|

市场调查报告书

商品编码

1438443

聚丙烯:市场占有率分析、产业趋势、成长预测(2024-2029)Polypropylene - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

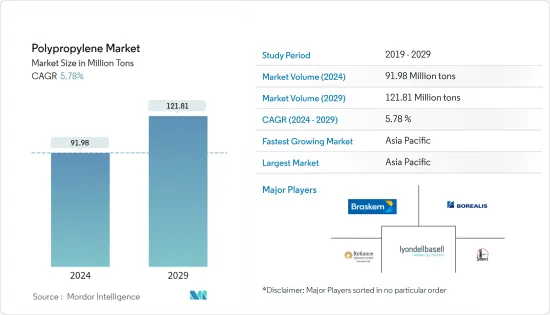

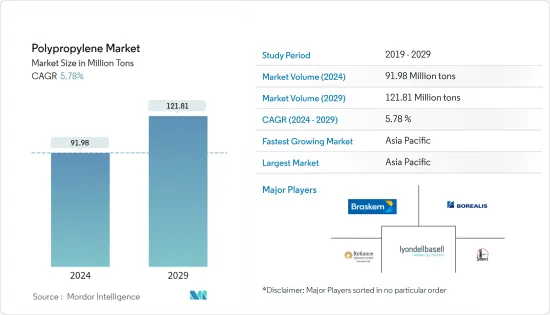

预计2024年聚丙烯市场规模为9,198万吨,预计2029年将达到1,2,181万吨,在预测期间(2024-2029年)复合年增长率为5.78%。

由于 COVID-19,聚丙烯的需求略有下降。对聚丙烯的需求很高的建筑和汽车产业出现了显着放缓。随着主要终端用户产业恢復运营,2022 年出现强劲復苏。

主要亮点

- 短期内,推动市场的主要因素是越来越多地使用塑胶来使汽车更轻、更省油,以及对软包装的需求不断增长。

- 另一方面,市场上各种替代产品的存在是预计在预测期内抑制所涵盖行业成长的主要因素。

- 再生聚丙烯的成长趋势可能会成为未来的机会。

- 亚太地区在全球整体市场中占据主导地位,预计在预测期内也将主导中国和印度等国家消费量最高的市场。

聚丙烯市场趋势

射出成型需求的增加主导了应用领域

- 聚丙烯主要用于射出成型,并且主要以颗粒形式用于此应用。聚丙烯易于成型,并且由于熔体黏度低而具有优异的流动性。

- 射出成型技术用于製造广泛用于电气和电子应用的塑胶。这些塑胶广泛用于製造电气和电子设备。

- 聚丙烯的灵活性使其适用于多种产品类型。最常用的应用之一是活动铰链,这是一种常用于瓶盖等消费品的一体式铰链设计。此过程製成的产品不计其数,包括儿童玩具、体育用品、瓶盖、汽车应用、食品托盘、杯子、外带容器、家居用品和洗碗机等消费性电子产品。

- 根据全球领先材料製造商之一的 HUBS 统计,聚丙烯占全球射出成型产量的35-40%,而其他材料如ABS(25%)、聚乙烯(15%)和聚苯乙烯(10%)紧随其后。它。

- 由于全球包装和化学加工行业的高速成长,预计射出成型的市场前景良好。凭藉分布到快速增长的亚太地区的地理优势,射出成型托盘的消费量可能会大幅增加。

- 此外,汽车中采用轻质部件以提高燃油效率预计将有利于预测期内调查的市场需求。

- 所有上述因素预计将刺激市场需求。

亚太地区成长最快

- 在中国和印度等国家的带动下,亚太地区的聚丙烯市场正在快速成长。聚丙烯广泛应用于汽车、消费品、电子和包装产业。由于这些行业的强劲成长和政府的支持,预计聚丙烯的需求在预测期内将以健康的速度成长。

- 中国是全球最大的汽车市场,并将持续保持年销量和製造产量第一的地位,预计到2025年国内产量将达到3,500万辆。

- 此外,根据OICA的数据,2021年中国汽车製造商将生产26,082,220辆汽车,较2020年成长3%。

- 据印度包装工业协会 (PIAI) 称,在印度,该行业正以每年 22% 至 25% 的速度增长,预计到 2025 年将达到 2,048.1 亿美元。印度包装产业在进出口方面拥有良好的记录,推动了该国技术和创新的成长,并为各个製造业付加了价值。

- 包装产业在推动印度聚丙烯市场的巨大成长方面发挥催化剂作用。此外,过去几年,该国对包装食品的需求量很大,预计这种情况在预测期内将持续下去,从而增加了对所研究市场的需求。

- 根据国家投资促进与便利化局统计,汽车产业对印度GDP的贡献率为7.1%,对製造业GDP的贡献率为49%。此外,根据国际汽车製造商组织的数据,印度汽车工业生产了4,399,112辆汽车,比2020年成长了近30%。

- 预计这些产业的成长将在预测期内推动亚太地区聚丙烯市场的发展。

聚丙烯产业概况

全球聚丙烯市场较为分散。以产能计算,前五大企业约占全球市场占有率的35%。该市场的主要企业包括中国石油化学集团公司 (SINOPEC)、LyondellBasell Industries Holdings BV、Borealis AG、Braskem 和 Reliance Industries Limited。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 增加塑胶的使用使汽车更轻并提高燃油效率

- 软包装需求不断成长

- 抑制因素

- 替代产品的可用性

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 价格趋势

- 进出口趋势

- 原料分析

- 技术简介

第五章市场区隔

- 类型

- 均聚物

- 共聚物

- 目的

- 射出成型

- 纤维

- 薄膜片材

- 其他应用(挤压涂布、吹塑成型)

- 最终用户产业

- 包装

- 车

- 消费性产品

- 电力/电子

- 其他最终用户产业(纺织、建筑)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、联盟、协议

- 市场占有率(%)分析

- 主要企业策略

- 公司简介

- Borealis AG

- Braskem

- China National Petroleum Corporation

- China Petrochemical Corporation(SINOPEC)

- Daelim Co. Ltd

- Exxon Mobil Corporation

- Formosa Plastics Corporation

- INEOS

- LG Chem

- Lotte Chemical Corporation

- LyondellBasell Industries Holdings BV

- Mitsubishi Chemical Corporation

- Mitsui Chemicals Inc.(Prime Polymer Co. Ltd)

- Reliance Industries Limited

- SABIC

- SIBUR International GmbH

- Sumitomo Chemical Co. Ltd

- Total Energies

第七章 市场机会及未来趋势

The Polypropylene Market size is estimated at 91.98 Million tons in 2024, and is expected to reach 121.81 Million tons by 2029, growing at a CAGR of 5.78% during the forecast period (2024-2029).

A slight decline in the demand for polypropylene has been observed due to COVID-19. A drastic slowdown was witnessed in the construction and automotive sector, where polypropylene is in high demand. With the resumption of operations in major end-user industries, it significantly recovered in 2022.

Key Highlights

- Over the short term, major factors driving the market studied are the increasing usage of plastics to reduce vehicle weight and enhance fuel economy and the growing demand for flexible packaging.

- On the other hand, the presence of different substitute products in the market is a key factor anticipated to restrain the growth of the target industry over the forecast period.

- The increasing trends of recycled polypropylene are likely to act as an opportunity in the future.

- The Asia-Pacific dominated the market across the world and is expected to dominate in the forecast period, with the largest consumption from countries such as China and India.

Polypropylene Market Trends

Increasing Demand for Injection Molding to Dominate the Application Segment

- Polypropylene is majorly used for injection molding and is mostly available for this application in the form of pellets. Polypropylene is easy to mold, and it flows very well because of its low melt viscosity.

- Injection molding technology is used to produce plastics that are used extensively in electrical and electronic applications. These plastics are widely used in the manufacturing of electrical and electronic devices.

- Polypropylene is well-suited to a wide range of product types due to its numerous flexible uses. One of the most frequent applications is the living hinge, a one-piece hinged design typically used in consumer items such as caps. Innumerable products made from the process include children's toys, sporting goods, closures, automotive applications, food trays, cups, to-go containers, household goods, and appliances like dishwashers.

- According to HUBS, a globally leading material manufacturing company, polypropylene accounts for 35-40% of worldwide injection molding output, followed by other materials such as ABS (25%), polyethylene (15%), and polystyrene (10%).

- The high growth of the packaging and chemical processing industries across the world is expected to offer a favorable market scenario for injection molding. Owing to the geographical advantage of distribution to the rapidly growing Asia-Pacific region, the consumption of injection-molded pallets may increase drastically.

- Moreover, the adoption of lightweight components for the automobile to increase fuel efficiency is expected to favor the demand for the market studied in the forecast period.

- All the aforementioned factors are expected to boost the market's demand.

Asia-Pacific to Register the Fastest Growth

- The Asia-pacific polypropylene market is growing at a fast pace, driven by countries like China and India. Polypropylene is widely used in the automotive, consumer products, electronics, and packaging industries. With robust growth in these industries and government support, the demand for polypropylene is projected to increase at a healthy pace during the forecast period.

- China is the world's largest vehicle market and will continue to be the largest market by both annual sales and manufacturing output, with domestic production expected to reach 35 million vehicles by 2025.

- Moreover, as per the OICA, Chinese automotive manufacturers manufactured 26,082,220 vehicles in 2021, registering a growth of 3% compared to 2020.

- In India, according to the Packaging Industry Association of India (PIAI), the sector is growing at 22% to 25% per annum and is expected to reach USD 204.81 billion by 2025. The Indian packaging industry made a mark with its exports and imports, driving technology and innovation growth in the country and adding value to the various manufacturing sectors.

- The packaging industry is enacting the role of catalyst in promoting the huge growth of the polypropylene market in India. Furthermore, the country has been exhibiting a significant demand for packed foods in the past few years, which is expected to continue during the forecast period, thus boosting the demand for the market studied.

- As per the National Investment Promotion & Facilitation Agency, the automobile industry contributes 7.1% of India's GDP and 49% of its manufacturing GDP. Moreover, according to Organisation Internationale des Constructeurs d'Automobiles, the Indian automotive industry manufactured 4,399,112 vehicles, which is almost 30% more than in 2020.

- Such growth in various industries is expected to drive the market for polypropylene in the Asia-Pacific region during the forecast period.

Polypropylene Industry Overview

The global polypropylene market is fragmented in nature. The top five companies hold around 35% of the global market share in terms of production capacities. Some of the major players in the market include China Petroleum & Chemical Corporation (SINOPEC), LyondellBasell Industries Holdings BV, Borealis AG, Braskem, and Reliance Industries Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Usage of Plastics to Reduce Vehicle Weight and Enhance Fuel Economy

- 4.1.2 Growing Demand for Flexible Packaging

- 4.2 Restraints

- 4.2.1 Availability of Substitute Products

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Price Trends

- 4.6 Import-Export Trends

- 4.7 Feedstock Analysis

- 4.8 Technological Snapshot

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Homopolymer

- 5.1.2 Copolymer

- 5.2 Application

- 5.2.1 Injection Molding

- 5.2.2 Fiber

- 5.2.3 Film and Sheet

- 5.2.4 Other Applications (Extrusion Coating, Blow moulding)

- 5.3 End-user Industry

- 5.3.1 Packaging

- 5.3.2 Automotive

- 5.3.3 Consumer Products

- 5.3.4 Electrical and Electronics

- 5.3.5 Other End-user industries (Textiles, Construction)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Russia

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Borealis AG

- 6.4.2 Braskem

- 6.4.3 China National Petroleum Corporation

- 6.4.4 China Petrochemical Corporation (SINOPEC)

- 6.4.5 Daelim Co. Ltd

- 6.4.6 Exxon Mobil Corporation

- 6.4.7 Formosa Plastics Corporation

- 6.4.8 INEOS

- 6.4.9 LG Chem

- 6.4.10 Lotte Chemical Corporation

- 6.4.11 LyondellBasell Industries Holdings BV

- 6.4.12 Mitsubishi Chemical Corporation

- 6.4.13 Mitsui Chemicals Inc. (Prime Polymer Co. Ltd)

- 6.4.14 Reliance Industries Limited

- 6.4.15 SABIC

- 6.4.16 SIBUR International GmbH

- 6.4.17 Sumitomo Chemical Co. Ltd

- 6.4.18 Total Energies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Recycled Polypropylene