|

市场调查报告书

商品编码

1438337

箱板纸 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Containerboard - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

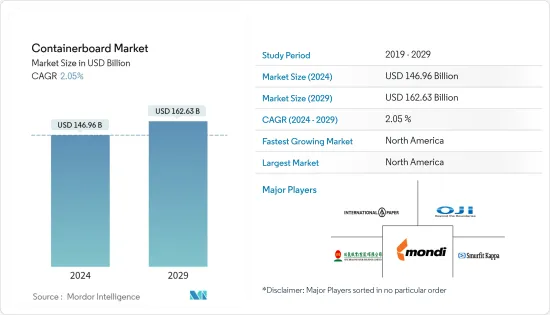

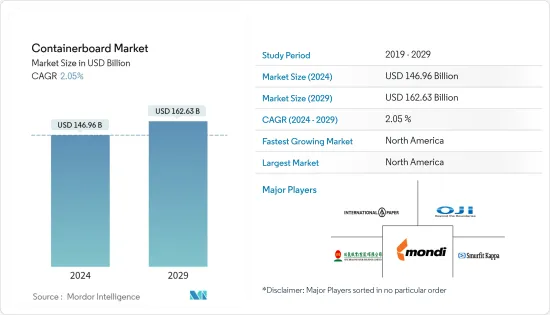

2024年箱板纸市场规模预计为1469.6亿美元,预计到2029年将达到1626.3亿美元,在预测期内(2024-2029年)CAGR为2.05%。

箱板纸在包装领域变得越来越普遍。由于其适应性、便携性和耐用性,它是最常用的包装材料。此外,它来自可再生资源。它也是回收最多的一种包装材料。

主要亮点

- 在整个预测期内,预计全球箱板纸市场将大幅扩张,这主要是由于瓦楞纸箱出货量和电子商务出货量的增加、对包装食品和企业的需求增加以及消费者偏好转向可回收包装选择。

- 迷你瓦楞纸箱在一些市场的使用也使他们能够扩大其在市场的影响力,例如麦片盒和外带食品包装。让瓦楞纸箱从纸板箱中获得份额的另一个因素是电子商务就绪包装的引入,该包装用轻质且易于打开的纸箱替代了能够承受严酷运输的盒子。这些趋势预计将促进电子商务领域和其他行业采用箱板纸。

- 儘管各国政府正在迫使包装业使用可回收材料进行包装,且环境问题日益严重,但预计期间正在调查的市场蕴藏着巨大的机会。

- 预计阻碍市场扩张的关键因素之一是替代包装选择的可及性。

- 由于 COVID-19 爆发,受调查市场的一些主要驱动因素包括食品包装的成长以及电子商务出货量不断扩大对瓦楞包装的需求不断增长。电子商务入口网站对食品杂货包装、医疗保健产品和电子商务运输的需求显着扩大。

容器纸板市场趋势

食品饮料产业见证成长

- 由于人们忙碌的生活方式,对包装和即食食品的需求不断增加。不断增长的年轻人口,特别是职业女性,也推动了对包装食品的需求,她们也被纳入研究的市场。

- 瓦楞纸板包装(主要是二级或三级包装)越来越多地被企业使用,以便为客户提供更好的结果,因为它可以保护物品免受潮湿并承受较长的运输时间。麵包、肉製品和其他易腐烂食品等加工食品推动了这一需求,这些食品需要这些包装材料一次性使用。预计食品和饮料行业对箱板纸的需求将会增加。

- 此外,该领域的新发展正在扩大瓦楞纸板包装的用途范围。 THIMM 集团的各公司创建了“COOLandFREEZE”,这是一种用于温控运输的瓦楞纸板箱,可以一次性运输冷冻、冷藏和非冷藏货物。

- 透过这种先进的包装,加工食品可以有效隔热并冷藏至少 36 小时。瓦楞纸板包装是比聚苯乙烯或塑胶更环保的运输解决方案。因此,预计该行业的需求在预测期内将激增。

- 这些产品还提供附加功能,例如防止加工食品暴露在阳光下,这会影响加工食品从生产单位运送到零售商时的品质和口味。

北美是全球箱板纸市场最重要的市场之一

- 在预计的时期内,北美对箱板纸材料的需求预计将受到消费者对环保产品益处的日益认识的推动。美国是箱板纸(尤其是瓦楞纸箱和牛皮纸箱板纸)的最大出口国之一。与其他地区相比,该国的製造和材料费用较低。高箱板纸产量与国家对永续发展的关注有关。

- 此外,纤维箱协会 (FBA) 成员还发起了一项计划,以提高人们对使用瓦楞纸板箱的认识。北美各地生产瓦楞纸包装产品的会员公司利用该计划与纸箱用户和消费者分享他们的进展,以便他们在选择、接收、使用和回收瓦楞纸板包装时保持放心。

