|

市场调查报告书

商品编码

1438334

云端微服务 - 市场占有率分析、产业趋势与统计、成长预测(2024 年 - 2029 年)Cloud Microservices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

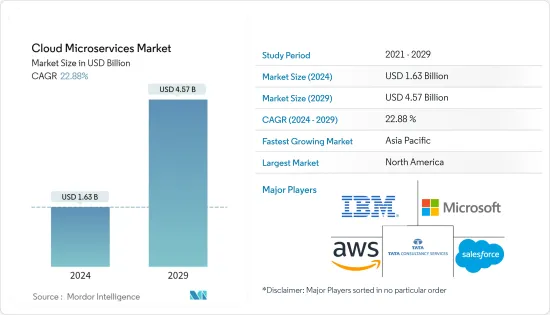

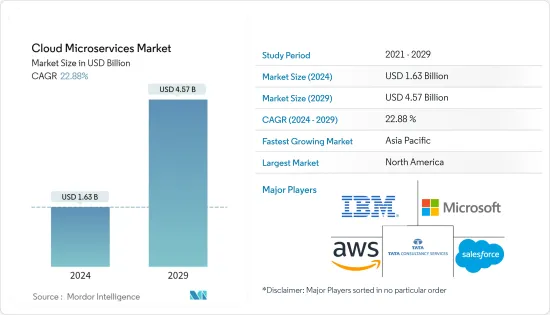

云微服务市场规模预计到 2024 年为 16.3 亿美元,预计到 2029 年将达到 45.7 亿美元,在预测期内(2024-2029 年)CAGR为 22.88%。

随着 Kubernetes 的采用率不断提高,公司预计会开始意识到仅仅采用它是不够的。他们也可能改变其流程、工具和架构的各个方面。 Kubernetes 很可能会大力推动全公司范围内的深刻变革。它提供了一种管理容器的绝佳方法,并使微服务架构在企业规模上变得实用。

主要亮点

- 由于 COVID-19 的爆发,全球对云端的需求增加。因此,直到去年年底,云端微服务都受到了严重影响。由于缺乏劳动力和远端监控需求,对云端服务的需求正在增长。

- 微服务架构的激增正在推动市场发展,因为它鼓励将应用程式分解为更小的元件。应用更改变得很容易。部署此类元件最终不会影响大部分程式码库。使用轻量级容器部署的云端原生应用程式采用这种架构风格是标准的。是因为大量的服务、去中心化的持续交付和DevOps。

- 各个最终用户产业的混合云端采用正在推动市场发展,因为许多企业目前正处于云端采用的不同阶段。混合云为他们探索新产品和业务模式提供了最大的灵活性。随着 IT 角色的发展,资料中心的负载也在不断变化。投资升级运算或储存成本高昂,但混合云端应用程式具有成本效益并推动市场发展。

- BFSI、IT、零售等行业日益采用云端技术,推动了云端微服务市场的成长。它是整体云端管理策略的重要组成部分,使 IT 管理员能够检查基于云端的资源的运作状态。例如,总部位于阿拉伯联合大公国的 Mashreq 银行采用了先进的数位营运模式,利用微服务架构,并利用即时资料进行分析。

- 安全和合规问题正在限制市场的成长。容器可以创造更多的软体开发环境,但它会带来新的安全风险,影响合规性。网路攻击者可以利用云端架构权限设定中的漏洞来存取敏感资料服务。

云端微服务市场趋势

製造业预计将显着成长

- 由于智慧技术的进步,随着传统自动化金字塔的瓦解,製造业对微服务云的需求不断增加。此外,製造业IT正朝向服务导向、应用导向发展。

- AWS(亚马逊网路服务)即用即付微服务和无伺服器运算模式以最少的前期投资和几乎无限的按需容量降低了运行互联製造工厂或智慧产品程式的成本。

- 「云端网路製造」为企业提供了一种新的商业方式,製造企业发现,如果没有资讯科技(IT)支援和电脑辅助能力,他们可能无法在竞争激烈的市场中生存。 Microsoft 是製造业主导的核心技术供应商,它为製造商提供了支援 OPC(开放平台通讯)UA 的机器的数位孪生,并显着增强了安全性和认证管理。在这里,客户可以使用 Azure 上执行的微服务直接从云端控制和管理他们的 OPC 双胞胎。

- 德国跨国集团蒂森克虏伯利用物联网技术将其电梯连接到微服务云。从电梯感测器收集的资料允许演算法处理资讯并在电梯发生故障之前预测何时需要维护。扩增实境进一步增强了这种预测性维护,电梯技术人员利用 Microsoft HoloLens 在现场接收专家的远端、免持指令。

北美将占据最大市场份额

- 由于采用日益先进的技术,该地区正在获得很高的市场份额。此外,北美公司的需求也在不断增长,因为他们在金融、电子商务和旅游服务中采用了微服务架构。它有助于经济高效地储存资讯和资料,并提高敏捷性、效率和可扩展性。

