|

市场调查报告书

商品编码

1437970

铅酸电池:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Lead-acid Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

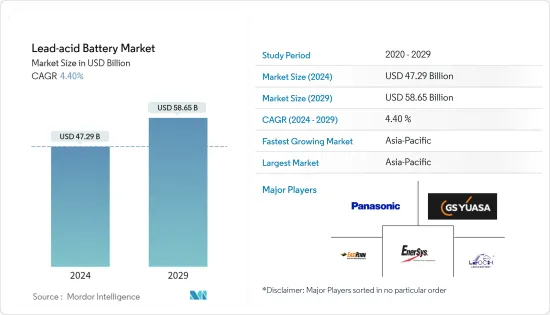

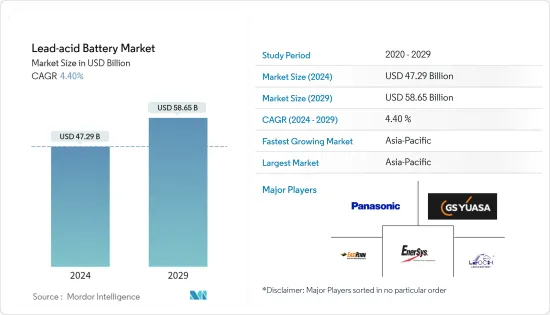

2024年铅酸电池市场规模预计为472.9亿美元,预计2029年将达到586.5亿美元,预测期内(2024-2029年)复合年增长率为4.40%。

儘管冠状病毒感染疾病(COVID-19)对2020年市场产生了负面影响,但已达到大流行前的水平。

主要亮点

- 从中期来看,汽车销售量的增加预计将刺激铅酸电池市场的成长。

- 另一方面,成本下降和锂离子电池的日益普及预计将阻碍预测期内的市场成长。

- 铅酸电池市场在 AGM(吸收玻璃毡)电池和 EFB(增强型富液式电池)技术等技术方面取得了多项进展,预计这些技术将在预测期内为市场提供重大机会。

- 预计亚太地区将主导铅酸电池市场,大部分需求来自中国、日本和印度。

铅酸蓄电池市场趋势

SLI 电池领域占据市场主导地位

- SLI 电池专为汽车使用而设计,始终连接到车辆的充电系统。这意味着每当车辆使用时,电池内部都会进行连续的充电和放电循环。 50 多年来,12 伏特电池一直是最常用的电池。然而,平均电压(在汽车中使用和使用交流发电机充电期间)接近 14 伏特。

- 2021年SLI电池领域占75.32%的市场占有率。由于汽车行业的全球成长,其份额预计在预测期内扩大。原始OEM和售后市场不断增长的需求正在推动汽车行业的发展。

- SLI电池市场成长的主要驱动力是对这些电池为启动马达、灯、点火系统或其他内燃机提供动力,同时确保高性能、长寿命和成本效率的需求的成长。

- 铅酸电池是全球小客车和卡车等传统内燃机车辆中所有 SLI 电池应用的首选技术。

- 根据国际工业组织 (OICA) 的数据,2020 年全球汽车销售将从低迷中復苏。 2021年,全球汽车销量较2020年成长4.96%。

- 虽然传统内燃机市场预计将在未来 30 至 40 年内衰退,但预计替代汽车技术将继续使用 SLI 型铅酸电池为车内的各种电子设备和安全功能提供动力。

亚太地区主导市场

- 预计亚太地区将主导铅酸电池市场,大部分需求来自中国、日本和印度。

- 截至2021年,中国是最大的电动车市场,销量约330万辆。

- 电动车的普及符合清洁能源政策。中国政府计划放宽对汽车製造商进口汽车的限制,以缩小供需缺口。目前,外国汽车製造商面临25%的进口关税,或被要求在中国建厂并拥有最多50%的所有权。电动车製造商预计将首先从这项变更中受益。

- 此外,印度汽车产业的成长、发电工程数量的增加以及通讯基础设施的持续扩张预计将推动国内铅酸电池的需求。

- 电讯业仍然是印度最有希望使用铅酸电池的最终用户之一。印度通讯业在过去十年中取得了显着成长。例如,根据印度电讯监管局的数据,2022 年 3 月无线或行动电话用户总数达到 1,14,208 万人。

- 然而,印度铅酸电池市场正面临锂离子电池技术的挑战,这导致铅酸电池的研发活动日益受到关注。製造商被迫提供低维护、高品质、持久的电池,以保持与锂离子电池的竞争。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 调查先决条件

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2027 年之前的市场规模与需求预测

- 最新趋势和发展

- 政府政策法规

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌意强度

第五章市场区隔

- 按用途

- SLI(启动、照明、点火)电池

- 固定电池(电信、UPS、能源储存系统(ESS)等)

- 可携式电池(家用电器等)

- 其他用途

- 依技术

- 液体型

- VRLA(阀控式铅酸蓄电池)

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 法国

- 义大利

- 英国

- 俄罗斯联邦

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 其他中东和非洲

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 北美洲

第六章 竞争形势

- 併购、合资、合作与协议

- 主要企业采取的策略

- 公司简介

- Johnson Controls International PLC

- Exide Technologies Inc.

- GS Yuasa Corporation

- EnerSys

- East Penn Manufacturing Co.

- C&D Technologies Inc.

