|

市场调查报告书

商品编码

1438106

石油和天然气领域的人工智慧:市场占有率分析、行业趋势和统计、成长预测(2024-2029)AI In Oil And Gas - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

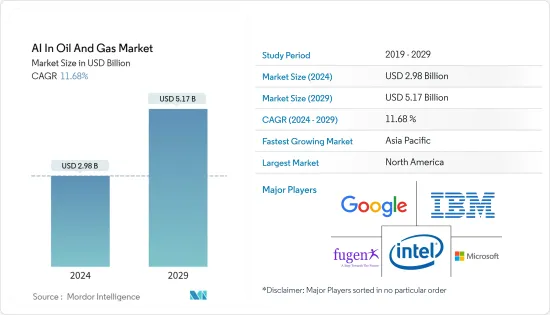

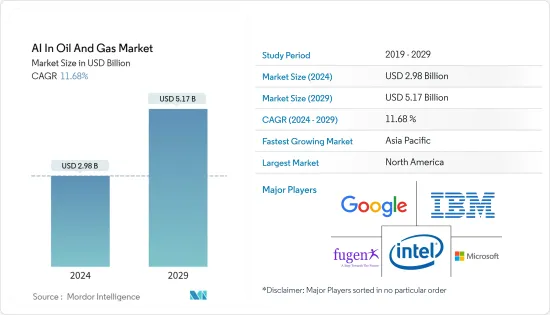

石油和天然气领域的人工智慧市场规模预计到2024 年为29.8 亿美元,预计到2029 年将达到51.7 亿美元,在预测期内(2024-2029 年)将成长至116.8 亿美元。将以复合年增长比率增长的 %。

主要石油和天然气公司在世界各地都有设施。因此,有效地管理它们非常重要。借助人工智慧,您可以在一个地方存取所有位置的资料。这使得所有工厂都可以进行远端管理和监控。资料记录可能不完整。因此,在使用它们之前对其进行数位化和评估非常重要。

主要亮点

- 人工智慧改善上游、中游和下游流程的业务。人工智慧将推动石油和天然气产业更高的安全标准。石油和天然气由于其易燃性和有毒气体排放而极度危险。人工智慧系统追踪毒性水平和洩漏,并提醒用户需要解决的问题。温度波动是石油和天然气产业安全的另一个威胁。随着一年中季节的变化,人工智慧会自动改变您的加热和冷却系统,以确保您的产品安全。当用于加工和运输原油的设备需要维护时,人工智慧也会向维修团队发出警报。

- 海上石油和天然气行业正在利用人工智慧和资料科学来简化对石油和天然气探勘和生产所需的复杂资料的存取。这使得公司能够找到新的探勘机会并改善现有基础设施的使用。例如,根据英国石油公司的数据,2021年全球石油产量达到8,990万桶/日。使用人工智慧工具可以提高产量。

- 全球油价大幅下跌是推动油气产业人工智慧需求最出乎意料的因素。因此,利润率限制迫使石油和天然气营运商改变其优先事项,从增加整体产量转向成功优化。推动石油和天然气产业全球人工智慧市场成长的因素包括消除成本高昂的钻井风险、利用巨量资料提高营运绩效以及利用新的预测技术改造传统生产系统等。

- 多家公司正在部署数位双胞胎,以实现基于地理位置的丛集中油井的整体健康状况。数位双胞胎的人工智慧执行特定的井校准要求和随后的根本原因分析,以提高整体功能品质。例如,雪佛龙正在为油田和炼油厂部署数位双胞胎技术。该公司还预计将节省价值数百万美元的品质和其他维护成本。

- 由于低油价和 COVID-19 大感染疾病,沙乌地阿拉伯经济承受着巨大压力。 COVID-19感染疾病油价进一步下跌,严重打击了沙乌地阿拉伯的非能源产业,该国一直在努力发展这些产业,作为其多元化策略的一部分。沙乌地阿拉伯将其经济从石油经济转向人工智慧经济的目标需要大量投资。沙乌地阿拉伯王储穆罕默德·本·萨勒曼在沙乌地阿拉伯国家电视台发表演说时表示,2030年註入国民经济的投资总额预计将达到3.2兆美元。

- 然而,自冠状病毒感染疾病以来,被压抑的需求刺激了全球对原油的需求。然而,这又是因为全球利率上升和地缘政治紧张局势(乌克兰战争)等宏观经济逆风正在给油价带来压力。

