|

市场调查报告书

商品编码

1850380

施工机械租赁:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Construction Equipment Rental - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

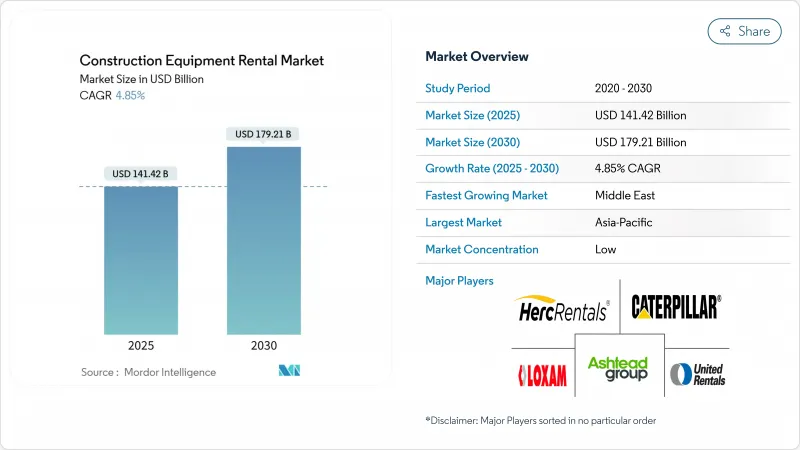

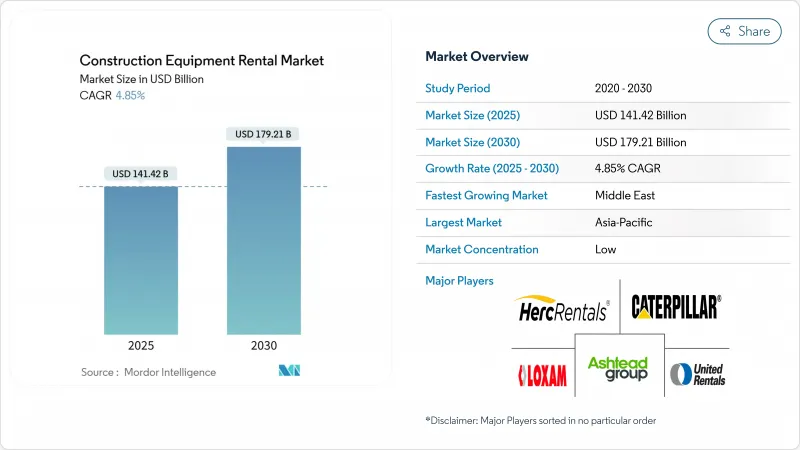

预计到 2025 年,施工机械租赁市场规模将达到 1,414.2 亿美元,到 2030 年将达到 1,792.1 亿美元,年复合成长率为 4.85%。

这一发展势头源于创纪录的公共部门基础设施建设项目、倾向于轻资产模式的承包商扩张以及租赁交易的快速数位化。电子机械和氢燃料电池机械的日益普及,以及基于绩效的服务合同,正在重塑车队战略并开闢高端定价市场。亚太地区凭藉着持续的公路、铁路和城市重建项目,保持着规模主导,而中东地区则在「2030愿景」大型企划的推动下,成为成长最快的地区。随着主要参与者加速收购以获得地域覆盖率和技术能力,竞争日益激烈。远端资讯处理驱动的车队优化正在成为提高运转率和客户维繫的关键手段,在一定程度上抵消了技术纯熟劳工短缺和维护多个品牌的不利影响。

全球施工机械租赁市场趋势与洞察

基础设施奖励策略方案:大量计划储备

美国1.2兆美元的《基础设施投资与就业法案》和印度1.4兆美元的国家基础建设规划正在推动多年设备需求週期。据联合租赁公司(United Rental)称,大型企划在租赁订单中所占份额不断增长,从而确保了计划整个生命週期内设备的可预测利用率。承包商越来越倾向于为各个阶段租赁专用机械,以避免资金閒置,而这些专案中的可再生能源部分正在推动氢动力和纯电动土方机械的早期应用。亚太和北美地区受益最大,这得益于其密集的物流网络和成熟的租赁分店,能够提供多样化的设备组合。公共规模也鼓励小型供应商透过数位化交易平台进行设备企业联合组织,将服务范围扩展到一线城市以外的地区。