- Amara Raja Batteries Ltd

- Leoch International Technology Limited

- Panasonic Corporation

第七章市场机会与未来趋势

简介目录

Product Code: 63927

The Lead-acid Battery Market size is estimated at USD 47.29 billion in 2024, and is expected to reach USD 58.65 billion by 2029, growing at a CAGR of 4.40% during the forecast period (2024-2029).

Though COVID-19 negatively impacted the market in 2020, it has reached pre-pandemic levels.

Key Highlights

- Over the medium term, the increasing sales of automobiles are expected to stimulate the growth of the lead-acid battery market.

- On the other hand, declining costs and increasing adoption of lithium-ion batteries are expected to hinder the growth of the market during the forecast period.

- The lead-acid battery market has witnessed several developments in technologies like AGM (Absorbed Glass Mat) batteries and EFB (Enhanced Flooded Battery) technology, which are expected to provide great opportunities for the market during the forecast period.

- Asia-Pacific is expected to dominate the lead-acid battery market, with most of the demand coming from China, Japan, and India.

Lead Acid Battery Market Trends

SLI Battery Segment to Dominate the Market

- SLI batteries are designed for automobiles and are always installed with the vehicle's charging system, which means there is a continuous cycle of charge and discharge in the battery whenever the vehicle is in use. The 12-volt batteries have been the most commonly used for over 50 years. However, their average voltage (while in use in the car and being charged by the alternator) is close to 14 volts.

- The SLI batteries segment held a 75.32% market share in 2021. Its share is expected to grow during the forecast period, owing to worldwide growth in the automotive sector. The growing demand from OEMs and aftermarkets has boosted the automotive sector.

- The major factors attributed to the growth of the SLI battery market are the increasing demand for these batteries to power start motors, lights, ignition systems, or other internal combustion engines while ensuring high performance, long life, and cost-efficiency.

- The lead-acid battery is the technology of choice for all SLI battery applications in conventional combustion engine vehicles, such as cars and trucks worldwide.

- According to the International Organization of Motor Vehicle Manufacturers (OICA), motor vehicle sales globally have been recovering after a downfall in 2020. In 2021, the world witnessed a 4.96% rise in motor vehicle sales compared to 2020.

- Although the conventional combustion engine market is expected to decline over the next 30-40 years, replacement car technologies are expected to continue using SLI-type lead-acid batteries to provide power for various electronics and safety features within the vehicle.

Asia-Pacific to Dominate the Market

- The Asia-Pacific is expected to dominate the lead-acid battery market, with most demand coming from China, Japan, and India.

- As of 2021, China is the largest electric vehicle market, selling around 3.3 million vehicles.

- The increasing adoption of electric vehicles aligns with the clean energy policy. The Chinese government plans to ease restrictions on automakers importing cars into the country to reduce the demand-supply gap. Currently, foreign automakers face a 25% import tariff or have to build a factory in China with a cap of 50% ownership. Electric vehicle makers are expected to be the first to benefit from this change.

- Moreover, in India, the growing automobile sector, the increasing number of solar power projects, and the continuous expansion of telecommunication infrastructure are expected to drive the demand for lead-acid batteries in the country.

- The telecom sector remains one of India's most promising end users for lead-acid battery use. The Indian telecommunication sector has registered strong growth over the past decade. For instance, according to the Telecom Regulatory Authority of India, the total wireless or mobile telephone subscriber base reached 1142.08 million in March 2022.

- However, the lead-acid battery market in India faces challenges from lithium-ion battery technology, which has led to an increased focus on research and development activities pertaining to lead-acid batteries. Manufacturers are being forced to offer high-quality, long-lasting batteries with low maintenance to sustain the competition from lithium-ion batteries.

Lead Acid Battery Industry Overview

The lead-acid battery market is fragmented. Some of the key players in this market (in no particular order) include Panasonic Corporation, GS Yuasa Corporation, EnerSys, East Penn Manufacturing Co., and Leoch International Technology Limited, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Application

- 5.1.1 SLI (Starting, Lighting, Ignition) Batteries

- 5.1.2 Stationary Batteries (Telecom, UPS, Energy Storage Systems (ESS), etc.)

- 5.1.3 Portable Batteries (Consumer Electronics, etc.)

- 5.1.4 Other Applications

- 5.2 By Technology

- 5.2.1 Flooded

- 5.2.2 VRLA (Valve Regulated Lead-acid)

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 Italy

- 5.3.2.4 United Kingdom

- 5.3.2.5 Russian Federation

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 Saudi Arabia

- 5.3.4.2 United Arab Emirates

- 5.3.4.3 South Africa

- 5.3.4.4 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Johnson Controls International PLC

- 6.3.2 Exide Technologies Inc.

- 6.3.3 GS Yuasa Corporation

- 6.3.4 EnerSys

- 6.3.5 East Penn Manufacturing Co.

- 6.3.6 C&D Technologies Inc.

- 6.3.7 Amara Raja Batteries Ltd

- 6.3.8 Leoch International Technology Limited

- 6.3.9 Panasonic Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219

![汽车铅酸电池市场(结构设计:富液式铅酸电池和密封铅酸电池[SLA]/阀控式铅酸电池[VRLA])-全球产业分析、规模、份额、成长、趋势和预测,2023 -2031](/sample/img/cover/42/1420808.png)