|

市场调查报告书

商品编码

1438097

追踪解决方案:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Track and Trace Solutions - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

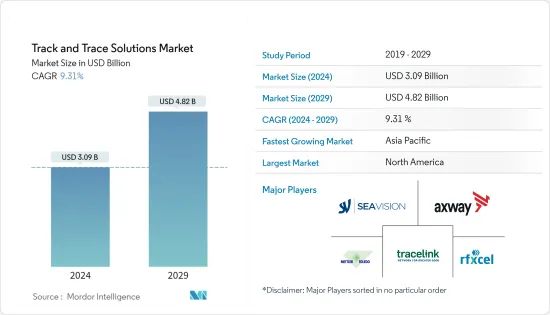

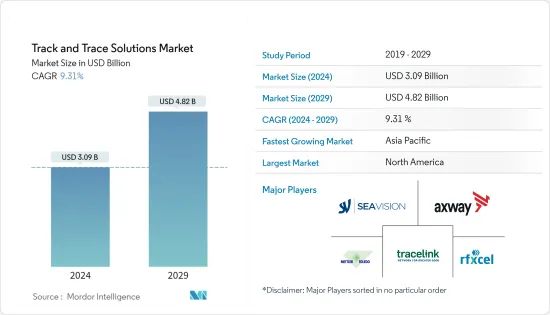

追踪解决方案市场规模预计到 2024 年为 30.9 亿美元,预计到 2029 年将达到 48.2 亿美元,预测期内(2024-2029 年)复合年增长率为 9.31%。

随着COVID-19感染疾病以及控制大流行的各种治疗和诊断设备和仪器的发展,全球范围内假冒药品和诊断设备的风险不断增加,这对药房自动化市场产生了越来越大的影响。例如,2020年3月和2020年4月,美国国防安全保障部也通报了19,000个与COVID-19相关的可疑感染疾病。结果,494出货的标籤诈欺、诈欺、未经授权或违禁的 COVID-19检测套组、治疗套件、同类疗法疗法、声称是抗病毒药物的产品和个人防护套件,价值320 万美元。这些查获导致另外11 人被捕。此类案例预计将推动追踪解决方案的采用。

推动追踪解决方案市场成长的关键因素包括医疗设备和製药业的成长、序列化实践的增加、包装相关产品召回数量的增加以及假药数量的增加。

药品假冒是各大製药和生物製药公司面临的一个主要问题。根据世界卫生组织 2019 年发表的一篇论文,在低收入和中等收入国家销售的医疗产品中,大约有十分之一被发现不合格或假冒。因此,这一因素正在推动製药公司和其他最终用户采用追踪解决方案。此外,2020年12月,强生子公司杨森製药通报称,一款仿冒品SYMTUZA(达芦那韦/考比司他/恩曲他滨/替诺福韦艾拉酚胺)已被分销到美国至少3家药局。杨森目前正在与美国食品药物管理局(FDA) 密切合作,以防止进一步分发并支持该机构对通报案例的调查。因此,这些因素预计将推动市场成长。

然而,与序列化和集中相关的高成本以及缺乏序列化和集中的通用标准等因素可能会阻碍市场成长。

追踪解决方案市场趋势

RFID技术有望在追踪解决方案市场中实现良好成长

冠状病毒感染疾病(COVID-19) 的爆发加速了数位化,从而增加了 2020 年医疗保健领域 RFID 技术的使用。这些技术用于追踪和验证疫苗、诊断套件和其他设备。例如,2020 年 6 月,美国卫生与公众服务部、国防部和 ApiJect Systems America 就旨在扩大注射器生产的「Project Jumpstart」和「RAPID USA」等计划建立了合作伙伴关係。因此,由于 COVID-19 的情况,预计这将支持该领域的市场成长。

无线射频识别 (RFID) 技术在库存管理和供应链营运、提高安全性和产品处理方面也发挥着重要作用。它还减少了处理供应链中产品所需的精力和时间。此外,它在追踪处方药和为医疗保健行业节省数十亿美元的成本方面发挥着重要作用。