承包商从资本支出转向营运支出

高利率和不稳定的订单迫使车队管理者租赁高达 80% 的现场设备,从而显着降低资产负债率。 37% 的美国承包商表示推迟了采购,这印证了营运支出模式日益增长的吸引力。设备即服务 (EaaS) 合约将维护和残值风险转移给租赁专家,使承包商能够将资金重新投入核心计划交付。中小企业可以透过获得以前预算以外的高端机械设备来获得竞争优势。同时,租赁公司受益于更高的设备周转率和更快的车队更新能力,确保符合日益严格的排放法规。

熟练操作人员短缺会增加停机风险

到2026年,将需要新增8万多名重型设备操作员,而现有操作员中有41%将退休。人手不足导致工地租赁设备利用率不足,延长计划工期并降低租赁收益。经验不足的操作员引发的安全事故也会推高保险和维修成本。大型租赁公司目前提供基于模拟器的培训,据称已将新员工培训时间从六个月缩短至七週,并将责任索赔减少了两位数。然而,人才缺口限制了先进电动和氢燃料电池设备的快速部署,因为这些设备需要更高的技术水平。

细分市场分析

预计到2024年,土木机械将占全球施工机械租赁市场收入的40.98%。挖土机和后铲式装载机是道路、地基和沟槽施工的主力设备,高峰期运转率超过70%。在这一类别中,受都市区噪音和废气排放法规的推动,电动小型挖土机的复合年增长率将达到8.81%。

由于亚洲和海湾国家高层建筑的激增,起重机和加长型堆高机等物料输送设备的重要性下降。而土木机械车队的远端资讯处理集成,则增强了预测性维护能力,从而延长了资产寿命,并提高了客户满意度。

售后服务领域也出现了类似的转变,租赁公司将操作员培训和全天候现场支援合约捆绑在一起,以此证明提高每日租金的合理性。大型平土机和推土机的数位双胞胎正在进行试验,以模拟磨损模式并确定最佳更换週期。结合推土机自主控制系统的维修,这些技术进步可望进一步提高生产效率,但不同地区的监管接受度不一。因此,车队所有者正在优先考虑并分散投资于运转率更高的都会区计划,同时密切关注农村地区的需求弹性。

到2024年,内燃机仍将维持85.74%的市场份额,这得益于完善的加氢基础设施和操作人员的熟悉程度。然而,随着各国政府强制要求在人口密集的都市区地区实现零排放,施工机械租赁市场正在改变。氢燃料电池原型机预计到2030年将以16.99%的复合年增长率成长,成为成长最快的领域,这得益于其快速加氢和比电池系统更长的运作週期。电池电动马达型在小型挖土机和剪式升降机成长最为迅速,这些机型可以有效缓解里程焦虑,并允许在现场进行夜间充电。

混合动力系统可以作为一种过渡技术。联合租赁公司(United Rental)报告称,将发电机与电池储能组结合使用,可节省高达 80% 的燃料,并降低 34% 的成本。然而,要推广应用,必须对残值有清楚的了解。高容量锂电池售后市场价格的不确定性阻碍了车队的积极部署。为了降低风险,大型租赁业者正在采用基于订阅的升级模式,以便在技术或法规变更时快速切换。

这份施工机械租赁报告按设备类型(土木机械(例如后铲式装载机)、其他)、驱动类型(内燃机、其他)、应用领域(住宅建筑、其他)、租赁管道(线下、线上)、服务类型(短期租赁、其他)和地区(北美、其他)进行细分。市场预测以价值(美元)和数量(台)为单位。

区域分析

2024年,亚太地区占全球租赁收入的39.01%,这主要得益于中国「一带一路」倡议的推进、印度创纪录的资本支出以及日本持续稳定的公共工程项目。 2024年,中国整车製造商(OEM)占全球电动施工机械出货量的75%,并积极向东南亚出口。印度的建筑业预计在2030年为GDP贡献1兆美元,这将推动大型租赁公司在全国扩张。日本在经历了两个季度的机械订单萎缩后,随着半导体分店投资的增加,于2025年初恢復成长。

中东是成长最快的地区,预计到2030年年均复合成长率将达到7.56%。在沙乌地阿拉伯,包括利雅德地铁和NEOM新城计划在内的「2030愿景」规划正在推动租赁需求以每年超过12%的速度成长。阿拉伯联合大公国(阿联酋)也同样受益于大型走廊和综合用途开发项目,例如耗资80亿澳元的马萨尔社区。起重机和加长型堆高机製造商正将其车队迁往海湾地区,以利用当地的高运转率和可观的收益。

