|

市场调查报告书

商品编码

1687463

电动汽车电源逆变器:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Electric Vehicle Power Inverter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

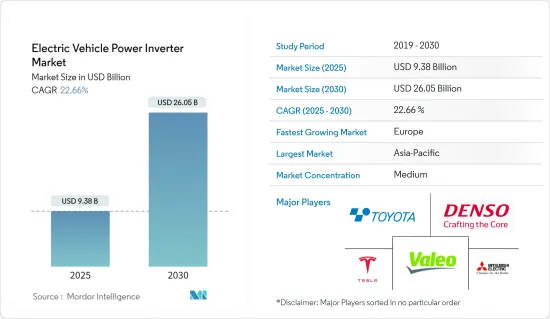

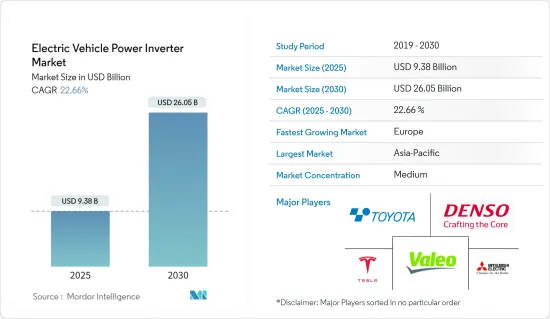

电动车电源逆变器市场规模预计在 2025 年为 93.8 亿美元,预计到 2030 年将达到 260.5 亿美元,预测期内(2025-2030 年)的复合年增长率为 22.66%。

世界各国政府都在电动车计划上投入巨额资金。政府正在寻求为电动车电源逆变器製造商提供机会。政府也鼓励汽车製造商和消费者生产和使用电动车。电动车需求的不断增长也有望推动电动车所用零件(如电源逆变器)的销售。

随着全球排放法规愈发严格,汽车製造商正逐步从传统引擎汽车转向混合动力汽车汽车和电动车的生产。此外,世界各国政府已开始向电动车购买者提供减免道路税、奖金和降低保险费等奖励,以支持电动车销售的成长。欧洲、北美和亚太地区(尤其是日本和中国)充电站安装的增加进一步推动了电动车销售的成长。

几家製造商已经提高了电动车相关公告的标准,预测到 2025 年以后。超过 10 家主要OEM已经宣布了 2030 年及以后的电气化目标。重要的是,一些OEM正计划重新配置其产品线以只生产电动车。例如,通用汽车在第一季宣布,计划到2025年将对电动和自动驾驶汽车的支出增加到200亿美元。该公司的目标是到2023年终推出20款新电动车,并在预测期内在美国和中国每年销售超过100万辆电动车。

电动车电源逆变器市场趋势

扩大电动车销量

电动车已成为汽车产业不可或缺的一部分,并为实现能源效率以及减少污染物和其他温室气体的排放提供了一条途径。人们对环境问题的认识不断提高和政府的积极倡议是推动市场成长的主要因素。

2023 年,全球纯电动车 (BEV) 和插电式混合动力汽车(PHEV) 销量预计将成长 35%,达到 1,400 万辆。其中,纯电动车(BEV)1000万辆,插电式混合动力车(PHEV)400万辆。世界各地正在兴起一股加速小型乘用电动车(EV)普及、逐步淘汰传统内燃机汽车的运动。平均燃料价格的上涨反映出欧洲新电动车註册比例高于其他地区。因此,由于燃料价格上涨而导致的电动车的大规模采用预计将扩大全球业务。

全球各国政府加大对充电基础设施的投资可能会促进电动车的销售。例如,

- 为了满足日益增长的电动车需求,英国政府计划在2030年将公共电动车充电站的数量扩大100倍以上,达到30万个。

- 2023年2月,BP揭露了到2030年在美国投资10亿美元建设电动车充电站的计划,这标誌着BP向综合能源公司转型迈出了重要一步。

此外,随着车辆性能的提高,电池相关的高成本使得逆变器和其他电力电子设备必须改进。

例如,客户偏好向电动车的转变是脱碳未来的明显征兆——同时,这对充电站来说也至关重要。然而,电动车的采用取决于许多属性,包括消费者行为、基础设施和特定的地理丛集。预计电动车销量的成长将刺激对充电站的需求。市场主要企业牢牢掌握消费者情绪,并专注于透过在全国范围内提供快速充电技术来满足消费者情绪。

