Palfinger, among others. These players have successfully capitalized on the significant demand for reliable cranes from key players in the construction, mining, and industrial sectors. In terms of tier-2 and tier-3 supply chains and supplying to small- and medium-sized applications, the market studied is fairly consolidated, with the presence of regional players.

The prominent players have exponentially increased their R&D expenditure to integrate innovation with excellence in performance. The demand for high-performance, highly efficient, and safe-handling equipment, is expected to make the market studied more competitive and effectively dynamic during the forecast period.

- In May 2021, In an effort to better serve the customers and as part of the global expansion of the company, Zoomlion inaugurated a production facility in Mantova, Italy. With this expansion, the company expects to further improve its foothold in Europe and global presence as a whole.

- In April 2021, Liebherr introduced a compact one-man taxi crane, MK 73-3.1 mobile construction crane. This latest machine is designed to fulfill the market demands for a small, compact, and flexible mobile construction crane that is fast and agile in operation.

- In February 2021, Manitex Valla of Italy, a subsidiary of the US-based Manitex international, launched the all-new V 110 R Electric Mobile Crane, which is battery-operated and remote-controlled. The machine is suitable to work in tight places and congested areas but securing in the meantime maximum maneuverability and flexibility in the most critical and demanding operating environments.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Driver

- 4.2 Market Restraint

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Buyers/Consumers

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value USD Billion)

- 5.1 By Machine Type

- 5.1.1 Mobile Crane

- 5.1.2 Fixed Crane

- 5.1.3 Marine and Port Cranes

- 5.2 By Application Type

- 5.2.1 Construction

- 5.2.2 Mining and Excavation

- 5.2.3 Marine and Offshore

- 5.2.4 Industrial Applications

- 5.2.5 Other Application Types

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United States

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Konecranes PLC

- 6.2.2 Cargotec

- 6.2.3 Manitowoc

- 6.2.4 Terex Corporation

- 6.2.5 Tadano Limited

- 6.2.6 Kobelco Cranes Co. Limited

- 6.2.7 Palfinger AG

- 6.2.8 Liebherr-International AG

- 6.2.9 Zoomlion Heavy Industry Science and Technology Co. Limited

- 6.2.10 Favelle Favco Group

- 6.2.11 Sumitomo Heavy Industries Construction Cranes Co. Ltd