石油和天然气领域的人工智慧市场趋势

上游业务实现大幅成长

- 世界各地的石油和天然气产业正在努力使石油探勘过程更加高效和优化。该领域的业务是石油和天然气公司使用人工智慧的主要驱动力。人工智慧工具可以帮助石油和天然气公司将记录数位化并自动分析收集的地质资料和图表。这可以导致潜在问题的识别,例如管道腐蚀和设备使用增加。

- 英国石油公司(BP)和荷兰皇家壳牌公司等公司计划在2050年实现净零碳排放,这加大了根据《巴黎协定》最大限度减少碳排放的压力。壳牌采用人工智慧技术对单一设备或整个系统进行预测性维护,以减少碳排放。该元素使公司能够在潜在的设备故障发生之前对其进行预测和回应。

- 石油公司正在部署人工智慧技术来提高业务效率,这为市场供应商创造了机会,并增加了上游业务对整体市场成长的贡献。例如,2022年12月,石油天然气控股公司(nogaholding)、ADNOC位于阿布达比的科技公司和AIQ合作,将数位解决方案和人工智慧整合并实施到上游业务中。这将允许 nogaholding 使用 AIQ 的技术。最新的人工智慧技术提高了业务效率。

- 透过将人工智慧软体纳入业务中,公司可以获得富有洞察力的资料主导讯息,从而改善上游流程的业务成果。此过程可能涉及将选定的资料记录和资讯从资料来源输入到软体中,例如结构化文件、PDF、音讯笔记以及音讯和视讯檔案。

- 人工智慧可用于石油和天然气产业的多种应用。例如,利用电脑视觉优化生产以更快地分析地震和资料资料、最大限度地减少石油和天然气设备预测性维护的停机时间、了解油藏并减少维护,其中包括腐蚀风险预测建模。这是要花钱的。此外,市场上还出现了许多技术领域领先公司的投资。

北美预计将获得显着的市场占有率

- 由于油田营运商和服务供应商越来越多地采用人工智慧技术,以及着名人工智慧软体和系统供应商的强大影响力,尤其是在美国和加拿大,北美市场预计将占据人工智慧的最大份额。它一直。预测期内的石油和天然气市场。

- 强劲的经济、油田营运商和服务供应商对人工智慧技术的高采用率、知名人工智慧软体和系统供应商的强大影响力,以及政府和私人组织联合投资开发和发展研发活动,有几个因素。预计这将推动该地区石油和天然气产业对人工智慧的需求。

- 埃克森美孚是美国领先的石油生产商之一,计划最早到 2024 年扩大其在德克萨斯州西部二迭纪盆地的生产业务,每日产量超过100 万桶石油当量(BPD)。宣布了扩大计划。与目前的产能相比,这相当于增加了近80%。

- 此外,美国业主和营运商正在认识到基于 IT 的自动化如何有效解决上游石油和天然气行业的独特挑战。例如,贝克休斯使用 InForce 地面控制系统。该系统将操作井下工具的液压与控制智慧井系统的控制逻辑结合。 PLC 控制系统功能以实现更复杂的完整配置。这主要在需要透过现有 SCADA 执行远端操作时使用。

- 在所有使能技术中,人工智慧预计将在该地区的石油和天然气产业中发挥关键作用。由于北美加油站发生的火灾数量不断增加,它也被用来提高加油站预防性维护的安全性。

人工智慧在石油和天然气行业的概述

石油和天然气市场的人工智慧竞争适中,由少数占据市场占有率的大公司组成。随着越来越多的现有公司和新公司扩大基于人工智慧技术的业务组合,市场适度分散。两家公司继续投资于策略重点,以扩展、补充和加强其产品和服务,增加新客户和认证人才,并支持销售管道的扩展。

- 2023年1月-人工智慧应用软体公司C3 AI宣布推出C3 Generative AI产品套件,并发布了首款产品C3 Generative AI for Enterprise Search。 C3 AI 的预先建置人工智慧应用程式是 C3 Generative AI 产品套件的一部分,其中包括先进的变压器模型,使客户可以轻鬆地在整个价值链中使用它们。此外,C3 Generative AI 将加速跨业务职能和产业(包括石油和天然气产业)的转型工作。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争公司之间的敌意强度

- 技术简介 - 按下应用

- 品管

- 生产计画

- 预测性维护

- 其他用途

- 评估 COVID-19感染疾病对市场生态系的影响

第五章市场动态

- 市场驱动因素

- 增强专注力,轻鬆处理巨量资料

- 生产成本呈下降趋势

- 市场限制因素

- 安装成本高

- 整个石油和天然气行业缺乏熟练的专业人员。

第六章市场区隔

- 外科手术

- 上游

- 中产阶级

- 下游

- 服务类型

- 专业服务

- 管理服务

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争形势

- 公司简介

- Google LLC

- IBM Corporation

- FuGenX Technologies Pvt. Ltd

- C3.AI

- Microsoft Corporation

- Intel Corporation

- Royal Dutch Shell PLC

- PJSC Gazprom Neft

- Huawei Technologies Co. Ltd

- NVIDIA Corp.

