|

市场调查报告书

商品编码

1438275

虚拟软体:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Virtualization Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

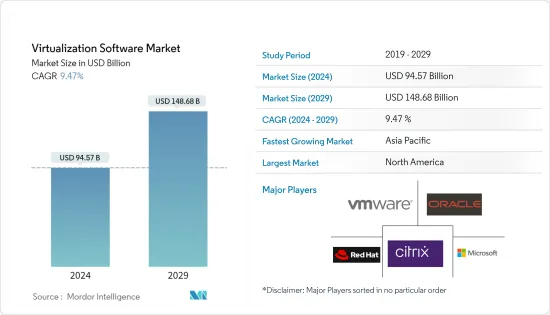

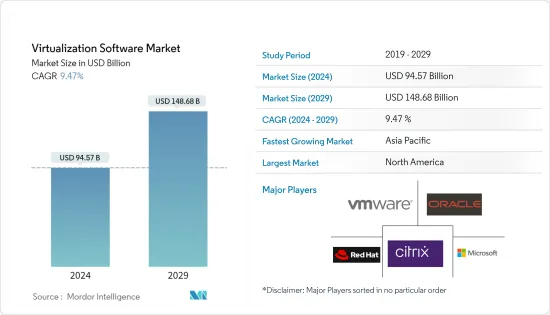

虚拟软体市场规模预计到 2024 年为 945.7 亿美元,预计到 2029 年将达到 1,486.8 亿美元,在预测期内(2024-2029 年)复合年增长率为 9.47%。

虚拟可以被描述为一个抽象层,它颠覆了传统电脑架构的标准范式。这将作业系统与实体硬体平台和应用程式解耦。

主要亮点

- 透过实施虚拟解决方案,IT 组织可以实现 IT 资源的高效利用和弹性。虚拟允许多个虚拟机器(通常具有不同的作业系统)在同一台实体机上独立并行运作。

- 通讯、云端运算和物联网 (IoT) 的快速发展促使许多公司专注于为智慧型手机和网路消费者提供积极的体验。应用虚拟技术预计将在亚太地区迅速采用。领先的 IT 公司对虚拟桌面基础架构 (VDI) 和软体虚拟平台(尤其是基于代理的平台)的接受度不断提高,正在推动亚太地区的业务扩张。

- 此外,云端基础的解决方案的使用增加是预计在预测期内推动行业成长的另一个关键驱动因素。此外,对高度安全的资料和统一储存基础设备不断增长的需求预计将在未来几年增加对虚拟的需求。

- 网路虚拟预计将受到解决方案供应商的更多关注,特别是随着 5G 在全球服务中的引入。宽频、光纤网路和其他类似的网路相关解决方案为市场参与者提供了新的机会。

- 由于 COVID-19 的爆发,许多公司鼓励员工远距工作(在家工作),事实证明这对供应商有利。它呼吁这些供应商提供建议和支持,以实现安全的远距工作计划,确保员工的安全和生产力,并在这场不断演变的全球危机中保持持续的业务运营,因为客户和组织的数量正在增加。疫情过后,企业也开始提供在家工作工作的永久性工作岗位,且在家工作工作的永久性工作岗位数量逐渐增加,推动了市场的成长。

虚拟软体市场趋势

PC/虚拟桌面预计将占据主要市场占有率

- PC虚拟是指工作站负载而非伺服器的虚拟。桌面上的精简型用户端通常允许使用者远端存取他们的 PC。当工作站在资料中心伺服器内运行时,这提供了安全和可携式的存取。许多公司正在采用 PC虚拟解决方案来最大限度地降低IT基础设施成本并加快部署速度。根据 PC Matic 进行的一项研究,虚拟私人网路 (VPN) 近年来在美国显着成长。 2019 年,15.3% 的参与者在职场中使用 VPN;今年,这一比例已增加至 63%。

- PC虚拟与应用程式虚拟和使用者设定檔管理系统一起提供了全面的桌面环境管理系统。预计推动市场需求的其他因素包括 IT 产业竞争加剧、强调降低成本、提高流程数位化以及增加行动劳动力。

- 市场的主要趋势是在过去几年的数位转型中,医疗保健产业对 PC虚拟的需求不断增加。这为医疗保健领域的IT服务铺平了道路。

- 公司正在专注于远距工作,以提高员工的效率和生产力。虚拟工作和互联网运算节省了IT基础设施成本。云端已成为一种普及的基础设施和实用程序,可实现电脑公共事业的不断扩展、虚拟分布。对云端运算的日益接受以及组织在云端安装工作站的偏好正在推动 PC虚拟的使用。

亚太地区预计将成为最大市场

- 由于该地区越来越多地采用虚拟技术和数数位化活动,预计亚太地区的成长率最高。亚太地区是虚拟软体的领先市场,由于经济扩张、 IT基础设施支出增加以及旨在部署物联网和人工智慧的政府和商业计划频率激增,该地区在预测期内将稳步增长。跨越多个领域。

