|

市场调查报告书

商品编码

1438301

汽车 DC-DC 转换器 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029 年)Automotive Dc-Dc Converter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

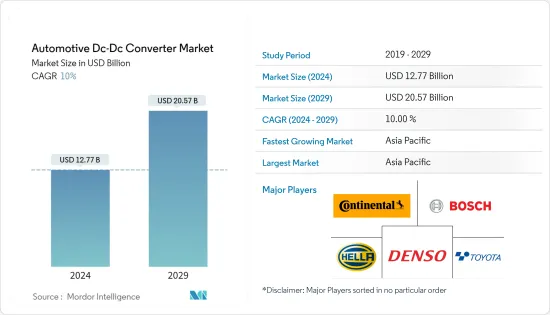

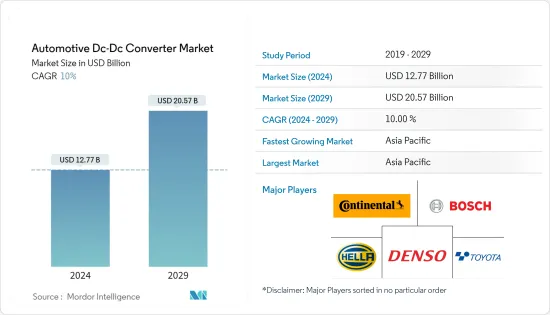

预计到 2024 年,汽车 DC-DC 转换器市场规模将达到 127.7 亿美元,预计到 2029 年将达到 205.7 亿美元,在预测期内(2024-2029 年)CAGR为 10%。

主要亮点

- COVID-19 大流行导致多家车辆和零件製造工厂暂时关闭。这一因素阻碍了汽车工业的发展。然而,随着一些国家逐步解除封锁,对车辆的需求略有增加,预计这将推动预测期内的市场成长。

- 透过将 ADAS 整合到现代汽车中,对资讯娱乐和增强安全性等电子系统的需求推动了市场的成长。电池供电和混合动力电动车的日益普及增加了对 DC-DC 转换器的需求,因为 DC-DC 转换器对于将 24V 或 48V 电源转换为 12V 电源以确保安全可靠的运作至关重要机载电子系统。

- 重要经济体和汽车製造公司正在投资研发 200-450V 转换器,其功能包括快速断路器控制,以符合汽车安全要求。然而,市场的成长可能会受到全球汽车产量波动等因素的限制,从而导致供应过剩,从而损害市场参与者的财务状况。

- 市场参与者正在尝试将直流转换器和逆变器单元集成为一个单元。此外,该市场是研发高度密集型市场,专注于将 DC-DC 转换器整合到大型车辆中。这一趋势鼓励 DC-DC 转换器製造商推出新产品,以促进整合到商用车中。

- 由于亚太地区(尤其是中国)较高的汽车生产率和年销量,预计该地区将主导市场。此外,先进驾驶辅助系统 (ADAS) 和车内资讯娱乐系统的普及已将车辆转变为复杂的轮子电子系统,需要多电平、无噪音 DC-DC 转换器来推动市场成长。

汽车DC-DC转换器市场趋势

全产业电气化可望推动市场

- 越来越多地采用严格的排放标准,促使汽车原始设备製造商 (OEM) 将先进技术整合到其车辆产品中,以提高燃油效率。这一趋势促进了中型和重型商用车 (M&HCV) 电动传动系统的发展。电动传动系统要求整合 DC-DC 转换器以确保更高的效率。商用车销售的成长推动零件製造商升级产品。

- 为此,浦卓最近推出了一款符合 48V 汽车系统 ISO/DIS 21780 标准的 48V 至 12V DC-DC 转换器。此转换器可进行配置以适应汽车网络,包括 CAN 和 FlexRay,并提供多种功率选项,范围从 400W 到 2.2kW。

- 同样,理光欧洲(荷兰)BV 推出了 R1273L 同步降压 DC/DC 转换器,该转换器可以在高达 34V 的宽输入电压范围内高效运行,提供最大 14A 的输出。

- 随着货运和物流活动的增加,物流和市政部门对皮卡车的需求也越来越大。最近,人们观察到对个人应用电动皮卡的巨大需求,特别是在欧洲和北美。在此背景下,福特、通用汽车和大众汽车等汽车製造商加强了对电动车生产的关注。

- 几家新公司/新创公司已宣布计划在未来几年生产混合动力或全电动皮卡车型。例如,福特宣布正在开发一款全电动皮卡,预计续航里程为 300 英里。儘管福特最初计划开发混合动力系统,但该公司已将其计划从混合动力转向全电动卡车。 F-150 电动车预计将于 2022 年推出。