- 根据国际电信联盟的数据,加拿大在数位转型技术和服务上的支出将超过160 亿美元,这得益于对认知/人工智慧(AI) 系统、物联网、下一代安全、扩增实境或虚拟现实等新兴技术的投资、3D 列印和机器人技术,推动云端微服务的发展。

- 沃尔玛加拿大将其软体架构重构为微服务。该公司无法处理每分钟 600 万次的页面浏览量,但在一夜之间实现了即时的效果,转换率显着提高。停机时间也被最小化,公司可以用更便宜的虚拟 x86 伺服器替换昂贵的商用硬件,从而节省 20% 到 50% 的总体成本。它提出了该领域对云端微服务的需求。

- 在美国,微服务与 IBM Cloud Functions 和 Cloud Foundry 部署了商店购物应用程式。它显示了一个古董计算设备目录,客户可以在其中进行购买并添加评论,从而促进市场的成长。

云端微服务产业概览

云端微服务市场是分散的。主要参与者在公有云、私有云和混合云等多种部署模式中采用了各种策略,例如新产品发布、合作、收购等。它有助于扩大他们在这个市场的足迹,以维持长期发展。亚马逊网路服务公司、微软公司、IBM公司等都是主要参与者。目前市场的进步有:

- 2022 年 1 月 - 领先的 EHS 软体和内容提供商 Red-online 收购了领先的 EHS 平台解决方案 Gutwinski Management GmbH。此次收购将创造一个深度互补的客户组合产品,并有机会向全球更多客户提供产品和服务。

- 分析自动化公司 Alteryx, Inc. 收购了 Trifacta,后者提供云端优先功能,帮助企业大规模推动分析转型。透过此次收购,Alteryx 将处于独特的地位,可以为大型企业提供云端中整合的端到端、低程式码/无程式码分析自动化平台。它还将满足整个企业的需求:资料分析团队、IT/资料工程团队和业务用户。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 市场概况

- 市场驱动因素与限制简介

- 市场驱动因素

- 微服务架构的激增

- 各个最终用户产业采用混合云端

- 市场限制

- 安全与合规性

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争激烈程度

第 5 章:COVID-19 对云端微服务市场的影响分析

第 6 章:市场细分

- 按部署模式

- 平台

- 服务

- 按企业规模

- 中小企业

- 大型企业

- 按最终用户产业

- BFSI

- 零售

- 电子商务

- 製造业

- 电信

- IT 与 IT 人员

- 卫生保健

- 其他最终用户产业

- 按地理

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第 7 章:竞争格局

- 公司简介

- Amazon Web Services Inc.

- Microsoft Corporation

- IBM Corporation

- Salesforce.com Inc.

- Tata Consultancy Services Limited

- Broadcom Inc. (CA Technologies)

- VMware Inc. (Pivotal Software Inc.)

- Infosys Ltd

- Oracle Corporation

- NGINX Inc.

- Syntel Inc.

- Idexcel Inc.

- RapidValue IT Services Private Limited

第 8 章:投资分析

第 9 章:市场机会与未来趋势

The Cloud Microservices Market size is estimated at USD 1.63 billion in 2024, and is expected to reach USD 4.57 billion by 2029, growing at a CAGR of 22.88% during the forecast period (2024-2029).

As Kubernetes' adoption grows, companies are expected to start realizing that it is not enough to adopt it. They will also likely change all aspects of their processes, tools, and architecture. Kubernetes is likely to be a big push for profound company-wide changes. It provides an excellent way to manage containers and makes microservices architectures practical at an enterprise scale.

Key Highlights

- Owing to the COVID-19 outbreak, the global demand for the cloud increased. Due to this, the cloud microservices were severely influenced until last year's end. The need for cloud services is growing due to a lack of workforce and remote monitoring requirements.

- The microservices architecture proliferation is driving the market, as it encourages breaking the application into smaller components. It becomes easy to apply changes. Deploying such components does not end up impacting a large part of the codebase. It is standard for such an architectural style to be adopted for cloud-native applications using lightweight container deployment. It is because of the large number of services, decentralized continuous delivery, and DevOps.

- Hybrid cloud adoption across various end-user industries is driving the market, as many enterprises are currently in different stages of cloud adoption. The hybrid cloud gives them maximum flexibility to explore new products and business models. As IT's role grew, the load on the data center was evolving. Investing money in upgrading computing or storage is costly, but hybrid cloud applications are cost-effective and drive the market.

- The growing cloud technology adoption across industries such as BFSI, IT, retail, and various others is augmenting the cloud microservices market growth. It is a significant part of an overall cloud management strategy, enabling IT administrators to review the cloud-based resources' operational status. For instance, United Arab Emirates-based Mashreq Bank adopted an advanced digital operating model, utilized microservices architecture, and leveraged real-time data for analytics.

- Security and compliance issues are restraining the market from witnessing growth. The container can create more software development environments, but it leads to new security risks that affect compliance. Cyber attackers can benefit from vulnerabilities inside the permission settings of cloud architecture to reach sensitive data services.

