|

市场调查报告书

商品编码

1438346

全球金融科技 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Global Fintech - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

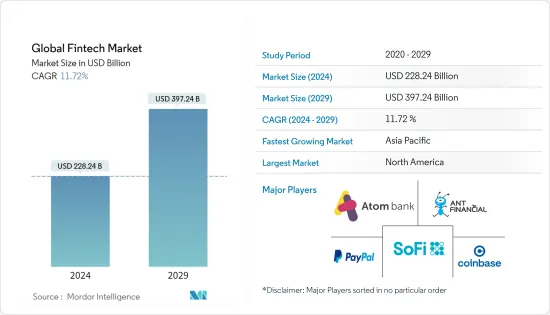

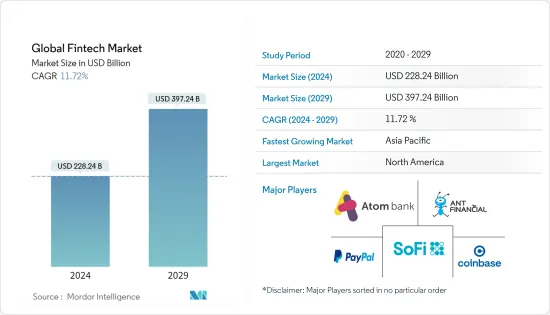

预计2024年全球金融科技市场规模为2,282.4亿美元,预估至2029年将达3,972.4亿美元,预测期内(2024-2029年)CAGR为11.72%。

FinTech(金融科技)现在是金融市场的流行词。它是指企业使用的电脑程式和其他现代技术,提供自动化和改进的金融服务。多年来,金融科技产业取得了重大发展,导致公司转型为以客户为中心的企业。因此,要在世界各地从新创公司到科技公司再到老牌公司的众多公司中找到一席之地并不容易。透过合作或具挑战性的方式,金融服务公司和科技公司已经占据了彼此的道路,并在不断发展的商业环境中提出颠覆性和创新性的主张。

各种危机成为金融科技市场发展的催化剂。自上次全球金融危机以来,金融科技投资一直在成长。该行业的扩张很大程度上是对传统金融服务业缺陷的技术回应,传统金融服务业在危机期间和危机后承受巨大压力。同样,COVID-19 也严重影响了全球经济并引发了衰退。这场危机促进了金融科技业的加速发展。为了因应 COVID-19,大型金融机构与新兴科技公司合作进入新市场。虽然金融科技本身也在寻求与大型金融机构合作扩大市场和服务,但无论如何,金融科技市场正在发展。

近年来出现了许多金融科技变体,它们使用针对特定功能或行业量身定制的尖端技术,例如保险科技、监管科技、支付服务等。现在,金融科技业显然不只是一种炒作,组织策略的执行程度也变得越来越重要。金融科技业的技术方面正在迅速发展。越来越多地使用区块链、应用程式介面 (API)、机器人流程自动化、资料分析等技术。这些技术可以实现更高的敏捷性、效率和准确性。

金融科技市场趋势

数位支付的激增正在推动市场发展

COVID-19 大流行促进了金融包容性,导致数位支付随着正规金融服务的全球扩张而大幅增加。这种扩张创造了新的经济机会。现金置换等支付发展、支付请求等新的支付选择、数位货币以及先买后付服务(BNPL)都为金融科技市场的成长创造了新的可能性。

金融科技公司投资激增预计将推动市场发展

世界许多地区对金融科技的投资大幅增加。 2010年至2019年间,金融科技公司的投资总额大幅成长,达2,151亿美元。然而,2020年金融科技公司的投资下降了三分之一以上,达到1,277亿美元,但2021年再次增加,达到2,265亿美元。美国吸引了该领域的投资最多,占总数的近80%。金融科技的这种投资趋势预计将为市场创造利润丰厚的成长前景。

金融科技业概况

在目前的情况下,在金融市场拥有悠久历史的大型金融机构正在寻求与新兴技术合作来拓展市场。同样,金融科技新创公司本身也在与大型成熟金融机构合作,以促进其成长和市场。因此,金融科技市场的併购交易正在增加。例如,2021 年,PayPal 完成了对 Paidy 的收购,Paidy 是一家总部位于日本的「先买后付」供应商。此次收购将扩大 PayPal 在日本国内支付市场的能力、布局和适用性。同样,2021 年,万事达卡收购了欧洲领先的开放银行技术供应商 Aiia。透过此次收购,万事达卡扩展了其目前的开放银行技术和已建立的资料技术,并加速了该组织建立更强大的全球开放资料网路的进程。市场主要参与者包括蚂蚁金服、众安银行、Atom Bank、SoFi、Paypal、Coinbase、Robinhood、Adyen 等。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场洞察与动态

- 市场概况

- 市场驱动因素

- 市场限制

- 产业吸引力 - 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争激烈程度

- 市场技术创新洞察

- COVID-19 对市场的影响

第 5 章:市场细分

- 按服务建议

- 汇款和付款

- 储蓄和投资

- 数位借贷和借贷市场

- 线上保险和保险市场(涵盖寿险和非寿险细分市场的见解)

- 其他(电商购买融资等)

- 按地理

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 瑞士

- 欧洲其他地区

- 拉丁美洲

- 巴西

- 阿根廷

- 拉丁美洲其他地区

- 亚太

- 中国

- 印度

- 日本

- 印尼

- 韩国

- 亚太地区其他地区

- 中东和非洲

- 阿联酋

- 沙乌地阿拉伯

- 黎巴嫩

- 中东和非洲其他地区

- 北美洲

第 6 章:竞争格局

- 市场集中度概览

- 公司简介

- Ant Financials

- Zhong An International

- Atom Bank

- Paypal

- SoFi

- CoinBase

- Robinhood

- Adyen

- N 26

- Ally Financials

- Oscar Health

- Klarna

- Avant*

第 7 章:市场机会与未来趋势

第 8 章:免责声明和关于我们

The Global Fintech Market size is estimated at USD 228.24 billion in 2024, and is expected to reach USD 397.24 billion by 2029, growing at a CAGR of 11.72% during the forecast period (2024-2029).

