|

市场调查报告书

商品编码

1437965

瓦楞包装:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Corrugated Board Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

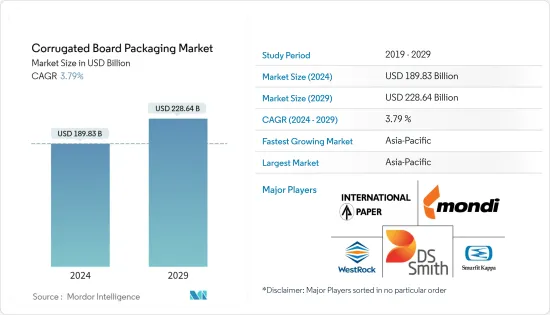

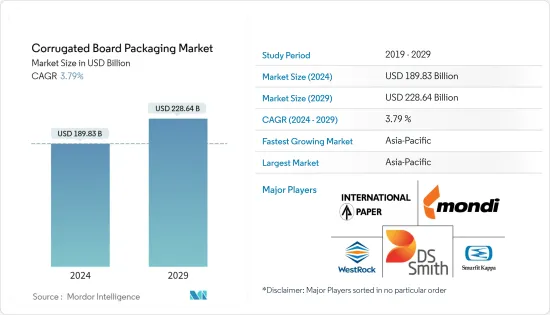

瓦楞包装市场规模预计到 2024 年为 1,898.3 亿美元,预计到 2029 年将达到 2,286.4 亿美元,预测期内(2024-2029 年)复合年增长率为 3.79%。

纸板由纸浆和纸製成。因此,与塑胶包装相比,它的可回收性很高。波纹槽介质可作为避震器,保护包装产品免受外部衝击。这些容器可以承受高压,并且凹槽的不同层数和厚度具有缓衝等优点,可以保护包装的货物。

主要亮点

- 近年来,电子商务产业已成为重要的终端使用者产业。亚马逊等着名电子商务公司使用瓦楞纸箱作为主要包装,并使用塑胶来包装单一产品。

- 即使在网路购物已经很普及的国家,电子商务也有望继续保持成长势头。据摩根士丹利称,由于韩国发达的付款和物流基础设施,线上销售占韩国零售总额的37%。然而,预计成长将持续。由于当日送达和食品配送选择,韩国的电子商务预计在未来五年内将成长 45%。摩根士丹利预计,电子商务规模可能从 2022 年 6 月的 3.3 兆美元成长到 2026 年的 5.4 兆美元。

- 纸板用途广泛。因此,它可以呈现各种形状,包括盒子。永续性问题正在逐渐取代柔性塑胶袋。此外,瓦楞纸箱是各种印刷技术的完美基础。因此,企业倾向于选择纸板包装作为行销工具。它们还可以充当行动广告牌,因此企业不必在行销上花费额外的资金。

- 人们忙碌的生活方式增加了对即食食品的需求。由于瓦楞纸包装可以防潮并且可以承受较长的运输时间,越来越多的公司采用这种包装类型来为客户提供更好的结果。麵包、肉品和其他生鲜食品等加工食品的需求量很大,因为这些包装材料只需使用一次。

- 由于 COVID-19感染疾病,食品包装的成长以及电子商务出货不断增加对纸板的需求不断增加是所研究市场的一些关键驱动因素。电子商务入口网站对杂货包装、医疗保健产品和电子商务运输的需求急剧增加。同时,对奢侈品、工业和一些 B2B 运输包装的需求有所减少。

瓦楞纸板市场趋势

加工食品领域预计将占据主要市场占有率

- 人们忙碌的生活方式增加了对即食食品的需求。因此,准备时间较短的加工食品吸引了许多消费者。随着人口的成长,对方便加工食品的需求也在增加。

- 由于瓦楞纸包装可以防止水分从产品中逸出,并且可以承受较长的运输时间,因此越来越多的公司采用这种包装来提供更好的客户成果,特别是在二级或三级包装中。麵包、肉品和其他生鲜食品等加工食品的需求量很大,因为这些包装材料只需使用一次。