北美地区维持6.58%的健康复合年增长率。大规模的基础建设和强劲的私人企业建设支撑着稳定的运转率。欧洲的成长放缓至5.30%,但严格的第五阶段柴油排放标准和市政零碳排放指令使其在低排放气体市场占据领先地位。南美洲的复合年增长率达到7.34%,这得益于交通走廊的现代化和商品产业的復苏。非洲的平均成长率为6.90%,但各市场的资金筹措管道和监管透明度仍不均衡。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 大型基础设施奖励策略计划储备

- 承包商资本支出向营运支出转变

- 严格的ESG目标推动电力租赁

- 按付费使用制和基于绩效的合约模式

- 新兴市场数位租赁平台的爆炸性成长

- 数据驱动的车辆优化可提高客户投资报酬率

- 市场限制

- 维护多个品牌的复杂性

- 熟练操作人员短缺会增加停机风险

- OEM厂商蚕食直接面向消费者的租赁业务

- 锂电池资产残值波动

- 价值/供应链分析

- 监管格局

- 技术展望

- 波特五力模型

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

5. 市场规模及成长预测(价值,十亿美元)

- 按设备

- 土木机械

- 后铲式装载机

- 装载机

- 挖土机

- 推土机

- 滑移装载机

- 其他土木工程

- 物料输送设备

- 起重机

- 堆高机

- 自动卸货卡车

- 加长型堆高机

- 其他物料输送

- 混凝土及道路施工机械

- 电力和能源设备

- 其他设备

- 土木机械

- 按驱动类型

- 内燃机

- 杂交种

- 电

- 氢燃料电池

- 透过使用

- 住宅建设

- 商业建筑

- 工业/製造业

- 基础建设(道路、桥樑、港口)

- 采矿和采石

- 石油和天然气

- 租赁频道

- 离线(基于分店)

- 线上平台

- 按服务类型

- 短期租赁(少于1个月)

- 中期租赁(1至12个月)

- 长期出租(1年或以上)

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 智利

- 其他南美洲

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- United Rentals Inc.

- Ashtead Group plc(Sunbelt Rentals)

- Herc Rentals Inc.

- H&E Equipment Services Inc.

- Loxam

- Caterpillar Inc.(Cat Rental Store)

- Sumitomo Corp.

- Hitachi Construction Machinery Co. Ltd.

- Liebherr-International AG

- Kanamoto Co. Ltd.

- CNH Industrial NV

- HSS Hire Group plc

- Boels Rental

- Cramo Oyj

- Ahern Rentals

- Maxim Crane Works

- Ramirent

- Coates Hire

- Sarens nv/sa

- MyCrane

第七章 市场机会与未来展望

The construction equipment rental market reached USD 141.42 billion in 2025 and is forecasted to expand at a 4.85% CAGR, lifting revenue to USD 179.21 billion by 2030.

Momentum stems from record public-sector infrastructure pipelines, widening contractor preference for asset-light models, and rapid digitalization of rental transactions. Rising adoption of electric and hydrogen fuel cell machinery, combined with outcome-based service contracts, is reshaping fleet strategies and opening premium pricing niches. Asia-Pacific maintains scale leadership on the back of sustained highway, rail, and urban-renewal programs, while the Middle East delivers the fastest regional growth supported by Vision 2030 mega-projects. Competitive intensity is increasing as larger players accelerate acquisitions to gain geographic density and technology capabilities. Telematics-enabled fleet optimization is emerging as a critical lever for utilization gains and customer retention, partly offsetting headwinds from skilled-labor shortages and multi-brand maintenance complexity.

Global Construction Equipment Rental Market Trends and Insights

Infrastructure-Stimulus Megaproject Pipeline

The USD 1.2 trillion U.S. Infrastructure Investment and Jobs Act and India's USD 1.4 trillion National Infrastructure Pipeline are fuelling multi-year equipment demand cycles. United Rentals reports that megaprojects already account for a rising share of rental orders, underpinning predictable utilisation across full project lifecycles. Contractors increasingly prefer renting specialised machines for discrete phases to avoid idle capital, while renewable-energy components of these programmes are driving early uptake of hydrogen and battery-electric earthmovers. Asia-Pacific and North America benefit most, given their dense logistics networks and established rental branches able to supply a diverse fleet mix. The scale of public works is also encouraging smaller providers to syndicate equipment via digital exchanges, widening access beyond tier-one cities.

