|

市场调查报告书

商品编码

1850396

5G基础设施:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030年)5G Infrastructure - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

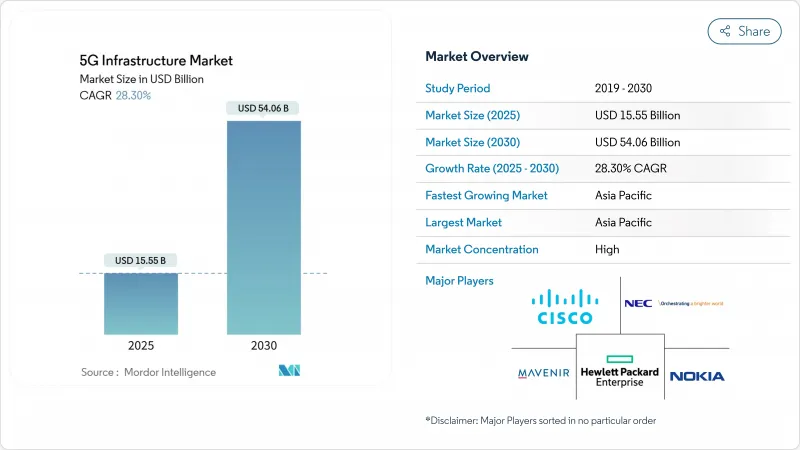

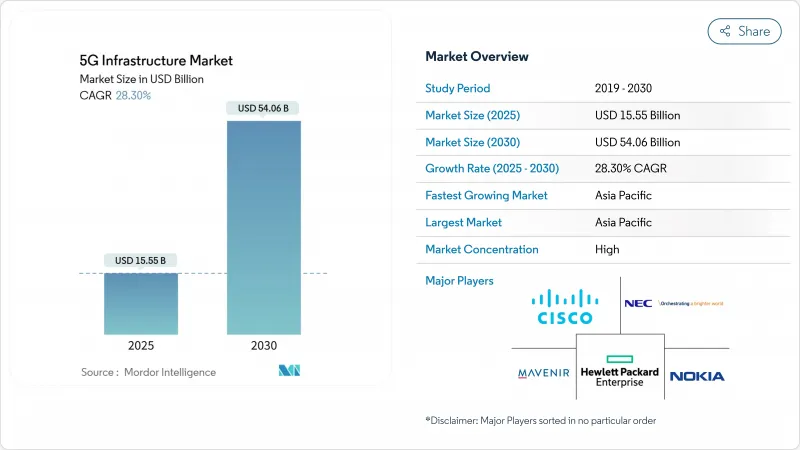

预计到 2025 年,5G 基础设施市场规模将达到 155.5 亿美元,到 2030 年将达到 540.6 亿美元。

目前的扩张趋势主要体现在营运商用完全可程式化的独立平台取代以往的非独立组网部署,这些平台支援网路切片、边缘运算和私有网路建置。资本正从单纯的覆盖转向软体定义能力,以缩短服务上线週期、提高自动化程度并降低生命週期营运成本。製造业、行动通讯和能源产业对私人网路的需求,以及将高速宽频扩展到农村地区的固定无线存取(FWA)部署,都进一步推动了这项需求。同时,频谱政策正在释放中频段频宽的新容量,供应商的蓝图也朝着云端原生开放式无线存取网路(Open RAN)设计方向发展,使通讯业者能够摆脱对单一供应商的依赖,并更快地实现应用程式介面(API)的商业化。

全球5G基础设施市场趋势与洞察

不断提高机器对机器(M2M)和物联网(IoT)设备密度

独立组网的5G网路将使每个行动通信基地台能够处理多达5万台连网设备,这是工业4.0生产线和庞大感测器网路的先决条件。现代汽车的RedCap工厂网路已证明,低容量设备可以在不损失网路覆盖的情况下降低功耗。边缘运算将运算资源部署到更靠近机器的位置,从而保持机器人和预测性维护方案所需的毫秒延迟。汽车、医疗保健和重工业领域的专用网路演示检验了设备密集型环境而非消费级手机带来的收入成长。这种趋势将支撑整个预测期内对小型基地台和边缘资料中心的持续投入。