Cloud Microservices Market Trends

Manufacturing Sector Expected to Register a Significant Growth

- Due to intelligent technology advancement, the microservice cloud demand is increasing in the manufacturing sector as the traditional automation pyramid dissolves. Moreover, manufacturing IT is moving toward service orientation and app orientation.

- AWS (Amazon Web Services) pay-as-you-go microservices and serverless computing models reduce the cost of running the connected manufacturing plant or smart product programs with minimum upfront investment and nearly unlimited on-demand capacity.

- "Cloud network manufacturing" provides a new way for business, as manufacturing companies discovered they may not survive in the competitive market without Information Technology (IT) support and computer-aided capabilities. Microsoft is the dominant core technology supplier to the manufacturing industry, which provides manufacturers a digital twin of their OPC (Open platform communication) UA-enabled machines and significantly enhances security and certification management. Here, customers can control and manage their OPC twins directly from the cloud using microservices running on Azure.

- ThyssenKrupp, a German multinational conglomerate, drew upon IoT technology to connect its elevators to the microservice cloud. The data collected from an elevator's sensors allows algorithms to process information and predict when maintenance is required before the elevator breaks down. This predictive maintenance is further enhanced by augmented reality, with elevator technicians utilizing Microsoft HoloLens to receive remote, hands-free instructions from experts while in the field.

North America to Account for Largest Market Share

- Due to the increasingly advanced technologies adoption, this region is gaining a high market share. Moreover, there is a growing demand from North American companies, as they have adopted microservices architecture in financial, e-commerce, and travel services. It helps store information and data cost-effectively and increases agility, efficiency, and scalability.

- As per ITU, digital Transformation technologies and services spent in Canada are set to exceed USD 16 billion sustained by the investment in emerging technologies, such as cognitive/artificial intelligence (AI) systems, IoT, next-generation security, augmented reality or virtual reality, 3D printing, and robotics, driving the cloud microservices.

- Walmart Canada refactored its software architecture to microservices. The company, which could not handle the 6 million page views per minute it was getting, realized instant results with a significant increase in its conversion rate overnight. The downtime was also minimized, and the company can replace expensive commodity hardware with cheaper virtual x86 servers, resulting in overall cost savings between 20 and 50 %. It gives demand for cloud microservice in this sector.

- In the United States, Microservices with IBM Cloud Functions and Cloud Foundry deploys a storefront shopping application. It displays an antique computing devices catalog where customers can make purchases and add review comments, increasing the market's growth.

Cloud Microservices Industry Overview

The cloud microservices market is fragmented. The major players have used various strategies, such as new product launches, partnerships, acquisitions, and others, across multiple deployment modes, like public, private, and hybrid cloud. It helps increase their footprints in this market to sustain the long run. Amazon Web Services Inc., Microsoft Corporation, IBM Corporation, etc., are the primary players. Current advancements in the market are:

- January 2022 - Red-on-line, a leading EHS software and content provider, acquired Gutwinski Management GmbH, a leading EHS platform solution. The acquisition will create a profoundly complementary client portfolio product and have an opportunity to make products and services available to even more customers worldwide.

- Alteryx, Inc., the Analytics Automation company, acquired Trifacta, which offers cloud-first capabilities to help enterprises drive their analytics transformation at scale. With this acquisition, Alteryx will be uniquely positioned to provide large enterprises with an integrated end-to-end, low-code/no-code analytics automation platform in the cloud. It will also serve the needs of the entire enterprise: data analytics teams, IT/data engineering teams, and business users.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Proliferation of the Microservices Architecture

- 4.3.2 Adoption of Hybrid Cloud Across Various End-user Industries

- 4.4 Market Restraints

- 4.4.1 Security and Compliance

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Analysis on the impact of COVID-19 on the Cloud Microservices Market

6 MARKET SEGMENTATION

- 6.1 By Deployment Mode

- 6.1.1 Platforms

- 6.1.2 Service

- 6.2 By Enterprise Size

- 6.2.1 Small and Medium Enterprises

- 6.2.2 Large Enterprises

- 6.3 By End-user Industry

- 6.3.1 BFSI

- 6.3.2 Retail

- 6.3.3 E-commerce

- 6.3.4 Manufacturing

- 6.3.5 Telecommunications

- 6.3.6 IT and ITes

- 6.3.7 Healthcare

- 6.3.8 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amazon Web Services Inc.

- 7.1.2 Microsoft Corporation

- 7.1.3 IBM Corporation

- 7.1.4 Salesforce.com Inc.

- 7.1.5 Tata Consultancy Services Limited

- 7.1.6 Broadcom Inc. (CA Technologies)

- 7.1.7 VMware Inc. (Pivotal Software Inc.)

- 7.1.8 Infosys Ltd

- 7.1.9 Oracle Corporation

- 7.1.10 NGINX Inc.

- 7.1.11 Syntel Inc.

- 7.1.12 Idexcel Inc.

- 7.1.13 RapidValue IT Services Private Limited