- 美国汽车製造商和汽车技术公司 Rivian 开发了一款全电动皮卡车 RT1。该车预计续航里程为 450 英里,并具有 3 级自动驾驶功能。 RT1 已于 2022 年 9 月交付给客户。

- 2023 年 6 月,主要半导体製造商安森美半导体宣布将供应功率半导体,用于建造具有低导通电阻、最小闸极容量和输出容量的 DC-DC 转换器,从而减少高频在电动车中得到广泛应用。

- 组件製造商之间的各种协议、合作伙伴关係和合资企业将很快使电动车高压 DC-DC 转换器市场受益。例如,由于商用车越来越多地采用 DC-DC 转换器,市场预计将在预测期内适度成长。

预测期内亚太地区将在市场中发挥重要作用

- 随着汽车产量的增加以及主要国家对汽车电气化的日益关注,预计亚太地区将在预测期内占据市场的主导份额。此外,阿里巴巴等一些着名的非汽车公司也正在进入该国快速成长的电动车市场。

- 例如,2021 年 1 月,阿里巴巴集团与上汽集团合作在该国推出了两款名为 IM(智慧运动)的电动车型。 CATL为这些车辆供应电池

- 亚太地区的电动乘用车市场也是全球最大的电动乘用车市场之一,并且在过去几年中一直在快速成长。预计在预测期内将成长更高,这也将对高压 DC-DC 转换器市场的需求产生积极影响。市场上的几个主要参与者正在与其他参与者合作开发电力电子元件。

- 例如。 2023年3月,Symbio SASU宣布在亚洲、欧洲和美国建立燃料电池零件生产系统。该公司涉足FCV业务,并开发将DC-DC转换器和压缩机等组件组合在一起的堆迭包,并将其供应给汽车製造商。

- 同样,2023 年3 月,英飞凌科技股份公司(Infineon Technologies AG) 与台达电子(Delta Electronics, Inc.) 签署了一份谅解备忘录,将深化双方的联合创新活动,为快速增长的电动汽车(EV) 市场提供更有效率、更高密度的解决方案。 )。该协议涵盖直流-直流转换器和车载充电器等传动系统组件的製造和供应。

- 此外,现代汽车计划投资160亿美元,到2023年增加其在全球的市场份额。随着新产品的製造和推出的增加,未来几年对DC-DC转换器的需求必将增加。

- 由于大部分电动车和零件都是在当地製造,加上政府的关键国家战略和计划,预计该国市场在预测期内将出现高成长率。此外,DC-DC转换器发挥主要作用。它们也用于不同类型的应用,例如混合动力电动车(HEV,混合动力电动车),因此这些转换器的采用不断增加,加上製造商的大量推出,预计将推动市场需求。

- 例如,2021 年 11 月,EPC 推出了 2 kW、48 V/12 V DC-DC 展示板,用于更有效率、更小、更快的汽车双向转换器。与硅 MOSFET 解决方案相比,此 DC-DC 转换器的速度提高了三倍,尺寸减小了 35% 以上,重量减轻了 35%,效率提高了 1.5% 以上,整体系统成本降低了。

- 因此,上述因素和情况可能会在预测期内推动亚太地区的需求。

汽车DC-DC转换器产业概况

由于一些活跃的供应商基于产品创新来争夺更大的市场份额,因此市场得到了适度的整合。主要针对成熟市场销售的供应商需要有效地创新其产品,以确保低环境影响和精心设计的数位功能。

2021年3月,英飞凌科技股份公司(Infineon)宣布推出汽车用650V CoolSiC混合分立元件。该装置包含一个 50 A TRENCHSTOP 5 快速开关 IGBT 和一个 CoolSiC 肖特基二极体,可实现经济高效的性能提升和高可靠性。这款装置非常适合快速开关汽车应用,例如车载充电器 (OBC)、功率因数校正 (PFC)、DC-DC 和 DC-AC 转换器。

2021年2月,纬腾科技发表了一款新型DC/DC转换器,电加热EMICAT催化剂的加热盘现在也可以为高压车辆供电。创新的电子催化剂可在实际运作中实现最低排放,考虑到即将出台的法规(例如欧7),这一点变得越来越重要。新开发的DC/DC 转换器现在可以从高电压为加热盘产生低电压和功率。驱动系统。

此外,这些供应商的业务营运模式和产品理念符合新兴经济体的具体要求,以鼓励高成长、低成本市场的永续发展。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 市场驱动因素

- 市场限制

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争激烈程度

第 5 章:市场区隔(市场规模,价值十亿美元)

- 车辆类型

- 商用车

- 搭乘用车

- 地理

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 欧洲其他地区

- 亚太

- 中国

- 日本

- 印度

- 韩国

- 亚太其他地区

- 世界其他地区

- 南美洲

- 中东和非洲

- 北美洲

第 6 章:竞争格局

- 供应商市占率

- 公司简介

- Toyota Industries Corporation

- TDK Corporation

- Continental AG

- Robert Bosch GmbH

- Denso Corporation

- Panasonic Corporation

- Infineon Technologies AG

- Hella GmbH & Co. KGaA

- Aptiv PLC

- Alps Alpine Co. Ltd

- Marelli Corporation

- Valeo Group

第 7 章:市场机会与未来趋势

The Automotive Dc-Dc Converter Market size is estimated at USD 12.77 billion in 2024, and is expected to reach USD 20.57 billion by 2029, growing at a CAGR of 10% during the forecast period (2024-2029).