Shift from CAPEX to OPEX Among Contractors

High interest rates and volatile backlogs are prompting fleet managers to rent up to 80% of site equipment, significantly reducing balance-sheet leverage. Deferred purchases, reported by 37% of U.S. contractors, underline the growing appeal of operational expenditure models. Equipment-as-a-Service agreements transfer maintenance and residual-value risks to rental specialists, enabling contractors to redeploy capital toward core project execution. Smaller firms gain competitive parity by accessing premium machines previously beyond their budget. Rental firms, in turn, profit from higher equipment rotation rates and the ability to refresh fleets faster, ensuring compliance with tightening emission norms.

Skilled-Operator Scarcity Elevates Downtime Risk

More than 80,000 additional heavy-equipment operators will be needed by 2026, while 41% of current operators approach retirement. Under-staffed sites struggle to utilise rented machinery fully, inflating project timelines and eroding rental yield. Safety incidents linked to inexperienced operators also raise insurance and repair costs. Leading renters now offer simulator-based training that compresses onboarding from six months to seven weeks, a move credited with reducing damage claims by double digits. Nevertheless, the talent gap limits rapid deployment of advanced electric and hydrogen models that require additional technical proficiency.

Other drivers and restraints analyzed in the detailed report include:

- Stringent ESG Targets Accelerating Electric Rentals

- Digital Rental-Platform Explosion in Emerging Markets

- High Multi-Brand Maintenance Complexity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Earthmoving machinery accounted for 40.98% of the global construction equipment rental market revenue in 2024. Excavators and backhoe loaders remain staple choices for roadbeds, foundations, and trenching, with utilisation rates often surpassing 70% during peak seasons. Within this class, electric mini-excavators are recording an 8.81% CAGR, propelled by urban noise and emission restrictions.

Material-handling units such as cranes and telehandlers are given secondary importance due to high-rise expansions in Asia and the Gulf states. Telematics integration across earthmoving fleets is bolstering predictive maintenance, thereby extending asset life and raising customer satisfaction indexes.

A parallel shift is visible in aftermarket services, where renters bundle operator training and 24/7 field support agreements to justify premium day rates. Digital twins of large graders and dozers are being trialled to simulate wear patterns, informing optimal replacement cycles. Coupled with autonomous control retrofits on bulldozers, these advancements promise step-change productivity, though regulatory acceptance varies by jurisdiction. Fleet owners are therefore staggering investments, prioritising high-utilisation metro projects while monitoring rural demand elasticity.

Internal-combustion units retained an 85.74% share in 2024, underscoring entrenched refuelling infrastructure and operator familiarity. Yet the construction equipment rental market is witnessing an inflection as governments roll out zero-emission mandates for dense urban zones. Hydrogen fuel cell prototypes log the highest forecast CAGR at 16.99% through 2030, buoyed by quick refuelling and extended duty cycles relative to battery systems. Battery-electric models are scaling fastest in compact excavators and scissor lifts, segments where range anxiety is limited and charging can occur overnight on-site.

Hybrid power systems act as a bridge technology. United Rentals reports up to 80% fuel savings and 34% cost reductions when pairing generators with battery energy-storage packs. Adoption, however, hinges on clear residual-value outlooks: uncertain aftermarket pricing for high-capacity lithium batteries dampens aggressive fleet rollouts. To mitigate risk, leading renters use subscription-based upgrades, allowing rapid turnover should technology or regulation shift.

The Construction Equipment Rental Report is Segmented by Equipment Type (Earthmoving Equipment (Backhoe Loaders and More), and More), Drive Type (IC Engine and More), Application (Residential Construction and More), Rental Channel (Offline and Online), Service Type (Short-Term Rental, and More), and Geography (North America and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia-Pacific held 39.01% of global rental revenue in 2024, underpinned by China's Belt and Road extensions, India's record capital-expenditure outlays, and Japan's steady public-works pipeline. Chinese OEMs captured 75% of global electric construction-equipment shipments in 2024, exporting aggressively to Southeast Asia. India's construction sector is on course to add USD 1 trillion to GDP by 2030, energising nationwide branch expansion by leading renters. Japan, recovering from two quarters of machinery order contraction, returned to growth in early 2025 as semiconductor-plant investments escalated.

The Middle East represents the fastest-growing territory at 7.56% CAGR through 2030. Saudi Arabia's Vision 2030 pipeline, including Riyadh Metro and NEOM city projects, is pushing rental demand beyond 12% annualised growth. The UAE likewise benefits from large corridors and mixed-use developments such as the AED 8 billion Masaar community. Companies with crane and telehandler specialities are relocating fleets to the Gulf to capitalise on strong utilisation rates and attractive yields.

