|

市场调查报告书

商品编码

1438270

工业照明:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Industrial Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

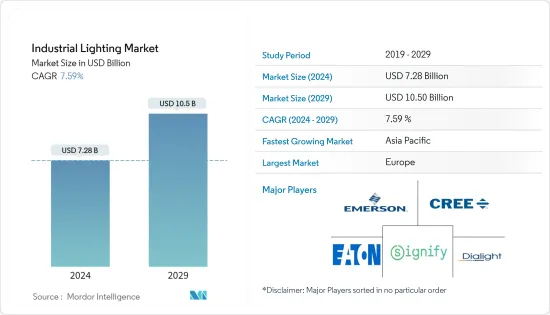

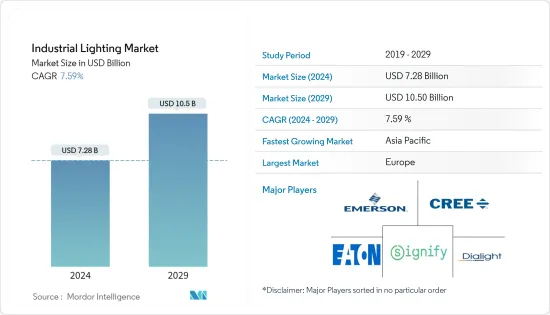

预计2024年工业照明市场规模为72.8亿美元,预计2029年将达105亿美元,预测期内(2024-2029年)复合年增长率为7.59%。

以具有竞争力的价格提供各种照明产品以及各个工业部门对节能照明系统不断增长的需求正在推动工业照明市场的成长。

主要亮点

- 多年来,工业照明的需求一直在稳步增长,随着它越来越多地应用于世界各地的仓库、物流设施、工业设施等,这一趋势预计将持续下去。工业照明通常用于有受伤或事故风险的区域,在提高工人安全和生产力方面发挥重要作用。

- 由于商业和工业环境中最常见的传统照明灯具(即萤光和高强度放电 (HID) 照明)的热量损失,工业运营商经常面临与高维护成本相关的挑战。 LED 照明在过去几年中需求量很大,因为它可以显着节省能源和成本,而且维护成本低。

- 随着多个地区工业生产持续快速成长,对电力的依赖也增加。製造商也经常面临巨大的营运成本。这是製造商采用节能照明解决方案的关键因素之一。此外,世界各地实施的许多法规鼓励使用 LED 等节能照明解决方案。

- 整合或更换製造工厂和生产设施中现有照明系统所需的初始成本通常很高,特别是对于中小型企业而言。因此,由于成本相对较低,一些最终用户仍然更喜欢紧凑型萤光(CFL)、LFL 和 HID,而不是新型 LED,阻碍了市场成长。

- COVID-19 导致许多工业部门的建设活动停止,导致市场需求暂时下降,特别是在疫情爆发的最初几个月。然而,随着许多疫情相关限制的放鬆,许多地区的建设活动开始回升,市场出现新的成长。

工业照明市场趋势

LED光源可望占较大份额

- LED具有更长的寿命、更高的能源效率、更低的营运/维护成本以及更快的投资收益(ROI)等特性,这些特性最终可能会推动工业照明市场的需求。此外,LED 不会发出任何有害的紫外线或红外线辐射,这具有多种优势,包括降低冷却成本、简化维护、延长产品寿命以及工业环境中的安全裕度。

- LED 没有活动部件,极其耐用,具有出色的抗衝击和耐腐蚀性能。另一个优点是它不会被火花点燃。这些特性使 LED 非常适合经常暴露于高振动、碎屑、化学物质和爆炸性溶液的采矿应用。

- 例如,工业 LED 照明解决方案供应商 Dialight Group 于 2021 年 8 月针对欧洲、中东和非洲 (EMEA) 和亚太地区市场推出了全新 ProSite LED 泛光灯系列。新型泛光灯专为工业应用而设计,透过清晰、接近日光的照明为外部工作场所提供出色的视野,确保包括矿场在内的各种设施的安全。

- 许多仓库采用线性萤光或金属卤素灯进行照明。儘管萤光和金属卤化物灯比白炽灯泡有所改进,但与 LED 直接相比,它们仍然存在处置危险、寿命缩短和光效率降低等问题。因此,这些仓库目前正在改用LED。

- 世界各地的政府和公共机构越来越多地部署这些 LED 照明网络,以解决使用白炽灯带来的维护问题。这些灯泡和高压钠很容易与周围的反应气体混合。此外,作为光源,与传统照明相比,LED 具有高亮度和高效率,并提供耐腐蚀和蒸气的操作解决方案。

欧洲占有很大的市场占有率

- LED 模组在欧盟市场迅速普及。推动该地区LED产品需求的关键因素是欧盟禁止销售低效率照明技术的政策措施。例如,随着新的生态设计和标籤检视法规在整个欧盟生效,某些萤光和卤素灯泡已从 2021 年 9 月起被禁止。

- 2021 年 8 月,Signify 推出了首款符合严格的欧盟生态设计和能源标籤法规的飞利浦 LED A-Class 灯泡。与标准飞利浦 LED 灯泡相比,新型飞利浦 LED A-Class 灯泡预计能耗减少 60%,且使用寿命更长。