行动数据消耗量快速成长

随着云端游戏、扩增实境影片和人工智慧串流媒体对稳定多Gigabit连结的需求不断增长,行动月流量持续攀升至新高。英国电信业者Three已将其骨干网路吞吐量提升至每秒9太比特,此前其吞吐量在2024年底曾达到每秒2太比特以上的峰值。在中国,监管机构预计到2030年国内流量将成长四倍,这将促使营运商转向能够在全天高负载下保持效率的容量架构。医疗保健试点项目,例如即时远端超音波演示,凸显了上行链路容量对于关键成像任务的重要性。随着固定无线存取(FWA)在印度和美国普及,将流量从智慧型手机重定向到客户端设备(CPE),营运商正被迫重新设计回程传输,以适应用户以家庭为中心的视讯使用习惯。

无线存取网密集化和高昂的初始回程传输成本

小型基地台造价在1万至5万美元之间,大型基地台单站造价高达20万美元,因此,密集型5G网路部署需要大量资金投入,尤其是在毫米波强制部署的情况下。光纤回程传输可能使计划预算增加30%,而郊区走廊挖掘量低导致沟槽开挖进度延误。预计2023年全球通讯支出将出现自2017年以来的首次下降,这使得财务长在加快网路部署方面更加谨慎。网路共用协议可以节省高达40%的成本,但会降低每个合作伙伴提供优质差异化行销的能力。每个业者超过10亿美元的频谱授权费进一步加剧了资产负债表的余量。

细分市场分析

2024年,随着通讯业者部署密集的大型基地台和小型基地台网络,无线接取网(RAN)设备将占据5G基础设施市场的最大份额,营收累计37%。虽然首批硬体仍将维持RAN的重要性,但核心网路将以32.36%的复合年增长率超越其他层,因为软体定义控制将决定未来的获利模式。随着能够虚拟化用户平面和控制平面功能的独立双模分组核心网的部署,5G核心网平台的市场规模将呈指数级增长。沃达丰西班牙和英国Three公司强调,云端原生核心网路使通讯业者能够开放用于边缘运算、安全和按需品质产品的API。

在本世纪后半段,通讯业者将融合核心网路视为专用网路切片、低延迟工业服务和即时分析的引擎。随着覆盖目标的逐步实现,无线存取网(RAN)的支出将会减少,而由于产品生命週期更新和功能附加元件,核心网路的成本将持续成长。此外,由于需要分散式单元将线速流量传输到资料中心核心网,传输和扩展传输(xHaul)的预算也将增加。因此,光网路和路由供应商将把自己定位为战略合作伙伴,而非战术性合作伙伴。

由于中频段兼具远距离传输和数百兆赫兹频宽的优势,能够支援大规模MIMO阵列,预计到2024年,中频段将占据5G基础设施市场份额的46%。从芝加哥到柏林,通讯业者在使用3.5 GHz无线电覆盖郊区环网,且基地台成本不高。这一发展趋势预示着毫米波无线电、中继器和先进波束成形晶片相关的5G基础设施市场规模将迅速成长,尤其是在美国、日本和韩国。

低于 1 GHz 的低频段对于广域物联网覆盖至关重要,但难以满足Gigabit目标,只能起到辅助作用而非主导作用。监管机构将中频段和高频段频谱资源捆绑在同一轮许可中,将有助于营运商根据不同的服务层级调整其频率组合。

5G 基础设施市场按通讯基础设施(5G 无线接取网路、5G 核心网路、传输/XHaul [前传、中传、回传]、其他)、频谱频段(低频段、中频段、其他)、网路架构(非独立组网 [NSA]、其他)、核心网路技术(软体定义网路 [SDN]、其他产业)

区域分析

到2024年,亚太地区将占据全球5G基础设施市场份额的24%,这主要得益于中国440万基地台以及印度力争在2027年前实现3000万固定无线接入(FWA)用户的快速增长。该地区将以32.27%的复合年增长率成长,韩国维持97%的人口覆盖率,而日本则推进郊区高密度化建设。印尼、越南和菲律宾的农村地区将倾向采用共用基地台模式,而澳洲则将转向混合卫星和5G备援模式,以支援偏远地区的采矿作业。

在北美,网路覆盖成熟度已接近80%,预计2023年下滑后,2025年支出将回升。爱立信报告称,2024年第四季各地区年增54%,这预示着独立核心网、边缘区域和大型企业项目的预算将再次成长。美国通讯业者正将固定无线存取(FWA)与光纤捆绑销售,以涵盖服务不足的郊区;而加拿大则正在分配新的中频段频谱,以加速原住民社区的网路连线。

欧洲在独立普及率方面落后于其他国家,但计画透过监管协调,到2030年将其经济规模扩大1,640亿欧元。德国96%的普及率是集体努力的成果,但英国在供应商禁令导致设备更换延迟后,需要重建其普及率。在拉丁美洲,已有29家业者进入商业化阶段。随着频谱费用下降和云端服务供应商为中立主机塔提供资金,预计到2030年,该地区的连线数将达到4.25亿。