North America shows a healthy 6.58% CAGR. Large infrastructure packages and robust private-sector industrial builds underpin stable fleet utilisation. Europe posts slower 5.30% growth, yet leads in low-emission rentals thanks to stringent Stage V diesel norms and municipal zero-carbon mandates. South America advances at 7.34% CAGR, fuelled by transport-corridor modernisation and commodity-sector revitalisation. Africa averages 6.90% growth, although access to financing and regulatory clarity remains uneven across markets.

- United Rentals Inc.

- Ashtead Group plc (Sunbelt Rentals)

- Herc Rentals Inc.

- H&E Equipment Services Inc.

- Loxam

- Caterpillar Inc. (Cat Rental Store)

- Sumitomo Corp.

- Hitachi Construction Machinery Co. Ltd.

- Liebherr-International AG

- Kanamoto Co. Ltd.

- CNH Industrial N.V.

- HSS Hire Group plc

- Boels Rental

- Cramo Oyj

- Ahern Rentals

- Maxim Crane Works

- Ramirent

- Coates Hire

- Sarens n.v./s.a.

- MyCrane

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Infrastructure-stimulus megaproject pipeline

- 4.2.2 Shift from CAPEX-to-OPEX among contractors

- 4.2.3 Stringent ESG targets accelerating electric rentals

- 4.2.4 Pay-per-use & outcome-based contracting models

- 4.2.5 Digital rental-platform explosion in emerging markets

- 4.2.6 Data-driven fleet optimisation boosts customer ROI

- 4.3 Market Restraints

- 4.3.1 High multi-brand maintenance complexity

- 4.3.2 Skilled-operator scarcity elevates downtime risk

- 4.3.3 OEMs' direct-to-customer rental cannibalisation

- 4.3.4 Residual-value volatility for lithium-battery assets

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD Billion)

- 5.1 By Equipment Type

- 5.1.1 Earthmoving Equipment

- 5.1.1.1 Backhoe Loaders

- 5.1.1.2 Loaders

- 5.1.1.3 Excavators

- 5.1.1.4 Bulldozers

- 5.1.1.5 Skid-Steer Loaders

- 5.1.1.6 Other Earthmoving

- 5.1.2 Material Handling Equipment

- 5.1.2.1 Cranes

- 5.1.2.2 Forklifts

- 5.1.2.3 Dump Trucks

- 5.1.2.4 Telehandlers

- 5.1.2.5 Other Material Handling

- 5.1.3 Concrete & Road Construction Equipment

- 5.1.4 Power & Energy Equipment

- 5.1.5 Other Equipment

- 5.1.1 Earthmoving Equipment

- 5.2 By Drive Type

- 5.2.1 IC Engine

- 5.2.2 Hybrid

- 5.2.3 Electric

- 5.2.4 Hydrogen Fuel Cell

- 5.3 By Application

- 5.3.1 Residential Construction

- 5.3.2 Commercial Construction

- 5.3.3 Industrial / Manufacturing

- 5.3.4 Infrastructure (Roads, Bridges, Ports)

- 5.3.5 Mining & Quarrying

- 5.3.6 Oil & Gas

- 5.4 By Rental Channel

- 5.4.1 Offline (Branch-based)

- 5.4.2 Online Platforms

- 5.5 By Service Type

- 5.5.1 Short-Term Rental (less than 1 Month)

- 5.5.2 Medium-Term Rental (1 - 12 Months)

- 5.5.3 Long-Term Rental (Over 1 Year)

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.1.4 Rest of North America

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Russia

- 5.6.2.7 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Rest of APAC

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Chile

- 5.6.4.4 Rest of South America

- 5.6.5 Middle East & Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global-level Overview, Market-level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 United Rentals Inc.

- 6.4.2 Ashtead Group plc (Sunbelt Rentals)

- 6.4.3 Herc Rentals Inc.

- 6.4.4 H&E Equipment Services Inc.

- 6.4.5 Loxam

- 6.4.6 Caterpillar Inc. (Cat Rental Store)

- 6.4.7 Sumitomo Corp.

- 6.4.8 Hitachi Construction Machinery Co. Ltd.

- 6.4.9 Liebherr-International AG

- 6.4.10 Kanamoto Co. Ltd.

- 6.4.11 CNH Industrial N.V.

- 6.4.12 HSS Hire Group plc

- 6.4.13 Boels Rental

- 6.4.14 Cramo Oyj

- 6.4.15 Ahern Rentals

- 6.4.16 Maxim Crane Works

- 6.4.17 Ramirent

- 6.4.18 Coates Hire

- 6.4.19 Sarens n.v./s.a.

- 6.4.20 MyCrane