|

市场调查报告书

商品编码

1642080

计划物流-市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Project Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

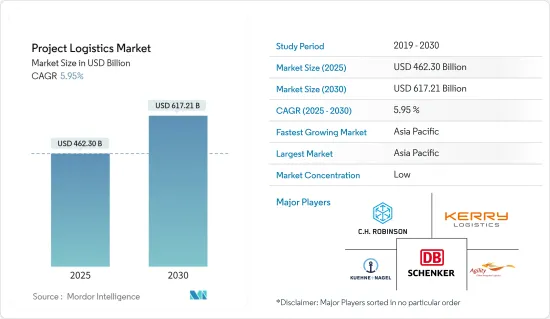

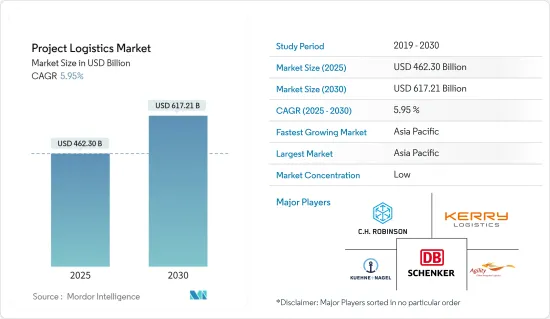

2025 年计划物流市场规模估计为 4,623 亿美元,预计到 2030 年将达到 6,172.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.95%。

计划物流涉及整个计划中货物、材料和资讯的综合管理和协调。运输大型货物需要专门的设备、基础设施和经验丰富的人员。处理具有特殊尺寸的货物对于承运人而言始终是一个挑战,但托运人和服务供应商在处理超大和重型货物方面变得越来越熟练。零件和模组化包装在不同地点生产并运送到最终目的地,需要仔细规划。近年来,从早期规划阶段开始就让运输业者参与的趋势日益明显。

亚太地区引领计划物流市场,预计将出现最高的成长率。基础建设投资在亚太国家经济发展中发挥关键作用,部分国家将国内基础建设列为优先事项。

全球计划物流网络 (GPLN) 等一些成熟的组织专门从事全球范围内的计划物流。 GPLN 成员从事广泛的工业计划,包括基础设施和能源计划,提供重型、超大和超限货物的运输、包装/装箱和起重等服务。

2020-2021 年,正值新冠疫情最严重时期,计划物流领域对空运的需求很高,用于运输全球必需品。

计划物流市场趋势

可再生能源的使用增加为计划物流公司创造了机会

根据国际能源总署 (IEA) 最新报告,受政策支持扩大、石化燃料价格上涨和能源安全担忧的推动,全球可再生能源发电能将在 2023 年增长三分之一。

预计明年这一成长动能将持续,使全球可再生能源发电装置容量达到 4,500 吉瓦,相当于中国和美国的总合装置容量。 2023年,全球可再生能源发电装置容量预计将增加107吉瓦,绝对增量将超过440吉瓦,为有史以来最大增幅。

此次扩张正在全球主要市场进行,主要包括欧洲、美国、印度和中国。尤其是中国,预计在 2023 年和 2024 年将占全球可再生能源发电新增产能的近 55%。

预计2023年风电装置将强劲反弹,预测与前一年同期比较增长近70%。这是继工业成长放缓之后出现的挑战。成长改善的原因是,由于中国 COVID-19 限制措施以及欧洲和美国的供应链问题而推迟的计划已完成。

然而,2024 年的成长程度将取决于政府提供更多的政策支持,以解决与授权和竞标设计相关的障碍。与太阳能领域不同,风力发电机供应链的扩张速度不够快,无法满足中期不断增长的需求。这主要是由于大宗商品价格上涨和供应链中的挑战,影响了製造商的盈利。

这种可再生能源需求必然需要计划物流,因为机械和其他零件非常大,因此需要单独运输然后在现场组装。

模组化建筑的发展推动市场

对永续基础设施的需求正在推动高效、环保的建筑技术的发展。传统的建筑方法可能已不足以满足永续基础设施的要求。模组化描述了一种解决传统施工方法不灵活性的方法。采用模组化施工方法,可将建筑成本降低 40%,并可实现场地准备和模组化/预製同时进行。

