|

市场调查报告书

商品编码

1438343

绿色包装 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Green Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

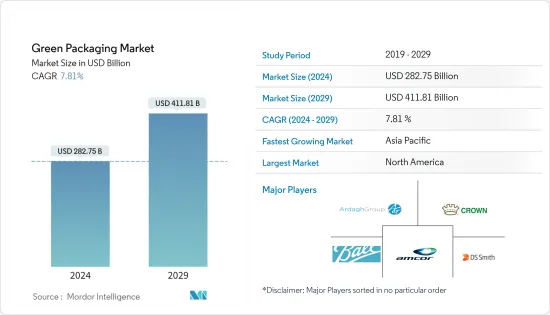

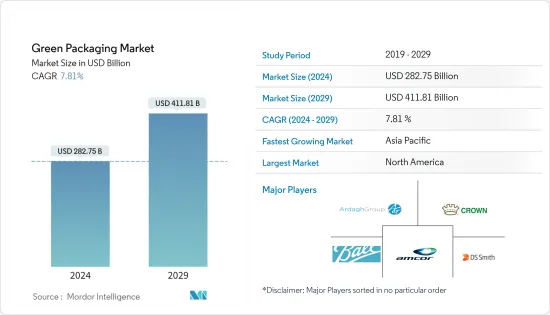

2024年绿色包装市场规模预估为2,827.5亿美元,预估至2029年将达4,118.1亿美元,预测期(2024-2029年)CAGR为7.81%。

消费产业对环境问题的认识不断提高以及严格的政府法规推动了市场的发展。

主要亮点

- 不断发展的食品和饮料行业不断采用可回收和可生物降解材料生产的包装,这对一次性塑胶的使用产生了严格的限制。消费者对永续包装意识的增强推动了这一趋势。

- 此外,包装导致商品和垃圾处理成本高。例如,每花费 10 美元购买商品,就有 1 美元用于包装成本。消费者支出的 10% 用于包装,而包装最终将被扔进垃圾箱。

- 此外,上述问题给监管机构、最终用户企业和包装公司带来压力,要求他们寻找替代品,减少包装对环境的影响,并提供可持续和环保的包装解决方案,从而导致绿色包装市场扩大。

- 然而,不断变化的监管标准、波动的原材料成本、不断增加的废物量以及日益严格的环境废物法规预计将阻碍预测期内的市场成长。这将使该细分市场的公司能够开发具有潜在颠覆性的新产品,并降低当前市场的风险。

- COVID-19 的爆发影响了必需品和非必需品及服务的国际贸易和供应链。随着新冠肺炎 (COVID-19) 在全球范围内的传播,企业遭受了巨大损失。由于大流行,所研究的市场受到了负面影响。许多政府推迟了对一次性塑胶的禁令,而由于线上购物和电子商务的显着增长,大流行见证了塑胶包装的使用量的增长。

绿色包装市场趋势

造纸业预计将显着成长

- 最常见的可持续包装技术是公司缩小包装尺寸或轻量化包装,并增加回收材料和可再生材料的使用。因此,纸和纸板在各业务领域的使用正在扩大。它还确保包装环保且可回收以供将来使用。

- 食品、饮料、消费品和包装商品产业的组织需要广泛使用包装。根据不同的地点,全球范围内都在社会或政府的推动下推动向绿色包装的转变。

- 由于顾客需要更环保的包装选择,一般大众越来越习惯纸质软包装。现在,消费者普遍认为纸张比塑胶更环保。

- 此外,优先考虑再生纸还有助于遏制传统纸张生产中的森林砍伐问题。这种再生纸与传统纸张类似,可用于企业的包装和印刷需求。

- 此外,由于木基纸的成本和消耗率不断增加,消费者正在寻找替代品以尽量减少对环境的影响。使用竹子或甘蔗製成的纸和纸巾作为替代品。这两种材料都是纸张的合适替代品,因为它们柔软、耐用且可生物降解。

美国将占重要市场份额

- 全球绿色包装最重要的市场是北美。与世界其他地区相反,政府法律是发展绿色包装的基础,而其快速接受的主要驱动力是消费者对环保产品的深入了解和偏好。

- 儘管加拿大和美国的所有企业都使用绿色包装,但政府政策和消费者行为有显着差异。

- 由于消费者基础不断扩大,对消费品、食品和饮料的包装给予很高的重视,预计美国市场在未来几年将迅速扩张。该地区的製造商正在改进他们的产品,以更好地适应不断变化的消费者偏好和环境。

- 世界各国政府正在调整其他来源,例如可生物降解包装,以应对包装垃圾数量不断增加的情况。世界上只有 4% 的人口生活在美国,占世界城市固体废弃物 (MSW) 的 2%。此外,据报道,每个美国人每年产生超过 106.2 公斤的塑胶垃圾。