- 纸板包装正成为各种食品塑胶包装的可行替代品。瓦楞纸箱包装更容易由回收材料製成,并且可以回收或堆肥。

- 消费者,尤其是千禧世代,越来越意识到食品包装、食品生产和食品浪费对环境的影响。根据斯道拉恩索的一项研究,59% 的千禧世代认为包装在整个价值链中应该是永续的。对永续包装产品的需求是加工食品包装的关键驱动力,对瓦楞包装市场的成长产生正面影响。

- 据日本经济产业省称,用于加工食品和饮料的纸板消费量正在稳步增长。 2017年,日本加工食品和饮料的消费量为39.3亿平方公尺,2021年将增加至41.4亿平方公尺。

中国预计在亚太地区占较大份额

- 中国瓦楞包装产业深受人均收入成长、社会风气变化和人口趋势的影响。这种变化需要新的包装材料、工艺和形状。阿里巴巴等不断发展的电子商务公司预计将在预测期内刺激纸板市场。

- 例如,在2021年阿里巴巴双11购物活动期间,中国消费者总共购买了价值5,403亿元人民币(约845.4亿美元)的产品。此外,据阿里巴巴和京东市场等电子商务供应商称,中国消费者花费了美元。双十一消耗了1390亿美元,增加了各种产品的库存和储存,并增加了对纸板包装的需求。

- 由于城市人口的增加、电子商务包装行业的发展、纸浆价格的下降以及公众对环保包装意识的增强,中国瓦楞包装市场预计将增长。瓦楞纸板生产能力的提高和技术进步是该行业的主要趋势和发展之一。然而,严格的法规和产品品质等一些障碍可能会阻碍市场的扩张。

- 目前,我国食品饮料、IT电子、家电等产业对纸板的需求量较大,消费也日益成熟。由于主要终端用户行业的包装升级趋势,中高檔瓦楞纸箱市场规模预计将持续成长。

- 此外,促进该国瓦楞包装市场加速发展的因素包括城市人口环保意识的增强、对永续包装的需求、对便利包装的需求增加、电子商务活动的增长、电子产品需求的增加为了。商品、家居和个人保健产品。

瓦楞纸板行业概况

瓦楞包装市场分散,许多公司提供瓦楞包装解决方案。本公司不断创新,推动永续包装,提供环保包装产品。为了利用这个机会,公司已经开始为各种最终用户产业设计瓦楞纸箱。市场上也见证了市场相关人员的多次联盟和收购,以加强其在瓦楞包装领域的产品组合。

- 2022 年 5 月-Mondi 宣布投资 2.8 亿欧元增加瓦楞纸板和纸板产量。该投资将有助于扩大捷克共和国、波兰、德国和土耳其的产能并提高效率。其中,1.85 亿欧元将投资于该公司位于中欧和东欧的 Corrugated Solutions 工厂网路。

- 2022 年 4 月 -英国永续包装供应商 DS Smith 开发并推出了用于医疗设备电子商务运输的瓦楞纸箱。这种新型瓦楞纸箱采用单一材料解决方案,而不是带有一次性塑胶插件的黏合包装。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争公司之间的敌意强度

- 评估新型冠状病毒感染疾病(COVID-19)对市场的影响

第五章市场动态

- 市场驱动因素

- 轻质材料的采用增加以及纸板数位印刷的发展

- 电商产业需求旺盛

- 市场挑战

- 增加可回收和可重复使用包装的使用

第六章市场区隔

- 按最终用户产业

- 加工过的食品

- 生鲜食品及农产品

- 饮料

- 个人和家庭护理

- 电子商务

- 其他最终用户产业(电气电子、医疗保健、工业、纺织、玻璃和陶瓷)

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 波兰

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 印尼

- 泰国

- 澳洲

- 马来西亚

- 其他亚太地区

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 其他拉丁美洲

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿拉伯聯合大公国

- 其他中东和非洲

- 北美洲

第七章 竞争形势

- 公司简介

- International Paper Company

- Mondi Group

- DS Smith PLC

- WestRock Company

- Smurfit Kappa Group

- Stora Enso Oyj

- Sealed Air Corporation

- Neway Packaging

- Wertheimer Box Corp.