这种变化虽然没有导致内燃机汽车销量的下降,但却为电动车创造了一个充满希望的市场,无论是现在还是未来。为了因应这一趋势,一些汽车製造商增加了对电动车以及电源逆变器等相关零件的研发投入。另一方面,一些汽车製造商开始专注于推出新产品以抢占市场占有率,最终刺激了市场需求。

亚太地区引领电动车电源逆变器市场

近年来,受环保意识增强、政府倡议和电动车 (EV) 技术进步等因素的推动,亚太地区的电动车市场经历了显着成长。随着人们对空气品质的担忧日益加剧以及对减少温室气体排放的承诺,该地区的国家正在实施支持性政策和奖励,以鼓励人们使用电动车。

- 2023年4月,包括印尼的ION Mobility和越南的VinFast在内的多家东南亚新兴企业筹集了大量资金并推出了新的电动车车型。

中国作为亚太地区的主要企业,已成为最大的电动车市场。中国政府的强大支持,包括慷慨的补贴和奖励以及全面的充电基础设施建设,正在推动中国电动车的快速发展。此外,中国致力于成为电动车领域的全球领导者,这也刺激了电动车製造业的创新和投资。

- 2023年7月,中国电动车巨头比亚迪超越特斯拉,成为2023年上半年全球第一大电动车销售公司,凸显中国企业在全球电动车市场实力日益增强。

日本、韩国等国家在亚太电动车市场也扮演着举足轻重的角色。日本是许多知名汽车製造商的所在地,在技术进步和对永续交通的坚定承诺的推动下,电动车的普及率稳步增长。在韩国,政府的激励措施和研发投资正在促进电动车市场的成长,重点是增强电池技术和扩大充电基础设施。

- 日本政府于2023年3月修改了电动车补贴方案,对符合条件的电动车延长补贴期限并增加补贴,以进一步促进电动车的普及。

- 2023 年 2 月,LG Energy Solutions 和本田宣布成立合资企业,在美国建立电池生产工厂,以满足北美对电动车日益增长的需求,并可能供应亚太市场。

印度凭藉其雄心勃勃的电气化计划,正逐渐成为亚太地区电动车领域的重要参与者。印度政府的倡议,例如加快采用和製造混合动力和电动车(FAME)计划,旨在奖励采用电动车并帮助发展充电基础设施。再加上消费者意识的不断增强,为电动车电源逆变器市场创造了有利的环境。

2023年5月,印度电动车市场出现销售量激增,创下单年电动车销量最高纪录。

电动车电源逆变器产业概况

电动车电源逆变器市场由少数几家公司主导,包括大陆集团、罗伯特·博世有限公司、Denso株式会社和三菱电机株式会社。公司正在透过开设新的生产工厂和建立合资企业来扩大业务,以获得竞争优势。例如

- 2024 年 6 月 NXP Semiconductors NV 和 ZF Friedrichshafen AG 合作开发了一种基于 SiC 的先进电动车牵引逆变器解决方案,该解决方案利用 NXP 的 GD316x HV 隔离闸极驱动器。这些解决方案旨在加速 800V 和 SiC 功率设备的采用,延长电动车续航里程,减少充电中断并降低OEM成本。

- 2024 年 1 月:博格华纳与陕西法士特汽车驱动集团合作,专注于中国电动商用车的高压逆变器解决方案。

- 2023年11月:开发出采用钻石晶片技术的电动车逆变器,其体积明显小于特斯拉3号机组,并提供更有效率的电力。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 电动车需求预计将增加

- 市场限制

- 基础设施发展和营运挑战

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 购买者/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 依推进类型

- 油电混合车

- 插电式混合动力汽车

- 纯电动车

- 燃料电池电动车

- 按车型

- 搭乘用车

- 商用车

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 世界其他地区

- 南美洲

- 中东和非洲

- 北美洲

第六章 竞争格局

- 供应商市场占有率

- 公司简介

- Vitesco Technologies

- Robert Bosch GmbH

- DENSO Corporation

- Toyota Industries Corporation

- Hitachi Astemo Ltd

- Meidensha Corporation

- Aptiv PLC(Borgwarner Inc.)