- Infosys Limited

- Neudax

第八章投资分析

第9章市场的未来

The AI In Oil And Gas Market size is estimated at USD 2.98 billion in 2024, and is expected to reach USD 5.17 billion by 2029, growing at a CAGR of 11.68% during the forecast period (2024-2029).

Large oil and gas firms have facilities spread out over the globe. Therefore it's crucial to manage them all effectively. They can access all of their locations' data in one spot thanks to AI. This enables them to manage and monitor all of their plants remotely. Data records may occasionally be incomplete. Thus it's crucial to digitize and evaluate them before using them.

Key Highlights

- AI improves operations in the upstream, midstream, and downstream processes. AI promotes high security and safety standards in the oil and gas sector. Due to their flammability and the release of toxic gases, oil and gas are highly hazardous. Artificial intelligence systems can track toxicity levels and leaks and warn users of issues that must be fixed. The fluctuation in temperature is another threat to safety in the oil and gas sector. As the seasons change throughout the year, AI can automatically modify cooling and heating systems to keep the goods safe. Artificial intelligence will also warn the maintenance team when equipment used to process and transport crude oil needs maintenance.

- The offshore oil and gas industries employ AI and data science to simplify access to the complex data required for oil and gas exploration and production. This enables businesses to find new exploration opportunities and improve the use of current infrastructures. For example, According to BP plc, global oil production amounted to 89.9 million barrels per day in 2021. Production can be increased by using AI tools.

- The sharp reduction in oil prices worldwide has been the most unexpected element driving up demand for artificial intelligence in the oil and gas industry. Margin constraints, as a result, forced oil and gas operators to change their priorities from raising overall output to successfully optimizing it. The factors propelling the growth of the global artificial intelligence market in the oil and gas industry include eliminating the costly risk of drilling, utilizing big data to improve operational performance, and transforming the traditional production system into new predictive technologies.

- Several companies are deploying digital twins to attain the overall health of the oil wells present in a cluster based on geographical position. The digital twins' AI performs the calibration requirements of certain wells and the subsequent analysis of the causes, improving overall functional quality. For instance, Chevron is rolling out digital twin technology for its oil fields and refineries. The company further expects to save millions worth of quality and other maintenance costs.

- The Saudi economy was under exceptional strain due to the low oil prices and the COVID-19 pandemic. COVID-19 had further depreciated oil and wreaked havoc on Saudi Arabia's non-energy industries, which it was attempting to grow as part of its diversification strategy. The Kingdom's objective to migrate its economy from oil-based to AI-based will require considerable investment. In a speech given to a state television of Saudi Arabia, The Crown Prince of Saudi Arabia, Mohammed Bin Salman informed that the total investment injected into the national economy is expected to reach USD 3.2 trillion by 2030.

- But after COVID, Pent up demand fueled the demand of crude across the world. But again, due to macro-economic headwinds like increasing intertest rate across the world and geopolitical tension (Ukrain war) putting pressue on crude oil prices.

AI in Oil and Gas Market Trends

Upstream Operations to Witness Significant Growth

- Oil and Gas industries worldwide are trying to make the oil exploration processes more efficient and optimized. The operations in this field are the major factors driving the usage of AI in oil and gas companies. The AI tools can help oil and gas companies digitize records and automate the analysis of the gathered geological data and charts, which can lead to the potential identification of issues, such as pipeline corrosion or increased equipment usage.

- Companies like BP and Royal Dutch Shell have planned to achieve net-zero carbon emissions by 2050, and are under increasing pressure to minimize their carbon footprint in compliance with the Paris Agreement. Shell is employing AI technology to do predictive maintenance of individual pieces of equipment or entire systems to reduce its carbon footprint. This factor allows the corporations to foresee and handle probable equipment faults before they occur.