- Georgia-Pacific LLC

- Nine Dragons Paper Holdings Limited

- Oji Holdings Corporation

第八章投资分析

第9章市场的未来

The Corrugated Board Packaging Market size is estimated at USD 189.83 billion in 2024, and is expected to reach USD 228.64 billion by 2029, growing at a CAGR of 3.79% during the forecast period (2024-2029).

Corrugated boards are made of pulp and paper; therefore, they are extremely recyclable compared to plastic packaging. The corrugated board's fluting medium serves as a shock absorber, shielding packaged items from external impact. These containers can bear high pressure, and the flutes' varied layers and thicknesses offer advantages, including cushioning to safeguard packaged goods.

Key Highlights

- The e-commerce industry emerged as a significant end-user industry in recent years. Prominent e-commerce companies, such as Amazon, have been using corrugated board boxes for principal packaging, and they rely on plastic packaging for individual items.

- E-commerce is expected to continue to gain traction, even in countries where online shopping is already popular. According to Morgan Stanley, In South Korea, due to well-developed payments and logistics infrastructure, online sales account for 37% of all retail activity. However, the growth is expected to continue further. E-commerce in South Korea is anticipated to increase by 45% in the next five years, driven by same-day delivery and food delivery options. Morgan Stanley estimates suggest that e-commerce could grow from USD 3.3 trillion as of June 2022 to USD 5.4 trillion in 2026.

- The corrugated board is highly versatile. Thus, it can take various forms including box. Due to sustainability issues, it is slowly replacing flexible plastic bags. Moreover, corrugated boxes are a perfect base for several printing techniques. Thus, companies tend to prefer corrugated packaging as a marketing tool. They also act as mobile billboards, where the companies do not have to spend additionally on marketing.

- The demand for convenience foods is rising due to people's busy lifestyles. As corrugated board packaging keeps moisture away and withstands long shipping times, companies are increasingly adopting this packaging type to offer better outcomes to customers. Processed foods, such as bread, meat products, and other perishable items, need these packaging materials to be used just once, thus driving the demand.

- The growth in food packaging and ever-increasing demand for corrugated packages in growing e-commerce shipments are some of the primary drivers of the studied market resulting from the COVID-19 outbreak. In e-commerce portals, demand has sharply increased for grocery packaging, healthcare products, and e-commerce shipments. At the same time, the need for luxury, industrial, and some B2B-transport packaging has declined.

Corrugated Packaging Market Trends

Processed Food Segment Expected to Occupy Significant Market Share

- The demand for convenience foods is rising due to people's busy lifestyles. Hence, processed food, which takes less time to cook, attracts many consumers. The increasing population also drives the demand for processed food, which is convenient.

- As corrugated board packaging keeps moisture away from products and can withstand long shipping times, companies are increasingly adopting this packaging to offer better customer outcomes, especially for secondary or tertiary packaging. Processed foods, such as bread, meat products, and other perishable items, need these packaging materials to be used just once, thus driving the demand.

- Corrugated board packaging is becoming a viable alternative to plastic packaging for many different food products. Corrugated box packaging can be created more simply from recycled materials and recycled or composted.

- Consumers, particularly millennials, are becoming more aware of the impact of food packaging, food production, and food waste on the environment. According to a Stora Enso survey, 59% of millennials think that packaging should be sustainable throughout the value chain. Demand for sustainable packaging products is a key driver in processed food packaging positively impacting corrugated board packaging market growth.

- According to the Ministry of Economy, and Industry of Japan, volume consumption of corrugated cardboard boxes for processed food and beverages has been steadily rising. In 2017, the consumption volume was 3.93 billion square meters for processed food and beverages which increased to 4.14 billion square meters in 2021 in Japan.

China is Expected to Hold Significant Share in Asia Pacific

- The Chinese corrugated board packaging sector is heavily influenced by the rising per capita income, changing social atmosphere, and demographics. As a result of this shift, new packaging materials, processes, and forms are required. Over the forecast period, growing e-commerce companies such as Alibaba are expected to fuel the corrugated packaging market.