- Mitsubishi Electric Corporation

- Marelli Corporation

- Valeo Group

- Lear Corporation

- Infineon Technologies AG

- Eaton Corporation

第七章 市场机会与未来趋势

- 双向充电集成

The Electric Vehicle Power Inverter Market size is estimated at USD 9.38 billion in 2025, and is expected to reach USD 26.05 billion by 2030, at a CAGR of 22.66% during the forecast period (2025-2030).

Governments in various countries are spending heavily on electric mobility projects. They are trying to provide opportunities for electric vehicle power inverter manufacturers. The governments are also encouraging automobile manufacturers and customers to produce and adopt electric vehicles. The rise in the demand for electric vehicles is also expected to increase the sales of the components used in electric vehicles, such as power inverters.

With growing stringent emission standards globally, automakers are gradually shifting their production from conventional engine vehicles to hybrid and electric vehicles. In addition, governments initiated incentives, such as a cut down in vehicle tax, bonus payments, and premiums, for buyers of electric vehicles in the respective countries to support electric vehicle sales growth. The increasing charging station facilities in the regions, especially in Europe, North America, and Asia-Pacific, particularly in Japan and China, further supported the growing electric vehicle sales.

Several manufacturers raised the bar to go beyond the announcements related to electric vehicles with an outlook beyond 2025. More than ten of the largest OEMs declared electrification targets for 2030 and beyond. Significantly, some OEMs plan to reconfigure their product lines to produce only electric vehicles. For instance, in the first trimester, General Motors announced its plans to raise its spending on electric and autonomous vehicles to USD 20 billion by 2025. The company launched 20 new electric models by the end of 2023 and aimed to sell more than 1 million electric cars a year in the United States and China over the forecast period.

EV Power Inverter Market Trends

Growing Sales of Electric Vehicles

Electric vehicles have become an integral part of the automotive industry, and they represent a pathway toward achieving energy efficiency, along with reduced emissions of pollutants and other greenhouse gases. The increasing environmental concerns, coupled with favorable government initiatives, are some of the major factors driving the market's growth.

In 2023, global sales of battery electric vehicles (BEVs) and plug-in hybrids (PHEVs) surged by 35%, reaching 14 million units. Among these, 10 million were pure electric BEVs, while 4 million were PHEVs. The movement to accelerate the adoption of light-duty passenger electric cars (EVs) and phase out traditional vehicles with internal combustion engines is gaining traction around the world. The increase in average fuel prices reflects the fact that Europe holds a higher share of new electric car registrations than other parts of the world. Hence, mass adoption of electric vehicles, owing to rising fuel prices, is expected to increase business globally.

Rising government investment in the development of charging infrastructure worldwide is likely to promote the sale of electric vehicles. For instance,

- The UK government aims to expand the quantity of public electric vehicle charging stations by over a hundredfold, reaching 300,000 by 2030, to match the rising demand for electric vehicles.

- In February 2023, BP revealed intentions to inject USD 1 billion by 2030 into electric vehicle (EV) charge points across the United States. It marked a significant stride in the company's evolution toward becoming an integrated energy company.

Moreover, the high cost associated with batteries necessitated the improvement of inverters and other power electronics, along with improving the performance of vehicles.

For instance, shifting customer preference toward electric vehicles is an evident sign of future decarbonization and is simultaneously decisive for charging stations. However, the penetration of EVs is subjected to various attributes, including consumer behavior, infrastructure, and certain regional clusters. The increase in electric vehicle sales is anticipated to proportionally fuel the demand for charging stations. Prominent players in the market have pinpointed consumer sentiment and thus are focusing on catering to it by offering fast-charging technologies across the country.

Though the change did not result in a slump in IC engine vehicle sales, it created a promising market for electric vehicles in the present and future. The above trend propelled some of the automakers to increase their expenditure on R&D in electric vehicles and associated components, like power inverters. While others, on the other hand, started focusing on launching new products to capture the market share, eventually pushing the demand in the market.

Asia-Pacific is leading the Electric Vehicle Power Inverter Market

The Asia-Pacific electric vehicle market has witnessed substantial growth in recent years, driven by a combination of environmental awareness, government initiatives, and advancements in electric vehicle (EV) technology. With a rising concern for air quality and a commitment to reducing greenhouse gas emissions, countries in the region have implemented supportive policies and incentives to promote the adoption of electric vehicles.