Key Highlights

- The COVID-19 pandemic caused several vehicles and component manufacturing facilities to shut down temporarily. This factor hindered the growth of the automotive industry. However, with the gradual removal of lockdowns in several countries, the demand for vehicles slightly increased, which was expected to propel the market growth during the forecast period.

- The market's growth is fueled by the demand for electronic systems, such as infotainment and enhanced safety, through the integration of ADAS in modern automobiles. The increasing adoption of both battery-powered and hybrid electric vehicles has enhanced the demand for DC-DC converters, as a DC-DC converter is vital for converting a 24V or 48V power supply into a 12V power supply to ensure the safe and reliable operation of onboard electronic systems.

- Prominent economies and vehicle manufacturing companies are investing in the research and development of 200-450V converters with features including fast circuit breaker control to comply with automotive safety. However, the market's growth may be limited by factors, such as fluctuations in global automotive production, resulting in an oversupply condition that could hamper the financial position of the market players.

- Market players are trying to integrate the DC converter and inverter units as a single unit. Further, the market is highly R&D-intensive and focused on integrating DC-DC converters in larger vehicles. This trend has encouraged manufacturers of DC-DC converters to launch new product offerings to facilitate integration into commercial vehicles.

- Asia-Pacific is anticipated to dominate the market, owing to the region's higher automotive production rate and annual sales, particularly in China. Moreover, The proliferation of advanced driver-assistance systems (ADAS) and in-cabin infotainment has turned vehicles into complex electronic systems on wheels that require multi-level, noise-free DC-DC converters to fuel market growth.

Automotive DC-DC Converter Market Trends

The Industry-Wide Electrification is Expected to Drive the Market

- The growing adoption of stringent emission norms is driving automotive original equipment manufacturers (OEMs) to integrate advanced technologies in their vehicle offerings to enhance fuel efficiency. This trend has resulted in the development of electric drivetrains for medium and heavy commercial vehicles (M&HCVs). The electric drivetrain mandates the integration of a DC-DC converter to ensure higher efficiency. The increase in sales of commercial vehicles has driven component manufacturers to upgrade their product offerings.

- On this note, Prodrive recently launched a 48V to 12V DC-DC converter compliant with the ISO/DIS 21780 standard for 48V automotive systems. The converter can be configured to suit automotive networks, including CAN and FlexRay, and is available in multiple power options, ranging from 400W to 2.2kW.

- Similarly, Ricoh Europe (Netherlands) BV introduced the R1273L synchronous buck DC/DC converter that can function efficiently over a wide input voltage range up to 34V to deliver a maximum output of 14A.

- With increasing freight and logistics activities, the demand for pickup trucks has seen significant demand from the logistics and municipal sectors. Recently, a significant demand for electric pickup trucks for personal applications has been observed, especially in European and North America. In context, automakers such as Ford, General Motors, and Volkswagen have sharpened their focus on electrified production vehicles.

- Several new companies/startups have announced plans to manufacture hybrid or fully electric pickup truck models in the coming years. For instance, Ford has announced that it is working on developing a fully electric pickup truck, which is expected to have a 300 miles range. Although Ford initially planned to develop a hybrid powertrain, the company has changed its plan from a hybrid to a fully electric truck. The F-150 electric is expected to be launched in 2022.

- Rivian, the American vehicle manufacturer and automotive technology company, has developed a fully electric pickup truck, the RT1. This vehicle is expected to have a range of 450 miles and has level-3 autonomous features. The RT1 was delivered to the customer by September 2022.

- In June 2023, ON Semiconductor Corp., a major semiconductor maker, announced that it would supply power semiconductors that will be used to build DC-DC converters that feature low ON resistance, minimal gate capacity, and output capacity, reducing electrical power loss at high frequencies to be used extensively in electric vehicles.

- Various agreements, partnerships, and ventures between the component manufacturers will benefit the electric vehicle high-voltage DC-DC converter market shortly. For instance, due to the increased adoption of DC-DC converters in commercial vehicles, the market is poised to register moderate growth during the forecast period.