- For example, Chinese shoppers purchased a total of CNY 540.3 billion (nearly USD 84.54 billion) value merchandise during Alibaba's Double 11 shopping event in 2021. In addition, according to the e-commerce vendors like Alibaba and JD.com, Chinese shoppers spent USD 139 billion during the Single's day festival, thus raising the inventory and storage of various goods and driving the demand for corrugated packaging.

- The growing urban population, developing e-commerce package industry, declining pulp prices, and improving population awareness about eco-friendly packaging are expected to propel China's corrugated board packaging market. Increased containerboard capacity and technological breakthroughs are among the industry's key trends and developments. However, some obstacles, such as tight rules and product quality, can stifle market expansion.

- Industries, including food and beverage, IT electronics, and home appliances, which have a huge demand for corrugated boxes, are currently witnessing a trend of consumption upgrading in China. The trend of upgrading packaging in leading end-user industries is expected to lead to continued growth in the market size of mid to high-end corrugated cartons.

- Further, factors that are contributing to the acceleration of the corrugated packaging market in the country are the growing environmental awareness by the urban population, demand for sustainable packaging, increasing demand for convenient packaging, growth in e-commerce activity, and rising demand for electronic goods and home and personal care products.

Corrugated Packaging Industry Overview

The market for corrugated board packaging is fragmented, with many players providing corrugated board packaging solutions. Companies are constantly innovating to promote sustainable packaging and provide eco-friendly packaging products. Companies are launching corrugated box designs for various end-user industries to leverage the opportunities. The market is also witnessing multiple partnerships and acquisitions by market players to strengthen their portfolios in the corrugated board packaging segment.

- May 2022 - Mondi announced to invest EUR 280 million to increase the production of corrugated board and cardboard. This investment will help to expand capacity and increase efficiency in the Czech Republic, Poland, Germany and Turkey. Of this investment figure, EUR 185 million will go to the company's network of Corrugated Solutions plants in Central and Eastern Europe.

- April 2022 - DS Smith, a UK-based sustainable packaging provider, developed and launched a corrugated cardboard box for e-commerce shipments of medical devices. This new corrugated cardboard box features a single-material solution in place of glued packaging with a single-use plastic insert.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Adoption of Lightweight Materials and Evolution of Digital Print for Corrugated Boards

- 5.1.2 Strong Demand from the E-commerce Sector

- 5.2 Market Challenges

- 5.2.1 Increasing Usage of Returnable and Reusable Packaging

6 MARKET SEGMENTATION

- 6.1 By End-user Industry

- 6.1.1 Processed Foods

- 6.1.2 Fresh Food and Produce

- 6.1.3 Beverages

- 6.1.4 Personal and Household Care

- 6.1.5 E-commerce

- 6.1.6 Other End-user Industries (Electrical & Electronics, Healthcare, Industrial, Textile, Glass & Ceramics)

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 Germany

- 6.2.2.3 France

- 6.2.2.4 Italy

- 6.2.2.5 Spain

- 6.2.2.6 Poland

- 6.2.2.7 Rest of Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 India

- 6.2.3.3 Japan

- 6.2.3.4 South Korea

- 6.2.3.5 Indonesia

- 6.2.3.6 Thailand

- 6.2.3.7 Australia

- 6.2.3.8 Malaysia

- 6.2.3.9 Rest of Asia-Pacific

- 6.2.4 Latin America

- 6.2.4.1 Brazil

- 6.2.4.2 Argentina

- 6.2.4.3 Mexico

- 6.2.4.4 Rest of Latin America

- 6.2.5 Middle-East and Africa

- 6.2.5.1 Saudi Arabia

- 6.2.5.2 South Africa

- 6.2.5.3 United Arab Emirates

- 6.2.5.4 Rest of Middle-East and Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 International Paper Company

- 7.1.2 Mondi Group

- 7.1.3 DS Smith PLC

- 7.1.4 WestRock Company

- 7.1.5 Smurfit Kappa Group

- 7.1.6 Stora Enso Oyj

- 7.1.7 Sealed Air Corporation

- 7.1.8 Neway Packaging

- 7.1.9 Wertheimer Box Corp.

- 7.1.10 Georgia-Pacific LLC

- 7.1.11 Nine Dragons Paper Holdings Limited

- 7.1.12 Oji Holdings Corporation