因此,该公司现在在其製造和包装过程中采用 RFID 技术。例如,2020 年 9 月,Fresenius Kabi 在医药产品(例如手术室常用的预填充注射器和管瓶)上采用了 RFID 标籤,以增强库存管理工作流程。使用最新先进 RFID 的好处正在提高其在医疗保健领域的采用和接受度。这对于推动 RFID 领域的成长非常重要。

预计北美将在预测期内主导市场

目前,北美在追踪解决方案市场占据主导地位,预计在预测期内将保持其主导地位。在北美地区,美国占最大的市场占有率。然而,新型冠状病毒肺炎 (COVID-19) 的爆发增加了该地区对追踪解决方案的需求。例如,2020年12月,开创传讯RNA(mRNA)疗法和疫苗、为患者开发新一代创新药物的临床阶段生物技术公司Moderna宣布,Moderna目前正在序列化和分销COVID-19病毒疫苗。该公司目前正在开发 mRNA-1273,这是针对 COVID-19 的候选疫苗。因此,预计 COVID-19感染疾病将对市场产生积极影响。

推动市场成长的主要因素是假药数量的增加。由于市场上的假药数量不断增加,食品药物管理局于 2019 年宣布启动一项新的先导计画,以促进新型电子、可互通的追踪系统的开发,作为药品供应链的一部分。国家安全法(DSCSA)。此新系统将减少国内药品分配不准确的情况,并防止假药进入供应链的可能性。 DSCSA试验计画的重点是确定符合药品供应链安全和资讯传播技术要求的高效流程。

此外,根据美国食品药物管理局(FDA) 的数据,2019 年美国共发布了 2,163 件药品召回事件。此外,2019 年 7 月,美国食品药物管理局召回了 CapsoCam Plus 胶囊视讯系统。这是由于 Capso Vision Inc. 产品上的序号标籤不正确,这可能导致患者误诊。此类案例促使美国医疗设备公司采用追踪解决方案。

此外,追踪和追溯方面的创新解决方案也推动了该地区的市场成长。例如,2020 年 6 月,Zebra Technologies Corp. 推出了具有用户级接近感应功能的 Zebra MotionWorks Proximity,可实现警报和接触者追踪。这使得医院和其他组织能够保护员工在职场中的健康。该公司的这项新产品的推出预计将提高其在市场上的可信度。因此,由于上述所有因素,预计所研究的市场将在预测期内自我推动。

追踪解决方案行业概述

追踪解决方案市场竞争激烈,由几家主要企业组成。从市场占有率来看,目前很少大公司占据市场主导地位。随着人们对追踪解决方案的认识不断提高以及医疗保健基础设施的改善,预计很少有其他小型企业会进入该市场。市场上主要企业包括 Axway、Mettler-Toledo International Inc.、Rfxcel Corporation、Seavision SRL 和 TraceLink Inc.。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 医疗设备/製药业的发展和系列化的不断实施

- 包装相关产品回收数量增加

- 假药增加

- 市场限制因素

- 与序列化和集中相关的高成本

- 缺乏序列化和聚合的通用标准

- 波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争公司之间的敌意强度

第五章市场区隔

- 副产品

- 硬体系统

- 印刷和标记解决方案

- 监控和检验解决方案

- 标籤解决方案

- 其他硬体系统

- 软体解决方案

- 工厂管理软体

- 线路控制器软体

- 捆绑追踪软体

- 其他软体解决方案

- 硬体系统

- 依技术

- 条码

- RFID

- 按用途

- 序列化解决方案

- 瓶子序列化

- 标籤序列化

- 纸箱序列化

- 资料矩阵序列化

- 聚合解决方案

- 捆绑集中

- 案例汇总

- 托盘聚合

- 序列化解决方案

- 按最终用户

- 製药公司

- 医疗设备公司

- 其他最终用户

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 其他亚太地区

- 中东和非洲

- GCC

- 南非

- 其他中东和非洲

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 北美洲

第六章 竞争形势

- 公司简介

- ACG

- Adents

- ANTARES VISION SpA

- Axway

- Mettler-Toledo International Inc.

- Rfxcel Corporation

- Optel Group

- SEIDENADER MASCHINENBAU GMBH(MEDIPAK SYSTEMS)

- Sea Vision SRL

- TraceLink Inc.