- 此外,2022 年 6 月,Mondi 预计将推出「Grow&Go」系列的可持续包装产品组合。整个 Grow&Goportfolio 符合食品接触标准,并且完全由纸张製成。

绿色包装产业概况

绿色包装市场竞争适中,由许多重要参与者组成,例如 Amcor Limited Ardagh Group SA、Ball Corporation、Crown Holdings Incorporated 和 DS Smith PLC。现在很少有大的竞争对手在市场占有率方面控制着大部分市场。这些相当大的市场参与者正专注于扩大其国际消费者基础。许多企业依靠策略合作专案来提高市场占有率和获利能力。

- 2022 年 6 月 - Ardagh Metal Packaging 透露计划在法国拉西约塔建造新工厂,以提高产能。为了满足中东和非洲 (MEA) 以及西南部现有和潜在客户对长期合作伙伴关係不断增长的需求,Sud Attractivite 和 Bpifrance 将为支出提供资金。

- 2022 年4 月- 透过利用埃克森美孚的Extend 技术,Amcor 增加了圆形聚合物等先进回收材料的使用,这是该公司履行其可持续发展承诺的一种方式,即到2025 年开发所有包装可重复使用或可回收,并增加循环聚合物的使用回收的内容。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 市场概况

- 产业供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争激烈程度

第 5 章:市场动态

- 市场驱动因素

- 严格的政府法规

- 消费产业对环境问题的认识不断提高

- 市场挑战

- 生物塑胶及相关材料供应不足

- 市场机会

- 主要品牌/公司越来越关注实现净零排放

- COVID-19 对绿色包装产业的影响

第 6 章:市场细分

- 包装类型

- 回收内容包装

- 纸

- 金属

- 塑胶

- 玻璃

- 可重复使用的包装

- 鼓

- 塑胶容器

- 中型散装货柜

- 其他可重复使用的包装

- 可降解包装

- 回收内容包装

- 最终用户产业

- 食物

- 饮料

- 製药

- 个人护理

- 其他最终用户产业

- 地理

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 亚太地区其他地区

- 拉丁美洲

- 中东和非洲

- 北美洲

第 7 章:竞争格局

- 公司简介

- Amcor Limited

- Ardagh Group SA

- Ball Corporation

- Crown Holdings Incorporated

- DS Smith PLC

- Elopak AS

- Emerald Packaging

- Mondi Group

- Nampak Ltd

- PlastiPak Holdings Inc.

- Sealed Air Corporation

- Sonoco Products Company

- Sgf packaging Co. Ltd

- Tetra Pak International SA

- Uflex Limited

- WestRock Company

第 8 章:投资分析

第 9 章:市场机会与未来趋势

The Green Packaging Market size is estimated at USD 282.75 billion in 2024, and is expected to reach USD 411.81 billion by 2029, growing at a CAGR of 7.81% during the forecast period (2024-2029).

Increasing Awareness About Environmental Concerns Among Consumer Industries and Stringent Government Regulations drive the market.

Key Highlights

- The rising food and beverage industry, embracing packaging produced from recyclable and biodegradable materials at a constant rate, has severe limits on the use of single-use plastics. Increased consumer awareness of sustainable packaging contributes to this trend.

- Also, packaging contributes to the high costs of goods and trash disposal. For example, out of every USD 10 spent on commodities, USD 1 goes toward the cost of the packaging. That's 10% of consumer spending going toward packaging, which will eventually end up in the garbage.

- Furthermore, the issues above are putting pressure on regulators, end-user businesses, and packaging firms to find a replacement that will reduce the environmental impact of packaging and provide sustainable and environmentally friendly packaging solutions, causing the market for green packaging to expand.

- However, changing regulatory standards, fluctuating raw material costs, increasing waste volumes, and rising environmental waste regulations have expected to hinder the market growth during the forecast period. This will enable companies operating in this market segment to develop new products that are potentially disruptive and also reduces the current risks in the market.

- The COVID-19 outbreak has affected international trade and supply chains of essential and non-essential goods and services. With the spread of COVID-19 across the world, businesses have suffered significantly. The studied market has been negatively impacted due to the pandemic. Many governments have postponed the ban on single-use plastic, and the pandemic witnessed growth in the usage of plastic packaging due to significant growth in online shopping and e-commerce.

Green Packaging Market Trends

Paper industry is Expected to Witness Significant Growth

- The most common sustainable packaging technique is that companies include downsizing or lightweight packaging and increasing the use of recycled content and renewable materials. Therefore, the use of paper and cardboard in various parts of the business is expanding. It also ensures the packaging is eco-friendly and recyclable for future usage.

- Organizations in the food, beverage, consumer, and packaged goods industries need to use packaging extensively. Depending on the location, there is a global push for a shift toward green packaging, driven either by society or the government.