- 由于现代技术的利用不断增加以及各个区域组织的数位化活动不断增加,日本的虚拟市场预计将大幅成长。 IT、通讯、银行、金融服务和保险 (BFSI) 行业的崛起也对该行业的扩张做出了重大贡献。虚拟桌面介面 (VDI) 和软体虚拟解决方案的接受度不断提高,正在推动大型 IT 公司的市场成长。

- 此外,市场主要企业增加投资预计将为预测期内的市场成长创造有利可图的机会。例如,根据惠普企业介绍,今年日本知名电讯营运商KDDI为符合O-RAN标准的5G独立基地台的商业网路营运部署了HPE ProLiant DL110 Gen10-Telco伺服器。

- 此外,今年微软也宣布 DCsv3 系列虚拟机器 (VM) 将在澳洲东部、日本东部和东南亚推出。 DCsv3 和 DCdsv3 系列虚拟电脑致力于保护公共云端中正在处理的业务代码和资料的机密性和完整性。英特尔软体防护扩充和英特尔总记忆体加密 - 多金钥可确保资料在使用时始终得到加密和保护。这些电脑配备了最新的第三代 Intel Xeon 可扩展处理器,透过 Intel Turbo Boost Max Technology 3.0 能够达到 3.5 GHz。

虚拟软体产业概况

虚拟软体市场较为分散,有许多大公司。 VMware Inc.、Citrix Systems Inc.、Oracle Corporation、Microsoft Corporation 和 Red Hat Inc. (IBM Corporation) 等市场主要企业正在寻求策略合作伙伴关係、合併、投资和协作,以维持其市场地位。

2022 年 7 月,ABB 和红帽联手为工业边缘和混合云端提供可扩展的数位解决方案。此次合作可透过红帽 OpenShift 实现自动化软体的虚拟和容器化,从而为针对应用需求进行最佳化的硬体部署提供更大的弹性。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争公司之间的敌意强度

- 替代品的威胁

- 评估 COVID-19 对产业的影响

第五章市场动态

- 市场驱动因素

- 透过减少硬体支出节省成本

- 透过虚拟提高 IT 效率

- 市场挑战

- 设定虚拟环境的复杂性

第六章市场区隔

- 按平台

- 电脑虚拟

- 移动虚拟

- 按类型

- 应用虚拟

- 网路虚拟

- 硬体虚拟

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争形势

- 公司简介

- VMware Inc

- Citrix Systems Inc.

- Oracle Corporation

- Microsoft Corporation

- Red Hat Inc.(IBM Corporation)

- Amazon Inc.

- Google LLC.

- NComupting Co. Ltd.

- Parallels International GmbH

- Huawei Technologies Co. Ltd.

- Datadog, Inc.

- Nutanix Inc.

- TenAsys Corporation

- Lynx Software Technologies

第八章投资分析

第九章市场机会与未来趋势

The Virtualization Software Market size is estimated at USD 94.57 billion in 2024, and is expected to reach USD 148.68 billion by 2029, growing at a CAGR of 9.47% during the forecast period (2024-2029).

Virtualization can be described as an abstraction layer that disrupts the standard paradigm of traditional computer architecture. It decouples the operating system from the physical hardware platform and applications.

Key Highlights

- As a result of the adoption of virtualization solutions, IT organizations can achieve efficient IT resource utilization and flexibility. Virtualization allows the use of multiple virtual machines, often with heterogeneous operating systems, to run in isolation, side-by-side, on the same physical machine.

- The rapid advancements in telecommunications, cloud computing, and the Internet of Things (IoT) have pushed many firms to focus on offering a positive experience to their smartphone and web-based consumers. It is predicted that Asia-Pacific will rapidly adopt application virtualization technology. The increasing acceptance percentage of virtual desktop infrastructure (VDI) and software virtualization platforms, particularly agent-based platforms, in big IT companies are driving business expansion in the Asia-Pacific region.

- Furthermore, the rising usage of cloud-based solutions is another important driver expected to boost industry growth throughout the forecast period. In addition, the growing demand for extremely secure data and consolidated storage infrastructure is projected to fuel the demand for virtualization over the coming years.

- Network virtualization is expected to gain further attention from the solution providers with a focus on 5G introduction in services across the world. Broadband, fiber network, and other similar network-related solutions provide a new opportunity for the players in the market.

- Due to the outbreak of COVID-19, many companies are encouraging employees to work remotely (work from home), which is proving to be beneficial for vendors. This is because a growing number of customers and organizations are turning to these vendors for advice and support to enable secure remote work initiatives that can ensure the safety and productivity of their employees and maintain ongoing business operations throughout this evolving global crisis. After the pandemic, companies have also been offering permanent work-from-home jobs, and the number of permanent work-from-home jobs is increasing gradually, propelling the market's growth.

