|

市场调查报告书

商品编码

1437984

农业机器人:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Agricultural Robots - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

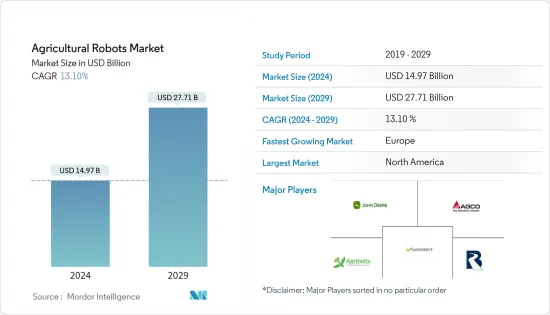

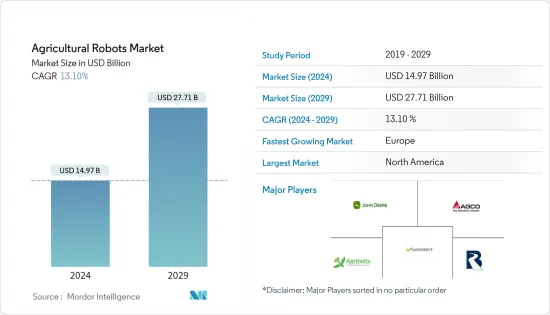

农业机器人市场规模预计2024年为149.7亿美元,预计到2029年将达到277.1亿美元,在预测期内(2024-2029年)将成长13.10%,以复合年增长率成长。

主要亮点

- 农业机器人,也称为农业机器人,是农业产业的最新革命之一。这些是自动化机器,用于提高产量品质和效率、提高整体生产力并最大限度地减少对体力劳动的依赖。随着人口成长,全球粮食需求迅速增加。因此,农民现在正在转向现代工具和设备,例如农业机器人,以提高整体生产力并创造更多收益。

- 此外,世界各国政府正在提供补贴并努力提高农民对自动化技术的认识。例如,欧盟在2021年推出了Robs4Crops等计划,范围从农业控制器、智慧农具到完全自主的农业系统。 Robs4Crops(新计划)正在帮助农民填补正在改变农业形势的劳动力短缺问题。这很可能会扩大农业机器人市场的范围。

- 此外,一些老牌和新兴农业公司正在投资研发工作,以引进创新的农业机器人。例如,爱科公司于 2021 年开始试行其 Precision Ag Line (PAL) 计划。该工具旨在简化在混合车队营运中使用爱科解决方案的农业客户的支援服务。

农业机器人市场趋势

人手不足,人事费用增加

- 近年来,由于农业劳动力老化和农业兴趣下降,农业劳动力不断减少。随着农业劳动力持续萎缩,农民感受到维持生产以满足对生鲜食品不断增长的需求的压力。而且,劳动力的下降趋势导致了劳动力工资的上涨。

- 此外,美国和英国等国家的农业依赖工人,其他已开发国家也有类似的趋势。根据世界银行的资料,过去十年来,全球农业就业人数下降了15%。劳动力短缺是一个全球性问题,农民老化进一步限制了体力劳动者的供给。因此,自动化农业系统可以帮助缓解农场劳动力短缺的压力。农业科技可以为农场系统带来新的效率并提高整体生产力。

- 因此,由于缺乏可用的工人,相关人员正在考虑如何实现农场现代化。例如,美国农业局联合会 (AFBF) 报告称,56% 的美国农场已开始使用农业技术,其中超过一半的农场将劳动力短缺作为原因。创新农业技术的使用包括无线感测器、机器人、预测模型和资料分析。因此,劳动力短缺和工资上涨正在推动市场成长。

北美市场占据主导地位

- 北美占据农业机器人市场的最大份额。由于劳动力短缺加剧、人事费用上升以及人均可支配收入高,该地区市场正受到先进技术日益采用的推动。政府加强鼓励将机器人引入农业,例如无人机、无人驾驶拖拉机和其他农业系统以实现智慧农业,是促进该地区成长的一些因素。为了提高农民的产量并降低成本,该市场的一些参与者正在大力投资开发具有成本效益和生产力的机器人。

- 例如,总部位于圣莫尼卡的 Future Acres 于 2021 年推出了首款机器人 Carrie,计划解决葡萄采摘问题。 Carrie 使用人工智慧与人类合作运输手工收割的作物。因此,缓解劳动力短缺的挑战并在市场上推出适合农民需求的新产品正在推动北美地区农业机器人市场的成长。

农业机器人产业概况

农业机器人市场由活跃的参与者进行整合,这些参与者在产品品质和促销的基础上竞争,并专注于策略倡议以占据更大的市场占有率。公司投入大量资金开发新的、具成本效益的产品。我们也与其他公司合作并收购其他公司,以扩大市场占有率并加强我们的研发活动。爱科公司、迪尔公司、Agrobot、Agribotix LLC 等公司是农业机器人市场的主要企业。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 市场限制因素

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争公司之间的敌意强度

第五章市场区隔

- 按类型

- 无人机(无人机)

- 挤乳机器人

- 无人拖拉机

- 自动收割系统

- 按用途

- 广泛应用

- 现场测绘

- 播种和种植

- 施肥和灌溉

- 跨文化运营

- 采摘和收穫

- 酪农管理

- 挤乳

- 牧羊人与牲畜

- 航空资料采集

- 气象追踪与预报

- 库存控制

- 广泛应用

- 按报价

- 硬体

- 软体

- 服务

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 非洲

- 南非

- 其他非洲

- 北美洲

第六章 竞争形势

- 最采用的策略

- 市场占有率分析

- 公司简介

- Agrobot

- Blue River Technology

- Harvest Automation

- AGCO Corporation

- Lely Industries

- Naio Technologies

- Precision Hawk

- Deere &Company

- AG Eagle LLC

- Agribotix LLC

- Trimble

- IBM

第七章市场机会与未来趋势

The Agricultural Robots Market size is estimated at USD 14.97 billion in 2024, and is expected to reach USD 27.71 billion by 2029, growing at a CAGR of 13.10% during the forecast period (2024-2029).