- 此外,由于纸浆价格相对较低,而且回收纸箱的历史记录不够坚固,无法完好无损地存活下来,因此美国早些时候对纸板回收并没有太大的消费者或监管压力。然而,由于电子商务的兴起,对纸板的需求增加,从而产生了对箱板纸包装材料的需求。

- 许多主要城市,如加利福尼亚州、纽约州、华盛顿州、缅因州和马萨诸塞州,已禁止使用塑胶容器和塑胶袋以及其他对环境有害的一次性不可回收产品,从而增加了对箱板纸包装解决方案的需求。

容器纸板产业概况

箱板纸市场竞争适中,由许多主要参与者组成。现在很少有大的竞争对手在市场占有率方面控制着大部分市场。这些重要的市场参与者正致力于扩大其国际消费者基础。许多企业依赖策略合作专案来提高市场占有率和获利能力

2022年2月,WestRock公司宣布打算在华盛顿州朗维尤建造一座新的瓦楞纸箱工厂,以满足太平洋西北地区当地客户不断增长的需求。新的瓦楞纸箱厂将为太平洋西北地区的所有细分市场和工业部门提供服务。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 市场概况

- 产业供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者的议价能力

- 新进入者的威胁

- 竞争激烈程度

- 替代品的威胁

- COVID-19 对市场的影响

- 市场驱动因素与限制简介

第 5 章:市场动态

- 市场驱动因素

- 透过电子商务增加出货量

- 对加工和包装食品的需求不断增加

- 环境问题导致对回收包装解决方案的高需求

- 市场限制

- 替代包装解决方案的可用性

- COVID-19 对瓦楞包装产业的影响

- 供应链场景

- 线下贸易限制导致电商需求上升

- 最终用户绩效对近期和中期成长预测的影响

第 6 章:市场细分

- 按材质

- 原生纤维

- 再生纤维

- 原生纤维+再生纤维

- 按类型

- 牛皮纸内衬

- 测试衬里

- 开槽

- 其他类型(白顶等)

- 按最终用户

- 食品与饮品

- 消费品

- 工业的

- 其他最终用户

- 按地理

- 北美洲

- 欧洲

- 亚太

- 南美洲

- 中东和非洲

第 7 章:竞争格局

- 公司简介

- International Paper

- Oji Fibre Solutions (NZ) Ltd

- Nine Dragons Paper (Holdings) Limited

- Smurfit Kappa Group

- Mondi Limited

- Sappi Ltd

- WestRock Company

- Cascades Inc.

- Stora Enso Oyj

- Svenska Cellulosa Aktiebolaget SCA

- Mitsubishi Corporation Packaging Ltd

- Georgia-Pacific LLC

第 8 章:投资分析

第 9 章:市场机会与未来趋势

The Containerboard Market size is estimated at USD 146.96 billion in 2024, and is expected to reach USD 162.63 billion by 2029, growing at a CAGR of 2.05% during the forecast period (2024-2029).

Containerboard is becoming more and more common in the world of packaging. Due to its adaptability, portability, and durability, it is the packaging material that is used most commonly. In addition, it comes from a renewable resource. It is also the one packing material that is recycled the most.

Key Highlights

- Throughout the forecast period, it has been anticipated that the global containerboard market will expand significantly, primarily due to rising corrugated box shipments and e-commerce shipments, increasing demand for packaged foods and businesses, and shifting consumer preferences toward recyclable packaging options.

- The use of mini-flute corrugated boxes in some markets has also enabled them to expand their presence in markets, such as cereal boxes and carryout food packaging. Another factor that allows corrugated boxes to gain a share from paperboard cartons is the introduction of e-commerce-ready packaging that substitutes lightweight and easy-to-open cartons for boxes that can withstand the rigors of shipping. Such trends are expected to boost the adoption of containerboard in the e-commerce sector and other industries.

- Although governments are forcing package industries to use recyclable materials for packaging and there are growing environmental concerns, the market under investigation for the projected period has a huge opportunity.

- One of the crucial aspects anticipated to impede the market's expansion is the accessibility of alternative packaging options.

- Some of the main drivers of the examined market as a result of the COVID-19 outbreak include growth in food packaging and continually rising demand for corrugated packages in expanding e-commerce shipments. The demand for grocery packaging, healthcare products, and e-commerce shipments has significantly expanded in e-commerce portals.

Container Board Market Trends

Food and Beverage sector to witness the growth

- Due to people's busy lifestyles, the demand for packaged and ready-to-eat goods is increasing. The need for packaged food is also driven by the growing young population, particularly working women, who are also included in the market, under study.