- Syntegon Technology GmbH

- Zetes

- Kezzler AS

- Korber Medipak Systems GmbH

第七章市场机会与未来趋势

The Track and Trace Solutions Market size is estimated at USD 3.09 billion in 2024, and is expected to reach USD 4.82 billion by 2029, growing at a CAGR of 9.31% during the forecast period (2024-2029).

With the development in the COVID-19 vaccine and the various treatment and diagnostic devices and instruments to curb the pandemic, the risk of counterfeit drugs and diagnostic devices increased globally, which impacted the pharmacy automation market. For example, in March and April 2020, Homeland Security in the United States also notified 19,000 suspects of COVID-19-related domain names. As a result, it seized over USD 3.2 million linked to 494 shipments of mislabeled, fraudulent, unauthorized, or prohibited COVID-19 test kits, treatment kits, homeopathic remedies, purported antiviral products, and PPE kits, which further led to 11 arrests. Such instances are expected to drive the adoption of track and trace solutions.

The major factors propelling the growth of the track and trace solutions market include the growth of the medical devices and pharmaceutical industries, an increase in implementation of serialization, a rise in the number of packaging-related product recalls, and an increasing number of counterfeit drugs.

Drug counterfeiting is one of the significant problems in large pharmaceutical and biopharmaceutical companies. As per the article published by the World Health Organization in 2019, about 1 out of 10 medical products that circulate in low- and middle-income countries are found to be substandard or falsified. This factor, consequently, is driving the adoption of track and trace solutions among drug manufacturers and other end users. Furthermore, in December 2020, Janssen Pharmaceutical, a subsidiary of Johnson & Johnson, notified that counterfeit SYMTUZA (darunavir/cobicistat/emtricitabine/tenofovir alafenamide) had been distributed to over three pharmacies in the United States. Janssen is currently working closely with the US Food and Drug Administration (FDA) to prevent further distribution and support the agency's investigation into the reported instances. Hence, these factors are expected to fuel market growth.

However, factors such as high costs associated with serialization and aggregation and lack of common standards for serialization and aggregation may hinder the market growth.

Track and Trace Solutions Market Trends

RFID Technology is Expected to Observe a Good Growth in the Track and Trace Solutions Market

The outbreak of COVID-19 has accelerated digitization, and thereby, the usage of RFID technology in the healthcare sector increased in 2020. These technologies are being used in tracking and authenticating vaccines, diagnostic kits, and other devices. For instance, in June 2020, the United States Department of Health and Human Services, Department of Defense, and ApiJect Systems America signed a partnership for projects, like "Project Jumpstart" and "RAPID USA," for expanding syringe production. Hence, this is expected to support the market growth in this segment due to the COVID-19 situation.

The radio-frequency identification (RFID) technology also plays a stellar role in inventory management and supply-chain operations, improving security and product handling. It also reduces the labor and time required for product handling in the supply chain. In addition, it has a huge role in tracking and tracing prescription drugs and reducing billions in costs in the medical and healthcare industry.

As a result, companies are now adopting RFID technology in the production and packaging process. For example, in September 2020, Fresenius Kabi incorporated RFID-tag-equipped labels on medications, such as prefilled syringes and vials, which are commonly used in operating rooms to enhance inventory management workflow. The benefits of using modern and advanced RFID have increased its adoption and acceptance in the healthcare sector, which is critical for boosting the growth of the RFID segment.

North America is Expected to Dominate the Market Over the Forecast Period

North America currently dominates the market for track and trace solutions and is expected to continue its stronghold over the forecast period. In the North American region, the United States holds the largest market share. However, due to the outbreak of COVID-19, the demand for track and trace solutions have fueled in this region. For instance, in December 2020, Moderna, a clinical-stage biotechnology company pioneering messenger RNA (mRNA) therapeutics and vaccines to develop a new generation of transformative medicines for patients, notified that Moderna is currently running SAP Digital Supply Chain solutions to help with the serialization and distribution of a potential COVID-19 vaccine. The company presently has mRNA-1273, a vaccine candidate against COVID-19. Therefore, a positive impact is expected on the market due to the COVID-19 pandemic.