Key Highlights

- Agricultural robots, also known as agribots, are one of the latest revolutions in the agriculture industry. They are autonomous machines employed to improve the quality and efficiency of yield, increase overall productivity, and minimize reliance on manual labor. With the growing population, the demand for food is rising at a rapid pace globally. Thus, farmers are now shifting toward modern tools and equipment, such as agricultural robots, to boost their total productivity and generate more revenue.

- Furthermore, governments across the world are offering subsidies and undertaking initiatives to propagate awareness about automated technologies among farmers. For instance, in 2021, the European Union launched projects, such as Robs4Crops, from farming controllers and smart implements to fully autonomous farming systems. Robs4Crops (a new project) is helping farmers fill the labor shortage, which is shaking up the farming landscape. This is likely to enhance the scope of the agricultural robots market.

- Moreover, several established and start-up agricultural companies are investing in research and development activities to introduce an innovative range of agricultural robots. For instance, in 2021, AGCO Corporation launched the pilot of its Precision Ag Line (PAL) program, a tool designed to streamline support services for farming customers using AGCO solutions with mixed-fleet operations.

Agricultural Robots Market Trends

Labor Shortage and Increasing Costs of Labor

- The agriculture labor force has decreased in recent years due to the reduced interest in farming, combined with the aging farmer population. As the population of farm laborers continues to decline, farmers are feeling pressure to keep up with production for the growing demand for fresh produce. Moreover, the downward trend of labor is translating into higher labor wages.

- Furthermore, the agricultural industry in the United States and the United Kingdom, among other countries, depend on laborers, and a similar trend is seen across other developed countries as well. Agricultural employment has declined by 15% in the last decade around the globe, according to World Bank data. The labor shortage has become a global problem, with an aging farmer population that further limits the supply of manual labor. Thus, automated farming systems can help to reduce the pressures of the farm labor shortage. Agtech can bring new efficiencies to farm systems and drive overall productivity.

- Consequently, with a shortage of available workers, stakeholders are looking at how to modernize the farms. For instance, the American Farm Bureau Federation (AFBF) reported that 56% of US farms have begun using agritech, with more than half stating labor shortage as the reason. The use of innovative agrotechnology includes wireless sensors, robotics, predictive forecasting model, and data analytics. Thus, increasing labor shortages and wages are driving the growth of the market.

North America Dominates the Market

- North America accounted for the largest share of the agricultural robots market. The market in the region is driven by the higher adoption of advanced technology due to increasing labor shortage, high labor costs in the region, and high per-capita disposable income. Increasing government encouragement for the deployment of robots in agriculture, such as unmanned aerial vehicles, driverless tractors, and other agriculture systems to provide smart farming, are some of the factors contributing to the region's growth. To increase the yields and reduce the costs of farmers, some of the players in this market are heavily investing in developing cost-efficient and highly productive robots.

- For instance, in 2021, Future Acres, based in Santa Monica, launched its first robot, Carry, with plans to tackle grape picking. Carry relies on AI to transport hand-picked crops, working alongside humans. Hence, reducing the challenges of labor shortages and introducing new products into the market suiting the farmer's needs are driving the growth of the agricultural robots market in the North American region.

Agricultural Robots Industry Overview

The agricultural robot market is consolidated with active players competing on the basis of product quality and promotion and focusing on their strategic moves to hold larger market shares. Companies are investing heavily to develop new and cost-efficient products. They are also collaborating with and acquiring other companies to increase their market shares and strengthen R&D activities. The companies like AGCO Corporation, Deere & Company, Agrobot, and Agribotix LLC are some of the major players in the agricultural robots market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Unmanned Aerial Vehicles (Drones)

- 5.1.2 Milking Robots

- 5.1.3 Driverless Tractors

- 5.1.4 Automated Harvesting Systems

- 5.2 By Application

- 5.2.1 Broad Acre Applications

- 5.2.1.1 Field Mapping

- 5.2.1.2 Seeding and Planting

- 5.2.1.3 Fertilizing and Irrigation

- 5.2.1.4 Intercultural Operations

- 5.2.1.5 Picking and Harvesting

- 5.2.2 Dairy Farm Management

- 5.2.2.1 Milking

- 5.2.2.2 Shepherding and Herding

- 5.2.3 Aerial Data Collection

- 5.2.4 Weather Tracking and Forecasting

- 5.2.5 Inventory Management

- 5.2.1 Broad Acre Applications

- 5.3 By Offering

- 5.3.1 Hardware

- 5.3.2 Software

- 5.3.3 Services

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Spain

- 5.4.2.5 Italy

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Rest of Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Agrobot

- 6.3.2 Blue River Technology

- 6.3.3 Harvest Automation

- 6.3.4 AGCO Corporation

- 6.3.5 Lely Industries

- 6.3.6 Naio Technologies

- 6.3.7 Precision Hawk

- 6.3.8 Deere & Company

- 6.3.9 AG Eagle LLC

- 6.3.10 Agribotix LLC

- 6.3.11 Trimble

- 6.3.12 IBM