其他福利:

- Excel格式的市场预测(ME)表

- 包含 3 个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 机器间通讯和物联网设备密度不断增加

- 行动数据消耗量快速成长

- 政府频谱竞标加速了中频宽部署

- 通讯业者资本支出转向云端原生、开放式无线接取网路架构

- 棕地工业对专用5G的需求日益增长

- 固定无线存取(FWA)作为农村市场光纤的替代方案

- 市场限制

- 无线存取网密集化和高昂的初始光纤回程传输成本

- 网路切片货币化标准化进程的延迟

- 对中国供应商的国家安全限制

- 毫米波部署所需技术纯熟劳工短缺

- 价值链分析

- 监管环境

- 技术展望

- 投资和资金筹措趋势

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

第五章 市场规模与成长预测

- 透过通讯基础设施

- 5G无线接取网路(RAN)

- 运输/跨运输(去程传输、中线运输、回程传输)

- 核心网路(云端原生 5GC)

- 按频谱带

- 低频宽(低于1GHz)

- 中频宽(1-6GHz)

- 高频宽/毫米波(24GHz以上)

- 透过网路架构

- 非独立式(NSA)

- 独立版 (SA)

- 透过核心网路技术

- 软体定义网路 (SDN)

- 网路功能虚拟化(NFV)

- 多接取边缘运算(MEC)

- 网路切片

- 最终用户

- 消费性电子产品

- 汽车与出行

- 工业製造

- 医疗保健和生命科学

- 能源与公共产业

- 公共与国防

- 智慧城市和基础设施

- 其他行业(零售业、媒体业、农业)

- 按地区

- 北美洲

- 美国

- 加拿大

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 澳洲

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Airspan Networks Inc.

- AT&T Inc.

- Casa Systems Inc.

- Cisco Systems Inc.

- CommScope Holding Company Inc.

- Corning Inc.

- Dell Technologies Inc.

- Telefonaktiebolaget LM Ericsson

- Fujitsu Limited

- Hewlett Packard Enterprise Development LP

- Huawei Technologies Co. Ltd.

- Intel Corporation

- Juniper Networks Inc.

- Mavenir Systems Inc.

- NEC Corporation

- Nokia Corporation

- Oracle Corporation

- Parallel Wireless Inc.

- Qualcomm Technologies Inc.

- Qucell Networks Co. Ltd.

- Rakuten Symphony Inc.

- Ribbon Communications Inc.

- Samsung Electronics Co. Ltd.

- Verizon Communications Inc.

- ZTE Corporation

第七章 市场机会与未来展望

The 5G infrastructure market reached USD 15.55 billion in 2025 and is on course to attain USD 54.06 billion by 2030, translating into a 28.30% CAGR.

The current expansion pivots on operators replacing earlier non-standalone rollouts with fully programmable standalone platforms that support network slicing, edge computing and private network creation. Capital is shifting from pure coverage toward software-defined functions that shorten service launch cycles, improve automation and lower lifetime operating costs. Demand is reinforced by private-network interest from manufacturing, mobility and energy, alongside fixed-wireless access (FWA) deployments that extend high-speed broadband into rural zones. Meanwhile, spectrum policy is unlocking fresh mid-band capacity, and vendor road maps are converging around cloud-native Open RAN designs that let carriers avoid single-supplier dependence and monetize APIs more quickly.

Global 5G Infrastructure Market Trends and Insights

Increasing Machine-to-Machine and IoT Device Density

Standalone 5G allows each cell site to handle as many as 50,000 connected devices, a prerequisite for Industry 4.0 production lines and massive sensor grids. Hyundai Motor's RedCap-enabled factory network proved that reduced-capability devices can lower power budgets without losing coverage. Edge computing is moving compute resources closer to machines, keeping latency within millisecond windows that robotics and predictive-maintenance schemes require. Private-network proofs in automotive, healthcare, and heavy industry validate the revenue upside that comes from device-dense environments rather than consumer handsets. This driver underpins sustained spending on small cells and edge data centers over the forecast window.

Surge in Mobile Data Consumption

Monthly mobile traffic continues to set new highs as cloud gaming, extended-reality video, and AI-enhanced streaming demand consistent multi-gigabit links. Three UK boosted backbone throughput to 9 Tbit/s after end-2024 peaks surpassed 2 Tbit/s. In China, regulators expect national traffic to quadruple by 2030, moving operators toward capacity architectures that remain efficient under day-long loads. Healthcare pilots, such as real-time tele-ultrasound demonstrations, underline the value of uplink capacity for mission-critical imagery. FWA uptake in India and the United States is also redirecting traffic from smartphones to CPE units, pushing carriers to redesign backhaul for home-first video habits.