- 此外,英国等许多欧洲国家的目标是到 2050 年实现净零碳排放。因此,基于此目标,本地製造公司正在大力投资照明创新。

- 天然气和电力批发价格空前上涨给欧洲许多产业带来压力。例如,根据欧盟委员会的数据,欧洲天然气批发价格在 2021 年第三季升至创纪录水平,到 9 月底达到 85 欧元/兆瓦时,这在欧洲中心基本上是看不到的。达到前所未有的水平。因此,企业面临越来越大的压力,要求降低製造、仓储和物流领域的成本,而这些领域是天然气和电力的主要用户。

- 根据宇能源介绍,在仓储物流业,大部分能源(一般约65%)用于照明。由于近年来全部区域的仓库容量迅速扩大,该产业的能源效率尤其重要。例如,根据英国国家统计局的数据,2021 年英国仓库建设的新订单价值 56 亿英镑(67.5 亿美元),超过 1985 年以来的任何一年。因此,对能源的需求庞大。 -该领域的高效照明解决方案。

工业照明产业概况

工业照明市场高度分散。整体而言,现有竞争对手之间的竞争非常激烈。此外,大型和小型企业的新创新策略预计将推动市场成长。

- 2022 年 5 月 Signify 宣布推出最新一代 Pacific LED gen5 防水灯具,该解决方案专为在工业和停车场等苛刻环境中实现最佳性能而设计。新的解决方案适用于各种重工业应用。灯具具有坚固、紧凑的产品架构,除了高度的机械保护外,还具有高度防水和防尘功能。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争公司之间敌对的强度

- 产业价值链分析

- COVID-19 对产业生态系统的影响

第五章市场动态

- 市场驱动因素

- 提高最终用户的节能意识

- LED 在各种工业应用的采用率不断增加

- 市场挑战

- 实施成本高

第六章市场区隔

- 按光源分类

- 引导的

- 高强度放电 (HID) 照明

- 萤光

- 依产品类型

- 高/低棚照明

- 泛光/区域照明

- 按最终用户使用情况

- 油和气

- 矿业

- 药品

- 製造业

- 仓库

- 其他最终用户用途

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争形势

- 公司简介

- Signify Holding

- Cree Inc.

- Eaton Corporation PLC

- Emerson Electric Co.

- Dialight PLC

- Legrand SA

- Zumtobel Group AG

- Acuity Brands Inc.

- Osram Licht AG

- Trilux Lighting Ltd

- Hubbell Incorporated

- Larson Electronics LLC

- Hilclare Lighting

- Raytec Ltd

- Glamox UK

- Nemalux Inc.

- R.Stahl Limited

- ABB Installation Products Inc.(ABB Limited)

第八章投资分析

第九章市场展望

The Industrial Lighting Market size is estimated at USD 7.28 billion in 2024, and is expected to reach USD 10.5 billion by 2029, growing at a CAGR of 7.59% during the forecast period (2024-2029).

The availability of a wide range of lighting products at competitive prices and the increasing demand for energy-efficient lighting systems across various industrial sectors drive the industrial lighting market's growth.

Key Highlights

- Over the years, the demand for industrial lighting has been experiencing steady growth, and this trend is expected to continue over the coming years as well, owing to the increasing use at warehouses and for logistics, industrial establishments, etc., across the world. Industrial lighting is often used in places that have risks of injury and accidents and play an important role in enhancing the safety and productivity of workers.

- Industrial operators often face challenges associated with high maintenance costs due to heat losses of the traditional and most common lighting fixtures in commercial and industrial settings, i.e., fluorescent and high-intensity discharge (HID) lights. LED lights that offer greater energy and cost savings, along with low maintenance costs, have witnessed a significant demand in the past few years.

- As the industrial output continues to grow rapidly across multiple regions, the reliance on electricity is also increasing. Also, the manufacturers are often challenged with substantial operational costs. This is one of the key factors compelling manufacturers to adopt energy-efficient lighting solutions. Additionally, many regulations imposed worldwide are promoting the use of energy-efficient lighting solutions, such as LED.

- The initial cost required for integrating or replacing the existing lighting systems in manufacturing plants and production facilities is usually high, especially for small and medium industries. Consequently, certain end-users still prefer compact fluorescent lamps (CFL), LFL, and HIDs over new and emerging LEDs, as they have a comparatively lower cost, which hampers the market growth.

- Covid-19 halted many construction activities in the industrial sector, especially in the initial months of the outbreak, temporarily dampening the market demand. However, with many pandemic-related restrictions easing up, construction activities have started picking up in many regions, and the market is witnessing renewed growth.

Industrial Lighting Market Trends

LED Light Source is Expected to Hold Major Share

- LEDs have features such as longevity, energy efficiency, low operational/maintenance costs, and the ability to deliver an increasingly shorter return on investment (ROI), which might ultimately drive their demand in the industrial lighting market. Moreover, LEDs do not produce any harmful ultraviolet or infrared radiation, thereby offering several benefits, such as lowered cooling costs, maintenance simplification, prolonged product life, and providing a margin of safety in an industrial environment.