- Oil companies are adopting AI technology to increase their operational efficiencies, which is creating an opportunity for the market vendors, and raising the contribution of Upstream operation in the overall market growth. For instances, in December 2022, Oil and Gas Holding Co. (nogaholding), ADNOC's Abu Dhabi-based technology venture, and AIQ have collaborated to integrate and implement digital solutions and artificial intelligence into its upstream operations, which would enable nogaholding to use AIQ's most recent AI technologies to improve operational efficiency.

- Companies can obtain insightful data-driven information that will enhance their business outcomes in their upstream processes by incorporating AI software into their operations. This process may involve feeding curated data records and information from data sources to the software, including structured documents, PDFs, handwritten notes, and audio or video files.

- AI has multiple applications in the oil and gas industry, such as production optimization with computer vision to analyze seismic and subsurface data faster, downtime minimizing for predictive maintenance for oil and gas equipment, reservoir understanding, and modeling for predicting oil corrosion risks to reduce maintenance costs. Moreover, the market has been witnessing many investments by big players in technology.

North America is Expected to have a Significant Market Share

- Owing to the increasing adoption of AI technologies across the oilfield operators and service providers and the robust presence of prominent AI software and system suppliers, especially in the United States and Canada, the North American segment is anticipated to account for the largest share of the AI in oil and gas market over the forecast period.

- Factors such as the strong economy, the high adoption rate of AI technologies across the oilfield operators and service providers, a robust presence of prominent AI software and system suppliers, and combined investment by government and private organizations for the development and growth of R&D activities are projected to drive the demand for AI in the oil and gas sector in the region.

- ExxonMobil, one of the leading oil producers in the country, announced its plans to increase the production activity in the Permian Basin of West Texas by producing more than 1 million barrels per day (BPD) of oil equivalent by as early as 2024. This capacity is equivalent to an increase of nearly 80% compared to the present production capacity.

- In addition, owners and operators in the United States recognize how IT-based automation can productively address the unique challenges of the upstream oil and gas sector. For instance, Baker Hughes uses the InForce surface control system, which combines the hydraulic power to activate downhole tools and the control logic to govern an intelligent well system. PLC controls system functions for more complex completion configurations. It is primarily used where remote operations must be done through existing SCADA.

- Among all the enabling technologies, AI is projected to play a significant role in the oil and gas industry in the region. It has also been used to increase the safety of gas stations for preventive maintenance due to the growing number of fire incidences at gas stations in North America.

AI in Oil and Gas Industry Overview

The AI in the oil and gas market is moderately competitive and consists of a few major players holding the market share. The market has been witnessing growth in the number of existing and new companies expanding their AI technology-based business portfolio, making it moderately fragmented. The companies continuously invest in the strategic priority to broaden, complement, and enhance their product and service offerings, add new customers and certified personnel, and help expand sales channels.

- January 2023 - C3 AI, an AI application software company, has announced the launch of the C3 Generative AI Product Suite with the release of its initial product, C3 Generative AI for Enterprise Search. C3 AI's pre-built AI applications in the C3 Generative AI Product Suite include advanced transformer models, making it easier for customers to use them throughout their value chains. In addition, transformation efforts across business functions and industries, including the oil and gas sector, would be accelerated by C3 Generative AI.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot - By Application

- 4.3.1 Quality Control

- 4.3.2 Production Planning

- 4.3.3 Predictive Maintenance

- 4.3.4 Other Applications

- 4.4 Assessment of the Impact of COVID-19 on the Market Ecosystem

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Focus to Easily Process Big Data

- 5.1.2 Rising Trend to Reduce Production Cost

- 5.2 Market Restraints

- 5.2.1 High Cost of Installation

- 5.2.2 Lack of Skilled Professionals Across the Oil and Gas Industry

6 MARKET SEGMENTATION

- 6.1 Operation

- 6.1.1 Upstream

- 6.1.2 Midstream

- 6.1.3 Downstream

- 6.2 Service Type

- 6.2.1 Professional Services

- 6.2.2 Managed Services

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Google LLC

- 7.1.2 IBM Corporation

- 7.1.3 FuGenX Technologies Pvt. Ltd

- 7.1.4 C3.AI

- 7.1.5 Microsoft Corporation

- 7.1.6 Intel Corporation

- 7.1.7 Royal Dutch Shell PLC

- 7.1.8 PJSC Gazprom Neft

- 7.1.9 Huawei Technologies Co. Ltd

- 7.1.10 NVIDIA Corp.

- 7.1.11 Infosys Limited

- 7.1.12 Neudax