The primary factor attributing to the market growth is the increasing number of counterfeit drugs. Due to the rising number of counterfeit medicines available in the market, in 2019, the Food and Drug Administration launched a new pilot project to inform the development of a new electronic, interoperable track-and-trace system, as part of the Drug Supply Chain Security Act (DSCSA). This new system will reduce incorrect domestic drug distribution and keep counterfeit drugs from potentially entering the supply chain. The DSCSA pilot program focuses on identifying efficient processes that will comply with drug supply chain security and technology requirements for disseminating information.

Furthermore, according to the United States Food and Drug Administration (FDA), the number of drug recall enforcement issued in the United States was 2,163 in 2019. Also, in July 2019, the US Food and Drug Administration recalled the CapsoCam Plus video capsule system of Capso Vision Inc., due to the mislabeling of the device with incorrect serial number labels, which may have resulted in a patient's misdiagnosis. Such instances have prompted US-based medical devices companies to adopt track and trace solutions.

Moreover, innovative solutions in track and tracing have also boosted this region's market growth. For instance, in June 2020, Zebra Technologies Corp. launched Zebra MotionWorks Proximity, which is featured with proximity sensing at the user level, enabling alerting and contact tracing. This will allow hospitals and other organizations to protect their employees' health while in the work environment. This new product launch by the company will increase its credibility in the market. Therefore, the market studied is expected to propel during the forecast period with all the factors mentioned above.

Track and Trace Solutions Industry Overview

The track and trace solutions market is competitive and consists of several major players. In terms of market share, few major players currently dominate the market. With the rising awareness about track and trace solutions and improving healthcare infrastructure, few other smaller players are expected to enter the market. Some of the major players in the market are Axway, Mettler-Toledo International Inc., Rfxcel Corporation, Sea vision SRL, and TraceLink Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth in the Medical Devices and Pharmaceutical Industries and Increase in Implementation of Serialization

- 4.2.2 Rise in the Number of Packaging-related Product Recalls

- 4.2.3 Increasing Number of Counterfeit Drugs

- 4.3 Market Restraints

- 4.3.1 High Costs Associated with Serialization and Aggregation

- 4.3.2 Lack of Common Standards for Serialization and Aggregation

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Product

- 5.1.1 Hardware Systems

- 5.1.1.1 Printing and Marking Solutions

- 5.1.1.2 Monitoring and Verification Solutions

- 5.1.1.3 Labeling Solutions

- 5.1.1.4 Other Hardware Systems

- 5.1.2 Software Solutions

- 5.1.2.1 Plant Manager Software

- 5.1.2.2 Line Controller Software

- 5.1.2.3 Bundle Tracking Software

- 5.1.2.4 Other Software Solutions

- 5.1.1 Hardware Systems

- 5.2 By Technology

- 5.2.1 Barcode

- 5.2.2 RFID

- 5.3 By Application

- 5.3.1 Serialization Solutions

- 5.3.1.1 Bottle Serialization

- 5.3.1.2 Label Serialization

- 5.3.1.3 Carton Serialization

- 5.3.1.4 Data Matrix Serialization

- 5.3.2 Aggregation Solutions

- 5.3.2.1 Bundle Aggregation

- 5.3.2.2 Case Aggregation

- 5.3.2.3 Pallet Aggregation

- 5.3.1 Serialization Solutions

- 5.4 By End User

- 5.4.1 Pharmaceutical Companies

- 5.4.2 Medical Device Companies

- 5.4.3 Other End Users

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle-East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle-East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 ACG

- 6.1.2 Adents

- 6.1.3 ANTARES VISION SpA

- 6.1.4 Axway

- 6.1.5 Mettler-Toledo International Inc.

- 6.1.6 Rfxcel Corporation

- 6.1.7 Optel Group

- 6.1.8 SEIDENADER MASCHINENBAU GMBH (MEDIPAK SYSTEMS)

- 6.1.9 Sea Vision SRL

- 6.1.10 TraceLink Inc.

- 6.1.11 Syntegon Technology GmbH

- 6.1.12 Zetes

- 6.1.13 Kezzler AS

- 6.1.14 Korber Medipak Systems GmbH