- LEDs do not have any moving parts, are very durable, and can withstand shock and corrosion better. An added advantage is their inability to ignite with a spark. With such properties, LEDs are highly suitable for mining industry applications that are often subject to high vibrations, debris, chemicals, and explosive solutions.

- For instance, in August 2021, Dialight Group, a provider of industrial LED lighting solutions, launched its new ProSite LED floodlight range for the EMEA and APAC markets. The new floodlights were designed for industrial applications, providing superior visibility to external worksites with crisp, near-daylight illumination to ensure the safety and security of a diverse range of facilities, including mine sites.

- Many warehouses use linear fluorescent lamps or metal halide lamps for lighting. While fluorescents and metal halides are an improvement over incandescent bulbs, they still present issues like disposal hazards, shorter lifespan, and less efficient light when it comes to a direct comparison with LEDs. As such, these warehouses are now switching to LEDs.

- Governments and public organizations worldwide are increasingly deploying these LED Lighting networks to address the maintenance issues created by incandescent lamps' usage. These bulbs and high-pressure sodium are easily compounded due to the surrounding reactive gases. Besides, as a lighting source, LED also provides a high luminosity and high efficiency and offers operational solutions against corrosion and vapor resistance compared to traditional lighting.

Europe to Hold Significant Market Share

- LED modules have had a rapid uptake in the EU market. An important factor driving the demand for LED products in the region has been the European Union's policy measures banning the sale of inefficient lighting technologies. For instance, certain fluorescent and halogen light bulbs have been banned starting September 2021, as new Ecodesign and labeling rules came into force across the European Union.

- In August 2021, Signify introduced the first Philips LED A-class bulbs that meet the stringent EU Ecodesign and Energy labeling regulations. The New Philips LED A-class bulbs are expected to consume 60% less energy compared to standard Philips LED bulbs and have a longer lifespan.

- Further, many European countries, such as the United Kingdom, are aiming for net-zero carbon emissions by 2050. Therefore, local manufacturing companies are investing considerably in lighting innovations based on this agenda.

- The unprecedented rise in wholesale gas and electricity prices has put a strain on many sectors across Europe. For instance, wholesale gas prices in Europe rose to record levels in Q3 2021, reaching 85 EUR/MWh by the end of September, a level rarely seen in European hubs, according to the European Commission. As such, companies are under increasing pressure to cut costs across manufacturing, warehousing, and logistics, which are the major users of natural gas and electricity.

- According to Yu Energy, in the warehousing and logistics industry, lighting uses most of the energy (typically around 65%). Energy efficiency in this sector is particularly important owing to the rapid expansion in warehousing capacity in recent years across the region. For instance, as per ONS, new orders for the building of warehouses in the United Kingdom were worth GBP 5.6 billion (USD 6.75 billion) in 2021, which is more than in any year since 1985. As such, there is significant demand for energy-efficient lighting solutions from this segment.

Industrial Lighting Industry Overview

The industrial lighting market is highly fragmented. Overall, the competitive rivalry among existing competitors is high. Further, the new innovation strategies of large and small enterprise companies are expected to drive market growth.

- May 2022 - Signify announced the launch of the latest generation of the Pacific LED gen5 waterproof luminaire, a solution designed for optimal performance in the demanding environments such as industry and parking areas. The new solution is suitable for a wide range of heavy industrial applications. The luminaires have a robust and compact product architecture, with high water and dust protection, along with a high degree of mechanical protection.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Industry Ecosystem

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Awareness About Energy Savings Among End-users

- 5.1.2 Rising Adoption of LED Across Diversified Industrial Applications

- 5.2 Market Challenges

- 5.2.1 High Cost of Implementation

6 MARKET SEGMENTATION

- 6.1 By Light Source

- 6.1.1 LED

- 6.1.2 High-intensity Discharge (HID) Lighting

- 6.1.3 Fluorescent Lighting

- 6.2 By Product Type

- 6.2.1 High/Low Bay Lighting

- 6.2.2 Flood/Area Lighting

- 6.3 By End-user Application

- 6.3.1 Oil and Gas

- 6.3.2 Mining

- 6.3.3 Pharmaceutical

- 6.3.4 Manufacturing

- 6.3.5 Warehouse

- 6.3.6 Other End-user Applications

- 6.4 Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Signify Holding

- 7.1.2 Cree Inc.

- 7.1.3 Eaton Corporation PLC

- 7.1.4 Emerson Electric Co.

- 7.1.5 Dialight PLC

- 7.1.6 Legrand SA

- 7.1.7 Zumtobel Group AG

- 7.1.8 Acuity Brands Inc.

- 7.1.9 Osram Licht AG

- 7.1.10 Trilux Lighting Ltd

- 7.1.11 Hubbell Incorporated

- 7.1.12 Larson Electronics LLC

- 7.1.13 Hilclare Lighting

- 7.1.14 Raytec Ltd

- 7.1.15 Glamox UK

- 7.1.16 Nemalux Inc.

- 7.1.17 R.Stahl Limited

- 7.1.18 ABB Installation Products Inc. (ABB Limited)