- Corrugated board packaging, mainly secondary or tertiary packing, is increasingly being used by businesses to provide better results to customers since it protects items from moisture and endures lengthy transportation times. The need is fueled by processed foods, such as bread, meat products, and other perishable goods, which require these packaging materials to be used once. The need for containerboard in the food and beverage industry is anticipated to increase as a result.

- Furthermore, new developments in the field are broadening the range of uses for corrugated cardboard packaging. The companies that make up the THIMM Group created "COOLandFREEZE," a corrugated cardboard box for temperature-controlled shipping that allows the transportation of frozen, chilled, and non-refrigerated goods together in a single shipment.

- With this cutting-edge packaging, processed meals are effectively insulated and kept cold for at least 36 hours. Corrugated cardboard packing is a more environmentally friendly shipping solution than polystyrene or plastic. Hence demand in this industry is anticipated to proliferate during the forecast period.

- These products also offer added capabilities, such as preventing the processed food from getting exposed to sunlight, which can impact the quality and taste of the processed foods while being transported from the production units to the retailers.

North America is One of the Most Prominent Markets in the Global Containerboard Market

- Over the projected period, North America's demand for containerboard material is anticipated to be driven by consumers' growing awareness of the benefits of eco-friendly products. One of the top exporters of containerboard, particularly corrugated containers and kraft liners, is the United States. Compared to other regions, the country has lower manufacturing and material expenses. High containerboard manufacture is related to the nation's concern for sustainable development.

- Moreover, a program was initiated by the Fiber Box Association (FBA) members to raise awareness regarding using corrugated cardboard boxes. The member companies that manufacture corrugated packaging products across North America use this program to share their progress with box users and consumers so they remain assured about choosing, receiving, using, and recycling corrugated cardboard packaging.

- Moreover, there has not been much consumer or regulatory pressure in the United States earlier for cardboard recycling due to the relatively low pulp price and a historical record of recycled boxes not being strong enough to survive the journey intact. However, due to the rise of e-commerce, there has been an increased demand for cardboard, which creates a need for containerboard packaging materials.

- Many major cities, like California, New York, Washington, Maine, and Massachusetts, have banned the use of plastic containers and bags and other single-use non-recyclable products that are harmful to the environment boosting the demand for containerboard packaging solutions.

Container Board Industry Overview

The containerboard market is moderately competitive and consists of many major players. Few big competitors now control most of the market in terms of market share. These significant market participants are concentrating on growing their consumer base internationally. Many businesses rely on strategic collaboration projects to improve their market share and profitability

In February 2022, the WestRock Company proclaimed its intentions to construct a new corrugated box plant in Longview, Washington, in order to satisfy the expanding demand from its local customers in the Pacific Northwest. The new corrugated box mill will supply all market segments and industry sectors in the Pacific Northwest.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Supply Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitutes

- 4.4 Impact of COVID-19 on the Market

- 4.5 Introduction to Market Drivers and Restraints

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Shipments through E-commerce

- 5.1.2 Increasing Demand for Processed and Packaged Foods

- 5.1.3 Environmental Concerns Leading to the High Demand for Recycled Packaging Solutions

- 5.2 Market Restraints

- 5.2.1 Availability of Alternative Packaging Solutions

- 5.3 Impact of COVID-19 on Corrugated Packaging Industry

- 5.3.1 Supply Chain Scenario

- 5.3.2 Rise in Demand for E-commerce due to Restrictions Over Offline Trade

- 5.3.3 Effect of End-user Performance Over Near and Medium-term Growth Forecasts

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Virgin Fibers

- 6.1.2 Recycled Fibers

- 6.1.3 Virgin + Recycled Fibers

- 6.2 By Type

- 6.2.1 Kraftliners

- 6.2.2 Testliners

- 6.2.3 Flutings

- 6.2.4 Other Types (White Top, etc.)

- 6.3 By End User

- 6.3.1 Food and Beverage

- 6.3.2 Consumer Goods

- 6.3.3 Industrial

- 6.3.4 Other End Users

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 South America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 International Paper

- 7.1.2 Oji Fibre Solutions (NZ) Ltd

- 7.1.3 Nine Dragons Paper (Holdings) Limited

- 7.1.4 Smurfit Kappa Group

- 7.1.5 Mondi Limited

- 7.1.6 Sappi Ltd

- 7.1.7 WestRock Company

- 7.1.8 Cascades Inc.

- 7.1.9 Stora Enso Oyj

- 7.1.10 Svenska Cellulosa Aktiebolaget SCA

- 7.1.11 Mitsubishi Corporation Packaging Ltd

- 7.1.12 Georgia-Pacific LLC