Asia Pacific Region to Play Prominent Role in the Market During the Forecast period

- The Asia-Pacific region is expected to hold a dominant share of the market during the forecast period in the wake of rising vehicle production and the growing focus of major countries on the electrification of vehicles. Further, some notable non-automotive companies, like Alibaba, are also entering the rapidly growing EV market in the country.

- For instance, in January 2021, Alibaba Group introduced two electric models in the country, under the IM label (Intelligence in Motion), in partnership with SAIC Motor. CATL supplies battery cells for these vehicles

- The Asia-Pacific electric passenger car market is also one of the largest worldwide and has been growing rapidly over the last few years. It is expected to grow higher in the forecast period, which will also positively impact the demand for the high-voltage DC-DC Converter Market. Several key players in the market are partnering with other players to develop power electronics components.

- For instance. in March 2023, Symbio S.A.S.U announced the establishment of production systems for fuel cell parts in Asia, Europe, and the United States. The company is involved in the FCV business and develops stack packs that combine components such as a DC-DC converter and compressor to supply them to automakers.

- Similarly, in March 2023, Infineon Technologies AG (Infineon) and Delta Electronics, Inc. signed a Memorandum of Understanding that will deepen their joint innovation activities to provide more efficient and higher-density solutions for the fast-growing market of electric vehicles (EV). The agreement covers the manufacturing and supply of drivetrain components like DC-DC converters and onboard chargers.

- Also, Hyundai Motors plans to invest USD 16 billion to increase its market share in the world by 2023. With the increase in the manufacturing and launching of new products, the demand for DC-DC converters is bound to increase in the upcoming years.

- With most of the electric vehicles and components being manufactured locally and with the government's key national strategies and plans, the country's market is expected to have a high growth rate during the forecast period. In addition, DC-DC converters play a primary role. They are also used in different types of applications, such as hybrid electric vehicles (HEV, Hybrid Electric Vehicle), and hence growing adoption of these converters, coupled with notable launches from manufacturers, is expected to drive demand in the market.

- For instance, in November 2021, EPC Launched a 2 kW, 48 V/12 V DC-DC Demonstration Board for More Efficient, Smaller, Faster Bidirectional Converters for Cars. The DC-DC converter is three times faster, greater than 35% smaller and lighter, and offers greater than 1.5% higher efficiency and lower overall system costs compared to silicon MOSFET solutions.

- Therefore, such factors mentioned above and instances are likely to drive demand in the Asia-Pacific region during the forecast period.

Automotive DC-DC Converter Industry Overview

The market is moderately consolidated owing to several active vendors competing for an enhanced market share based on product innovation. The vendors with sales directed prominently to mature markets are required to effectively innovate their product offerings to ensure low environmental impact and well-designed digital features.

In March 2021, Infineon Technologies AG (Infineon) announced that it had launched the 650 V CoolSiC Hybrid Discrete for automotive. The device contains a 50 A TRENCHSTOP 5 fast-switching IGBT and a CoolSiC Schottky diode, enabling a cost-efficient performance boost and high reliability. It makes the device ideal for fast-switching automotive applications such as onboard chargers (OBC), power factor correction (PFC), DC-DC, and DC-AC converters.

In February 2021, Vitesco Technologies announced a new DC/DC converter, the heating discs of the electrically heated EMICAT catalyst can now also be supplied with electricity in high-voltage vehicles. The innovative e-catalyst enables the lowest emissions in real operation, which is becoming increasingly important considering forthcoming regulations such as Euro 7. The newly-developed DC/DC converter now generates the low voltage and power for the heating disc from the high voltage of the drive system.

Besides, these vendors' business operation models and product concepts align with the specific requirements of emerging economies to encourage sustainability in high-growth, low-cost markets.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value USD Billion)

- 5.1 Vehicle Type

- 5.1.1 Commercial Vehicle

- 5.1.2 Passenger Vehicle

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 United Kingdom

- 5.2.2.3 France

- 5.2.2.4 Italy

- 5.2.2.5 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 Japan

- 5.2.3.3 India

- 5.2.3.4 South Korea

- 5.2.3.5 Rest of Asia-Pacific

- 5.2.4 Rest of the World

- 5.2.4.1 South America

- 5.2.4.2 Middle-East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Toyota Industries Corporation

- 6.2.2 TDK Corporation

- 6.2.3 Continental AG

- 6.2.4 Robert Bosch GmbH

- 6.2.5 Denso Corporation

- 6.2.6 Panasonic Corporation

- 6.2.7 Infineon Technologies AG

- 6.2.8 Hella GmbH & Co. KGaA

- 6.2.9 Aptiv PLC

- 6.2.10 Alps Alpine Co. Ltd

- 6.2.11 Marelli Corporation

- 6.2.12 Valeo Group