- The general population is becoming increasingly accustomed to paper-based flexible packaging as customers want more environmentally friendly packaging options. Consumers now generally believe that paper is better for the environment than plastic.

- Moreover, Prioritizing recycled paper also helps curb deforestation issues in conventional paper production. This recycled paper is similar to traditional paper and can be used for businesses' packaging and printing needs.

- Also, due to the increasing costs and consumption rates of wood-based paper, consumers are looking for alternatives to minimize the environmental impactment. Paper and tissues made from bamboo or sugarcane are utilized as an alternative. Both materials are suitable alternatives to paper as they are soft, durable, and biodegradable.

United States to Execute a Significant Market Share

- The most significant market for green packaging worldwide is North America. Contrary to other parts of the world, where government laws are fundamental to developing green packaging, the main drivers of its quick acceptance are strong consumer knowledge and preferences for eco-friendly products.

- Although all firms in Canada and the United States use green packaging, there are significant differences in governmental policies and consumer behavior.

- The market in the United States is anticipated to expand quickly in the coming years due to an expanding consumer base that places a high value on the packaging of consumer goods, foods, and beverages. Manufacturers in the region are modifying their products to better suit changing consumer preferences and the environment.

- Governments worldwide are adjusting to other sources, such as biodegradable packaging, in response to the rising amount of packaging trash produced. Only 4% of the world's population lives in the United States, making up 2% of the world's municipal solid waste (MSW). Additionally, it has been reported that each American generates more than 106.2 kg of plastic waste annually.

- Moreover, in June 2022 - Mondi expected its sustainable packaging portfolio with its "Grow&Go" line. The entire Grow&Goportfolio complies with food contact standards and is made entirely of paper.

Green Packaging Industry Overview

Green Packaging Market is moderately competitive and consists of many significant players, such as, Amcor Limited Ardagh Group SA, Ball Corporation, Crown Holdings Incorporated, and DS Smith PLC. Few big competitors now control most of the market in terms of market share. These considerable market participants are concentrating on growing their consumer base internationally. Many businesses rely on strategic collaboration projects to improve their market share and profitability.

- June 2022 - Ardagh Metal Packaging revealed plans to build a new plant in La Ciotat, France, to increase its production capacity. To meet the growing demand from current and potential clients for long-term partnerships in the Middle East and Africa (MEA) and Southwestern Europe, Sud Attractivite and Bpifrance will fund the expenditure.

- April 2022 - By utilizing ExxonMobil's Extend technology, Amcor increases the use of advanced recycling materials like circular polymers, which is one way the company complies with its sustainability commitment to develop all of its packagings to be reusable or recyclable by 2025 and increase the use of recycled content.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Supply Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power Of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Stringent Government Regulations

- 5.1.2 Increasing Awareness About Environmental Concerns Among Consumer Industries

- 5.2 Market Challenges

- 5.2.1 Lack of Supply of Bio-plastics and Related Materials

- 5.3 Market Opportunities

- 5.3.1 Increasing Focus of Major Brands/Companies to Achieve Net Zero

- 5.4 Impact of COVID-19 on the Green Packaging industry

6 MARKET SEGMENTATION

- 6.1 Type of Packaging

- 6.1.1 Recycled Content Packaging

- 6.1.1.1 Paper

- 6.1.1.2 Metal

- 6.1.1.3 Plastic

- 6.1.1.4 Glass

- 6.1.2 Reusable Packaging

- 6.1.2.1 Drums

- 6.1.2.2 Plastic Containers

- 6.1.2.3 Intermediate Bulk Containers

- 6.1.2.4 Other Reusable Packing

- 6.1.3 Degradable Packaging

- 6.1.1 Recycled Content Packaging

- 6.2 End User Industry

- 6.2.1 Food

- 6.2.2 Beverage

- 6.2.3 Pharmaceutical

- 6.2.4 Personal Care

- 6.2.5 Other End User Industry

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.2.5 Rest of Europe

- 6.3.3 Asia Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 South Korea

- 6.3.3.5 Rest of Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor Limited

- 7.1.2 Ardagh Group SA

- 7.1.3 Ball Corporation

- 7.1.4 Crown Holdings Incorporated

- 7.1.5 DS Smith PLC

- 7.1.6 Elopak AS

- 7.1.7 Emerald Packaging

- 7.1.8 Mondi Group

- 7.1.9 Nampak Ltd

- 7.1.10 PlastiPak Holdings Inc.

- 7.1.11 Sealed Air Corporation

- 7.1.12 Sonoco Products Company

- 7.1.13 Sgf packaging Co. Ltd

- 7.1.14 Tetra Pak International SA

- 7.1.15 Uflex Limited

- 7.1.16 WestRock Company