High Upfront RAN Densification and Fiber Back-Haul Costs

Small-cell bills from USD 10,000 to USD 50,000 and macro-cell outlays that reach USD 200,000 per site make dense 5G footprints capital heavy, especially where mmWave is mandated. Fiber back-haul can add 30% to project budgets, and scarce digs in suburban corridors slow trenching schedules. Global telecom CAPEX dipped in 2023, the first drop since 2017, making CFOs cautious about accelerated rollouts. Network-sharing deals deliver up to 40% savings but reduce each partner's ability to market premium differentiation. Spectrum licence fees above USD 1 billion per operator further compress balance sheet headroom.

Other drivers and restraints analyzed in the detailed report include:

- Government Spectrum Auctions Accelerating Mid-Band Rollouts

- Telco Capex Pivot to Cloud-Native Open RAN Architectures

- Delayed Standardisation for Network-Slicing Monetisation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

RAN equipment generated the largest slice of the 5G infrastructure market, delivering 37% revenue in 2024 as carriers rolled out dense macro and small-cell grids. That initial hardware wave will keep RAN important, yet core networks outpace other layers with a 32.36% CAGR because software-defined control decides future monetisation. The 5G infrastructure market size for core platforms is set to increase sharply as standalone rollouts mandate dual-mode packet cores that virtualise user plane and control plane functions. Vodafone Spain and Three UK highlight how cloud-native cores let operators expose APIs for edge, security and quality-on-demand products

In the second half of the decade, operators view the converged core as the engine for private-network slices, low-latency industrial services, and real-time analytics. RAN spend will taper as coverage milestones are met, whereas lifecycle refresh and feature add-ons keep core invoices growing. Transport and xHaul budgets also rise because distributed units must feed line-rate traffic into data-centre cores. Consequently, the 5G infrastructure market will witness supplier jockeying where optical and routing vendors position themselves as strategic rather than tactical partners.

Mid-band commanded 46% of 5G infrastructure market share in 2024 because it blends propagation reach with multi-hundred-MHz bandwidth that supports massive MIMO arrays. Operators from Chicago to Berlin use 3.5 GHz radios to cover suburban rings without overspending on cells. mmWave, however, shows the fastest 33.58% CAGR by serving FWA households and event venues. This trajectory means the 5G infrastructure market size linked to mmWave radios, repeaters and advanced beamforming silicon will climb quickly, especially in the United States, Japan and South Korea.

Low-band below 1 GHz stays vital for wide-area IoT coverage but struggles with gigabit targets, keeping it a supplement, not a star. mmWave deployment faces line-of-sight and foliage loss, yet high-gain antennas and AI-aided beam steering are closing some gaps. Regulators that bundle mid-band and high-band blocks in the same licence round help carriers align the spectrum mix with differentiated service tiers.

The 5G Infrastructure Market is Segmented by Communication Infrastructure (5G Radio Access Networks, 5G Core Networks, Transport / XHaul [Front, Mid, Back-Haul], and More), Spectrum Band (Low-Band, Mid-Band, and More), Network Architecture (Non-Standalone [NSA] and More), Core Network Technology (Software-Defined Networking [SDN] and More), End-User Vertical (Consumer Electronics, and More), and Geography.

Geography Analysis

Asia Pacific held 24% of 5G infrastructure market share in 2024, driven by China's 4.4 million base stations and India's race to connect 30 million FWA subscribers by 2027. The region will expand at a 32.27% CAGR as South Korea sustains 97% population coverage and Japan adds suburban densification. Rural programmes in Indonesia, Vietnam, and the Philippines will lean on shared-tower models, while Australia advances with hybrid satellite-5G back-ups for remote mining operations.

North America shows coverage maturity above 80% of people yet reinvigorated spending in 2025 after a 2023 dip. Ericsson logged 54% year-over-year regional growth in Q4 2024, signalling that standalone cores, edge zones, and large enterprise deals are moving budgets again. US carriers bundle FWA with fibre to capture underserved suburbs, and Canada allocates fresh mid-band spectrum to accelerate indigenous-community connectivity.

Europe trails on standalone penetration but targets a EUR 164 billion economic boost by 2030 from harmonised regulation. Germany's 96% coverage illustrates what cohesive awards achieve, whereas the United Kingdom must rebuild performance after vendor bans slowed equipment swaps. Latin America steps into commercial phase with 29 operators live; regional connections should reach 425 million by 2030 as spectrum fees fall and cloud players finance neutral-host towers.