向模组化(异地)施工方法的转变创造了新的市场,特别是对于人事费用低且预製土地充足的新兴国家。在支援永续基础设施发展方面,预製组装式施工方法可大幅节省材料,例如与同等规模的传统施工方法相比,可减少60%的钢骨、56%的混凝土和77%的模板。

然而,模组化预製概念仍存在挑战,包括规模经济和运输超过 ISO 货柜尺寸的模组化组件的复杂性。这种异地建设模式也为特定地理区域内的国际贸易开闢了机会,这取决于每个国家的竞争优势。国际自由贸易的成长带来更为广阔的商机和新的贸易关係的潜力。国际和区域贸易也推动了工程、采购和建设(EPC)计划的海外贸易的成长。海外EPC计划采用模组化建造方式,将对计划的货物运输发展和计划物流的整体投资产生影响,包括国内和海外的物流成本。国内物流成本包括製造成本(加工、预拌混凝土、散装材料、钢筋和钢材)。另一方面,海外物流成本包括船舶租赁费、燃油价格、外汇、距离、体积尺寸、保险、清关等。

计划物流行业概况

计划物流市场分为全球参与企业和中小型参与企业。大多数全球物流参与企业都有专门的计划货运部门来满足市场的需求。本土参与企业在机队规模、服务内容、服务业和技术方面的能力也日益增强。全球製造商都在异地生产大型和超大零件,这给重型运输公司带来了巨大的复杂性。拥有雄厚资本和资产的全球公司可以投资升级后的车辆并从中受益。同时,区域和地方企业也正在提出更好的行业解决方案,以支援客户在规定时间内交付计划的需求。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查结果

- 调查前提

- 研究范围

第二章调查方法

- 分析方法

- 研究阶段

第三章执行摘要

第四章 市场概况

- 当前市场状况

- 市场动态

- 驱动程式

- 可再生能源计划对计划物流的需求不断增加

- 增加基础建设投资

- 限制因素

- 初期资本投入高

- 驱动程式

- 产业吸引力-波特五力分析

- 产业价值链分析

- 政府法规和倡议

- 全球物流业(概况、LPI 得分、主要货运统计等)

- 焦点 - 多式联运在计划货物中的作用

- 洞察-石油与天然气零售物流业

- 重型和大型货物评论和说明

- 聚焦预製产业-计划物流公司在运输中的作用

- 深入了解重型货物运输定制拖车製造商

- 关注合约物流和综合物流的需求

第五章 市场区隔

- 服务

- 运输

- 运输

- 库存管理和仓储

- 其他附加价值服务

- 最终用户

- 石油和天然气、采矿和采石

- 能源动力

- 建设业

- 製造业

- 其他的

- 地区

- 亚太地区

- 美洲

- 欧洲

- 中东和非洲

第六章 竞争格局

- 公司简介

- Rhenus Logistics

- Bollore Logistics

- Agility Logistics

- EMO Trans

- Hellmann Worldwide Logistics

- Kuehne+Nagel International AG

- CH Robinson Worldwide Inc.

- Ceva Logistics

- NMT Global Project Logistics

- Rohlig Logistics

- Ryder System Inc.

- Expeditors International of Washington Inc.

- Megalift Sdn Bhd

- Dako Worldwide Transport GmbH

- CKB Logistics Group

- SAL Heavy Lift GmbH

- DB Schenker

- Kerry Logistics

- Deutsche Post DHL*

- 其他市场参与企业

- FLS 运输服务、Crowley Logistics、Highland Forwarding Inc.、Kinetix International Logistics、Cole International Inc.、Hisiang Logistics Co. Ltd、Sea Cargo Air Cargo Logistics Inc.、Bati Group

第七章 市场机会与未来趋势

第 8 章 附录

- 主要国家按活动分類的 GDP 分布

- 资本流动洞察 – 主要国家

- 经济统计-运输及仓储业及其对经济的贡献(主要国家)

- 全球主要计划清单(石油和天然气、建筑、基础设施开发等)

- 货物统计(运送方式、产品类型等)

第九章 免责声明

The Project Logistics Market size is estimated at USD 462.30 billion in 2025, and is expected to reach USD 617.21 billion by 2030, at a CAGR of 5.95% during the forecast period (2025-2030).

Project logistics encompasses the comprehensive management and coordination of goods, materials, and information throughout the entire process of a project. The transportation of large-sized cargo requires specialized equipment, infrastructure, and experienced personnel. Dealing with cargo of unique dimensions poses a constant challenge for transporters, but shippers and service providers are becoming more adept at handling oversized and heavyweight shipments. The complexity of manufacturing also contributes to the difficulty, as parts and modular packages are produced in various locations and then shipped to their final destinations, necessitating meticulous planning. In recent years, there has been a growing trend of involving transportation providers in the early stages of the planning process.

The Asian-Pacific region leads the market in project logistics and is expected to experience the highest growth rate. Infrastructure investment has played a significant role in the economic development of Asia-Pacific countries, with some nations prioritizing the advancement of their domestic infrastructure.

Several established organizations, such as the Global Project Logistics Network (GPLN), specialize in project logistics on a global scale. GPLN members handle a wide range of industrial projects, including infrastructure and energy projects, providing services such as transportation, packing/crating, and the lifting of heavy, oversized, and out-of-gauge cargo.

During the height of the COVID-19 pandemic in 2020-21, air freight was in high demand within the project logistics sector for the transportation of essential items worldwide.

Project Logistics Market Trends

Increasing Usage of Renewable Energies Boosts Opportunities for Project Logistics Companies

According to the latest update from the International Energy Agency, global renewable power capacity is expected to increase by a third in 2023 due to factors such as growing policy support, higher fossil fuel prices, and concerns about energy security.

This growth will continue next year, with the world's total renewable electricity capacity reaching 4,500 gigawatts, equivalent to the combined power output of China and the United States. In 2023, global renewable capacity is projected to increase by 107 gigawatts, the largest absolute increase ever recorded, reaching over 440 gigawatts.

This expansion is happening in major markets worldwide, with Europe, the United States, India, and China leading the way. China, in particular, is expected to account for nearly 55% of global renewable power capacity additions in both 2023 and 2024.

Wind power installations are expected to experience a significant recovery in 2023, with a projected increase of nearly 70% compared to the previous year. This comes after a challenging period of slow growth in the industry. The improved growth can be attributed to the completion of projects that were delayed due to COVID-19 restrictions in China and supply chain issues in Europe and the United States.

However, the extent of growth in 2024 will depend on whether governments can offer more policy support to address obstacles related to permitting and auction design. Unlike the solar PV sector, the wind turbine supply chains are not expanding quickly enough to keep up with the growing demand in the medium term. This is primarily due to escalating commodity prices and difficulties in the supply chain, which are impacting the profitability of manufacturers.

This renewable energy requirement incorporates project logistics as the machines and other parts are so huge that they are shipped separately and then assembled at the site.

Growing Modular Construction Driving The Market

The need for sustainable infrastructure is driving the development of construction technology that is efficient and environmentally friendly. The traditional construction method may no longer be sufficient to meet the requirements of sustainable infrastructure. Modularization offers a solution to the inflexibility of conventional construction methods. By using modular construction, the cost of construction can potentially be reduced by 40%, and activities can be carried out simultaneously on site preparation and modular prefabrication.

The shift towards modular (offsite) construction methods creates a new market, particularly for developing countries that have low labor costs and ample land for prefabrication areas. In terms of supporting sustainable infrastructure development, prefabrication methods can lead to significant material savings, such as 60% less steel, 56% less concrete, and 77% less formwork compared to conventional construction methods of a similar scale.

However, there are still challenges with the modular prefabrication concept, such as the economics of scale and the complexity of transporting modular components that exceed the size of ISO containers. This offsite construction model also opens up opportunities for international trade within specific geographical regions, depending on each country's competitive advantages. The growth of international free trade provides broader business opportunities and potential for new trading connections. International and regional trade also increases the overseas trading of engineering, procurement, and construction (EPC) projects. The decision to use modular construction for overseas EPC projects impacts the development of project cargo movement and the overall investment in project logistics, including domestic and overseas logistics costs. Domestic logistics costs include manufacturing costs (fabrication, ready-mix concrete, bulk materials, rebar, and steel materials). In contrast, overseas logistics costs include vessel charter rates, bunker pricing, currency exchange, distance, volumetric sizing, insurance, and customs clearance.

Project Logistics Industry Overview

The project logistics market is fragmented, with the presence of global players and small- and medium-sized local players. Most global logistics players have a special project cargo division to meet the market needs and demand. Local players are also increasingly enhancing their capabilities in terms of fleet size, service offerings, industries served, and technology. Global manufacturers are making large and oversized components in the factory sites (off-site), which creates huge complexities for heavy cargo haulage companies. Global companies with high capital and assets can invest in upgraded fleets and benefit from this scenario. On the other hand, regional and local players are also coming up with better industry solutions to support the client's needs in executing the projects in the scheduled time.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Current Market Scenario

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.1.1 Increasing Demand For Project Logistics From Renewable Energy Projects

- 4.2.1.2 Increasing Investments In Infrastructure

- 4.2.2 Restraints

- 4.2.2.1 High Initial Capital Investment

- 4.2.1 Drivers

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4 Industry Value Chain Analysis

- 4.5 Government Regulations and Initiatives

- 4.6 Global Logistics Sector (Overview, LPI Scores, Key Freight Statistics, Etc.)

- 4.7 Spotlight - Role of Multimodal Transport in Project Cargo

- 4.8 Insights - Retail Oil and Gas Logistics Sector

- 4.9 Review and Commentary on Heavy and Large Dimension Shipments

- 4.10 Focus on the Prefabrication Industry - Role of Project Logistics Companies in Transportation

- 4.11 Insights into Customized Trailer Manufacturers for Moving Heavy Cargo

- 4.12 Spotlight on the Demand for Contract Logistics and Integrated Logistics

5 MARKET SEGMENTATION

- 5.1 Service

- 5.1.1 Transportation

- 5.1.2 Forwarding

- 5.1.3 Inventory Management and Warehousing

- 5.1.4 Other Value-added Services

- 5.2 End User

- 5.2.1 Oil and Gas, Mining, and Quarrying

- 5.2.2 Energy and Power

- 5.2.3 Construction

- 5.2.4 Manufacturing

- 5.2.5 Other End Users

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.2 Americas

- 5.3.3 Europe

- 5.3.4 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Overview (Market Concentration and Major Players)

- 6.2 Company Profiles

- 6.2.1 Rhenus Logistics

- 6.2.2 Bollore Logistics

- 6.2.3 Agility Logistics

- 6.2.4 EMO Trans

- 6.2.5 Hellmann Worldwide Logistics

- 6.2.6 Kuehne + Nagel International AG

- 6.2.7 C.H. Robinson Worldwide Inc.

- 6.2.8 Ceva Logistics

- 6.2.9 NMT Global Project Logistics

- 6.2.10 Rohlig Logistics

- 6.2.11 Ryder System Inc.

- 6.2.12 Expeditors International of Washington Inc.

- 6.2.13 Megalift Sdn Bhd

- 6.2.14 Dako Worldwide Transport GmbH

- 6.2.15 CKB Logistics Group

- 6.2.16 SAL Heavy Lift GmbH

- 6.2.17 DB Schenker

- 6.2.18 Kerry Logistics

- 6.2.19 Deutsche Post DHL*

- 6.3 Other Players in the Market

- 6.3.1 FLS Transportation Services, Crowley Logistics, Highland Forwarding Inc., Kinetix International Logistics, Cole International Inc., Hisiang Logistics Co. Ltd, Sea Cargo Air Cargo Logistics Inc., and Bati Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 APPENDIX

- 8.1 GDP Distribution, by Activity - Key Countries

- 8.2 Insights into Capital Flows - Key Countries

- 8.3 Economic Statistics - Transport and Storage Sector, and Contribution to Economy (Key Countries)

- 8.4 List of Major Global Projects (Oil and Gas, Construction, Infrastructure Development, Etc.)

- 8.5 Freight Statistics (Mode, Product Category, Etc.)