FinTech (Financial Technology) is now a buzzword in the financial market. It refers to computer programs and other modern technologies used by businesses that provide automated and improved financial services. Over the years, the fintech industry has evolved in significant ways, leading to the transformation of companies into customer-centric businesses. Thus, finding a place among a plethora of companies ranging from startups to tech companies to established firms all over the world is not easy. With either a collaborative or a challenging approach, financial services companies and tech companies have taken up each other's lanes and are progressing with disruptive and innovative propositions in an ever-evolving business landscape.

Various crises have acted as the catalyst for the development of the FinTech market. Since the last global financial crisis, investments in Fintech have been growing. The expansion of the sector was largely a technological response to the shortcomings of the traditional financial services industry, which came under extreme pressure during and after the crisis. Similarly, COVID-19 also severely impacted the global economy and initiated the recession. This crisis resulted in the accelerated development of the FinTech industry. In response to COVID-19, large financial institutions partnered with emerging technology companies to access the new market. While FinTech are themselves seeking to team up with large financial institutions to expand their market and services, In any case, the FinTech market is developing.

Many variations of fintech have emerged in recent years that use cutting-edge technologies tailored for specific functions or sectors, such as Insurtech, regtech, payment services, and so on. Now that the FinTech industry is clearly more than a hype, the extent of execution achieved in organizations' strategy gathers importance. The technology aspect of the FinTech industry is growing rapidly. are increasingly using technology such as Blockchain, Application Programming Interface (API), robotic process automation, data analytics, etc. Which are enabling greater agility, efficiency, and accuracy.

Fintech Market Trends

Surging Adoption of Digital Payments is Driving the Market

The COVID-19 pandemic boosted financial inclusion, which resulted in a significant increase in digital payments along with the global expansion of formal financial services. This expansion created new economic opportunities. Payments developments such as cash displacement, new payment choices such as the request to pay, digital currencies, and buy now, pay later services (BNPL) all created new possibilities for the FinTech market growth.

Surging Investment in Fintech Companies is Anticipated to Drive the Market

Investment in financial technologies has increased significantly in many parts of the world. Between 2010 and 2019, the total value of investments in fintech companies increased dramatically, reaching USD 215.1 billion. However, investments in fintech companies fell by more than one-third in 2020, reaching USD 127.7 billion, but increased again in 2021, reaching USD 226.5 billion. The United States attracted the most investments in the sector, accounting for nearly 80% of the total. This investment trend in financial technology is expected to create lucrative growth prospects for the market.

Fintech Industry Overview

In the present scenario, large financial institutions with a long history in the financial market are seeking to team up with emerging technology to expand their market. Similarly, FinTech startups themselves are partnering with large and established financial institutions to enhance their growth and market. So, M&A deals are increasing in the FinTech market. For instance, in 2021, PayPal completed its acquisition of Paidy, a buy now, pay later supplier based in Japan. This acquisition would broaden PayPal's capabilities, allocation, and applicability in Japan's domestic payments market. Similarly, in 2021, Mastercard acquired Aiia, a leading European provider of open banking technology. With this acquisition, Mastercard expands its current open banking technology and established data techniques, as well as accelerates the organization's progress toward establishing a more powerful global open data network. The major players in the market include Ant Financials, Zhong An, Atom Bank, SoFi, Paypal, Coinbase, Robinhood, Adyen, etc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions And Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Attractiveness - Porters' Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Insights of Technology Innovations in the Market

- 4.6 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Service Propositions

- 5.1.1 Money Transfer and Payments

- 5.1.2 Savings and Investments

- 5.1.3 Digital Lending & Lending Marketplaces

- 5.1.4 Online Insurance & Insurance Marketplaces (Insights into Life & Non life segments covered)

- 5.1.5 Others (E-Commerce Purchase Financing, etc)

- 5.2 By Geography

- 5.2.1 North America

- 5.2.1.1 USA

- 5.2.1.2 Canada

- 5.2.2 Europe

- 5.2.2.1 UK

- 5.2.2.2 Germany

- 5.2.2.3 France

- 5.2.2.4 Spain

- 5.2.2.5 Switzerland

- 5.2.2.6 Rest Of Europe

- 5.2.3 Latin America

- 5.2.3.1 Brazil

- 5.2.3.2 Argentina

- 5.2.3.3 Rest of Latin America

- 5.2.4 Asia-Pacific

- 5.2.4.1 China

- 5.2.4.2 India

- 5.2.4.3 Japan

- 5.2.4.4 Indonesia

- 5.2.4.5 South Korea

- 5.2.4.6 Rest of APAC

- 5.2.5 Middle East and Africa

- 5.2.5.1 UAE

- 5.2.5.2 Saudi Arabia

- 5.2.5.3 Lebanon

- 5.2.5.4 Rest of Middle East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Ant Financials

- 6.2.2 Zhong An International

- 6.2.3 Atom Bank

- 6.2.4 Paypal

- 6.2.5 SoFi

- 6.2.6 CoinBase

- 6.2.7 Robinhood

- 6.2.8 Adyen

- 6.2.9 N 26

- 6.2.10 Ally Financials

- 6.2.11 Oscar Health

- 6.2.12 Klarna

- 6.2.13 Avant*