Virtualization Software Market Trends

PC/ Desktop Virtualization is expected to hold Major Market share

- PC virtualization refers to the virtualization of the workstation load rather than a server. With a thin client at the desk, the user typically has remote access to the PC. This provides secure and portable access, as the workstation operates in a data center server. Numerous enterprises are adopting PC virtualization solutions to minimize IT infrastructure costs and enhance deployment speed. According to a survey conducted by PC Matic, virtual private networks (VPNs) have grown significantly in the United States in recent years. 15.3% of participants used a VPN at work in 2019. The percentage of respondents increased to 63% this year.

- PC virtualization is used with application virtualization and user profile management systems to offer a comprehensive desk environment management system. Other factors anticipated to drive demand for the market include rising competition in the IT sector, which will emphasize cost savings, increasing digitization of processes, and an increase in the mobile workforce.

- The major trend observed in the market is the increasing demand for PC virtualization in the healthcare sector amid the digital transformations over the past few years. This has paved the way for IT services within the healthcare sector.

- Enterprises are focused on remote working to increase the efficiency and productivity of their employees. Virtual working and Internet computing save IT infrastructure costs. Clouds have become popular as an infrastructure, allowing the constantly scalable and virtualized distribution of computer capabilities as a utility. The increased acceptance of cloud computing and the organizational preference for installing workstations in the cloud promote the use of PC virtualization.

Asia - Pacific is Expected to Register the Largest Market

- Asia-Pacific is expected to witness the highest growth rate owing to the region's increasing adoption of virtualization technology and digitalization activities. Asia-Pacific is a key market for virtualization software and is witnessing steady growth throughout the projection timeframe due to its expanding economy, increased expenditures on IT infrastructure, and a surge in the frequency of government and commercial projects aimed at deploying IoT and artificial intelligence (AI) technology throughout several sectors.

- With the increasing use of modern technologies and the rising number of digitization activities by different regional organizations, Japan is predicted to grow significantly in the virtualization market. The rise of the IT, telecommunications, and banking, financial services and insurance (BFSI) sectors also contributes significantly to industry expansion. Increasing acceptance of virtual desktop interfaces (VDI) and software virtualization solutions is driving market growth in large-scale IT companies.

- Furthermore, increasing investments by major players operating in the market are expected to create lucrative opportunities for the market to grow over the forecast period. For instance, According to Hewlett Packard Enterprise, this year, KDDI, a renowned Japanese telecommunications operator, deployed the HPE ProLiant DL110 Gen10 -Telco server for the commercial network operation of O-RAN compliant 5G standalone base stations.

- Furthermore, this year, Microsoft announced the availability of DCsv3-series virtual machines (VMs) in Australia East, Japan East, and Southeast Asia. The virtual computers of the DCsv3 and DCdsv3 series serve to protect the confidentiality and integrity of the business code and data while they are being processed in the public cloud. Intel Software Guard Extensions and Intel Total Memory Encryption - Multi Key can ensure that data is always encrypted and protected in use. These computers are powered by the newest 3rd Generation Intel Xeon Scalable processor and can achieve 3.5 GHz with Intel Turbo Boost Max Technology 3.0.

Virtualization Software Industry Overview

The Virtualization Software Market is fragmented, with the presence of many major players. The key players in the market, such as VMware Inc, Citrix Systems Inc., Oracle Corporation, Microsoft Corporation, Red Hat Inc. (IBM Corporation), among others are making strategic partnerships, mergers, investments, and collaborations to retain their market position.

In July 2022, ABB and Red Hat collaborated to provide scalable digital solutions for the industrial edge and hybrid cloud. The collaboration enables virtualization and containerization of automation software with Red Hat OpenShift to provide advanced flexibility in hardware deployment, optimized according to application needs.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Assessment of Impact Of Covid-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Cost Reductions due to Reduced Hardware Spending

- 5.1.2 Improved IT Efficiency due to Virtualization

- 5.2 Market Challenges

- 5.2.1 Complexity in Setting up a Virtual Environment

6 MARKET SEGMENTATION

- 6.1 By Platform

- 6.1.1 PC Virtualization

- 6.1.2 Mobile Virtualization

- 6.2 By Type

- 6.2.1 Application Virtualization

- 6.2.2 Network Virtualization

- 6.2.3 Hardware Virtualization

- 6.2.4 Other Types

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 VMware Inc

- 7.1.2 Citrix Systems Inc.

- 7.1.3 Oracle Corporation

- 7.1.4 Microsoft Corporation

- 7.1.5 Red Hat Inc. (IBM Corporation)

- 7.1.6 Amazon Inc.

- 7.1.7 Google LLC.

- 7.1.8 NComupting Co. Ltd.

- 7.1.9 Parallels International GmbH

- 7.1.10 Huawei Technologies Co. Ltd.

- 7.1.11 Datadog, Inc.

- 7.1.12 Nutanix Inc.

- 7.1.13 TenAsys Corporation

- 7.1.14 Lynx Software Technologies