- In April 2023, several startups in Southeast Asia, like Indonesia's ION Mobility and Vietnam's VinFast, raised significant funding and launched new electric vehicle models, indicating a growing interest in regional EV production.

China, as a major player in the Asia-Pacific region, has emerged as the largest market for electric vehicles. The Chinese government's robust support, including generous subsidies, incentives, and the establishment of a comprehensive charging infrastructure, has propelled the rapid growth of electric vehicles in the country. Additionally, China's push toward becoming a global leader in electric mobility has spurred innovation and investment in electric vehicle manufacturing.

- In July 2023, Chinese EV giant BYD overtook Tesla as the world's leading electric vehicle seller in the first half of 2023, highlighting the growing strength of Chinese players in the global EV market.

Countries like Japan and South Korea have also played pivotal roles in the Asia-Pacific electric vehicle market. Japan, home to renowned automakers, has seen a steady increase in electric vehicle adoption, driven by technological advancements and a strong commitment to sustainable transportation. In South Korea, government incentives and investments in research and development have contributed to the growth of the electric vehicle market, with a focus on enhancing battery technology and expanding charging infrastructure.

- In March 2023, the Japanese government revised its EV subsidy program, extending it and increasing benefits for eligible electric vehicles to further promote EV adoption.

- In February 2023, LG Energy Solution and Honda announced a joint venture to establish a battery cell production plant in the United States, catering to the growing demand for EVs in North America and potentially supplying the Asia-Pacific market as well.

India, with its ambitious plans for electrification, is gradually becoming a significant player in the Asia-Pacific electric vehicle landscape. The Indian government's initiatives, such as the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme, aim to incentivize electric vehicle adoption and support the development of charging infrastructure. This, coupled with increasing consumer awareness, is fostering a positive environment for the electric vehicle power inverter market.

In May 2023, the Indian EV market experienced a surge in sales, registering the highest number of electric vehicles sold in a single year, driven by rising fuel prices and increasing awareness of environmental benefits.

EV Power Inverter Industry Overview

A few players, such as Continental AG, Robert Bosch GmbH, DENSO Corporation, and Mitsubishi Electric Corporation, dominate the electric vehicle power inverter market. Companies are expanding their business by opening new production plants and making joint ventures so that they can gain an edge over their competitors. For instance,

- June 2024: NXP Semiconductors NV and ZF Friedrichshafen AG collaborated on advanced SiC-based traction inverter solutions for EVs, utilizing NXP's GD316x HV isolated gate drivers. These solutions aim to expedite the adoption of 800-V and SiC power devices, enhancing EV range, reducing charging stops, and lowering costs for OEMs.

- January 2024: BorgWarner, in partnership with Shaanxi Fast Auto Drive Group, is focusing on high-voltage inverter solutions for electric commercial vehicles in China.

- November 2023: Diamond Foundry Inc. developed an electric car inverter using diamond wafer technology, which was significantly smaller than Tesla 3's unit and delivered more efficient power.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Rising Demand for Electric Vehicles Is Expected to Increase the Demand

- 4.2 Market Restraints

- 4.2.1 Infrastructure Challenges May Possess Operational Challenges

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD)

- 5.1 By Propulsion Type

- 5.1.1 Hybrid Electric Vehicles

- 5.1.2 Plug-in Hybrid Electric Vehicle

- 5.1.3 Battery Electric Vehicle

- 5.1.4 Fuel Cell Electric Vehicle

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Vitesco Technologies

- 6.2.2 Robert Bosch GmbH

- 6.2.3 DENSO Corporation

- 6.2.4 Toyota Industries Corporation

- 6.2.5 Hitachi Astemo Ltd

- 6.2.6 Meidensha Corporation

- 6.2.7 Aptiv PLC (Borgwarner Inc.)

- 6.2.8 Mitsubishi Electric Corporation

- 6.2.9 Marelli Corporation

- 6.2.10 Valeo Group

- 6.2.11 Lear Corporation

- 6.2.12 Infineon Technologies AG

- 6.2.13 Eaton Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Integration of Bidirectional Charging