- Airspan Networks Inc.

- AT&T Inc.

- Casa Systems Inc.

- Cisco Systems Inc.

- CommScope Holding Company Inc.

- Corning Inc.

- Dell Technologies Inc.

- Telefonaktiebolaget LM Ericsson

- Fujitsu Limited

- Hewlett Packard Enterprise Development LP

- Huawei Technologies Co. Ltd.

- Intel Corporation

- Juniper Networks Inc.

- Mavenir Systems Inc.

- NEC Corporation

- Nokia Corporation

- Oracle Corporation

- Parallel Wireless Inc.

- Qualcomm Technologies Inc.

- Qucell Networks Co. Ltd.

- Rakuten Symphony Inc.

- Ribbon Communications Inc.

- Samsung Electronics Co. Ltd.

- Verizon Communications Inc.

- ZTE Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing machine-to-machine and IoT device density

- 4.2.2 Surge in mobile data consumption

- 4.2.3 Government spectrum auctions accelerating mid-band rollouts

- 4.2.4 Telco capex pivot to cloud-native open RAN architectures

- 4.2.5 Emerging demand for private 5G in brownfield industrial sites

- 4.2.6 Fixed-wireless access (FWA) substituting fiber in rural markets

- 4.3 Market Restraints

- 4.3.1 High upfront RAN densification and fiber back-haul costs

- 4.3.2 Delayed standardization for network-slicing monetization

- 4.3.3 National-security restrictions on Chinese vendors

- 4.3.4 Skilled-labor shortages for mmWave deployment

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Investment and Funding Trends

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Intensity of Competitive Rivalry

- 4.8.5 Threat of Substitute Products

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Communication Infrastructure

- 5.1.1 5G Radio Access Network (RAN)

- 5.1.2 Transport / xHaul (Front-, Mid-, Back-haul)

- 5.1.3 Core Network (Cloud-native 5GC)

- 5.2 By Spectrum Band

- 5.2.1 Low-Band (less than 1 GHz)

- 5.2.2 Mid-Band (1-6 GHz)

- 5.2.3 High-Band / mmWave (above 24 GHz)

- 5.3 By Network Architecture

- 5.3.1 Non-Standalone (NSA)

- 5.3.2 Standalone (SA)

- 5.4 By Core Network Technology

- 5.4.1 Software-Defined Networking (SDN)

- 5.4.2 Network Function Virtualization (NFV)

- 5.4.3 Multi-access Edge Computing (MEC)

- 5.4.4 Network Slicing

- 5.5 By End-user Vertical

- 5.5.1 Consumer Electronics

- 5.5.2 Automotive and Mobility

- 5.5.3 Industrial Manufacturing

- 5.5.4 Healthcare and Life Sciences

- 5.5.5 Energy and Utilities

- 5.5.6 Public Safety and Defense

- 5.5.7 Smart Cities and Infrastructure

- 5.5.8 Other Verticals (Retail, Media, Agriculture)

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 APAC

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 South Korea

- 5.6.4.4 India

- 5.6.4.5 Australia

- 5.6.4.6 Rest of APAC

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Airspan Networks Inc.

- 6.4.2 AT&T Inc.

- 6.4.3 Casa Systems Inc.

- 6.4.4 Cisco Systems Inc.

- 6.4.5 CommScope Holding Company Inc.

- 6.4.6 Corning Inc.

- 6.4.7 Dell Technologies Inc.

- 6.4.8 Telefonaktiebolaget LM Ericsson

- 6.4.9 Fujitsu Limited

- 6.4.10 Hewlett Packard Enterprise Development LP

- 6.4.11 Huawei Technologies Co. Ltd.

- 6.4.12 Intel Corporation

- 6.4.13 Juniper Networks Inc.

- 6.4.14 Mavenir Systems Inc.

- 6.4.15 NEC Corporation

- 6.4.16 Nokia Corporation

- 6.4.17 Oracle Corporation

- 6.4.18 Parallel Wireless Inc.

- 6.4.19 Qualcomm Technologies Inc.

- 6.4.20 Qucell Networks Co. Ltd.

- 6.4.21 Rakuten Symphony Inc.

- 6.4.22 Ribbon Communications Inc.

- 6.4.23 Samsung Electronics Co. Ltd.

- 6.4.24 Verizon Communications Inc.

- 6.4.25 ZTE Corporation

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment