|

市场调查报告书

商品编码

1438296

驱虫剂:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Insect Repellent - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

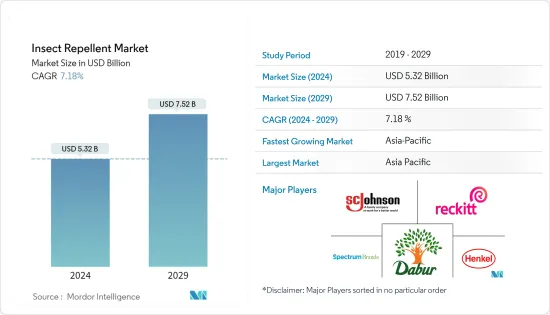

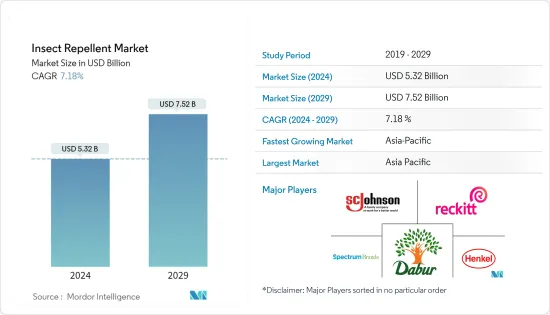

驱虫剂市场规模预计2024年为53.2亿美元,预计到2029年将达到75.2亿美元,在预测期内(2024-2029年)复合年增长率为7.18%增长。

COVID-19感染疾病对全球驱虫剂市场产生了积极影响,因为驱虫剂被认为是家庭卫生和家庭护理产品。此外,由于消费者意识不断增强,对个人和家庭护理产品的需求预计在不久的将来将会增加。此外,製造商指出,疫情让消费者更加意识到需要保持个人和家庭卫生,以减少感染机会,从长远来看,这一趋势预计将持续下去。我认为是有的。

登革热、疟疾、基屈公病、兹卡病毒和发烧等疾病的威胁日益增加,预计将在预测期内增加对驱虫剂的需求。政府为控制疾病而采取的措施、提高人们的健康意识以及这些产品的实惠价格是预计增加全球驱虫剂需求的一些主要因素。

此外,随着生活水准的提高、都市化的加速和人口的成长,对驱蚊剂的需求不断增加,特别是在热带地区。此外,包括驱蚊剂在内的各种驱虫剂有不同的价格分布可供选择,这使得大量消费者群体可以轻鬆获得且负担得起。基于天然成分的驱虫剂越来越多地被采用。除此之外,越来越多地采用此类驱蚊剂,以避免皮疹和过敏等问题。

驱虫剂市场趋势

虫媒疾病的传播

世界城市人口的健康意识越来越强,人们也越来越意识到蚊虫叮咬的风险。此外,随着新兴国家蚊子引起的疾病数量增加,农村人口越来越关注健康和卫生。根据世界卫生组织2020年3月发布的报告,媒介传播疾病占所有感染疾病的17%以上。这些疾病每年导致超过 70 万人死亡。它可能是由寄生虫、细菌或病毒引起的。过去十年来,爆发了多次危及生命的感染疾病,包括屈公病、流感、H1N1病毒、兹卡病毒和登革热,其中大多数是透过昆虫媒介传播的。媒介传播疾病的增加可能会在不久的将来增加昆虫控制产品的需求和消费,这反过来将推动昆虫控制活性化学品市场。此外,这些媒介传播的疾病和新病毒可以透过旅行和物流到达不同的地区。日益增长的都市化和工业化也间接造成环境污染,进而增加蚊媒疾病的传播。

亚太地区驱虫剂需求不断成长

由于中国是亚太地区人口最多的国家,收入较高,意识增强,生活水准提高,驱虫剂价格实惠,因此驱虫剂在家居产品中的普及不断增加,使其成为亚太地区最大的驱虫剂市场地区。所有这些因素累积增加了产品销售。此外,苍蝇、白蚁、臭虫、蚂蚁和蟑螂等家庭昆虫在中国也很常见。喷雾剂、喷雾剂、粉笔和粉末等可用形式的驱虫剂的使用导致了中国家用产品销售的激增。同时,由于家庭收入增加和产品价格实惠,公众意识的提高和对健康的日益关注正在推动印度家庭普及驱虫剂。卫生与家庭福利部于 2016 年推出了国家消除疟疾框架。政府也启动了《消除疟疾国家战略计画》,制定了未来五年的策略。此外,诸如 Swacch Bharat Abhiyaan 等各种计划的推出提高了人们对卫生和清洁的重视,从而促进了市场成长。例如,由蚊子引起的疟疾发病率已显着下降。根据世界卫生组织的资料,到2030年,全球疟疾发病率可能下降90%。捲绕驱虫剂是该地区最受欢迎的产品,因为它们具有成本效益,并且在所有零售通路都有售。便利商店等线下分销管道在该地区的农村地区更为流行。

驱虫剂产业概况

由于各种全球和区域参与者的存在,驱虫剂市场高度停滞且竞争激烈。主要市场占有率由市场领导庄臣公司占据,其次是 Spectrum 品牌和利洁时集团 (Reckitt Benckiser Group PLC)。广泛的产品系列、全球影响力以及公司在研究市场中的持续活动使 Godrej Consumer Products 成为市场领导者。研究期间,公司主要注重产品创新,开发了四款创新产品,旨在扩大产品系列和全球影响力。另一个市场领导庄臣公司也报告了所研究市场的销售情况,这是由各种产品的消费趋势推动的,这些产品包括所有类型的产品,例如避蚊胺产品、天然有机驱虫剂和其他产品。长高了。因此,为了进一步巩固市场地位,公司进行了大量投资,扩大主要产品的生产。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 市场限制因素

- 波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争公司之间的敌意强度

第五章市场区隔

- 产品类别

- 身体驱虫剂(乳霜/乳液、油)

- 其他驱虫剂

- 线圈

- 液体汽化器

- 喷雾/气雾剂

- 垫

- 其他驱虫剂

- 分销管道

- 线下零售店

- 网路零售店

- 类别

- 天然驱虫剂

- 传统驱虫剂

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 英国

- 德国

- 西班牙

- 法国

- 义大利

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 南非

- 阿拉伯聯合大公国

- 其他中东和非洲

- 北美洲

第六章 竞争形势

- 主要企业采取的策略

- 市场占有率分析

- 公司简介

- Spectrum Brands Holdings Inc.

- Henkel AG &Co. KGaA

- Newell Brands

- Enesis Group

- SC Johnson &Son Inc.

- Quantum Health

- Reckitt Benckiser Group PLC

- Jyothy Labs Limited

- Dabur India Ltd

- Sawyer Products Inc.

- Kao Corporation

第七章市场机会与未来趋势

The Insect Repellent Market size is estimated at USD 5.32 billion in 2024, and is expected to reach USD 7.52 billion by 2029, growing at a CAGR of 7.18% during the forecast period (2024-2029).

The COVID-19 pandemic positively affected the insect repellent market worldwide, as insect repellents are perceived as a home hygiene and home care product. In addition, the demand for personal hygiene and home care products is expected to grow in the near future due to the growing awareness among consumers. Moreover, manufacturing companies believe that the pandemic has made consumers more aware of the need to maintain hygiene at a personal level and at home to reduce the chances of infection, which is expected to become a trend in the long run.

The rising threat of diseases, such as dengue, malaria, chikungunya, zika virus, and yellow fever, is expected to increase the demand for insect repellents during the forecast period. The government initiatives being undertaken for disease control, the rising health awareness among people, and the affordable costs of these products are some of the major factors that are expected to boost the demand for insect repellents across the world.

Additionally, with improvements in living standards, increasing urbanization, and rising population, the demand for mosquito repellents is constantly on the rise, particularly in tropical parts of the region. Also, the availability of a wide range of insect repellents, including mosquito repellents, under different price ranges has made them easily accessible and affordable for a large consumer base. There is a rise in the adoption of insect repellents based on natural ingredients. The adoption of such mosquito repellents is increasing to avoid problems, such as skin rashes and allergies, among others.

Insect Repellent Market Trends

Rising Prevalence of Insect-borne Diseases

The global urban population is becoming more health-conscious, and people are becoming more aware of the risks of mosquito bites. Furthermore, as the number of diseases caused by mosquitoes increases in developing countries, the rural populace is becoming increasingly concerned about health and hygiene. According to a WHO report released in March 2020, vector-borne diseases account for more than 17% of all infectious diseases. Each year, these diseases cause more than 700,000 deaths. They can be caused by parasites, bacteria, or viruses. Several outbreaks of life-threatening infections, such as chikungunya, influenza, H1N1 virus, zika virus, and dengue, have occurred in the previous decade, mostly spread by insect vectors. With the rise in vector-borne diseases, the demand for and consumption of insect-repellent products is likely to rise in the near future, thus driving the market for insect-repellent active chemicals. Additionally, these vector-borne diseases and new viruses can reach different regions via travel and goods transport. Also, growth in urbanization and industrialization is indirectly creating environmental pollution, which can promote the dominance of mosquito-borne diseases.

Increased Demand for Insect Repellents from Asia-Pacific

China represents the largest market for insect repellents in the Asia-Pacific region on account of being the most populous country with high disposable income, growing awareness, improved living standards, and affordable pricing of repellents, which has increased their penetration in household goods. All these factors cumulatively augment the sales of the product. Moreover, household insects like flies, termites, bed bugs, ants, and cockroaches are very common in China. The use of insect repellants in usable forms like sprays, vaporizers, chalks, powders, and others has proliferated product sales in Chinese homes. Whereas, in India, the growing awareness and the rising health concerns among people, backed by increased household income and affordable product pricing, have improved insect repellents' penetration in Indian homes. The Ministry of Health and Family Welfare 2016 launched the National Framework for Malaria Elimination. The government also launched the National Strategic Plan for Malaria Elimination, which formulated strategies for the next five years. Additionally, the launch of various programs like Swacch Bharat Abhiyaan increased the importance of hygiene and cleanliness among people, which improved the market growth. For instance, the incidences of malaria caused by mosquitoes have reduced significantly. As per data from the WHO, there is a possibility of a 90% reduction in global malaria incidences by 2030. Insect repellents in the coil form are the most popular products in the region because they are cost-effective and available across all retail channels. Among the rural areas of the region, offline distribution channels like convenience stores are more popular.

Insect Repellent Industry Overview

The insect repellent market is highly stagnant and competitive, with the presence of various global and regional players. The major market share was dominated by SC Johnson & Son, which is the market leader, followed by Spectrum brands and Reckitt Benckiser Group PLC. The extensive product portfolio, global presence, and the company's continuous activities in the market studied have made Godrej Consumer Products a leader in the market. During the study period, the company's major focus was on product innovations, as it developed four innovative products with an aim to extend its product portfolio and global presence. Another market leader, SC Johnson & Son, is also enjoying greater sales in the market studied, supported by consumer inclination toward its wider range of products, including all product types, such as DEET products, natural and organic insect repellents, and other products. Accordingly, to further strengthen its position in the market, the company has been widely investing to scale up the production of its core products.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Body Work Insect Repellents (Cream/ Lotion and Oil)

- 5.1.2 Other Insect Repellents

- 5.1.2.1 Coil

- 5.1.2.2 Liquid Vaporizer

- 5.1.2.3 Spray/Aerosol

- 5.1.2.4 Mat

- 5.1.2.5 Other Insect Repellents

- 5.2 Distribution Channel

- 5.2.1 Offline Retail Stores

- 5.2.2 Online Retail Stores

- 5.3 Category

- 5.3.1 Natural Insect Repellent

- 5.3.2 Conventional Insect Repellent

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 Spain

- 5.4.2.4 France

- 5.4.2.5 Italy

- 5.4.2.6 Russia

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East & Africa

- 5.4.5.1 South Africa

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Rest of Middle East & Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Strategies Adopted by Leading Players

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Spectrum Brands Holdings Inc.

- 6.3.2 Henkel AG & Co. KGaA

- 6.3.3 Newell Brands

- 6.3.4 Enesis Group

- 6.3.5 S.C. Johnson & Son Inc.

- 6.3.6 Quantum Health

- 6.3.7 Reckitt Benckiser Group PLC

- 6.3.8 Jyothy Labs Limited

- 6.3.9 Dabur India Ltd

- 6.3.10 Sawyer Products Inc.

- 6.3.11 Kao Corporation